This e-publication is for internal sharing only and is not to be distributed outside of the company.

June 2020

Click below to read more.

Featured Story

» Empowering financial reps to scale up with digital skills and competencies

COVID-19 Efforts

» Great Eastern Cares Community Fund raises $265,000 for three charities; Advisor’s Clique donates $50,000

» A special meal treat for the financial representatives

» Helping our customers through COVID-19

» Great Music for a Great Cause

» Boosting staff morale during COVID-19 pandemic

» GELM ensures employee wellbeing at the workplace

» GELI and GEGI host first-ever Virutal townhalls

» COVID-19 landing page on website

Business & Innovation

» Five consecutive years of customer satisfaction

» GE Integrated Shield policyholders to enjoy affordable online and offline GP consultations

» Helping financial representatives stay in step with clients’ general insurance needs with Project Allegro

» We Are The Life Company – new corporate video for 2020

» GELI financial statement for 2019

» GELI launches its Great Eastern Mobile Assistance

People

» Spin the Wheel for your 2020 Great Eastern t-shirt!

» Returning to work after Circuit Breaker

» Welcoming the newly promoted batch of leaders!

Read & Win

» What do you think of the new TGT look? We want to hear from you!

» Shopping galore with RebateMango on UPGREAT

Click here for past TGT issues.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

The new reality brought about by COVID-19 has disrupted the traditional way of working that many financial representatives are familiar with, such as face-to-face meetings with clients. Social distancing is now the de-facto norm and many Great Eastern financial representatives have realised that by going DIGITAL, they are still able to engage their clients anytime, anywhere, without compromising the high quality of advisory service, responsiveness and agility that their clients have come to expect.

If you haven’t already gotten well and truly Digital, now is the time to plunge right into it and find out how to up your Digital Game.

Our Centre for Excellence (CFE) has created an extensive curriculum to help equip our financial representatives in the areas of product knowledge, regulatory updates, and to hone their soft skills in communication, sales and leadership.

Lessons previously conducted as face-to-face class lectures by experienced trainers and industry professionals have morphed into webinars via WebEx technology and live streaming sessions to become the norm to deliver digital-centred training programmes to the financial representatives. This is on top of the e-learning modules, pre-recorded videos, online quizzes and assessments available 24/7, where representatives have been able to learn at their own pace on their digital devices.

Depending on how popular these are, each training session can cater to up to 200 attendees per video webinar with two-way interaction between trainer and students or a one-way webinar session for up to 1000 attendees with the right support of IT bandwidth.

These digital-centred training programmes cover a wide range of topics in enabling our financial representatives to be ready for business:

Functional Digital Capabilities – Pick up the skills and techniques to engage with clients in virtual meetings using WebEx technology and master how to use our Great Digital Advantage Suite of applications and interface such as GreatAdvice, Financial Storyboard, Great Planner and GERICA.

Product Capabilities – Learn about Great Eastern insurance and financial products through highly interactive and intuitive e-learning modules equipped with easy dashboard, to understand unique features of these products and to gain product knowledge quickly.

Sales Capabilities – Acquire key sales skills for financial representatives to excel in delivering on sales targets and results. These webinars may be hosted by internal trainers, invited speakers from our pool of distinguished Associate Trainers, proven achievers like Million Dollar Round Table (MDRT) practitioners or external trainers who will share their expertise on attaining sales success.

Building the Digital Brand – Learn via Webinar from successful social influencers as they share best practices to help create effective digital presence on popular social media sites like Facebook, Instagram and LinkedIn as well as other topics such a Social Listening and Leads Generation on how to build up an established digital profile and credibility.

Investment Knowledge and Sentiments – These series of Webinars are helmed by renowned fund managers to provide up-to-date perspectives on the current market situation and opportunities that can be tapped during these unprecedented times. Topics range from basic investing knowledge on the asset classes to asset allocation techniques, structuring an investment portfolio, and managing clients’ expectations on their investments.

Leadership Capabilities – As a foundation for all leaders in Great Eastern and in partnership with the Financial Services Managers Association, Agency Manager Training Course (AMTC) is an IBF level 3 certified programme that offers a signature 25-week curriculum where practitioners are the trained moderators and facilitators of this programme over five topics – Planning, Recruitment, Selection, Performance Management & Training. Highlihjy intercative, with multiple projects and break out discussions, this programme is now successfully implemented via Webinar.

Ms Zubaidah Binte Osman (Zuby), Head, Centre for Excellence said : “Establishing digital grit and enablement is the new norm now for our financial representatives, from learning through digital formats or leveraging on digital tools. Digital learning is no longer optional but an essential lever of learning and development to build their competencies to establish their public profiles, serve their clients and provide quality advisory services. At CFE, we give our financial representatives various opportunities and engagements to upskill themselves quickly and to grow their personal and professional competencies to serve the protection and financial needs of our customers.”

One financial representative who has seen the benefits of going digital is Ms Linda Chua. A 27-year insurance veteran after spending 17 years in the civil service, she currently heads a team of 16 representatives, and is an Associate Trainer with Great Eastern.

Ms Chua has attended various webinars covering topics such as sales, funds updates and investments and also learnt how to use WebEx to conduct training like AMTC and conduct meetings. As the Chairman of Great Alliance, she uses WebEx to meet her board of directors and agency members virtually and also conduct lessons for her team of representatives, on top of her regular team meetings and individual coaching sessions.

To those who have still to embrace digital as part of their work and advisory services, Ms Chua has this to say: “Change is necessary going forward. Reaching out to our clients and making connections via the digital way is going to be norm of our life and work in the future. We should accept and embrace the digital connections and take up courage to start straight away.”

She added : “It’s a matter of moving from the unknown to the known. Once, you master it, and as it becomes more familiar with more practice, you will enjoy the smoother and faster process of doing your work. Such is the beauty of digital technology, when used in its right application. We should leverage technology and not be made a slave of technology.”

For more details of CFE’s training programmes, you can email excellence@greateasternlife.com.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

The Great Eastern Cares Community Fund was set up with the aim of helping Singapore-based charities that are struggling for funds to support their beneficiaries and activities due to the COVID-19 pandemic. In collaboration with the Community Chest, the Great Eastern Cares Community Fund will help to raise funds for three charities – AWWA, Care Corner and New Hope Community Services.

This company-wide month-long fund-raising exercise which took place from 4 May till 31 May raised a total of $164,491 from 410 donors. With the company matching donations dollar-for-dollar up to $100,000, a total of $264,491 was raised for the three charities.

This is in addition to the S$200,000 donated to the Community Chest’s Courage Fund in February 2020, to help support vulnerable individuals and families affected by Covid-19.

Great Eastern Cares was launched in 2018 to bring together our community programmes, strengthened by active employee volunteerism initiatives. It also serves to rally our people - both corporate employees and the distribution force - behind our corporate social responsibility efforts. Our approach is driven by supporting causes and charities that help the less fortunate and vulnerable, including low-income families, women, children and youth, elderly and disadvantaged communities.

Advisors Clique (AC), a group of financial consultants representing Great Eastern Financial Advisers, made a donation of $50,000 to the Great Eastern Cares Community Fund.

This is the single largest donation made a by an individual staff or Great Eastern entity.

As Singapore’s largest financial advisory agency group, AC was established in 2001 by five co-founders along with five other founding members and has since grown to a staff strength of approximately 800 financial representatives and support staff.

Doing meaningful charity work has been a part of the DNA and corporate culture of AC.

Starting as an idea from Director Yeoh Cheng Huann, AC established its charity arm AC Cares in January 2015 for its CSR efforts.

In the last five years, AC Cares has helped to raise funds for charities such as Mainly I Love Kids (MILK) and the Home Nursing Foundation and delivered daily essentials to low-income elderly residents.

With the escalation of the COVID-19 pandemic in Singapore, AC Cares was involved in the purchase and distribution of surgical masks to beneficiaries under the Migrant Workers Assistance Fund, the YMCA Project Makan and to tertiary students on financial assistance schemes studying at the National University of Singapore, Nanyang Technological University, Singapore Management University and the Singapore University of Social Sciences.

Mr Patrick Loh, Senior Director and the President of Advisors Clique said: “This donation of $50,000 is a collective decision undertaken by all 25 directors of Advisors’ Clique, as well as 145 of our financial representatives who achieved Million Dollar Round Table status in 2019. This had started as a pledge in 2019 whereby we set out to achieve and fulfil 111 MDRT qualifiers in line with Great Eastern’s 111th anniversary and at the same time, to raise $111,000 for 11 charities. We are very pleased to have achieved this goal but more importantly, play our part to contribute to Great Eastern’s efforts to raise funds for these charities and the causes they support.”

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

With the Singapore government putting in place a circuit breaker period since April, the usual work routine of our agency force came to a standstill – and these included one-on-one interactions with clients and referrals as well as individual coaching and team training sessions.

This unprecedented situation has not dampened the enthusiasm of our financial representatives. Our recently-introduced digital tools and tele-advisory services have enabled them to keep in regular contact with and to continue to offer quality advisory services to their clients during this period.

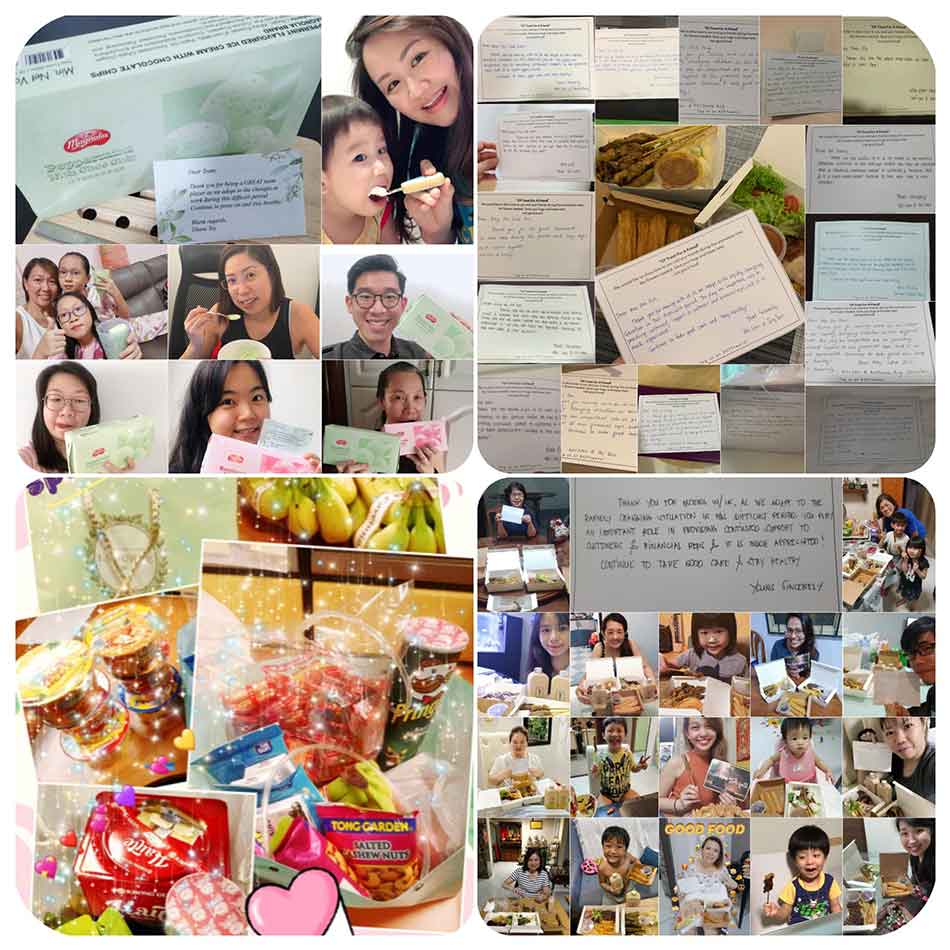

As a gesture of gratitude to the directors and managers for their inspired leadership and to show appreciation for their hard work, the Agency Business Development team, part of the SG Agency and FA office, delivered 700 meal sets to them in May. The meal sets were from Football Café and Be Frank and came with a personalised card signed off by Mr Khor Hock Seng, Group Chief Executive Officer; Mr Ben Tan, Managing Director, Regional Agency / FA and Bancassurance and Mr Patrick Peck, Head, SG Agency & FA.

Looking at the smiling faces, this unexpected surprise was very well-received and appreciated by the directors and managers, judging from the thank you notes and social media posts tagged #GECares.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

The ongoing COVID-19 pandemic has changed the lives and livelihoods of many Singaporeans these past months, particularly those who worked in the gig economy or hold seasonal or freelance jobs.

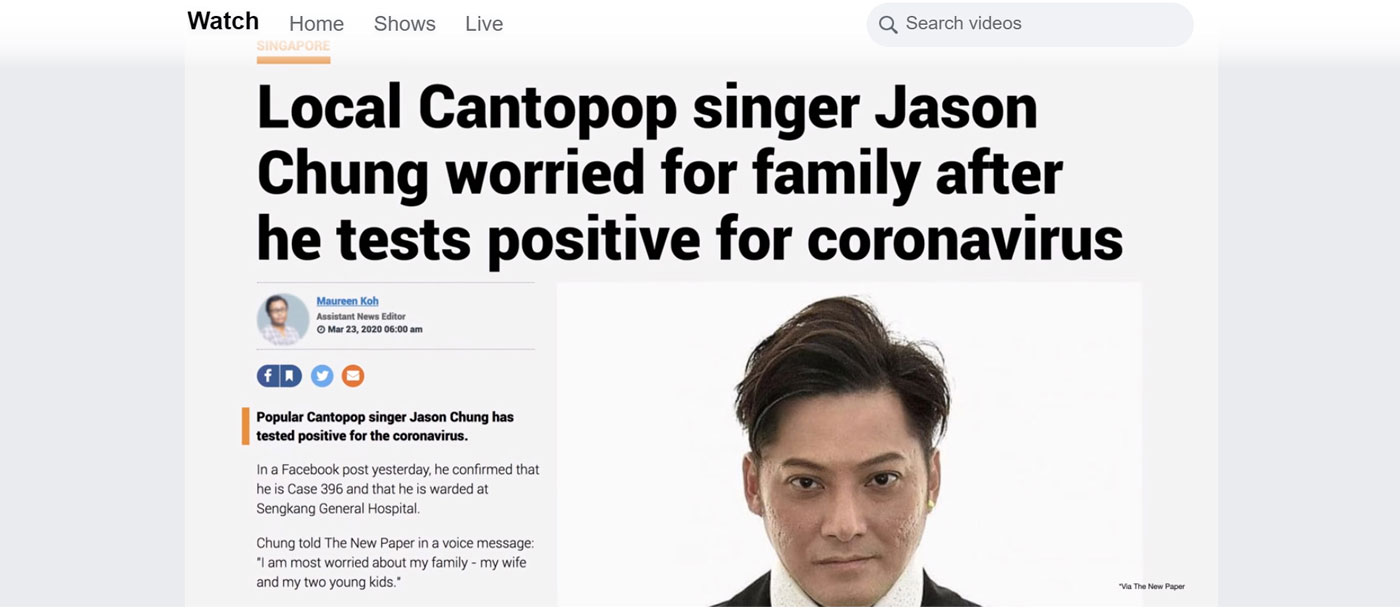

Mr Jason Chung, a well-known getai singer in the local Cantonese music scene was struck with COVID-19 back in early March, and hospitalised after a 40-degree fever which did not subside after 5 days. Eventually warded, he was discharged with a clean bill of health after 8 days..

TGT caught up with Mr Chung’s financial representative Mr Stanley Tng, a 30-year veteran currently with the agency under Stephen Chan Fook Seng who recounts how he helped Mr Chung with his medical claims through the Great Eastern COVID-19 Customer Care Fund.

Question) How long have you known Mr Jason Chung as a customer?

I have known Jason for about 25 years where he currently has life insurance and personal accident policies with me. I was supposed to meet up with Jason in early March this year for our regular review session but we had to postpone. That was when I found out how that Jason was warded in hospital with COVID-19.

Question) What was your initial reaction when you heard the news?

I was shocked when I heard the news. I was particularly concerned as he is the sole breadwinner of the family with two young kids aged 4 and 2 years and had recently undergone heart surgery. I checked in with him practically every day to find out his progress in hospital as his high fever persisted. Fortunately, he told me his condition was improving and that he had no other symptoms other than the fever which eventually subsided.

Question) How did the Great Eastern COVID-19 Customer Care Fund help Jason and his family?

When I learnt about Jason’s diagnosis that he had COVID-19, I shared with him the Great Eastern COVID-19 Customer Care Fund for our policyholders and their family members. Jason was very surprised and relieved to hear that Great Eastern had this benefit for our policyholders. When he was finally discharged from hospital, I proceeded to process his medical claims immediately. I would like to say a big Thank-You to our colleagues from the claims department for their prompt assistance with the payout!

Jason received a $1,600 payout which he was grateful for as it helped to defray his expenses such as utilities, daily essentials and pre-school fees for his elder daughter. Since the circuit breaker period, he has had no income as the entertainment industry had been shut down. So far, Jason is doing well now as I spoke to him about a week ago (in mid-May).

Question) How has COVID-19 affected your work as a financial representative?

The COVID-19 situation has definitely affected everyone in one way or another. Before the onset of COVID-19, I was able to meet up with at least two to three people each day. With the Circuit Breaker and restrictions on face-to-face meetings, I regularly send out text messages to between 15 to 20 of my customers daily to check in how well they are faring and be updated of their well-being. At the same time, I would also use the opportunity to keep them posted on our new products and promotions. As most of my new customers are through referrals, it is important to be in contact with them regularly.

During this Circuit Breaker period, the digital tools have allowed us to engage with our customers and offer advisory services. Whether it is for processing loans, settling claims and attending to enquiries about the Deferred Premium Programme, I am able to assist them via video chats and text messages. Features such as the online submission of forms has been a tremendous help and made it more productive for us as financial representatives to process the paperwork promptly and seamlessly.

Question) Lastly, do you have any advice or words of encouragement to other Great Eastern financial representatives and colleagues during this COVID-19 situation?

For all my colleagues, let’s take this episode as a challenge! See it positively! Adapt and adjust! There are more opportunities than you could imagine! Just take the first step and the rest shall follow.

To my customers, rest assure that Great Eastern will always be with you.

Let’s not be overwhelmed by the situation but overcome it ! Put the fear away. Stay safe and stay well!

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

GELI collaborated with BookMyShow to organise "Great Music for a Great Cause". This 1-hour online concert was broadcasted over Youtube on Sunday, 10 May at 8pm and featured popular musician Rendy Pandugo, also known as Indonesian’s John Mayer.

The online concert was aimed at helping Indonesian music fans to remain positive, uplifted and optimistic in the face of the COVID-19 pandemic and also served as a fund-raising exercise to help communities that have been affected by COVID-19.

Great Eastern is committed to giving back to the community and helping the needy and vulnerable in the markets where we operate.

All donations were made through a specially setup portal at id.gelife.co/bmsathome and distributed by Food Cycle Indonesia Foundation to beneficiaries such as hawkers, scavengers and orphans who have been impacted by the COVID-19 pandemic.

During the 2-week fund-raising period from 4 to 18 May 2020, a total of 81 donors contributed close to Rp 8,000,000 or close to S$800.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

During this WFH period, what do most staff miss from office the most?

Face-to-face interactions where you have a quick chat with your colleagues and laugh it off? Or perhaps regular team lunches to satisfy your cravings together?

To boost staff morale and uplift spirits, Group Operations organised their very own “WE” series – a series of staff engagement activities with weekly treats in March, a virtual team-bonding activity in April and a virtual town hall in May to put a smile on your face when you say “WE”.

Healthy booster snacks such as Red Ginseng extract, Almond Nut, Chewy Mints and Yakult drinks were distributed to all Group Operations staff during the month of March as a little perk-me-up and to encourage them to stay in good physical and mental state.

When Circuit Break was first implemented in April, the teams in Group Operations were split into WFO (work from office) and WFH (work from home). To bring all together, a virtual team-bonding activity was organised for the staff to showcase their creativity by submitting their pictures or videos to share how they had maintained their bonding with their colleagues. Judging from the submissions received, there was certainly no lack of imagination among the Group Operations staff. Check out the video here and be amazed by the hidden talents!

Group Operations also held their first-ever virtual town hall in May where Mr Patrick Kok, Managing Director of Group Operations and his HODs addressed the Group Operations staff on their performance to date, future business plans and expectations as well as challenges that lay ahead. Mr Kok also thanked all staff for their hard work, support and contributions during this challenging period. The virtual town hall ended with games played by all Group Operations staff who had to win points for their own department. It was definitely an evening well-spent as all Group Operations staff are winners walking away with a virtual prize as well – the “CAMARADERIE” that is now stronger and more closely-knit than ever before.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

While COVID-19 has halted businesses nationwide and presented a new norm for business operations, Great Eastern Life Malaysia remains committed in serving its customers during this challenging time. Deemed as an essential financial service provider during the Movement Control Order period, our head office remained open, though with reduced capacity, so as to provide the necessary services to our policyholders.

To safeguard our colleagues’ health and wellbeing at the workplace, our LIFE Programme organised an Immunity Boosting and Hygiene Campaign from March to April 2020. During this campaign, we shared daily immunity and hygiene tips, posted weekly email challenges, as well as organised a series of Vitamin-C rich fruits and hygiene products giveaways to our colleagues.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

On 15 May, Great Eastern Life Indonesia (GELI) held its first virtual town hall for its management and staff. During this challenging situation brought about by COVID-19, the management wanted to uplift the employees’ morale and convey the message that they can still contribute to the company while remaining productive, all while working from home. A total of 255 employees attended the inaugural virtual town hall.

The virtual town hall was opened by GELI CEO, Mr Clement Lien. He shared that so long GELI can survive this crisis, it will be strong enough to grow from the crisis and be better positioned to face and solve these challenges. GELI will focus to automate its processes and build new distribution channels such as direct channels through the GELI website so that it can grow both its conventional life and sharia businesses.

The next speaker was Compliance Director Mr Yungki Aldrin where he spoke on employees having to work during this “new normal” and the re-skilling required during this WFH period, from acquiring new skills and attaining mental resilience.

The virtual town hall concluded with Head of IT Mr Boby reiterating the importance of cybersecurity during this WFH period and the measures his team has put in place so that all employees can work from home safely and effectively, from ensuring each employee has a laptop to providing access to VPN and VDI.

A day before, Great Eastern General Insurance Indonesia (GEGI) held its first virtual town hall for its 167 employees from its nine offices across Indonesia.

President Director Mr Aziz Adam Sattar started the town hall by applauding and showing appreciation to all employees who had continued to work well and deliver good service to its customers, agents and brokers during this COVID-19 pandemic. For the first time in 2020, GEGI attainted strong profitable numbers in March and gave assurance that its action plans are in place to help steer the company towards business growth and a sustainable future.

Operations Director Ms Lee Pooi Hor thanked the IT team which has worked hard, day and night, to ensure that all employees could work from home during this period. Using the virtual town hall as an example, GEGI had leveraged on technology to adapt to any challenging situations and to uphold exceptional customer service standards.

Finance Director Andy Soen shared his personal gratitude to employees who have worked hard to ensure that it was business-as-usual for its customers even as the employees were getting used to the new work arrangements of working-from-home and split team arrangements.

Marketing Director Ms Cong Chun Ling thanked the employees for the good cooperation among all teams and divisions in the company. Because of the close-knit teamwork, the company was able to continue the good service offered to the customers.

The 30-minute virtual town hall ended with the Board of Directors wishing all Muslim staff a Happy Eid Mubarak and happy holidays to all.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Since the Circuit Breaker period was implemented in early April, Great Eastern has put in place a host of measures to help our customers, financial representatives and the community at large affected by COVID-19.

To help them be better informed of these measures and assistance schemes, we created a page on our corporate website which consolidated our collective COVID-19 care initiatives. Visit page here.

These care initiatives are categorised under our policyholders, financial representatives and the community.

For our policyholders

As the Life Company, we #Lifeproof the lives of our customers.

On 14 February, we introduced our S$1 million COVID-19 Customer Care Fund where Great Eastern customers or their immediate family members, if hospitalised, will receive a cash benefit of S$200 per day (for up to 60 days) and a S$20,000 death benefit if due to COVID-19.

We launched our COVID-19 Deferment of Premium Payment Programme in April to help policyholders with a six-month grace period for life insurance premium payments to keep policy coverage uninterrupted.

For our financial representatives

To help our representatives and their families should they be caught in the COVID-19 pandemic, we established the Covid-19 Agency Force to provide them with quarantine, hospitalisation, and death benefits.

Our financial representatives will also have access to the latest online sales and lead generation tools so that they can work from home and continue to provide advisory service to their customers and engage with new customers.

Helping them stay abreast with the latest in product knowledge, regulatory updates and skills in communication, sales and leadership, we also support the financial representatives’ continuous learning and development needs for a successful career with us.

For our Community

We have not forgotten the hardships endured by the community at large, particularly charity groups that are challenged by a reduction in public donations and a growing pool of beneficiaries that need their assistance more than ever before.

We donated S$200,000 to the Community Chest’s Courage Fund, to help support vulnerable individuals and families affected by Covid-19.

Our Great Eastern Cares Community Fund also partnered the Community Chest to help three charities – AWWA, Care Corner, New Hope Community Services – where we will match up to S$100,000 of staff’s and representatives’ contributions dollar for dollar.

To date, we have raised a total of close to $265,000 from 410 donors.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Great Eastern has ranked first within the Life Insurance sector in the Customer Satisfaction Index of Singapore (CSISG) 2019. This is the fifth consecutive year that we have topped Singapore Management University’s (SMU) industry rankings in the life insurance sector.

First launched in April 2008, the CSISG is an independent qualitative indicator of the Singapore economy and a measure of customer satisfaction cutting across sectors and sub-sectors in the services industry of Singapore such as finance, insurance, info-communications, transportation, retail and many others.

It is jointly developed by the Institute of Service Excellence (ISE) at SMU and the Singapore Workforce Development Agency (WDA).

This achievement is testament to our customer-centric culture made possible by the hard work of our customer-facing front-line service staff, dedication of our financial representatives and the commitment of our teams who create financial products and initiatives to protect our customers’ needs at every stage of their lives.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

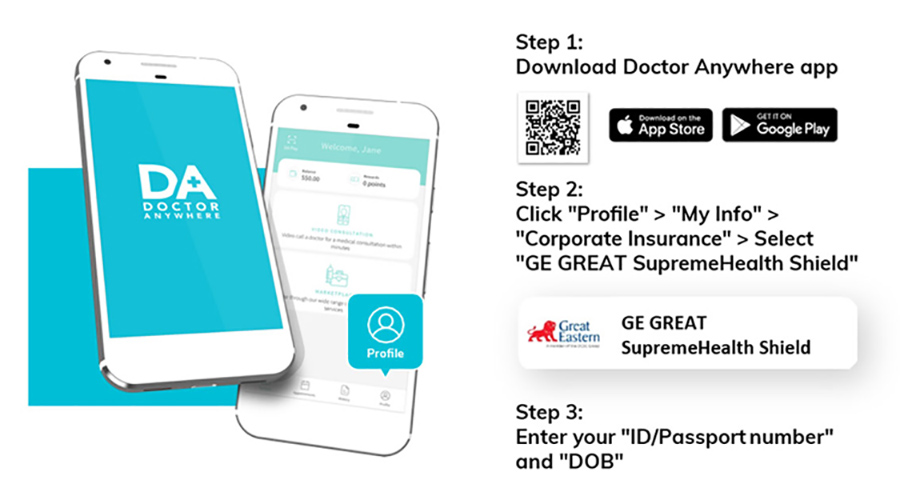

If you are a GREAT SupremeHealth policyholder, you can look forward to a host of health and wellness services provided by local health-tech partner Doctor Anywhere.

For a start, you need to only pay a $12 consultation fee which covers both online and offline GP services.

Not feeling well and dreading the queues at the clinics? You can choose to schedule a video consultation service with a Singapore-licensed doctor.Alternatively you can do a walk-in to see doctors from DA’s panel of over 300 GP clinics. For specialist referrals, you can access the complimentary Health Connect service schedule appointments with any of the doctors in the panel of more than 400 specialists across all medical disciplines.

There is no excuse not to take charge of your own health and wellness. Enjoy Doctor Anywhere’s membership perks with preferential rates for dental services, traditional Chinese medicine (TCM) services such as acupuncture and traditional chinese massage and optical services.

On the DA Marketplace, a specially curated in-app shopping platform, you can also shop for a wide range of health and wellness products and services, such as nutritional supplements, skincare products, physical therapy sessions, and even book home-based healthcare services.

For more information, visit here.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

During the present COVID-19 situation, our financial representatives were not able to make general insurance claims and submissions on behalf of their clients. This was because most of the existing processes were not yet digitalised. This has also impacted the work of corporate staff who could not offer effective post-purchase support for motor, home and travel insurance products to these financial representatives.

Our present GIX, POLS and POLM systems were not built to operate under current circumstances and that was the main reason for the birth of Project Allegro. The introduction of the software upgrade called Integral will replace the current GIX, POLS and POLM which has been around for over a decade.

GIX or General Insurance Exchange are the current front-end system where our financial representatives log in to issue each group insurance policy. Our Singapore and Malaysia office each has their own GIX catered for their respective financial representatives.

POLS (or Polisy SEA) and POLM (or Polisy M) are our current back-end system for handling processing work for general insurance policy claims and submissions for the Singapore and Malaysia offices respectively.

With the implementation of Integral, our general insurance products can be easily viewed, compared and purchased through our Great Eastern portal and customers can make their claims online. As the workflow is also digitalised, our colleagues can work remotely from home and this means that each group insurance policy application or submission can be accurately tracked for better accountability by our corporate colleagues.

Under Integral, we will progressively automate most of the current work processes such as having online general insurance application and processing which will reduce our reliance on hardcopy documents. We can then transit to a close system where the work task goes into the inbox of the person responsible and upon completion, sent to the next person in line.

The Integral project team is led by a cross-functional team comprising Great Eastern staff from the group insurance’s Singapore and the Malaysian offices, in partnership with the vendor DXC.

Mr Peter Ng, Assistant Vice-President, General Insurance and the project lead said : “This is an ambitious project as we are looking to complete this in one year, compared to the usual 2-3 years expected for similar projects. With the backing of a committed and highly-experienced project team, we will be able to roll out the system smoothly and seamlessly and offer personalised experiences for our general insurance clients in time to come.”

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

This year marks Great Eastern’s 112th year in business. As one of South East Asia’s most established insurers with a policyholder base of 8 million and counting, we are committed to making the lives of our people and customers lifeproof, whilst bettering the communities we live in.

To help our stakeholders understand and appreciate our long-standing legacy, our Banding team has created a new corporate video.

There are currently 2 versions – English and Bahasa voice-over with English, Bahasa and Chinese subtitles – ready for use by all our regional offices as well.

The corporate video is also available on the Great Eastern website here.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

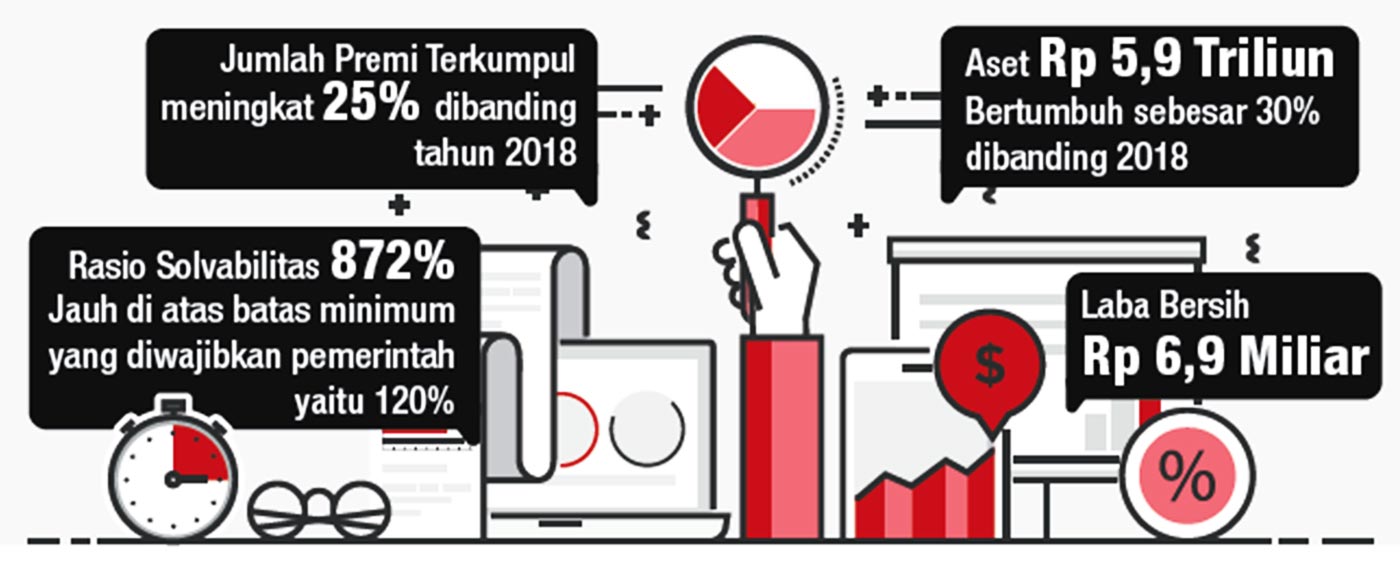

On 18 May, Great Eastern Life Indonesia (GELI) released its financial statement 2019 on local newspaper Media Indonesia.

The financial results showed significant growth of 25% of premiums collected and asset growth of 30% as compared to last year, resulting in a net profit of Rp 6,9 billion.

Key to GELI’s business growth has been its strong collaboration with Bank OCBC NISP and with insurance increasingly viewed by many policyholders as an alternative to diversify their financial portfolios.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

In April, GELI launched its latest innovation – the Great Eastern Mobile Assistance (GEMA) – where customers, present and prospective, can access GELI’s services through the Whatsapp chat application.

The launch of GEMA through Whatsapp reflects GELI’s commitment to continually improve and innovate to provide the best service for its customers and is most timely during the on-going COVID-19 situation where there have been movement restrictions.

Through this service, customers can enquire about their insurance policies and claims and get new product notifications and promotion information. GEMA can be accessed via Whatsapp at 0811 956 3800 and operates from Mondays to Fridays 9am to 6pm. During the present COVID-19 pandemic situation, GEMA will operate on reduced hours, from 9am to 4.30pm.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Earlier this year, Group Human Capital introduced its refreshed values and descriptions - Do the Right Thing, Take The Lead and Choose ‘We’ over ‘Me – to all Great Eastern employees.

Through a series of materials such as the new landing page, a culture manifesto video and the Life Book, they serve as a guide to life as a Great Eastern employee. These are also made accessible to all employees via gelife.co/cultureproject.

In May, it rolled out WHEEL OF LIIIFE, a Spin-the-Wheel interactive activity where staff can get to choose their 2020 Great Eastern t-shirt. With our core beliefs of Integrity, Initiative and Involvement printed on the t-shirts, the t-shirts aim to inspire us to excellence, both as a company and as individuals.

Even if you missed out on the activity, don’t fret! All Great Eastern staff can look forward to getting the new t-shirts in the later part of this year so keep a look out for it!

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

![]() Returning to work after Circuit Breaker

Returning to work after Circuit Breaker

The circuit breaker (CB) imposed by the Singapore government to break the spread of the COVID-19 pandemic ended on 1 June.

With Phase 1 of the post-CB in place, selected companies and businesses that do not pose high risks of transmission are allowed to resume daily operations.

This means that having spent the past two months working from home, more employees are now allowed to return to the office, with strict measures and precautions in place.

Great Eastern is no exception. Besides corporate offices, our customer service centres re-opened their doors on 2 June to welcome policyholders and financial representatives on an appointment-basis.

To ensure the safety of employees returning to the office or customer service centres, Group Human Capital has progressively put in place measures and guidelines, taking reference from government advisories, and reinforced by regular email updates sent to all staff.

In case you didn’t already know, employees headed back (beyond updating your departments) need to note:

- Staggered reporting hours and lunch hours

- Observe social distancing – that means no mingling of staff from different levels and in common areas such as pantries and lift lobbies

- Virtual meetings are the default mode. No face-to face meetings with external parties permitted and all non-essential physical meetings should be postponed.

- All employees are required to log-in their entry and exit information through SafeEntry, to facilitate contact tracing.

- Appointment of Safety Management Officers to walk the grounds of the office premises to ensure employees comply to following social distancing and other health and safety rules.

- All employees are to practice personal responsibility and not come to work if they are not feeling well and to seek medical attention immediately.

For further enquiries, you can refer to the Great Eastern staff handbook here.

During the past two months, it has been a period of adjustments for many. Whether it is getting used to working from home and being away from colleagues or having virtual meetings while having to supervise your child’s home-based-learning lessons, it is no wonder that coming back to office to work takes some adapting.

TGT spoke to two staff who recently came back to work and what it felt like to do so.

Miss Jacine Yeo, Secretary at Group Marketing found it a breath of fresh air coming back to office on 2 June.

“After WFH for 2 months, I was feeling excited while preparing to go back to office. At the MRT station, it was the familiar scene of people rushing to work and students in their uniforms, although there were less of them with the only difference being all of us wearing masks in various colours and designs.

For the first time, my usual commute to work was a peaceful and noise-free journey. Alighting at the Raffles Place MRT, I was expecting to see more people but it was like a weekend crowd. There were hardly any cars on the roads or people on the streets.

Reaching the office, I noticed that the Great Eastern foyer is just as windy and cool but for once, there were no long lift queues! The office was quiet and it took me a while to get used to it. I definitely missed my colleagues around me and look forward to seeing them soon!”

Mr William Soong, Vice-President, Digital Marketing, spent a day in the office on 1 June before the Circuit Breaker was lifted to prepare for a vendor that was coming in to the office the following day.

“Working from home was an evolving experience and took some adjustments. At the start, the time saved on commuting allowed me to be more effective on my work projects. However, the boundaries between work and personal life started to blur. It was important to be self-disciplined to keep both areas separate.

My usual commute before the Circuit Breaker from home to office was a 45-minute drive. But the travelling time was halved with traffic noticeably less during the peak hours. It was a refreshing change! One notable difference was that in addition to our staff pass, we had to use SafeEntry to log in and out of the office. This applies for every occasion we had to leave the office premises such as for lunch or to grab a coffee.

After eight weeks away from the office, I was pleased to find my desk clean and spotless, thanks to the cleaning staff. Due to the lack of people around, the office was freezing. It was hot and uncomfortable wearing the mask the whole day so I was relieved to take it off during my drive home!”

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Our SG Agency & FA team has welcomed Agency’s newly-promoted batch of 94 leaders, following the conclusion of its higher appointment exercise held in January. Financial representatives who meet stringent requirements can apply to lead sales teams twice a year in Great Eastern.

To qualify, the financial representatives need to achieve total group production of $700,000 first year commissions (FYC) in the past three years and $250,000 in the past 12 months to be promoted to Director. Other qualitative criteria such as professional qualifications (Agency Manager Training Course and Leadership Education and Development Program), market conduct, balanced scorecard grading, and training & competency audit. As long as the leaders fulfil all requirements, there is no limit to the number of leaders that can be promoted.

The leaders’ conferment ceremony typically held in March for January’s higher appointments was postponed due to the on-going COVID-19 pandemic.

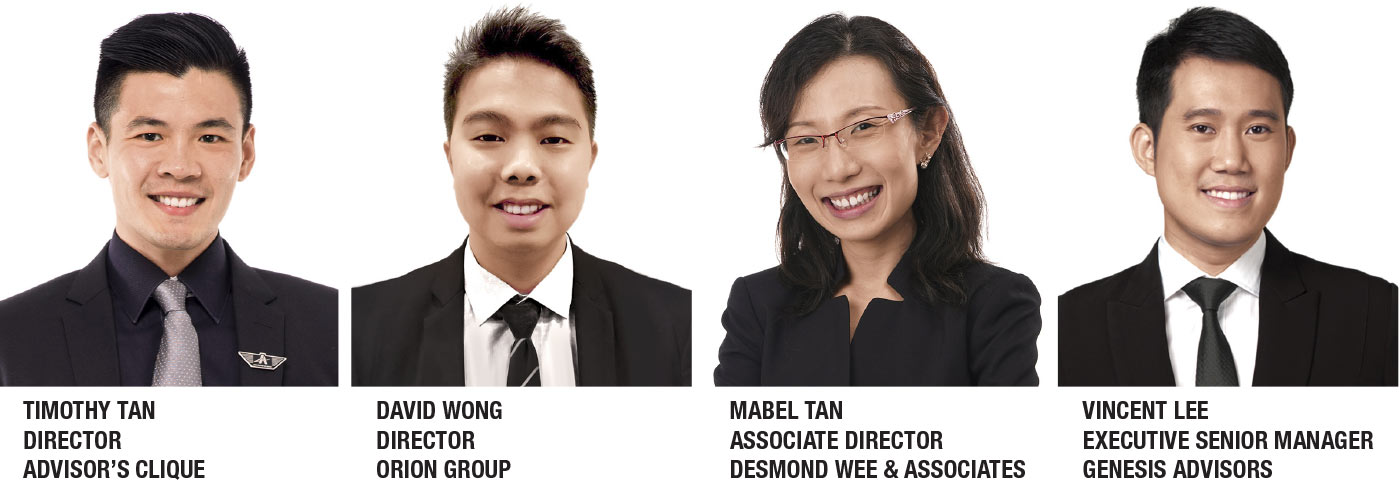

TGT spoke to four of these newly-promoted leaders - Timothy Tan, Director, Advisor’s Clique, David Wong, Director, Orion Group, Mabel Tan, Associate Director, Desmond Wee & Associates and Vincent Lee, Executive Senior Manager, Genesis Advisors - shared their motivations and aspirations

Who or what inspired you to become a leader?

Timothy: I am grateful to agency founder Mr Colin Ong who taught me to the meaning of servant leadership and not be afraid of getting my hands dirty so that I can serve my team and clients well.

David: My grandfather suffered a stroke and was bedridden for a year and eventually passed away during my NS days. I felt helpless and useless at that period of time and it made me realise the importance of financial security so that I could provide for my family.

Vincent: My client and former secondary school classmate had a heart attack at the age of 33 years which left him in a vegetative state. He was the only child and his aged parents depended on him for their livelihood. Fortunately with a sound financial plan, I could help ensure that his family needs were taken care of. This episode reinforced my belief of the importance of proper financial planning.

What does this promotion mean to you?

Mabel: This promotion goes out to my team, who has worked together really hard over the past year. It is a recognition for us as a team, we are moving together strong and in the right direction. I could not have succeeded if not for their daily hard work and commitment.

Seeing how the team has grown and bonded over the past year, and developing our own unique culture really fills me with pride. I am very proud that despite the team being very young, I have very high-potential leaders working alongside with me.

What are the qualities that one needs, to excel in the insurance industry?

Timothy: Leadership is about the selfless contribution to others to help bring out the best in them. Growing a team with that philosophy will bring fulfilment, pride and sustainable success for every member of the team.

David: Don't let the fear of failures hinder you from trying your best and enjoying life’s experiences.

Mabel: Continue to stay humble and continuously learn, only when we are open to learning new things can we become better versions of ourselves, whether as a producer or a leader.

Vincent: An observation I made during the COVID-19 pandemic is the need to be adaptable since we are not able to meet our clients in person and have to find alternative ways to do so. More than just learning new things, we need to find new ways of thinking to help our clients to secure financial peace-of-mind

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

We hope you’ve enjoyed the new look of TGT and the stories we’ve put together for you.

So what do you think of it so far? Let us know what you would like to read or areas that we can refine or improve on.

We love to hear from you. Spare us a couple of minutes and fill up the online survey here.

Five winners with the best feedback and suggestions will each win 2,000 UPGREAT points (worth S$20).

To be one of the five winners, send in your entries by 25 June 2020. Only GELS staff and financial representatives are eligible to win the prize.

Check out the offers below where you can redeem the UPGREAT points and claim e-vouchers from Shell Select, adidas, Guardian’s and other retailers!

- GrabFood $10 e-Voucher = 930 points

- EAMart $20 e-Voucher = 1940 points

- Adidas $20 e-Voucher = 1940 points

- Shell Select $5 Voucher = 440 points

- Guardian $10 Voucher = 1000 points

The survey closes 2 July 2020.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Our all-in-one reward platform UPGREAT has tied up with RebateMango to offer attractive dining, lifestyle and shopping rewards every time you shop at any of their online retail stores in-app.

With over 500 localised retailers such as Shopee, Agoda, AliExpress, Booking.com and Lazada to choose for, you can earn UPGREAT points which can be used to exchange for KrisFlyer miles, Shell Select vouchers, GrabFood vouchers and dining vouchers from various food establishments.

RebateMango.com is an online rewards digital platform that allows users to choose their preferred rewards when they shop online on over 500 popular retailers. The company was founded in May 2017 and is now present in Singapore, Malaysia, Thailand and Philippines with a membership base of over 1.5 million users.

To sign up and start shopping on RebateMango, go to rebatemango.sg/upgreat today!

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------