This e-publication is for internal sharing only and is not to be distributed outside of the company.

January 2021

Click below to read more.

Hear from Our Leaders

» Message from Patrick Peck

» You’ve got mail

Business Updates

» The Great Kick-Off 2021 Event: Maximising Opportunities in the New Future

» Do you have the #Gift of Empathy?

» #Lifeproof-ing our young jobseekers with the Next Gen Webinars

» Gear Up for the Inaugural Learning Festival…Coming your way 19 Jan onwards!

» Revealing our Top 10 Sellers for GREAT CareShield!

» Upskilling is the Name of the Game!

» Do you know about Deferred Benefits?

» A Caregiver’s Story – the Value of Being Insured when life goes Topsy Turvy

» Great Eastern: KEE-ping it in the Family

» Spot yourself or your kakis rockin’ under the Christmas Tree?

» Calendar of Upcoming Events

People

» Lim Kopi with Jesslyn Tan, CEO, GEFA

» Paying forward the Gift of Empathy - Zoe Yap and Angela Tan

From Good to Great

» Up your Service with Great Digital Advantage

» Top 3 Tips for Business Success

» Ron Kaufman’s Top 3 tips on Giving the Best Customer Service

Click here for past TGC issues.

Message from Patrick Peck

Dear colleagues,

Happy New Year!

I would like to thank you for your hard work to deliver an exceptional performance in 2020!

Last year was a very special year for the Company, especially so for our RAFABA family. Despite the pandemic, we set a series of new records, smashing well past the Agency Manpower target and achieved more than 5000. As for TWNS, together we achieved something “Amazing”.

This year will be a start of an era with an Ambitious Target set for the Agency and Bancassurance. We will be embarking on a journey to transform Great Eastern into even greater heights, not just to be Number 1 in Singapore, but as THE Indisputable Number 1.

Some exciting news to share. We capture highlights of our first virtual event of the year - The Great Kick-Off, which opened with Mr Khor’s energetic and inspiring address of our new Big, Hairy and Audacious Goals from now until 2023. You will be touched by our client’s caregiving story about taking care of his wife with dementia and how being insured has helped him to lead a regular life and to encourage others.

If you haven’t seen our newly launched Gift of Empathy campaign yet, catch it here. Kudos to all you #AgentsofLife. We’re looking for Empathy as a Core Value, so if this heartwarming video strikes a chord with you, share it with others and get them to join us. Hear the inspiring stories of our reps Zoe Yap and Angela Tan who ‘starred’ in this campaign in ‘Paying Forward the Gift of Empathy’!

As we go into the Lunar New Year – I would like to wish all of you an Ox-picious New Year filled with good health, happiness and prosperity!

Leaving you with one of my favourite quotes from President J. F. Kennedy:

“We choose to go to the moon in this decade and do the other things, not because they are easy, BUT because they are hard, Because that GOAL will serve to organise and measure the best of our energies and skills, because that Challenge is one that we are willing to accept, one we are unwilling to postpone and one we intend to WIN and the others too!”

You've got mail

We bade goodbye to 2020 and welcomed 2021 with open arms, beginning with Mr Khor Hock Seng, our Group Chief Executive Officer’s rallying message to us.

Be inspired and encouraged by his message below.

Dear Great Eastern Agency Leaders and Financial Representatives,

I would like to say a big ‘Thank You’ to all of you for pulling through this extremely difficult year and emerging stronger together! I’m filled with appreciation for your hard work, dedication and commitment that have helped us achieve so much more in spite of the challenges faced.

What we’ve all overcome and built together at Great Eastern have indeed put us in the winning position this year, helping us bear good results from both sales and our recruitment efforts.

Thanks to your strong support and participation, we have launched successfully numerous initiatives this year to continue helping our customers and community Live #Lifeproof – notably the GREAT CareShield, Great Eastern App, COVID-19 Customer Care Fund and Great Eastern Cares Community Fund.

Most of all, I applaud the Agility, Positivity and Resilience in all of you, for adapting quickly and embracing the many digital initiatives we have launched to turn challenges into opportunities. Earlier this year, all of you were still meeting your clients face-to-face. The majority of you have now embraced conducting meetings and signing contracts with your clients in virtual mode with the remote advisory services and digital applications we have launched.

I heartily congratulate all of you once more for your tremendous resilience in facing these unprecedented challenges of our times and your firm focus on being Customer First. As we look ahead to the New Year with renewed hopes and new goals, let us conquer the New Future together, that will surely make us stand out as true leaders of the industry.

Here’s to a healthy and successful 2021 for everyone at Great Eastern! Happy New Year!

Warmest wishes,

Khor Hock Seng, Group CEO

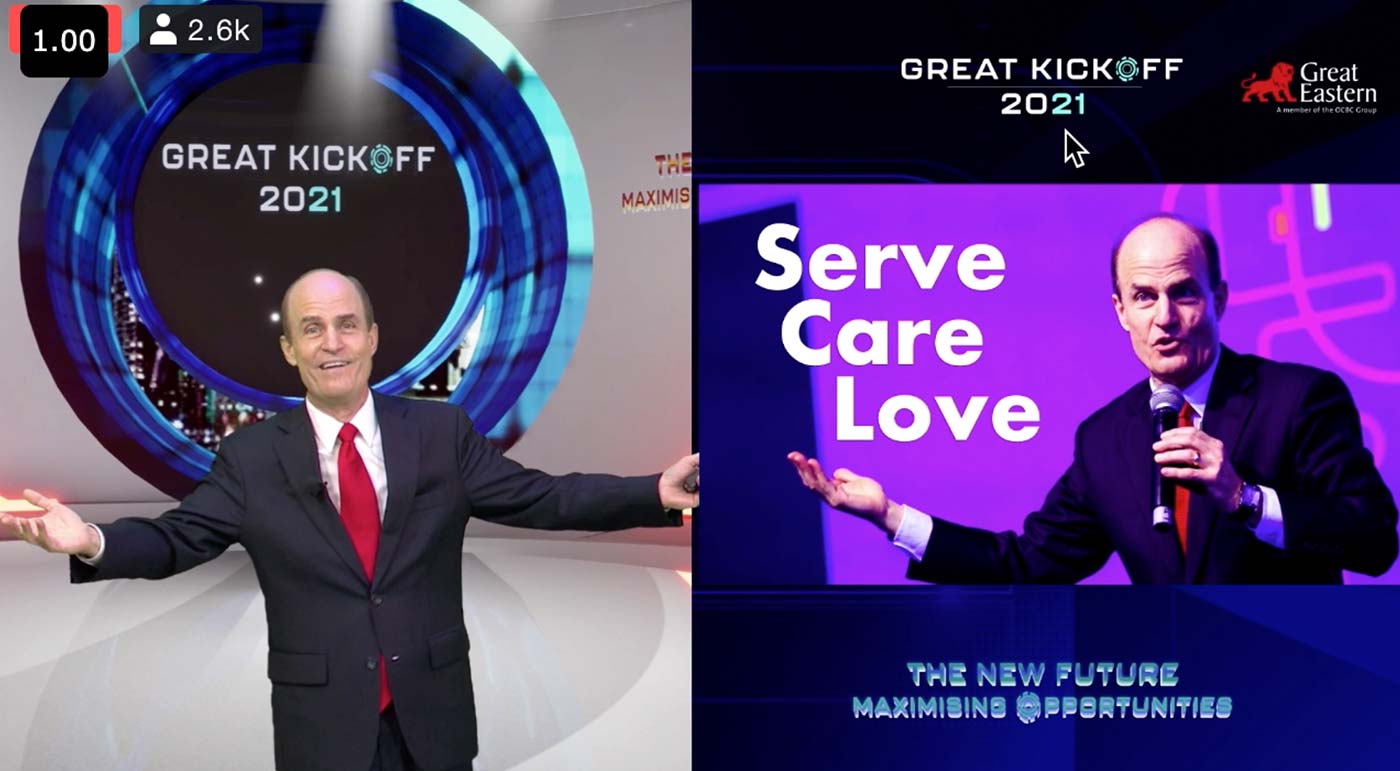

The Great Kick-Off 2021 Event: Maximising Opportunities in the New Future

Happy New Year to all and to all, a GREAT 2021! Our senior management and guest speakers shared their motivating and forward-looking sharing at our virtual GREAT Kick-Off 2021 event on 6 Jan, revealing new goals and tools for the new year! A big THANK you to the 2600 attendees who participated.

The event theme - Maximising Opportunities in the New Future – was entirely filmed at VOLTAGE and here are the highlights.

Our Leaders

Mr Khor, Group Chief Executive Officer opened the event by recognising the reps' commitment to excel and their resilience in producing exceptional business results.

Out with the Big Hairy Audacious Goals (BHAG) and in with the new BHAG2! To be focused, customer centric, professional, all while doing the right thing will be our mantra towards achieving the BHAG2 for the next 3 years. So let’s work together as one because it is “all about teamwork and us!”

Patrick Peck, MD of Regional Agency, FA & Bancassurance, pumped up the volume with our result highlights from last year. Fancy yourself bringing newer and better tools to meet your clients’ needs? Patrick delighted the audience on the pipeline plans for our new digital tools and platforms. Think E.A.T. (Engage with your clients, Acquire leads and making Transactions easy) – Enhanced financial storyboards and your very own digital advisor portal (more on this here) which will be rolled out in the first quarter. These tools will help to boost your sales and productivity!

Colin Chan, MD of Group Marketing, shared that we will reinforce our #Lifeproof brand promise with new and enhanced insurance solutions. He applauded the reps for their tremendous sales of GREAT CareShield and rallied them to continue to reach out to those in their late 20s-30s to educate them on the importance of being insured with this plan.

The reps were certainly enthusiastic as Colin shared the upcoming sales training webinars, promotions, as well as our latest Gift of Empathy recruitment video. The brand video as launched last December depicted that we are all about #Lifeproofing careers and aspirations of those who have the gift of empathy to join us. Missed out on the viewing of the Gift of Empathy video? Check it out right here!

Finally and certainly not the least, Glenn Yong, Head, Agency Business Development closed the event in style, cueing drumroll for ELECT Convention 2021. Always one to focus on looking after the troops, Glenn called on all to stay safe and healthy. His sound advice for all? “Wake up earlier in the morning! Wake up one hour earlier in the morning and with the one hour: drink your water, eat your fruits, exercise and then spend 10 minutes clearing your mind and with the other 20 minutes that you have, learn!” What a GREAT way to start this new year!

He also spurred the reps to up their game so that we will not be overtaken by competitors, and whetted their desire to succeed by unveiling the next convention destination – Sapporo!

Our very own financial rep – Zoe Yap gripped us with her personal experiences as a cancer survivor and what motivated her to join us as an #AgentofLife. Curious to learn more about what inspired her? Find out more in this story where we spoke to her and Angela, another #AgentofLife about what inspired them to #maketheshift.

Mr Nicholas Sim, one of our clients, shared his personal story on how we protected his family against the unforeseen as his wife was suddenly found to have dementia. Check out the whole story here.

Ron Kaufman, well-known author and customer service consultant, shared his tips to help YOU to provide the best service to your customers. More on that here!

Well done to the team who put together our first virtual Great Kick-off for 2021. Let’s all chart to our Big, Hairy and Audacious Goals where the sky’s the limit!

Sidebar

Most Striking Tagline: Mr Khor’s “Big Hairy Audacious Presenter by the Power of 2”

Most Memorable Abbreviation: Patrick’s Engagement Acquisition and Transaction (EAT) to help us to be more productive!

Most Passionate Call to Action: Colin’s call to the reps to take on the challenge to reach out to the younger target group to be insured with GREAT CareShield

Best Motivating Story of the Year: Zoe’s battles against cancer and how she lives life to the fullest each day

Best Presenter: Glenn (all dapper and cool while speaking Mandarin!)

Do you have the #Gift of Empathy?

Have you watched our latest #Gift of Empathy film? If you have not, catch it here and SHARE with your customers, friends and contacts to get the word out about our #AgentsofLife.

Launched just last month, the film is a heart-warming one as it depicts a young boy, Asher, demonstrating empathy and love towards his grandfather with their family parrot echoing the words of his late grandmother.

As we set out to help our customers in their financial planning by understanding their concerns and anxieties that they may have about life, EMPATHY is the X-factor and must-have for our financial representatives to be the best in the field. Let Empathy be our buzzword for 2021 as we go out there and make a difference in our customers’ lives.

Click here to read the interview stories of our two #AgentsofLife on what made them switch to this purposeful career and be inspired too!

#Lifeproof-ing our young jobseekers with the Next Gen Webinars

The #Lifeproof Next Gen Webinar continues its run to equip Singapore’s next generation with futureproof skills that are important for the job climate today and tomorrow! Happy referrers1 and referrals received 1,000 UPGREAT points for their efforts. Keep them coming as we go into 2021 series!

Here’s the round-up of the Oct-Dec sessions:

- October: Mr Dominic Bohan, co-founder of Story IQ shared on how to harness the power of Data Storytelling and some of the best practices of using data to tell a compelling story to drive call-to-action.

- November: Mr Isaac Reyes, co-founder of Story IQ conducted a session on “An Introduction to Artificial Intelligence (AI) for Everyone”. The webinar introduced artificial intelligence and its uses in today’s world.

- December: Mr Jason Tan from Signature Image Academy held a “Digital Personal Branding for Career Success” webinar where he shared tips on how to create a strong personal branding using digital tools to stand out at the workplace.

Ending the 2020 Next Gen Webinars on a high note, here are our participants’ feedback:

“Dominic is very eloquent and very knowledgeable. Wei Ming was also a good host and asked very good questions.”

“The session was inspiring, insightful and informative.”

“It was an informational and useful session!”

Do look out for our Next Gen webinars and let’s all learn to live #Lifeproof together!

1Referrers must be neither Great Eastern staff nor financial representatives. Referrers will only be credited the UPGREAT points only when their referral(s) quotes the referrer’s email on registration and subsequently attends the webinar. Refer to the #Lifeproof circular on Lifehub for more details.

Gear Up for the Inaugural Learning Festival…Coming your way 19 Jan onwards!

Join us at our first-ever experiential Learning Festival event that will keep you on the cutting edge of our latest learning offerings to be #futureready! The upcoming Learning Festival is themed “S.M.A.R.T. GEN - Enabling S.M.A.R.T. Reps” - building a Solutions-Focused (S), Motivated (M), Achievers (A), Resourceful (R) and Tech-Savvy (T) workforce.

Organised by the Centre For Excellence (CFE), the Learning Festival promises to be a highly interactive and engaging learning experience over four days where you will get to play with various immersive technologies such as Augmented Reality (AR), Virtual Reality (VR) and Mixed Reality (MR).

GAME ON as we aim to trigger all your senses for learning and transform classrooms into learning playgrounds!

Happening at the Great Eastern Centre and Paya Lebar Quarter, the Learning Festival will certainly be a uniquely fun and memorable one. What’s more, in support of our sustainability drive, we will be going 100% paperless for this festival and you can simply scan the unique QR code to download the e-learning materials at each booth.

Mark your calendars! We look forward to seeing you there!

Dates: 19 – 21 Jan 2021 @ Great Eastern Centre - CFE Training Centre and the Voltage

26 Jan 2021 @ Paya Lebar Quarter (Level 13)

Revealing our Top 10 Sellers for GREAT CareShield!

A big pat on the back and hearty congratulations to our top 10 sellers of GREAT CareShield since its launch in October. Big kudos to them and all of you who have relentlessly helped to educate and help our customers to plan for the unforeseen to be #Lifeproof.

Drum roll… here are our top 10 GREAT CareShield Sellers (as of 13 Dec 2020):

Name: CHUA SIEW LENG – GEH02

Director: GOH CHAN JOO

Case Count: 91 Cases

Name: CHUNG DE RONG, JONATHAN – GEH02Director: GOH CHAN JOOCase Count: 83

Name: LYE WEI REN - GEH02

Director: LYE WEI REN

Case Count: 82

Name: AW LILAC (HU LILIE) – GEE02

Director: ENG WEE YEE (HUANG WEIYI)

Case Count: 78

Name: LIU XINLIN – GEC04

Director: LOH CHIN HWEE PHILIP (LUO JIN HUI PHILIP)

Case Count: 71

Name: NG KOK HWA – GEE02

Director: ENG WEE YEE (HUANG WEIYI)

Case Count: 70

Name: ZHANG XIULIAN - GEE02

Director: JASMINE NG SOR KHIM

Case Count: 68

Name: PHUA YIH KIAT (PAN YIJIE) – GEC01

Director: ROSELINE TER CHIEW PING

Case Count: 66

Name: HUANG ZHONGYONG – GEE01

Director: CHOO KOK BOON

Name: NGO JINSHEN, DENYS – GEC02

Director: TAN WEI YAN, TIMOTHY

Case Count: 65

Case Count: 65

Sneak in and find out the secret success recipes of Joey Goh, Denys Ngo and Janice Zhang!

1. How do you constantly motivate yourself to achieve your sales targets?

Joey Goh: I believe in leading by example. I wish to demonstrate to my juniors that it is possible to keep achieving your targets, year after year.

Janice Zhang: I am clear about my goals and my action plans to achieve them. The FYC target that I want to achieve will then determine the monthly sales volume I need to do. I often share with my team to “own” the target and be committed to the target you set for yourself.

Denys Ngo: I don’t actively think of the sales targets. I believe my clients will benefit most when I can help them to plan for their protection needs early and be the first to help them. I am also motivated to offer holistic financial planning to prospects and my clients.

2. Which of the product benefits do you think your clients like?

Joey Goh: They appreciate the lump sum payable upon the inability to perform at least 1 Activity of Daily Living (ADL) and the fact that their premiums will be waived from as early as 1 ADL.

Janice Zhang: The attractive selling point is that we pay out a benefit in the event of 1 ADL. On top of that, we are also the only insurer that pays the initial benefit more than once. Premiums can be paid through CPF Medisave so the buying barrier is lowered.

Denys Ngo: The peace of mind that my clients will get from the lump sum payout from 1 ADL is a very competitive advantage to us. These payouts will help them to manage their associated long-term care expenses such as installing safety fixtures at home.

3. What is your ’30-second elevator pitch’ to someone to take up the GREAT CareShield plan?

Joey Goh: Having a Great CareShield plan will help address your concerns for disability protection. The plan will complement your existing insurance and critical illness portfolio, and you can also fund this plan with your MediSave funds!

Janice Zhang: Hi, have you received a mailer from MOH last year regarding your Careshield Life scheme? This is a national scheme to provide long-term care if we suffer from disability and are unable to do daily activities like toileting, walking and feeding. However, as the benefit payout starts from just $600/month, do you think it’s sufficient to hire a caregiver and help manage your other long-term care expenses on your own? You can now make use of your CPF MediSave to enhance this coverage. Let me show you.

Denys Ngo: If you haven’t heard of the GREAT CareShield plan yet, you ought to find out more as it can take care of your long-term care needs through payouts and gives you enhanced protection if you are struck by disability. You do not need to worry about forking out in cash to fund this plan.

Upskilling is the Name of the Game!

Stay ahead of the industry changes and upskill to enhance your advisory skills and knowledge with our learning modules mapped to the Institute of Banking and Finance (IBF) curriculum. For leaders, hone your skills and get the IBF Level 3 accreditation for the Agency Management Training Course (AMTC). This skills-based programme by LIMRA, a U.S. consulting and professional development trade association helps leaders develop and sharpen supervisory skills in the areas such as planning, recruiting, selecting, training and performance management. The AMTC is administered by the Financial Services Managers' Association in Singapore.

We are proud to share that 168 of our leaders have completed all 3 levels of the course and have been awarded with AMTC!

Want to outdo everyone else? You can take another step up and jump onboard the Chartered Insurance Agency Manager (CIAM), another prestigious certification by LIMRA!

Hear what our leaders have to say:

Patrick Peck, Managing Director, Regional Agency/FA and Bancassurance

“In Great Eastern, we believe in our People, our Customers and our Representatives. Therefore, we will still continue to invest in the professional development of our leaders and reps so that they can continue to provide their customers with professional financial advice and to delight them with excellent service. I am heartened that we have put in place the various learning and development programmes to enhance the professionalism and competencies of our staff. The IBF certification is an industry benchmark and I am confident that our high calibre distribution team will be #futureready to meet the needs of their customers in this ever changing market environment.”

Vincent Gan, Senior Director

“It is great that IBF distinguishes finance professionals through their accredited certification programmes so that they can serve their clients at the highest professional excellence standard. We need to keep up with the industry changes and this highlights the importance of continuous learning and development so that we constantly upskill to stay abreast of the industry changes.”

Jason Thian, Director

“With so many financial reps in the industry, how do you differentiate one from another? The differentiating factor would be to obtain an IBF certification which is a mark of professionalism.

My certification assures my clients that I can be trusted to provide professional advice to help with their financial planning. I found that the certification has helped enormously with my client retention and referrals.”

Linda Chua, Director

“The IBF Standards are a set of competency standards for financial skills which is an all-important framework for professionals in the finance industry. This certification is a mark of professional excellence as it sets the industry standard in providing financial advisory practices. I believe that having the IBF certifications will enable us to provide even more value-added services to our clients to better serve their financial planning needs.”

As we encourage all to upskill, let’s continue to be the #AgentsofLife to make a difference for our customers through the work we do!

Do you know about Deferred Benefits?

Have you heard of deferred benefits? As one of the perks introduced in 2018, you will certainly find it useful to know how you can benefit from them with the latest updates!

Read on for the WHAT, WHOs, HOWs and WHEN you can receive these deferred benefits!

WHAT are deferred benefits?

Deferred benefits are designed as a retention scheme by giving benefits in the form of cash to all leaders and reps for their sales made. They also serve as a form of retirement funds for leaders and financial representatives to tap on in their later years.

WHO will receive the deferred benefits?

The deferred benefits will be given to the following groups:

- Financial representatives who are holding the commission and servicing role of the policies;

- Executive Senior Manager/Associate Director/Director who are holding the commission and servicing role of the policies, will receive production commissions of the deferred benefits on those policies; and

- Immediate Officers/Directors of the reps will receive the overriding commission of the deferred benefits on those policies.

HOW does deferred benefits work?

You will receive the deferred benefits if you have sold an insurance product from our list of selected products. Click here to find the complete details of the benefits on Lifehub (Under the Product Listing Section) and to find out more about the specific changes made!

Selected Products Eligible for Deferred Benefits: |

|

|

|

|

|

|

|

It will be accumulated with us and the accumulated deferred benefits will earn interest from the 7th policy year onwards based on the investment performance of a Balanced Fund, which consists of bonds and equities.

The cash amount you will receive from your deferred benefits will depend on:

- the product sold;

- the premium payment term made on the product; and

- the investment performance of the Balanced Fund.

You will receive monthly statements of your deferred benefits and you can withdraw the deferred benefits by writing to the company.

WHEN can I withdraw my deferred benefits?

You can withdraw up to 50% of the accumulated deferred benefits (or Accumulated Funds) as long as you reach 55 years of age and complete 10 consecutive years of service with us.

If you choose not to withdraw the Accumulated Funds, these funds will continue to be accumulated with us in the Balanced Fund. The Remaining Funds can be withdrawn only once a year in your birthday month after you reach your prevailing Retirement Age.

A Caregiver’s Story – the Value of Being Insured when life goes Topsy Turvy

We never know the impact we have on others till we hear real stories from our customers. Be encouraged and inspired by Mr Nicholas Sim’s story on being a caregiver for his wife and know your value of providing financial advice to your customers.

As a business owner of an executive search and human resources training firm, Nicholas’s comfortable life took a turn when his wife of 35 years was diagnosed with dementia. Within a span of 14 months from her diagnosis, his wife lost the ability to read numbers and alphabets. This rapid slide of finding herself unable to recognise words and numbers was a difficult period for her as she used to be an able-bodied, quick-thinking executive in the corporate world. Depression followed soon after.

At the early onset of his wife’s dementia, Nicholas recalled an incident where he was woken by her crying. When he asked her why she cried, she said something that could have stopped him in his tracks: “I am afraid that one day I may forget about you”. That night, Nicholas wept when she fell into sleep.

To support his wife, he decided to give up his business and take on the responsibility as the sole caregiver to his wife. He admitted that it was not easy to be a full-time caregiver as he juggled multiple roles - being a single parent to his two sons and managing his freelance consultancy work. However, he was grateful that he was able to look after his wife as he felt that it prevented her situation from deteriorating.

Looking back today, Nicholas is thankful for the forward planning that both he and his wife did for themselves as they bought insurance plans to protect themselves against any unforeseen circumstances. The insurance payouts that lasted for 6 years, enabled him to be a full-time caregiver. He did regret that they did not purchase insurance plans with higher premiums which would have given him lifetime payouts as these payouts would certainly better help in managing his expenses.

His message to all? Things can change in an unexpected manner and it is important to plan ahead. What is admirable about Nicholas is his positivity and his forward looking approach towards life.

He ended his video with these words of advice - “Concentrate on something positive and do something positive. When you keep on encouraging people, you also get encouraged.” Calling it a positive-reinforcing cycle, he called for all to be “captains of our ships to move ahead and look forward all the time.”

Great Eastern: KEE-ping it in the Family

Here’s our article featuring our multi-generational family of financial representatives, Benny Kee and his wife and daughter, on what it means to work together in the same industry as a family and what keeps them together for their work. Enjoy reading!

Spot yourself or your kakis rockin’ under the Christmas Tree?

Our Agency Business Development (ABD) and Accident & Health (A&H) departments organised a Christmas social media challenge (3-24 December 2020) to groove into the festive mood!

The challenge was for you to post a photo with our ABD and A&H decorated Christmas Trees and caption how you #lifeproofed your customers against the unforeseen on Facebook or Instagram, with the hashtag #GECelebratesXmas.

Here are our winners who won a Christmas treat (brownies and wine) worth more than $50!

- Andy Seng

- Eric Chan Wei Zhang

- Director Johnson Gan

- Director Jessie Lim

- Bruce Poh Wei Xian

- Director Grace Chua

- Samantha Lim Ai Lian

Check out some of the award winning social posts below!

Congratulations to all our winners!

Calendar of Events

Here’s our article featuring our multi-generational family of financial representatives, Benny Kee and his wife and daughter, on what it means to work together in the same industry as a family and what keeps them together for their work. Enjoy reading!

Lim Kopi with Jesslyn Tan, CEO, Great Eastern Financial Advisors (GEFA)

1) Tell us your biggest highlight of 2020.

Seeing so many businesses affected by COVID-19 and our industry as a silver lining amid the economic gloom, I consider ourselves very fortunate in this respect. The biggest highlight for me would be GEFA’s ability to rise above the COVID-19 challenges.

2) How do you motivate the GEFA team in challenging times?

The GEFA team is very self-motivated and driven by the meaningful work that they do - by being emphatic to their clients’ needs in these uncertain times and offering peace of mind to them.

Beyond that, they are also motivated that we have in place the various support systems for them. For example, we are the first insurer to launch the Non Face-to-Face sales advisory process amid COVID-19 and organised clients’ webinars monthly to create more sales and engagement opportunities for them. All these made them feel we are in this with them to help their sales together.

3) Describe a moment you’re very proud of in your career with GEFA.

Five years ago, we created a vision to be the largest financial advisory firm in Singapore and for GEFA to contribute more than 50% of Great Eastern’s agency business by 2020. It was no mean feat, as back then, GEFA was only a third of Great Eastern’s total distribution force. Today I am proud to say that we achieved that vision last year and this is attributed to the keen support of our reps and staff, and everyone’s desire to succeed.

4) What’s your take on lifelong learning?

I have an innate interest towards learning and developing my growth mentality. To me, learning is the only way to navigate the many changes and challenges we face every day as I need to adapt to the changes around me.

5) What new/old hobbies have you picked up/rediscovered in the last year?

Well, my new hobby during WFH is watching Korean dramas! Family time over movies or meals also became a new pursuit. These are indeed rare occasions as my family members would otherwise have their own activities with friends if not for the circuit breaker.

6) Complete this sentence: My favourite food is ……… and the best way to enjoy it is ………

My favourite food is home baked English scones and the best way to enjoy them is to spread lemon curd and salted butter, accompanied with a cup of freshly brewed English tea.

7) Your wish for the GEFA team for the New Year?

Embrace change, overcome challenges and emerge as champions was our success formula for 2020.

Going into 2021, my wish is for GEFA to trail blaze new frontiers as the industry is expected to be saturated with new joiners. We must continue to strive to stay ahead of competitors, discover new markets and explore all growth opportunities.

My wish for our advisers - go where nobody dares to tread, acquire new skills and knowledge with voracity, and identify and ride the waves of change.

For all in GEFA, we have weathered this pandemic together successfully thus far. If we stay focused and remain passionate in our work, we can only win!

I wish for everyone to stay healthy and safe! Continue the great work you are doing, and together we will make 2021 another resounding success!!

Paying forward the Gift of Empathy - Zoe Yap and Angela Tan

Catch up with our financial representatives, Zoe Yap and Angela Tan and listen to their side of the story on why they made the made the switch to be #AgentsofLife.

Zoe Yap

Zoe was previously a Sales and Marketing Manager from an interior fit-out company.

Angela Tan

Angela was doing Ship Management in the Oil & Gas industry.

1. Why choose to be a financial representative?

Zoe: I am an end-stage cancer survivor. For 5 years, I fought through 4 cancer strikes. When the going got tough, I benefitted from insurance planning that gave me peace of mind and enabled me to take care of my loved ones.

My own experience makes me want to educate people on the importance of planning early for the unforeseen by getting protected so that they too can have peace of mind if any mishap were to happen to them.

Angela: I wanted to contribute more to help others. While my job in the Oil and Gas industry was exciting, I felt that something was missing. Particularly as I also see my fiancé’s work as a doctor, working with cancer patients, it motivated me to make a difference in people’s lives through my work. My fiancé encouraged me to make the switch because he believes that I can help others.

Today, I am motivated by the fact that I am able to meet the protection needs of my customers and I am there to support them. It gives me great satisfaction that my customers can enjoy peace of mind as they are aware that they have planned for the future, come what may.

2. Did you face difficulties in becoming a financial representative? How did you overcome them?

Zoe: The most challenging thing for me was to find prospects and to share with them about financial planning, especially when it came to sharing with my relatives and friends. Whenever I encountered rejection, I would feel discouraged. As a mid-career joiner, I had to overcome my own fear of leaving my comfort zone and starting all over again to prove my worth in a new career. I also found it challenging to attend the various training courses to learn about financial planning without any prior background. However, I persevered as I want to succeed and do well in my new career.

Thankfully, I managed to overcome my fear of reaching out to prospects through a Great Eastern coaching workshop called “The GREATER Way” that taught me the right techniques of approaching people. I also received unconditional support and encouragement from my colleagues who believed in me.

Angela: I decided become a financial representative during the circuit breaker. Initially, I felt very stressed as this job was a steep learning curve because I needed to attend the rigorous training courses to have a good grasp of the various aspects on financial planning.

I had encouraging friends and ex-colleagues who gave me the opportunity to share with them about financial planning as many were starting their own families. I would say that even though the training was challenging, it was necessary as it provided me with the skills and resources to perform in my job. My team mates were all very encouraging and helpful which helped me to ease into my job.

3. What has changed in your life personally since you became a financial representative?

Zoe: I enjoy managing my own work schedule. I used to work late hours in my previous job. Since becoming a financial rep, I am now able to spend more time with my family which I value.

I am also motivated to work harder by reaching out to more people as I believe in the purpose of my job – making a difference to people’s lives. I hope that I can encourage them to do financial planning at whichever life stage they are at because I have seen for myself how it is really so important to be protected. I am inspired by how my Immediate Officer Xavier Ang reached out and what he had done to help me with my financial planning in the past.

Angela: In the past, I was mostly an empathetic listening ear to my friends’ problems. Now, I can help people by providing them with insurance solutions to make sound financial decisions, which I find very meaningful.

4. How have you changed someone’s life or perception about financial protection through your work?

Zoe: In less than 2 years, I have helped numerous friends and relatives to make claims for their hefty medical bills, including death payout. I want to be there for my customers in both their good and bad times.

Angela: I have been educating my clients about the importance of insurance and connecting with them to understand their concerns and needs. It gives me a great sense of satisfaction whenever I am able to explain to our insurance solutions them in simple and bite-sized way which they appreciate. I am glad to share with them how they can live #Lifeproof.

Up your Service with Great Digital Advantage

Catch up with our financial representatives, Zoe Yap and Angela Tan and listen to their side of the story on why they made the made the switch to be #AgentsofLife.

At Great Eastern, we are always reimagining and enhancing our digital journey experience for you to better serve your customers’ needs. Thank you for closely partnering with us and sharing your valuable feedback from the numerous interviews and user experience workshops conducted by our User Experience (DXB) team colleagues from October to December last year.

Check out some of the updated Great Digital Advantage (GDA) initiatives that will help you stay ahead!

A digital workbench that acts as a unified platform where you can perform your daily activities is coming your way! You will no longer have to keep fiddling between the different platforms to access all the information and services you need. In addition, following up with your leads and serving your clients’ requests will be much faster and easier too!

To increase your presence in the digital and social front, we will be piloting an agent web portal for you to share your professional services and knowledge to reach out to your prospects. With this new portal, you also can connect more easily with them through your social sharing. We will also be rolling out a digital shop front for your clients to purchase insurance online.

Furthermore, new enhancements to the financial storyboards in GreatAdvice include getting auto populated products’ recommendations to share with your customers' based on the simulated scenarios of their life stage needs. In time to come, your clients will be able to access the depicted scenarios you have shared with them through the Great Eastern App too!

With all these upcoming improvements to the GDA, we are excited about what it will bring for you – greater level of service and professionalism to our customers.

Be sure to follow us for more updates on our digital initiatives!

Top 3 Tips for Business Success

We ask Jesslyn, CEO of GEFA for her top 3 tips for business success and here they are!

1) Keeping our Vision

As the saying goes, “Without a vision, the people perish”. Having a vision lays the foundation on what and where we want to reach, but keeping the vision ensures we will continue to steer towards the path of success and not waiver even during challenging or difficult situations. Be prepared to make changes in your journey but keep the vision and your goal. For this industry, vision and perseverance are key to keep one motivated and to succeed.

2) Standing on the Shoulders of Giants – to constantly learn from others

Sir Isaac Newton wrote “If I have seen further, it is by standing on the shoulders of giants”. There are many legends out there who have been there and done that. Be ready to emulate and learn what is working successfully for others rather than re-create. This will save precious time and you need not reinvent the wheel. When you leverage such transferable knowledge and skills to your advantage, you go further and faster.

3) Networking

To build a large and successful business, networking is key. Networking helps you with important collaborations and connections that can be invaluable for your business. In other words, you are expanding your centre of influence that will result in your ability to find new customers. It should not be limited to those within the industry but rather span across all industries. Having a good network will help identify interesting and relevant business opportunities.

Ron Kaufman’s Top 3 tips on Giving the Best Customer Service

Acclaimed author and customer service guru on the New York Times’ bestseller’s list with his book “Uplifting Service”, this year’s Great Kick-Off speaker Mr Ron Kaufman, spills his top tips to aspiring sales people.

We’ve got it right here:

1. Serve others with a heart – Be genuine and have empathy

It is all about empathy and being OTHERs-centric! Why? That’s because with empathy, you get to understand what your clients actually value and want, helping YOU to be the answer to their problems!

We will not know what others are going through unless they share. By you lending an ear or even a hand, your clients will feel that you are with them. (Not to mention, it will also help you to handle the difficult ones!)

2. DOING MORE to providing an uplift in service – every single time

Twiddling your thumbs and wondering if you should reply an after-work hours text from your client? Go on and start right on that text message now! And if you used to reply his or her message on time, push yourself to understand and anticipate your clients’ needs even before they reach out to you for help!

3. Take action – THE RIGHT ONES PLEASE

Singapore Airlines (SIA) is no stranger in the list of top 20 airline companies since 2013, even snagging No. 1 spot in 2019. How is that possible in an environment where product offerings across most airline companies are similar? It’s all about EXECUTION! SIA’s near-perfect eye-to-detail in their service offerings to customers has won the hearts of their customers. Now ask yourself - Have YOU been taking the right actions to make your clients feel understood and cared for?

Service is care in action to bring value for your customer’s well-being. This year, challenge yourself to uplift your service and provide them with REALLY INCREDIBLE service!