This e-publication is for internal sharing only and is not to be distributed outside of the company.

May 2020

Click below to read more.

Top Story

» Great Eastern Cares Community Fund - Give to help others

COVID-19

» Showing support for our health care workers

» Helping our customers and the community in the fight against COVID-19

» Working From Home - Views from Malaysia and Indonesia

People

» Down but not Out

» Reaping the rewards of our digital transformation

» Stepping up to help struggling workers

» Building an enduring corporate culture

» 2019 Next Gen Awards - grooming the next generation

» 2020 Exclusive Top GM (National & Central) Chinese New Year Dinner

» Another whopping success for the Great Eastern Prosperity Draw!

Business & Customers

» Be protected from life's uncertainties

» Moving Together As One in Unprecedented Times

» Transforming our workplace

» Giving words of encouragement during COVID-19

» Great Eastern 2019 Annual Report

» Get your home kit now and safeguard the next chapter of your life

» Sign up for insurance protection coverage instantly while on the move!

Click here for past TGT issues.

![]() Great Eastern Cares Community Fund - Give to help others

Great Eastern Cares Community Fund - Give to help others

COVID-19 has impacted many Singaporeans in our midst, with many struggling with their daily needs and possible loss of livelihoods. Charities have been hard-hit too, as they face a decline in public donations and funding for critical services, at a time when this is needed most.

As the Life Company, we believe in doing our part to support the community through their ups and downs and to help our customers whose lives and livelihoods have been affected by the COVID-19 pandemic.

To date, we have put aside S$1 million as part our COVID-19 Customer Care Fund to support our customers and their immediate family members who have been hospitalised due to COVID-19. We also contributed S$200,000 to provide financial assistance to those in Singapore affected by COVID-19 through the Courage Fund. On 1 April, we launched our COVID-19 Deferment of Premium Payment Programme which offers policyholders a six-month grace period for their life insurance premium payments, thereby ensuring that their insurance cover continues uninterrupted.

Starting from 4 May till 31 May 2020, our Great Eastern Cares Community Fund in collaboration with Community Chest aims to bring relief to the beneficiaries supported by these three charities:

To show full commitment and support for our consolidated effort as one organisation, the company will match donations dollar-for-dollar up to $100,000.

We encourage all staff and financial representatives to give generously. On behalf of the beneficiaries of the three charities, we say “Thank You!”

For more details on how to donate, visit here or use the QR code.

Showing support for our health care workers

In a show of support and solidarity to our frontline healthcare workers for their hard work and sacrifices amid the COVID-19 outbreak, the SG Agency and FA office donated about 1900 bottles of cold pressed juices to healthcare workers at Singapore General Hospital (SGH) and Tan Tock Seng Hospital (TTSH).

There were two separate delivery runs made. About 400 bottles of cold pressed juices were sent to SGH on 23 April, while 1500 cold pressed juices made their way to TTSH a week later on 28 April. The cold pressed juices come in a variety of flavours such as Little Gingy (Orange, Carrot, Ginger and Tumeric) and Granny Grammy (Apple, Celery, Cucumber).

Overseeing this project was Mr Glenn Yong, Head of Agency Business Development, SG Agency & FA. He said: “Throughout these past two months, the frontline health care workers have been at the centre of the COVID-19 outbreak. They’ve made personal sacrifices, placed their well-being at risk and endured physical discomfort wearing the personal protective equipment for hours. We hope that our small token of a cold pressed juice will bring a smile to their faces and remind them that they are not alone during these trying times.”

Besides the frontline healthcare workers, the COVID-19 outbreak has also shone a spotlight on the plight of small business owners such as hawkers. With the circuit breaker measures implemented, hawkers can only rely on take-away orders. This has affected the businesses of such hawkers who depend on the lunch-time office crowds or walk-in customers. To help these hawkers keep their businesses going, our financial representative Diana Liew stepped forward and volunteered to do food deliveries for them, free of charge.

TGT caught up with Diana and found out what motivated her to take time off from her busy schedule as a financial representative to offer pro-bono food delivery services. You can read her story here.

![]() Helping our customers and the community in the fight against COVID-19

Helping our customers and the community in the fight against COVID-19

Over the past few months, COVID-19 has taken over our lives, disrupted our routines and impacted the health and livelihoods of people all around the world. Across the Great Eastern Group, we have introduced a host of support measures to help our customers and community.

On 14 February, we introduced our S$1 million COVID-19 Customer Care Fund where Great Eastern customers or their immediate family members, if hospitalised, will receive a cash benefit of S$200 per day up to 60 days and a S$20,000 death benefit if affected by COVID-19.

Our regional offices have also launched similar holistic support packages to assist their affected customers. There is a RM1 million Financial Assistance Programme in Malaysia, a Rp10 billion Corporate Care Fund programme in Indonesia as well as a B$50,000 support package in Brunei.

Recognising that incomes and livelihoods of some Singaporeans may be affected , we launched our COVID-19 Deferment of Premium Payment Programme in April to help policyholders with a six-month grace period for life insurance premium payments to keep policy coverage uninterrupted.

In February, to support individuals and groups such as patients, healthcare workers and members of the community, we committed S$200,000 to provide financial assistance to the vulnerable in Singapore through the Courage Fund

With charities struggling for funds to support their beneficiaries and activities, our Great Eastern Cares Community Fund is collaborating with the Community Chest to help three charities – AWWA, Care Corner, New Hope Community Services - during these trying times.

From 4 May till 31 May 2020, log on to website and make your donation to support these deserving causes. The company will match donations dollar-for-dollar up to $100,000.

The COVID-19 situation has indeed taken a toll on our customers and we are heartened to receive positive feedback and words of appreciation from them who are thankful of our assistance during their time of need. Great Eastern remains committed and steadfast as we stand shoulder-to-shoulder with our customers and communities in the fight against COVID-19, and providing them with the protection and support they need.

Working From Home - Views from Malaysia and Indonesia

With the spread of COVID-19 across the world, many of us are having to get used to a new routine – working from home. With the Movement Control Order (MCO) measures in place, we had some of our colleagues from Malaysia and Indonesia share on how working from home has been like so far.

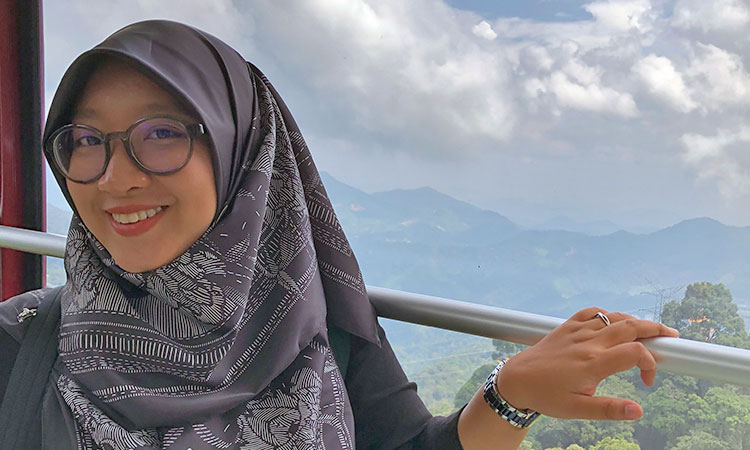

Nurulkhysan Hamzah

Head, Claims

GETB

Having to stay home because of the MCO has provided the perfect environment for me to experience the introvert side of my character.

I can better plan my daily tasks and manage my time towards the full completion of my work. I love the quality time spent working from home, and not having to worry about traffic jams, parking issues and what to wear for work every day!

And because I am not caught up with the usual hectic routines, I am able to enjoy the true worth of what we do – claims processing and ensuring that our clients’ needs are always being attended to. With quiet time to think and reflect, I am able to provide ideas on how to improve our workflows and processes.

The more important aspect of MCO is knowing that we can all do our part to stop the spread of Covid-19 and minimise the risk of infecting our loved ones.

Izzati Zawanah Mohamed Izan

Asst Manager, Strategic Management

GETB

Being at home all the time and confined to the same space 24/7 has given me the chance to think of new décor ideas to spruce up the house which I recently moved in last year. Weekends are now a more fun and joyful affair as my husband and I turn our décor ideas into reality.

Dinner time is more eventful with more time on our hand to experiment with dishes that we haven’t tried cooking before. I especially enjoy my husband’s latest invention – ‘Special’ Chicken Kurma – which he improvised despite the lack of some main ingredients but was nonetheless very delicious.

During the MCO, a group of my close friends and I kept in contact through Google Hangout and encouraged and motivated each other during this WFH phase. Although we may be socially distanced, technology has enabled us to still remain socially close with one another.

Khairul Anuar Che Yeop

Head, mySalam

GETB

Working from home is not a new experience to me. As I travel often for work, it is no different from working in the hotel room.

Neither is it a new experience for the mySalam team as my colleagues have been working from home the past year. There have been advantages as well as challenges since we first started on the scheme. So far I am able to engage my team and motivate them to up the ante serving our customers…virtually.

There is no denying that workplace mobility is the future so the implementation of MCO should be regarded as an opportunity for companies to take proactive approaches for any possible predicaments ahead.

Muhammad Daniel Adam Janudin

Assistant Manager, mySalam Scheme Development

GETB

The present WFH arrangement has been working out fine for me. It’s been a pleasant change of environment as I was barely at home due to back-to-back work trips. With the improvements made on the company’s VPN access, we are able to do our work much more conveniently!

One advantage of the MCO is that I am able to keep my expenses in check as I only need to spend on groceries, and I am sure many others may have made a similar discovery about their spending habits.

It’s been truly enlightening to be positive while undergoing tough times in life. Seeing how the Malaysian government is managing the COVID-19 pandemic situation with the MCO measures in place, I am also inspired to play my part by staying home!

Febria Tanjung Retno Maruti (Febry)

PA & Secretary to Board of Directors

GELI

During this work from home period the past month, I have been multi-tasking. I am able to juggle my work, attend to emails and schedule meetings while doing the household chores such as the laundry and preparing meals.

I am also involved in teaching my son and helping him with his schoolwork as part of his home-based learning. It sounds hectic and demanding but the truth is that I enjoy it!

There are moments that I miss – dressing up for work, talking to my colleagues, meeting my friends after work or going to the malls.

But working from home offers convenience especially when you consider my daily peak-hour traffic commute. I normally finish work around 7pm and it takes me close to 2 hours to reach home! So working from home is really about working for myself.

I hope that this COVID-19 pandemic will be over soon. Keep safe, everyone!

Mario Yeremia Ginting (Mario)

Senior Branding & Digital Executive

GELI

Working from home is not new to me as my previous workplace allowed staff to do so twice a week. However the circumstances today are different. As all schools are closed, I have been busy looking after my son in addition to my work commitments.

However, during this period, I’m able to spend more time with my family. We go to the park where I will cycle with my son. These are precious moments that I will cherish.

One downside is that my expenses have increased since I am spending more time at home. Besides paying more for utilities, I am always ordering food online!

My personal wish to all colleagues – we will prevail from this situation so stay strong!

![]()

![]() Down but not Out

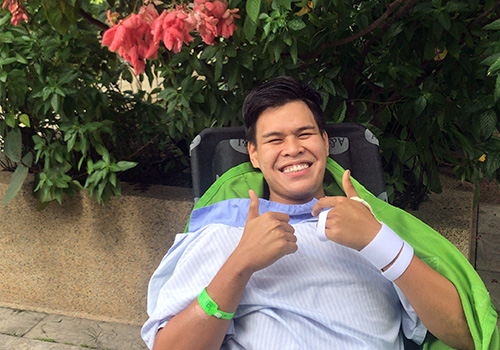

Down but not Out

Financial representative Asyraf Ghazali was a speaker at our Great Kickoff 2020 event in January this year at the Singapore Expo. Like many new financial representatives, he is still learning the ropes of his trade. But Asyraf faces a unique challenge - he goes about his daily life in a wheelchair.

TGT spoke to Asyraf as he found his life changed forever in November 2018 when a road accident left his paralysed. In spite of this tragic setback, he is working hard to start his life by establishing a career with Great Eastern.

Can you recall the moments leading up to the accident and what happened next?

I was serving my national service in the Singapore Armed Forces when I was tasked with a dispatch job to another military camp. I was on my way on my motorbike when I met with an accident with a car. Everything happened so quickly and all I could remember was looking up to the sky and asking for help before passing out. The next thing I knew, I was in ICU with multiple tubes running in and out of his body. I was on life support as I wasn’t able to breathe on my own.

What was your first reaction when the doctor told you that you would not be able to walk anymore? How did you cope and manage your life thereafter?

When the doctor broke the news to me that my spine was broken and that there was a 3 per cent chance that I’ll ever walk again, I broke down.

But I didn’t wallow in self-pity for long. I started on therapy at a rehabilitation centre which specialises in helping patients with spinal cord injuries. It was tough as I had to learn how to move around, learn to use the toilet.”

How did you come to learn about being an insurance financial representative?

After my discharge from hospital, I was searching for career options that would provide me with flexibility, where I can avoid peak-hour crowds, that are not prejudiced against individuals with physical disabilities, and one which rewards fairly based on results and efforts. That’s when I came across financial planning as a possible career option.

As I was covered under the group insurance scheme as part of my national service, the payout I received after the motor accident had allowed me to re-start my life. Having seen for myself how insurance had provided me with the protection and crucial financial assistance needed at the unforeseen moment in my own life, I was keen to help change people’s perceptions of the trade.

I joined Great Eastern as it is a brand I trusted, and all the support I have received so far has convinced me that I made the right decision - from the workplace accommodating me so that I can easily move around to the help from my leaders and peers to guide me to improve my craft. They have given me advice on how I can do better in terms of presenting myself and ideas, to value-add to my clients, and to inspire me to have the confidence and self-belief to speak publicly to a large audience of fellow financial representatives as the guest speaker at the Great Kickoff 2020 event.

I am thankful for how inclusive and supportive my team, leaders and the company have been towards me, and appreciate the attention paid to structured training and learning that have encouraged new financial representatives to get on their feet and to grow.

What are some of the challenges you’ve faced in your career so far?

Meeting people especially prospects has been tough. Many of them feel awkward as they were not too sure how to act or behave around me. Some of them ended up not meeting me or following up from our earlier meetings because they felt obliged to buy from me because of my disability. It was disheartening as all I wanted to do was to help educate them on the benefits of financial planning.

I am grateful to have had the opportunity to speak at the Great Eastern Kickoff 2020. I hope what I shared managed to touch people’s hearts, and to inspire other financial representatives to not give up in challenging times, and to see that one can always turn things around with the right mentality and positive thinking.

What are your future goals?

I want to create this awareness that even if though one is disabled, one can still be able to lead a normal life and contribute to the community.

Joining this industry has opened new doors for me. I am hopeful that it will allow me to work towards financial freedom and enable me to care for my family as well. My mother and fiancée are my main pillars of support and inspiration and they are always urging me on, never giving up on me during his moments of despair. I cannot emphasise the importance of family because you can always count on them to be there for you.

![]()

![]() Reaping the rewards of our digital transformation

Reaping the rewards of our digital transformation

Photo credit: LianHe ZaoBao

The COVID-19 pandemic has accelerated the digitalisation of the insurance industry, said Group CEO Mr Khor Hock Seng in an exclusive interview with Ms Hu Yuanwen, Associate Business Editor of LianheZaobao.

During the 1-hour videocon interview on 2 April, Mr Khor shared that he expected the pace of transformation to pick up even more and influence the future insurance needs of customers, such as the channels where they purchase insurance products. Below are key excerpts from the article.

New business opportunities through digital

Amid the COVID-19 pandemic, our digital initiatives are heralded and much appreciated to enable our financial representatives to continue business-as-usual by digitally engaging their clients despite the circuit breaker measures and restrictions on face-to-face interactions. Customer Service is seamlessly accessible to customers via our E-Connect portal to check for policy updates and make simple transactions. Since February this year, customers can also buy selected life insurance products via an online portal if they do not need financial advice yet still have access to financial advisory post-sales if needed.

Telemedicine has really taken off because of the COVID-19 pandemic and we now provide this service to other Great Eastern policyholders such as Integrated Shield plans, having first started with our Live Great Group insurance customers last August.

Demand for protection products still good

According to an LIA study, there is a mortality protection gap of 20% or $355 billion and a critical illnesses protection gap of 80% or $538 billion in Singapore. While savings products are still keenly sought, since last year, there has been a demand for protection products covering major illnesses, death and disability. With the COVID-19 outbreak creating uncertainties in people’s lives, we believe consumer demand for protection products is expected to increase.

Technology continues to shape customer expectations

Technology has been responsible for changing customer expectations where they now demand responsive service, instantaneous information updates and 24/7 access. It has helped insurers to accelerate the development of new insurance products, making them available to the market in the space of a few weeks, as opposed to a few months. More importantly, these products can also be created and customised to meet the individual customer needs.

To reach new customer groups, we embarked on digital affinity partnerships with numerous companies such as Singtel, Samsung and Axiata Digital Capita, opening up new channels to build our brand affinity and open up more avenues where our insurance products can be purchased.

Only the agile will win

While it is difficult to stay ahead of the technological changes taking place because of its unpredictability, the company that is most adaptable and agile will succeed.

![]() Stepping up to help struggling workers

Stepping up to help struggling workers

It wasn’t just Great Eastern that stepped up in the fight against the COVID-19 outbreak, starting with our S$1 million COVID-19 customer care fund and donation of S$200,000 to the Courage Fund back in February.

One Great Eastern representative has quietly contributed by volunteering her free time and paying out of her own pocket to help affected communities.

TGT spoke to Ms Diana Liew, an Executive Senior Financial Consultant with Genesis Advisors for nine years, who helped hawkers with their delivery orders in her own car, free of charge. Here is the lowdown on what makes her tick.

What made you decide to advertise your services on Delivery United to help struggling hawkers?

My parents were hawkers in an army camp and I grew up seeing their daily struggles. With the COVID-19 outbreak, I empathised with the older, senior hawkers who are not tech-savvy to use delivery services to sustain their businesses in the current situation. I also have friends and clients who are hawkers and own F&B businesses and facing similar difficulties. The worst hit are those working in the CBD areas as their main clientele – the office workers – are now working from home. There are also cases of hawkers who lost out on orders because they were dropped by delivery riders over lower fees. So I decided to sign up and volunteer my services on Delivery United. Since I started sharing my personal delivery services on the social media platforms, they approached me to help.

Have you made any deliveries so far? What challenges have you faced while doing the deliveries?

Since I started my personal delivery service in mid-April, I have practically been all over Singapore, covering Punggol and Sengkang in the North, Bedok and Tanah Merah in the East and the Central region of Ang Mo Kio, Woodleigh and Whitley Road. I did encounter some logistical challenges – my car boot was not big enough for huge deliveries. Recently, I made 9 delivery runs for 29 packets of food. I recently installed a food warmer, emptied my car boot and put in additional storage boxes to cope and manage the huge orders.

What made you decide to join the industry and in particular, Great Eastern? What do you appreciate most about being a financial representative?

My father once met with a minor accident and while I was filing the claims with his insurance agent, I discovered that he was not covered under any hospital plans despite paying exorbitant premiums each month.

Upset with the service of his insurance agent, I pursued my father’s case and was introduced to my present manager, Madeline through a mutual friend. Madeline helped review my parents’ policies and filled in the missing coverage gaps. I was impressed with Madeline’s service and was subsequently introduced to her director, whom I am currently working for. These two meetings left a lasting impression with me that I gave up my final year of law studies to pursue a career in the insurance business.

As a financial representative, I appreciate the time flexibility I have to juggle between work and life, and the motivating factor of “writing my own pay cheque”. More importantly, I value the luxury of having the spare time and finances to help the underprivileged communities.

How does your role as a financial representative enable you to participate in such charitable initiatives? How have your leaders supported you?

As a financial representative, I can arrange my food deliveries to suit my schedule. Since my leader learnt about my delivery service from the TODAY newspaper, he has supported my initiative and constantly reminds me to protect and look after myself such as wearing a mask while helping others.

My director and agency have had a huge influence in my career and personal life. Besides donating regularly to charities, our team of 30 financial representatives are also involved in a bi-monthly programme where we pack and deliver essential items for underprivileged households. This has provided a good opportunity for the team to bond with each other outside of the workplace.

How does your family feel about your charitable initiative?

My parents don’t know about my initiative but my extended family who resides in Australia are proud of my efforts, such as my brother and my nephews whom I miss dearly. I am also very thankful to the support and inspired by my partner who is an active fund-raiser for charities and sponsor of essentials for orphans.

![]() Building an enduring corporate culture

Building an enduring corporate culture

In 2019, Group Human Capital (GHC) re-introduced our core values - Integrity, Initiative and Involvement – to all Great Eastern employees, starting with a series of screensavers with messages such as “Do the Right Thing”, “Take the Lead” and “Choose ‘We’ over ‘Me’”.

In March this year, they introduced a new landing page, produced a culture manifesto video and launched the Life Book, which served as a guide to life as a Great Eastern employee. These are made accessible to all employees via gelife.co/cultureproject.

This year, as Great Eastern marks its 112th year, GHC will be working towards building our corporate culture, one that puts our customers at the heart of all that we do, and over and above our own interests. By putting in practice our core values, we can build and grow an enduring corporate culture that will move our company forward.

GHC has designed a series of initiatives and programmes to help staff remember, understand, and act on these core values. Over the next few months, they can look forward to our office walls which will come refreshed with new designs centred on our core values. There will also be new lanyards and T-shirts given out to employees. If you are into augmented reality technology, check out some of the animations and illustrations that will bring our core values to life.

Employees can also look forward to using a specially-designed email signature sign-off as well as take part in the Culture Awards which recognises employees for living out the core values. Look out for the Culture Beats EDM that was first shared to all employees in March 2020 if you do not want to miss out on any of these initiatives and programmes.

These new GHC initiatives and programmes will be progressively rolled out throughout the year to our colleagues in the regional offices.

Stay tuned by visiting gelife.co/cultureproject to find out more and to be kept informed of the latest updates.

![]() 2019 Next Gen Awards - grooming the next generation

2019 Next Gen Awards - grooming the next generation

To celebrate the achievements of our Year 1 and 2 financial representatives for 2018 and 2019, the 2019 Next GEN Awards was held on 13 January at Genting Highlands.

The Next Gen Awards is a coveted award that honours achievements of GELM’s Year 1 and Year 2 financial representatives. It recognises achievers from the following categories - Next GEN Builder (comprising Direct Group Builder and Whole Group Builder categories), ACTiveOne Bonus Qualifiers and Next GEN Year 1 & 2 in the categories of Mass, Emerging and Affluent Next GEN Builder.

The event was split into two sessions. More than 800 guests were at the Genting International ShowRoom where all Nex Gen award recipients, including the Direct Group and Whole Group Builder categories winners, were recognised. Following the welcome speech by Mr Koh Ken Yong, Head, National Agency Sales, GELM, Mr Willis Lau, Executive Senior Manager from Prelit Advisory Group in Singapore shared his recent achievements to inspire the award winners. He recounted when he first started his career as a financial representative in 2013 to the point when he became a finalist at the 4th Asia Trusted Life Agents & Advisers Award 2019 in the Digital Agent category.

The second session saw 900 guests attend the Gala Dinner at the Genting International Convention Center to see the top Next Gen award recipients presented with their accolades. It was graced by Dato Koh Yaw Hui, Chief Executive Officer of GELM and hosted by one of Malaysia’s top influencers Dennis Yin. The gala dinner saw attending guests in splendid masquerade ball themed costumes. There was also dinner entertainment provided by Brian Chew, winner of the 2016 TVB International Chinese New Talent Singing Championship, as well as live band and dance performances.

One of the top winners recognised during the Gala Dinner was Dato Gan Ai Ling who has been with Great Eastern since 2010. She was the recipient of the 2nd Runner-up Next Gen Builder (DG) award and shared: “I am grateful for this award. I am thankful to learn and be led by my Group Agency Manager Dato’ Eric Toh. Under his guidance, I am driven in my passion to grow a team not just to achieve higher goals but to build a team of financial representatives who are professional and serve their customers with sincerity, honesty and integrity.”

![]() 2020 Exclusive Top GM (National & Central) Chinese New Year Dinner

2020 Exclusive Top GM (National & Central) Chinese New Year Dinner

On 7 February, GELM held its 2020 Exclusive Top General Manager (GM) Chinese New Year Dinner at the Equatorial Hotel, Kuala Lumpur to mark the achievements of its Top GM for the national region (across Malaysia-wide) and central regions of Kuala Lumpur and Klang for 2019

Dressed in traditional Chinese costumes, all attending guests were welcomed by a lion dance troupe performance and ang bao giveaways by the God of Prosperity. All guests were also presented with a personalised hand-fan by a calligraphy master as the event door gift.

This year’s theme “I Want to Fly!” serves to motivate the agency force to go above and beyond and to rise to the next level. Dato Koh Yaw Hui, Chief Executive Officer of GELM, was the guest-of-honour and he presented the awards to all Top GM recipients.

Throughout the night, guests were entertained by live band music performed by staff talents and as well as mini-games. The evening ended with a lucky draw and prize presentation to the winning teams of the mini games.

![]() Another whopping success for the Great Eastern Prosperity Draw!

Another whopping success for the Great Eastern Prosperity Draw!

“From what we get, we can make a living; what we give, however, makes a life.” – Arthur Ashe

At Great Eastern, we value and celebrate the spirit and generosity of our staff reaching out and giving back to the community.

The seventh edition of the annual Great Eastern Chinese New Year Prosperity Draw organised by Group Corporate Communications drew overwhelming support from our corporate staff and agency force alike. Held during the month of February 2020, we raised a record $45,270 with all proceeds helping needy school children under the Straits Times School Pocket Money Fund.

This year’s Prosperity Draw offered a unique and innovative feature as e-tickets were used and purchased through our loyalty rewards platform UPGREAT. This meant that there were no limit to the availability of tickets, and there was no need to rush to reserve or purchase tickets like past years.

It was heartening to see collaborative efforts across departments and agency groups working towards a good cause, as facilitators were on hand to reach out and garner sign-ups.

More than a hundred fabulous prizes were given out during the Prosperity Draw, with the top-prize winners walking away with an iPhone 11 Pro (for staff) and $1,088 cash (for financial representatives).

![]() Be protected from life's uncertainties

Be protected from life's uncertainties

Give yourself some financial peace of mind and protect yourself and your loved ones with our new Personal Accident (PA) solutions.

You can now get started on this critical first step by purchasing these PA plans such as Great Protector Active (GPA), Great Junior Protector (GJP) & Great Golden Protector (GGP) direct from our website.

For customers who are not sure which PA plans suits them or their family, they can arrange for a Great Eastern financial representative to call them and receive a complimentary Assurance Kit that comes with GREAT MozzieSafe coverage (in view of the peak dengue season – May to September) and a video-consult session with tele-health service provider Doctor Anywhere. This promotion ends 30 June.

![]() Moving Together As One in Unprecedented Times

Moving Together As One in Unprecedented Times

0n 6 May 2020, we held our inaugural virtual staff townhall in Singapore over web-conferencing facility, Webex. It was a success with over 800 colleagues and our management gathering together online for a seamless live session. GCEO Mr Khor Hock Seng shared the company updates with our latest financial results. We delivered strong operating results in the first quarter of 2020, with good momentum. Q2 will be a challenging quarter, but many initiatives are planned to help our sales force during this period

As we navigate around the current environment, our key focus will continue to be on accelerating our digital and strategic priorities to support a quicker response to the challenges and opportunities of the changing environment as well as adapting to a new engagement and operating model.

This period has brought out a “new norm”. We need to unlearn what we have learnt and explore new ways of doing things, for example in the way we work and the way we serve our customers, etc. We should take the opportunity to learn from this situation and position ourselves in a strategic place to be ready to seize opportunities in this new era.

Mr Ryan Cheong, MD, Digital for Business, shared that digital sales over the online platform, Orion, has recorded more than 2,000 policies, with more than 1,000 agents using it, contributing more than $1 million in NBEV, as at 30 April 2020. On the customer front, a Great Eastern app will be launched in mid-May 2020. This new app will complement services on our current platform, e-Connect.

COVID-19 has also fast-tracked our digital transformation. Mr Gary Teh, MD, Group IT, shared that in the last 60 days, Group IT has accelerated the implementation of various platforms to support work from home. Moving forward, more upgrades will be introduced such as a Skype upgrade, accesses through your own devices for better collaboration as well as project rooms to share documents with both internal and external vendors.

On the employee front, Mr James Lee, MD, Group Human Capital, highlighted the initiatives that have been put in place to support employees during this period. These include WFH arrangements, social distancing measures in the office and transport claims for employees who are rostered to return to the office. Convenience to systems is key and the new Oracle HR core self-service applications allow employees to continue managing their records as well as expense claims. LinkedIN Learning is available for continuous learning for career development. On the well-being front, the next GO GREEN challenge has started from May 2020.

As a member of the Great Eastern family, we're called to live out the values of The Life Company. And when we act with our values in mind, we move our culture, our company, forward. Since last year, the team re-introduced our three simple, but fundamental, “I”s, Integrity, Initiative and Involvement. This year, more initatives will be introduced to showcase how to live out the values, by Doing The Right Thing, Taking The Lead and Choosing ‘We’ Over ‘Me’

From 4 May to 31 May 2020, we are raising funds for the beneficiaries supported by AWWA, Care Corner Singapore and New Hope Community Services through the Great Eastern Cares Community Fund. All contributions will go towards providing critical and essential services to the vulnerable such as hot meals, food supplies, medicine, hardship subsidies for individuals and families in need, and providing shelter for the displaced to help alleviate the impact of COVID-19 on them and their families, as shared by Mr Colin Chan, MD, Group Marketing. To show full commitment and support for our consolidated effort as one organisation, Great Eastern will match donations dollar-for-dollar up to $100,000. Donate generously at sg.gelife.co/communityfund. Spread the word among your friends, family and others whom you think would like to support this meaningful cause!

![]() Transforming our workplace

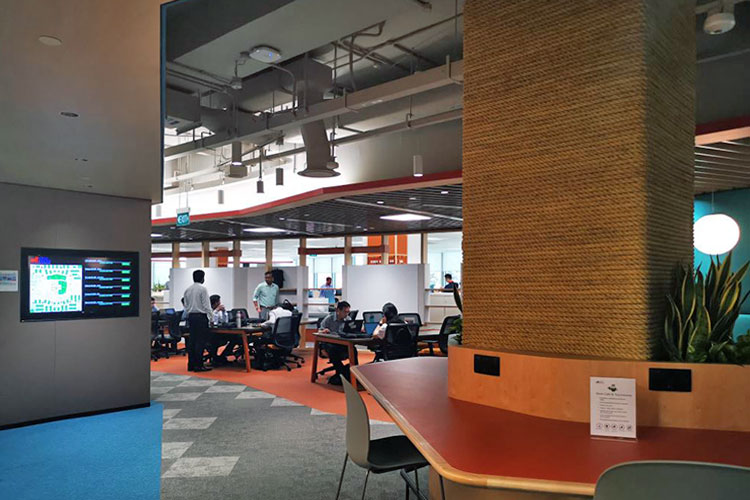

Transforming our workplace

Last year, Group Human Capital introduced the Workplace Transformation initiative to advance and upgrade our physical workplace to drive greater collaboration and digitalisation across the Group.

This initiative was progressively rolled out, with the pilot project completed on 2 March following Group IT’s move to their new office premises at GE Changi from Alexandra Technopark. This followed months of preparations, communication sessions with affected staff, packing of office furniture and personal belongings and lastly, the physical move itself which was completed over one weekend.

A total of 185 colleagues and 95 IT vendors are now based at the new workplace, which is filled with amenities to foster communication and collaboration.

The GE Changi office has two main areas – a central collaboration hub and work zones.

The central collaboration hub has flexible spaces for teams to do project work, staff training and conduct brainstorming sessions. There are also technology-enabled meeting rooms and flexible project labs that have glazed sliding doors and writeable surfaces that double-up as walls, and a work café situated at the entrance for casual discussions and break-times.

The work zones are the staff work areas that come with open shared desks and quiet rooms for taking personal calls or for staff who prefer to do work away from interruptions.

Ms Rinu Sharma is a Senior Software Engineer at Group IT and has been based at the Alexandra Technopark (AT) office since she joined four years ago before moving to her new office.

She said: “Like most of my colleagues, initially I was quite resistant to move out of the AT office, having spent a long time here. But since making the move, I’ve enjoyed it here. The breakout spaces, collaboration spaces, training rooms and work café are nice and I am no longer confined to work in one isolated zone only. The office premises and décor are lively and colourful and helps to chase away any Monday blues!”

![]() Giving words of encouragement during COVID-19

Giving words of encouragement during COVID-19

It’s been a difficult period for many Singaporeans trying to make sense and come to terms with the changes to their lives amidst the COVID-19 outbreak. Some Singaporeans and their family members were unfortunate to have caught the virus and were hospitalised. Others lost their jobs due to the nation-wide circuit breaker period as many companies were forced to scale down their business operations or worse, close down for good.

To rally our financial representatives in these challenging times, the Agency Business Development (ABD) team started a series of activities to engage and encourage our agency force to let them know that we are in this fight together and that we have their backs.

These include a series of live video conferencing sessions as well as 1-minute inspirational video clips helmed by various GMC members to share words of encouragement.

On 17 April, ABD organised its inaugural webcast event titled “The Great Conquests”. Hosted by GCEO Mr Khor Hock Seng, Managing Director of Regional Agency / FA and Bancassurance Mr Ben Tan and the Head of Agency & FA Mr Patrick Peck, more than 400 agency leaders also took part virtually.

During the webcast event, Mr Khor called on all agency leaders to be adaptable as the financial representatives get used to conducting their advisory services remotely using digital means. With new initiatives such as tele-advisory complementing our suite of digital tools, our financial representatives are able to connect and engage their customers during this period of social distancing.

Lastly, Mr Khor rallied all agency leaders that in spite of the many unknowns that confront our society today, they must all continue to be innovative and resilient to keep their lives going like they always have been.

![]() Great Eastern 2019 Annual Report

Great Eastern 2019 Annual Report

The theme for this year’s Great Eastern Annual Report is “Doing Great for You”. It demonstrated our commitment to deliver the best to our customers – from the development of innovative financial and insurance solutions to empowering our customers through our numerous events and initiatives to Live The Great Life. The design elements that appear in the Annual Report is a reflection of our harnessing the power of technology to transform the company and the way we live, work and play. To learn more of some the key corporate highlights that took place during FY2019, you can access the Annual Report at here.

We announced our Q1 results for the financial year 2020 on 6 May. For details, please click here.

In view of the on-going COVID-19 pandemic, this year’s Annual General Meeting (AGM) will be held via electronic means on Thursday 14 May at 3pm. For more details, please visit here.

![]() Get your home kit now and safeguard the next chapter of your life

Get your home kit now and safeguard the next chapter of your life

For first-time home buyers and new homeowners, your property purchase may very well be your biggest and most expensive purchase. In addition to the downpayment for your home, you’ll likely to incur other expenses such as renovations and furnishings along the way. These will add up and affect how much you have left for other home incidentals.

To help new home owners ease into this phase of their life, we are introducing the Great Eastern Home Kit – specially put together with their needs in mind.

The kit comprises of a free 6-months Home Contents insurance coverage and discounts on cleaning services – Home cleaning, laundry, air-con. To top it off, every 50th eligible participant will receive a Dyson SupersonicTM Hair Dryer (capped at 30 pieces).

Visit the website to find out more. This promotion ends 31 October.

![]() Sign up for insurance protection coverage instantly while on the move!

Sign up for insurance protection coverage instantly while on the move!

Since 7 April, Singapore entered the circuit breaker period to manage the COVID-19 infections in the country. During this time, we were advised to work from home and avoid physical meetings. But life goes on and the on-going COVID-19 pandemic has in fact resulted in greater awareness among the public looking for increased protection coverage.

Great Eastern is well-placed to respond to these new customer needs. Since February, we have made available online purchases of certain life insurance products for customers who need simple and annually-renewable insurance products. They can make these transactions on Great Eastern’s website or through a personalised link from their financial representatives. Insurance products that are currently available include our Personal Accident products such as GREAT Protector Active, GREAT Junior Protector, GREAT Golden Protector and Essential Protector Plus, with more products to be unveiled in the coming months.

Customers who opt to purchase directly benefit from getting instant quotations without the need to meet up with a financial representative. However after making a purchase with us, they will still enjoy the post-purchase services from financial representatives who will be assigned to them.

Besides customers able to buy our insurance products online, we are also going full-on into empowering our financial representatives with tele-advisory services capabilities to better serve customers amid the COVID-19 pandemic, and continue business activities as seamlessly as possible.

Like virtual medical consults, our customers can interact with our financial representatives on video conference calls from the comfort of their own homes, almost anytime, anywhere. In the forseeable future, customers can also look forward to additional digital capabilities that will allow both financial representatives and customers to seamlessly co-browse interactive screens and co-create Life Storyboards together on mobile devices.

We have also simplified the digital authorisation of policy purchases which will also allow applications to be processed more quickly. By streamlining the policy application process, we have enabled quicker response times, and improved the quality of customer service, without comprising health and safety of both customers and financial representatives.

Khor Hock Seng, Group Chief Executive Officer said: “The COVID-19 situation is accelerating the speed of digital adoption to complement what is traditionally a face-to-face business. This new-normal ‘virtual’ way of doing things, empowers financial representatives to continue serving customers, with speed and agility. It also provides our customers with greater peace of mind, and continued access to professional advisory services.”