Key benefits

-

Be 100% covered for all cancer stages1

Have peace of mind knowing that your recovery is financially supported, whether it is an early, intermediate or major stage of cancer diagnosed.

-

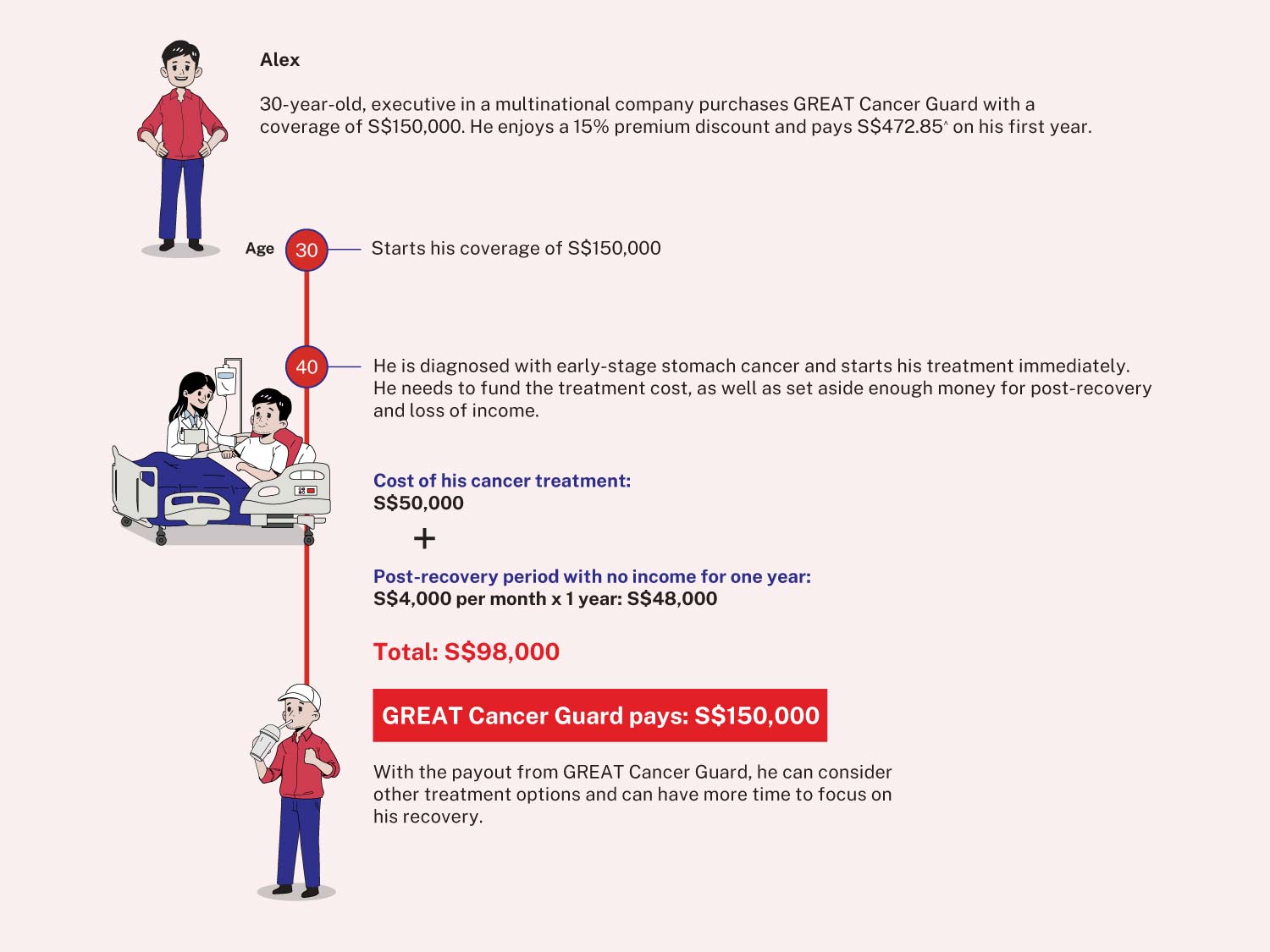

Receive up to S$300,000 cash payout upon any cancer diagnosis1

You will receive a 100% lump sum cash payout, which you can use to fund your treatment and other expenses for the family, such as mortgage and bills.

-

Affordable premium from S$0.42* a day for all stages of cancer coverage1

Choose your coverage from S$50,000 to S$300,000 as we lock-in the same premium2 that does not increase with age.

-

Easy, hassle-free sign up with no medical check-up needed

Secure your cancer coverage online within minutes by answering just 3 simple health declarations.

Your questions answered

GREAT Cancer Guard is a non-participating, yearly guaranteed renewable health insurance plan that provides coverage for all stages (Early, Intermediate or Major) of cancer. Policy will terminate upon any successful claim.

| Plan Type | Lite | Plan A | Plan B | Plan C | Premier |

| Sum Assured (S$) | 50,000 | 100,000 | 150,000 | 200,000 | 300,000 |

Yes, the premium is subject to prevailing GST.

Yes, there is a 90-day waiting period from the policy issue date or date of reinstatement of the policy, whichever is later.

The Company will not pay the benefits for:

(a) any early, intermediate or major stage cancer (“Cancer”), if the diagnosis of the Cancer, or undergoing of such medical procedure which is regarded as a Cancer, was made within 90 days from the policy issue date or date of reinstatement of the policy, whichever is later.

(b) any Cancer caused directly or indirectly by any of the following:

(i) a pre-existing condition which is related to the Cancer that is the subject of a claim under this Policy;

(ii) alcohol or drug abuse;

(iii) any congenital anomaly or defect.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.

Understand the details before buying

* Daily rate is based on a 17-year old male, non-smoker with the annual premium of GREAT Cancer Guard Lite Plan, divided by 365 days and rounded off to the nearest cent, inclusive of 9% prevailing GST, before any promotional discount. The premium rate is not guaranteed and are subject to 9% prevailing GST and may be adjusted at policy renewal at the full discretion of the company with at least 30 days' notice.

^ Premium is inclusive of 15% first-year discount and 9% prevailing GST. The premium rate is not guaranteed and may be adjusted at policy renewal at the full discretion of the company with at least 30 days’ notice.

1 "All cancer stages" refers to the diagnosis of Early, Intermediate or Major Cancer. Cancer payouts vary according to the plan type chosen. Exclusions apply. Refer to product summary for more details.

2 The premium amount is determined at the age of entry and does not increase with your age. However, the premium rate is not guaranteed and may be adjusted based on future experience of the plan. Adjusted rates, if any, will be advised prior to policy renewals.

The maximum entry age to purchase GREAT Cancer Guard is at 55. Upon successful purchase of the plan, the renewal of the plan is guaranteed till end of policy term at age 85.

All ages specified refer to age next birthday.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract. This is only product information provided by us. You may wish to seek advice from a qualified adviser before buying the product. If you choose not to seek advice from a qualified adviser, you should consider whether the product is suitable for you. Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs. If you decide that the policy is not suitable after purchasing the policy, you may terminate the policy in accordance with the free-look provision, if any, and the insurer may recover from you any expense incurred by the insurer in underwriting the policy.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

In case of discrepancy between the English and Chinese versions, the English version shall prevail.

Information correct as at 1 January 2024.