This e-publication is for internal sharing only and is not to be distributed outside of the company.

July 2020

Click below to read more.

Hear from Our Leaders

» Message from Ben Tan

Business Updates

» The First Virtual Mid-Year Boost: Conquering the New Future Together

» Live #Lifeproof Campaign Unveils New Inspiring Brand Films and Consumer Promotions to Boost Resilience

» Accolades for Prestige Life Gold 2 & Universal Life 18 Achievers

» New Great Eastern App: Active Policy Management On the Go!

» Get New Online Shopping Rewards on UPGREAT with RebateMango

» VOLTAGE – The New Career Discovery Space for Financial Representatives

» Coming Up Soon: Webinars to #Lifeproof the Next Generation

» Calendar of Events

From Good to Great

» Delivering Successful Learnings via Webinars

» Tapping on GREAT Talent: #Lifeproof Academy Masterclasses

» GreatAdvice Update: Making it Easier for You to Do Business

People

» Lim Kopi with Our Leaders

» Dan & Reena: The Power to Change

» Vanessa Lim: Achieving with a Competitive Mindset

![]() Message from Ben Tan

Message from Ben Tan

Dear colleagues,

I am very pleased to present our brand new quarterly e-newsletter, all dedicated to You.

The Great Connect comes at a very meaningful moment for us, as we emerge digitally ‘transformed’ and stronger from the challenges of COVID-19 and adopting new ways of engaging with our customers and one another.

This is where you’ll find out about the many exciting new initiatives we’re rolling out for a greater 2H 2020 and beyond. In this inaugural issue, catch these highlights such as this month’s Mid-Year Boost virtual event, our new Live #Lifeproof campaign, Make The Shift campaign and Lifeproof Academy Masterclasses to help drive our 1,000 open positions, and the PLG2 and UL18 achievers whom we are very proud of. As walking brand ambassadors to your clients, we look forward to you communicating how we Lifeproof our customers, and fill them in on the latest updates from the company.

With each issue, we want to celebrate your tales of dedication, talent and outstanding achievements, and hear your customer stories and personal successes as our financial representatives. Don’t forget to up your digital game and check in on useful tips from our CFE to continually upgrade your skills too. We hope that these will help you do your best to achieve our Resilience Challenge targets for Q3.

As you are eagerly scrolling down to check out our latest news, I welcome all of you to share more of your interesting stories at work and your contributions to our wider community in The Great Connect.

We look forward to your feedback on how to Connect better with You. Enjoy reading and hope this will be a GREAT way for you all to stay connected digitally!

Ben Tan

The First Virtual Mid-Year Boost: Conquering the New Future Together

In case you missed it, here are the highlights of our very first virtual Mid-Year Boost on 7 July at VOLTAGE, staged innovatively complete with lights, camera and music, led by our energetic senior management and guest speakers, and hosted by ABD Head Glenn Yong.

Group Chief Executive Officer Khor Hock Seng opened the afternoon by recognising the tremendous resilience of its agency network in overcoming the unprecedented challenges posed by COVID-19 and called for continued momentum critical for success.

Urging all reps to be agile and adaptive to customers’ digital needs, and reinforcing the importance of continued strong partnership with Great Eastern, Mr Khor also spoke passionately about achieving higher goals together, with upcoming plans in the second half for more digital engagement with customers and financial reps.

“Going forward, we plan to have a fully digital-enabled agency. We need to continue investing in a full set of digital capabilities for all of you, so that your interaction with customers is seamless.”

He noted that while the COVID-19 situation presented new opportunities, it is a great reminder to focus on the Customer First. “In this ‘New Future’ (not just the New Norm), it’s about putting ourselves in the winning position. So we need to continue to do right by the customer with customer centricity, take the right actions… and think big,” he said.

Ben Tan, MD, Regional Agency, FA & Bancassurance, built further on the continued importance of adapting to changes and new thinking to emerge stronger. “We are (already) in the next paradigm today. Let's be steadfast on our journey to greatness. If we try new things, like new ways of working and thinking, we will emerge stronger and more resilient,” he said.

Ben reinforced the brand’s purpose as the Life Company, helping to ‘lifeproof’ its customers earlier this year, highlighting Great Eastern’s S$1 million COVID-19 Customer Care Fund and assistance for its agency force as well as its suite of digital initiatives which supported them well in 1H2020. Great Eastern’s first-to-market launch of its remote sales advisory earlier in the year, even before Singapore went into Circuit Breaker mode, and customer adoption of its digital platforms since February he said, all added to the company’s digital initiatives to empower its financial representatives to deliver continued quality service to customers.

He also strongly encouraged everyone to up their digital game, take ownership of their own continuous learning to tap on training programmes and webinars the company has put in place to respond effectively and emerge even stronger as Agents of Life.

MD, Group Marketing Colin Chan unveiled the new Live #Lifeproof brand films to give the audience a preview ahead of its launch to consumers. He elaborated on how #Lifeproof would be supported in practical solutions for the next half year, complemented by relevant benefits such as dengue and retrenchment coverage and telehealth services such as Doctor Anywhere. He also encouraged them to share forth the company’s newly launched Great Eastern App with customers, to bring to life solutions to provide customers with flexibility to actively manage their investment-linked policies' fund transactions anywhere on a mobile device.

Lastly, he shared on Great Eastern’s opening of job opportunities for the community during this challenging time, aided by its upcoming Lifeproof Academy masterclasses with top trainers on kick-starting a financial representative career and its ‘Make The Shift’ campaign on making the move to join this industry mid-career.

Newbie financial representative Vanessa Lim, 23, shared about her strong desire to succeed and learnings on the job, notably working in remote mode from Day One and how she overcame her personal challenges with the support of her team and agency to clock in a high number of cases within the circuit breaker months, resulting in her promotion to Senior Financial Consultant.

External speaker Dr Sanjay Tolani, renowned financial advisor and coach, shared his experience on how to restart and make good use of the opportunities amid the challenges. He said, “Customers’ needs for a financial representative’s services are still the same, even in the light of COVID-19,” and urged the audience to continue reaching out to meet their customers’ needs.

Patrick Peck, Head of Agency & FA, closed the Mid-Year Boost for 2020 by issuing a Resilience Challenge for Q3. 17 awards were also presented virtually for numerous categories for the year 2019 such as Top Directors, Top Master Builder and Top Recruiting Directors to recognise the most outstanding among Great Eastern’s agency force.

The event received positive feedback from the audience. As what financial representative Willis Lau commented, “An amazing virtual show as all speakers gave their best to make this count.”

We thank all the 3,000 of you who have attended the event online. Our speakers could really feel your warm enthusiasm in the air, not a bit less!

Eye-Catching Moments

Most Striking Tagline: Mr Khor’s ‘The New Normal Future’

Most Humorous Slide: Ben’s spunky fist-clenching baby

Most Touching Moment: Colin’s Live #Lifeproof brand films that have brought a tear to our eyes

Most Personal Tales: Vanessa’s dad’s sacrifices for her family and Sanjay’s dad’s words of wisdom for him on dealing with COVID-19

Most Cheery-Looking Presenter: Patrick (yes, even during the rehearsals!)

Live #Lifeproof Campaign Unveils New Inspiring Brand Films and Consumer Promotions to Boost Resilience

If you haven’t seen them at the Mid-Year Boost, we hope you’ve caught our new Live #Lifeproof brand films launched earlier this month. If you shed a tear, then they have worked their magic.

Why? Because for many of us, including our customers living in these unprecedented times, are facing huge disruptions and uncertainties, and can relate to the questions posed by the films.

But all is not lost as “Life's questions do not define us. Our answers do.” We can all choose how we respond, to keep a dream alive, to be survivors. This second instalment of #Lifeproof extends Great Eastern’s central brand promise as The Life Company and our vision to empower our customers to stand ready for all of life’s uncertainties and take positive action on the matters in life near and dear to them.

Consumer Promotions: Free Retrenchment & Dengue Coverage

To help customers with practical concerns during this time of uncertainty, we are also offering an additional retrenchment benefit to customers who purchase regular premium investment-linked plans from now to 31 August 2020. Customers will receive a complimentary Retrenchment Premium Waiver benefit up to 12 months, in the unforeseen event that they are retrenched during the first two years of their policy.

In view of the rising dengue cases in Singapore, customers who purchase selected regular premium life, personal accident and health insurance plans from now to 31 August 2020 will receive complimentary 12-month Dengue Care. This includes a $1,000 one-time hospital benefit, $200 per day of hospitalisation, and 50% coverage for their spouse and children.

Customers will also receive 15-20% premium savings for selected health and investment-linked insurance plans, which are growing areas of importance to consumers.

Share the good news with your clients, and find out more about living #Lifeproof at www.TheLifeCompany.sg or visit the Great Eastern website for more details on the offers.

Accolades for Prestige Life Gold 2 & Universal Life 18 Achievers

Great Eastern’s digital engagement with its financial representatives is growing in scope. The recent virtual roll-outs of Prestige Life Gold 2 from 4-15 June, and of Universal Life 18 on 23 June with over 350 reps attending, are marked by strong participation and fantastic results achieved in the high net worth financial product arena.

Congratulations to our PLG 2 and UL 18 Achievers!

Quick Chat with 2 PLG 2 Achievers

Director Ivan Chee of Ivan Chee & Associates

What’s your secret sauce for closing a $1m PLG 2 policy?

I do not have any "secret sauce". It just happened that this client is my existing one who first bought a UL from me in the first UL tranche 10 years ago, and she is keen to look at maximising wealth creation upon death and wants to leave some legacy for her children. Hence PLG 2 can offer what she needs.

What did your clients like best about this product?

PLG 2 resembles UL closely although it is a par fund without the currency risk and coupled with the very attractive OCBC current premium financing campaign. In addition, potentially the coverage will increase over the longer term, unlike UL which is fixed.

ASD Kenny Lim of Jessica Lee & Associates

What’s your secret sauce for closing multiple PLG 2 policies?

Success is all about hard work and that's my secret. My focus has always been closing regular premiums plan with at least 100 Regular Premium (RP) cases a year. This enables me to expand my market to higher net worth individuals.

Being a family person with two kids, my network revolves around married couple with kids too. Hence, their needs for legacy and estate planning are important. My success foundation also comes from my agency Advisors' Clique and my mentors who are always there to lead me and add value to my planning process constantly.

What did your clients like best about this product?

PLG’s biggest attraction is that it’s in SGD. The currency risk is not there as compared with a UL. This current PLG also has very competitive premiums and surrender values in the market.

In addition, the current underwriting risk class upgrade also benefits our healthy client in a great way. With all these great features and the current low interest rate environment, selling PLG 2 is not a big challenge. I am grateful to Great Eastern for coming up with such good products.

Our treats for some of the winners of PLG 2 Virtual Launch quiz.

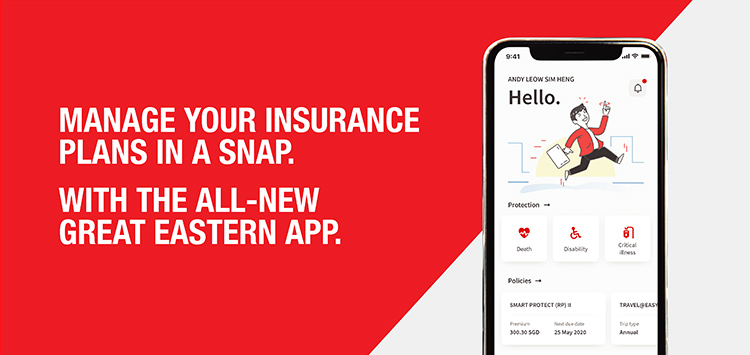

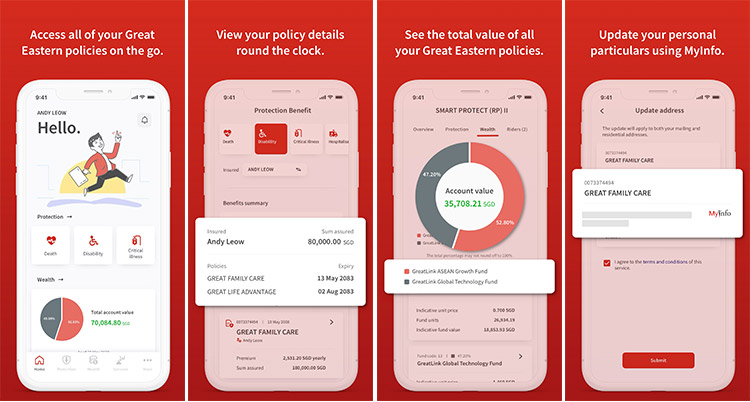

New Great Eastern App: Active Policy Management On the Go!

Problem: Your customer has Dependents’ Protection Scheme, Great Family Care and Great Life Advantage, and wants to know the total disability benefits i.e. sum assured of all her three life policies in a jiffy. No time to fish out and look through her documents one by one.

Solution: Simply get her to download the Great Eastern App, log on with her GREAT ID and voila! She can instantly view at one glance the aggregated policy benefits category by category, as well as her aggregated ILP wealth value.

That’s not all. This amazing new app will make a big selling point for our ILP products for your customers. Our Singapore ILP customers can now instantly access their aggregated wealth value, premium amounts and maturity or expiry dates of policies and payments. They can also track investment performance, make fund switches, fund withdrawals and premium apportionments at any time.

Among its security features are biometric authentication and GREAT ID - customers’ single sign-in identity for all Great Eastern digital platforms. Customers can also securely update their personal particulars via MyInfo and SingPass – a first for the industry.

This is a significant boost in Great Eastern’s digital transformation, to provide greater visibility and convenience for customers to actively and securely manage their insurance portfolio. It’s a step towards putting the customer first, with the best user experience design and functionalities, tested against customers’ and financial representatives’ feedback.

The Great Eastern App – for the digital customer of today – is rolling out more value-added services in the next few months. Stay tuned!

Get your customers to download it now. Try out the ILP functionality yourselves. Click for more info on the Great Eastern App.

Customer Quotes from Apple App Store & Google Play Store

"Excellent app. Makes it very convenient to keep track and manage all policies. It’s user friendly and efficient."

"Smooth installation and I am able to see my policies within one location."

"Clear cut, fuss free and neat."

Financial Representative Quotes

"The Great Eastern App has allowed me and my clients to connect better in today's digitalization age. I believe that it would bring the efficiency of our company to another level of excellence."

Vincent Oo, Credence Financial Planners (Rix Chan & Associates)

“I have been playing around with the app. It looks wonderful and good that we have such an app for our clients.”

Tan Yu Sheng, Joe Lim & Associates

Get New Online Shopping Rewards on UPGREAT with RebateMango

Our all-in-one reward platform UPGREAT is partnering once again with online rewards digital platform RebateMango to offer new attractive dining, lifestyle and shopping rewards in-app.

UPGREAT members will enjoy a new seamless online shopping experience and the chance to receive more UPGREAT points when they shop at over 500 localised retailers such as Shopee, Agoda, AliExpress, Booking.com, Lazada and more!

What’s more, they can exchange their UPGREAT points for KrisFlyer miles, Shell Select vouchers, GrabFood vouchers, dining vouchers from various food establishments and other attractive rewards.

Ryan Cheong, our MD, Digital for Business said: “As we look to launch UPGREAT across the region, we will continue to work with RebateMango and like-minded partners to engage our members in new and exciting ways.”

Sign up and start shopping on RebateMango, at rebatemango.sg/upgreat today!

VOLTAGE – The New Career Discovery Space for Financial Representatives

Opened last December, VOLTAGE, our new Career Discovery Space for our financial representatives, is a holistic, unique new age space specially designed for a multi-purpose experience.

Here is where you’ll find:

- A stimulating space to engage potential recruits and host learning journeys, complete with interactive digital displays

- A nurturing area to support future learning, that comes with a 360° screen

- A dedicated private space for our Prestige Partner customers

- A one-stop service centre for financial representatives on Operations, IT Helpdesk and Customer Service

Opening hours: 8:30am to 5:30pm, Monday-Friday

Discover with us the highlights of VOLTAGE:

The Rotunda:

A uniquely designed open space to host events and seminars creatively.

Multi-Purpose Service Centre:

Drop boxes are also available for our financial representatives to perform a prompt transfer of essential documents to the respective departments in Great Eastern beyond office hours.

Prestige Suite:

Equipped with digital face biometrics for secure entry, this is an exclusive space for PP financial reps to connect with their clients in a cosy setting.

The GREAT Discovery Zone:

An experiential digital showcase to show potential millennial recruits what it means to be a financial rep.

Booths like ‘Be Advisor for the Day’ will give potential recruits a glimpse into the career, Great Eastern’s values and strengths as a regional leader through interactive digital screens.

This space aims to be an Academy of Excellence to support awareness programs to all visitors, to inspire the next generation of advisors.

We look forward to serving you at VOLTAGE!

Coming Up Soon: Webinars to #Lifeproof the Next Generation

Great Eastern is partnering with trending speakers on a series of webinar workshops to cater to the next generation customers in the upcoming months. Covering topics namely Professional Competencies, Financial Literacy and Lifestyle Skills, these sessions aim at helping young adults with fun, bite-sized learning workshops to Lifeproof their priorities and milestones.

These workshops are designed to help profile Great Eastern as their top-of-mind insurance provider and provide a curated learning platform for fresh graduates and the new-to-workforce on relevant topics such as career, health, fitness, financial life hacks and more.

A rich, informative webinar series for your next generation customers by Great Eastern, not to be missed. Starting from Q4 2020. So watch this space!

Calendar of Events

Stay up-to-date on Great Eastern’s upcoming activities and events for its financial reps. You can login to Lifehub to view the calendar.

Delivering Successful Learnings via Webinars

To help our financial representatives staying ever agile, resourceful and responsive in the face of COVID-19 challenges, Great Eastern has dived into the digital mode and plugged into the latest technology to create a new world of webinar learnings for its financial representatives.

This is marked by the recent success of the ‘Group CEO-Great Conquest Series’ hosted by the Agency Business Development Team, which is focused on staying connected and engaged with the agency force with the social distancing requirements.

During its third and latest series ‘Conquer the New Norm’ on 2 June 2020, Group CEO Mr Khor Hock Seng delivered a total of seven speeches in a single day, a truly amazing feat. He touched on topics such as Agency Sales and Manpower, Digital for Business in the New Norm and 151 Agency Directors attended. We hope you have heard from them in your various groups.

The second half of the session was an interactive panel discussion comprised of 11 panelists across the Great Eastern senior management team including Mr Khor. They were joined by different departments namely SG Agency & FA, GEFA, Group Operations, Propositions & Portfolio Management, Digital Business Platforms and Agency Business Development. It was a well-designed effort to engage with a focused group of Agency Directors in each session, which has greatly benefited everyone.

To support you, the Agency Business Development Team has also created multiple webinars in collaboration with Propositions and Portfolio Management and Accident & Health in May and June. They range from online workshops to virtual product launches, such as Prestige Life Gold 2, Fund Sharings and Great Cancer Guard Webinar, just to name a few. These webinars were well received, based from the agency force’s strong turnout.

To ‘Conquer the New Norm’, or rather The New Future, it is imperative to continually adapt and learn. Notably, more than 2,000 of Great Eastern’s financial representatives have embraced the remote sales advisory process by now. This achievement is undoubtedly the result of the improved productivity as we deep dive into webinar learnings.

With the right tools and new mindset, we are confident that we will be able to turn this crisis into our strength and create opportunities together with you.

Watch this space as we roll out even more exciting webinars, specially curated for the agency force.

Tapping on GREAT Talent: #Lifeproof Academy Masterclasses

Know anyone who would be interested in picking up professional skills or keen to join us as a financial adviser? Get them to join us for #Lifeproof Academy’s two-day webinar series run by Regina Chia, Willis Lau, Josh Han, Benjamin Lim and Jason Thian. The five speakers will be sharing useful tips across different topics to kick start a career as an Agent of Life.

Created specially for fresh graduates and mid-career PMEBs who are exploring this career option, this is a series of free online masterclasses covering customer care to social media tips, led by these experienced Agents of Life. We are pleased to talk to two of them here.

Willis Lau

Willis who has marked his 10-year milestone at Great Eastern, is Executive Senior Manager at Prelit Advisory today, and has his own TikTok page. So it’s no surprise that he is speaking on ‘Leveraging Social Media for Business Network’, on building your brand and relating to your clients on social media.

1. Besides your webinar topic, what other insurance-related/professional subjects have you conducted training for?

Regina: Some training areas on retirement planning, tax planning, estate planning, critical illnesses, leadership modules etc.

Willis: I’ve also spoken on motivational and inspirational topics based on my key realisations after 10 years in this profession. They cover mindset shifts and practical strategies to help new advisors to be on track.

2. What/who has inspired you to become a trainer in the first place?

Regina: Both my leaders when I started out as a planner. Their advice to me was to build a team and share my skills and experience. With the team building, I started focusing more of my time on training and coaching them. Each generation can become better and stronger by building on previous experience, and through this synergy, the whole group can improve.

Willis: To be honest, speaking on stage or training is not something I imagined I could do. But I guess it’s through the influence from the other speakers at company events, seminars etc. that I realised how powerful communication can be, especially when your words can inspire and influence others. I’ve grown because of many others, so now when the opportunity arises, I would want to do the same and help others grow too. When everyone actively shares, that’s when collective greatness can be established and everyone grows together.

3. What are the red hot questions surrounding your topic that you aim to address during your webinar?

Regina:

Financial secrets to wealth.

How to let your money work harder for you.

Success secrets that schools will never teach you.

Willis:

How can anyone get started in leveraging social media when you’re new.

What can I do if I’m not comfortable in sharing content on my personal accounts?

How much time do you spend in creating content?

4. What will be some of the techniques you’ll be using to keep your audience engaged and inspired?

Regina:

Revelation of these secrets!

Willis:

Trends and statistics to showcase the potential of social media in our works.

Real-life case studies with screenshots and videos for instance to illustrate how these strategies can be applied.

Asking questions time to time to engage the audience. They can reply via the chat function.

5. What are the three key takeaways for the audience?

Regina:

Keep an open mind, perseverance and choice of network

Willis:

Different is better than better now. Start becoming different and become better at what you’re different at.

If you’re well-liked by one person, you can also be well-liked by many as long as you have a way to amplify it.

People buy people first, no matter how smart or capable you are. if you’re not well-liked, loved or respected, you simply do not get the attention.

We wish them both and the other masterclass trainers great success for their webinars!

Other masterclasses:

Josh Han - Customer Thinking: Understanding the Needs of Your Customer

Benjamin Lim - Personalising Your Digital Brand

Jason Thian - Building Resilience Through Adaptability

#LifeProofAcademy is open to all Singapore Citizens or Permanent Residents who are 21 years of age and above with any one of the following education qualification:

- A recognised degree

- Diploma awarded by a polytechnic in Singapore

- Full A-Levels Certification

Interested parties can register here.

GreatAdvice Update: Making it Easier for You to Do Business

When the Non-Face-To-Face (NFTF) sales process was implemented in GreatAdvice this March, it quickly became the new norm of doing business when the Circuit Breaker was introduced a couple of weeks later in April.

In the last couple of months, our financial representatives have been making the switch to conduct sales via video consultation and obtaining client’s signature remotely using the newly introduced eConfirmation (NFTF) form.

In the recent GreatAdvice update (released on 23 July, version 3.3.058.1), we have enhanced the eConfirmation (NFTF) form. At the preview page of the proposal pack, a copy of the NFTF form is inserted with some essential pre-populated data such as client name, document ID and plan name. You can download this pre-filled form and forward to your clients for signing and more inputs.

With the pre-population of fields when completing the eConfirmation form, we have eased the data entry process and brought greater convenience to you and your clients.

As we are working to bring you a full end-to-end integrated system, do keep a lookout for GreatAdvice Version 4.0 to be launched in Q4, which will provide even greater ease and automation for your business transactions.

Lim Kopi with Our Leaders

In this new segment, different leaders of our management team take turns to talk about what drives them and inspires them, as well as their take on life and work, shared for the first time.

First up is Patrick Peck, Head, Agency & FA, who has joined Great Eastern since April 2020. Patrick is in charge of driving sales and recruitment for the agency force and FA.

1) What is the biggest key learning/observation you have made from the COVID-19 situation since you joined us?

In every crisis, there are opportunities. We can either choose to sit and blame everything on COVID-19, or we can embrace the new “norm” or “future” and step UP and grab the opportunity, to rise up to become stronger and better.

2) What is the next big trend in DIGITAL that we should all pay attention to?

Digital is already in our daily lives, from communicating, working, playing and even entertaining. Let us embrace digital to help us become more productive and professional with digital as we go about prospecting, advising and servicing our clients with quality service.

3) Your personal motto is…

In our current situation, I would say, “Never let a bad situation bring out the worst in you. Be strong and choose to be positive.”

4) What is your management philosophy?

Embrace team work, eliminate individualism. We need to go long and far, and this can only be achieved if we all work as a team.

We are all in our very own “Moment of Time”, in work, life, love and family at different stages of our lives, and I try my best in all my MOTs.

We all share one common MOT right now, as colleagues, as leaders. To live Great is not just saying “Let’s DO SOMETHING GREAT”, but rather let’s walk this moment together and achieve together to NEW Heights, so our next generation in Great Eastern can see it and set their bar higher.

5) Something fun that you do in your spare time is?

Thanks to Digital especially during CB, I play a lot of Chinese chess, and can often find very good chess players online from China.

Dan and Reena: The Power to Change

Call it a leap of faith. Former Air Force safety officer Dan Loi and former finance professional Reena Guo were in different worlds from insurance before joining Great Eastern. Today, they share their stories in boldly making the shift to become successful Agents of Life.

Reena who has been with Great Eastern for seven years, is Executive Senior Financial Consultant (ESC) with Alvin Choong & Associates today, while Dan is five years with us and now Executive Senior Financial Consultant (ESC) with Ivan Chee & Associates.

1) What motivated you to make the shift?

Dan: Other than looking for challenges and better prospects for my career, I decided to find a long-term career when I can be happy with what I will be doing. I also believe that one should be rewarded for the effort and hard work put in. Better work-life balance was also another major factor. At the end of the day, one must be satisfied with the results they achieved and the sacrifices they made.

Reena: The desire to have full control of my time, income and career progression. I was also motivated by the freedom to shape my own business.

2) What is the biggest surprise for you upon entering the insurance world?

Dan: Financial planning is not as simple as it seems. Many factors have to be taken into consideration and there is no “one perfect plan” for all. Not all “close friends” will be your clients, and some of your biggest clients may be the ones whom you were never close to. Lastly, speaking with strangers isn’t that difficult to begin with. We just have to overcome the self-doubt first and we will discover that most people are friendly, as long as you treat them politely.

Reena: It’s more of a culture shock transiting from an employee mindset to an entrepreneurial environment. All of a sudden I felt that I could have so much control in my career - how I want to market my services, how fast I want to move up the ranks and most importantly, how much dollar per hour I’d like to earn. All these were determined for me by someone else when I was an employee.

3) What kind of preparations did you make prior to joining the industry?

Dan: Before joining the industry, having the support of your loved ones is the most important initial preparation anyone can ever have. For those who don’t, they must have the strong will to continue to do what they think is right for their career, and hope to convince and prove to their loved ones that this is the right career choice.

Attending seminars and talks by successful agents and leaders, and learning from their experiences are also important. This should be done before and after joining the industry. Learning from other people’s experiences should be a never-ending process.

Reena: My then Immediate Officer (IO) also my Agency Director today, Alvin Choong, has prepared me well for this business since the day I decided to quit my previous job. He taught me how to reconnect with some of my long lost contacts and convinced me to work on my warm market for a start. I was already meeting friends for casual coffee sessions and subtly securing appointments in advance while waiting for my Intermediary Agreement Contract (IAC). I am grateful to have a dependable mentor like Alvin to guide me in this industry.

4) How are the skills of your previous profession helping you as a financial representative today?

Dan: As a former training officer and safety officer, I have learnt how to communicate and manage trainees and team members effectively, and doing things with a sense of urgency. I am able to listen and communicate with clients very well and cater to their needs. When clients know that you understand them and put their needs as your priority, you will gain their trust to leave their entire financial planning to you and will refer potential prospects to you.

Reena: Skills such as client relationship management, financial market understanding and sales techniques give me confidence to serve my clients. With confidence and experience in the finance industry, I enjoyed a pretty smooth head start in my Great Eastern career. My warm market was quite supportive and referrals started to flow in over time. Till today I am very grateful to those who have given me an opportunity when I just started my career here.

5) What do you like most being an Agent of Life at Great Eastern?

Dan: Being able to meet and interact with people from all walks of life and having the constant opportunities to learn from them. Also, having my clients share with me their moments of joy (welcoming a newborn, getting married) and sorrow (passing of loved ones, being diagnosed with critical illness), helped me to be more empathetic and thankful for everything in life. Also, I’m part of one of Singapore’s top insurance companies!

Reena: The fact that I’m representing a company that almost every Singaporean have heard of!

Vanessa Lim: Achieving with a Competitive Mindset

TGC catches up with our new financial representative Ms Vanessa Lim who was a guest speaker at the Mid-Year Boost.

Vanessa who joined Advisors' Clique in April, met her first big challenge upon her licensing as Singapore entered Circuit Breaker and non-Face to Face was the only option for interaction with clients. With her competitive mindset and support of her team’s robust training, she defied the odds to obtain her Senior Financial Consultant title with 25 cases in just two months.

1) What makes you tick, career-wise?

Knowing that I will have the potential to earn an above-average income and yet still be able to be with my kids as much as possible in the near future motivates me to work hard now even if it means burning off my weekends. This is so that I can find the key to getting a consistent Million Dollar Round Table (MDRT) and won't have to still be out all the time including weekends to meet clients and leave little time for my family.

Also, I have many friends who are in the same industry. We have many mutual friends and I think consumers will see for themselves who will be the one they can trust more. By pushing myself hard now, I hope to be able to set the impression for these mutual friends to think of me first whenever they need advice on their financial portfolios.

2) What’s your personal motto at work?

"Insurance helps the rich stay rich and help the poor to not get poorer" by Sanjay Tolani, the other guest speaker at Mid-Year Boost, and I remind myself with this all the time to make sure that I will always think in my client's best interest and I should not choose my clients based on their financial backgrounds. Regardless of their financial power, I must still do my best to design a portfolio that is unique for each one of them.

3) What are your self-improvement techniques or activities?

During our weekly team meetings, there will be a new topic shared by a senior. I would make good use of the sharing and see how I can incorporate their work style and try to retune it to fit me to see what method suits me best. I am just trying whatever that works on other people and try to retune it to fit myself, and by trial and error to see what method suits me best.

Also, I try to meet up with friends who are professionals in fields such as stock brokers, forex, property and healthcare to keep myself updated on how the market is, and from their professional opinions, I can gather pointers that would help me in objection handling when meeting my prospects or clients.

4) What corporate social responsibility activities are you involved in? Tell us more.

I have a soft spot for animals and I do make a regular donation to WWF every single month. It is not a large sum, but I think every cent counts for them. The donation is to help to make the world a better place by replanting trees in some places and restoring habitats for wildlife.

5) With what you’ve experienced and learnt so far, any good advice for young people like you joining the insurance industry?

This industry is definitely a not easy one because you are paid and promoted 100% based on your hard work and effort. Getting rejections from clients is normal, all of us face them and we need to convert these to positive energy to improve yourself. Keep an open mind and don't take it so personally when your friends or prospects who have a negative perception of this career say things that are not pleasant to you. Take those comments as a motivation to push yourself harder and prove to them that this career is not what they think it is.