1 Coverage for Presumptive Total and Permanent Disability (TPD) is for the whole of the policy term, while coverage for other forms of TPD is up till the policy anniversary on which the life assured is age 65. Presumptive TPD refers to a state of incapacity which is total and permanent and takes the form of total and irrecoverable loss of:

(a) the sight in both eyes;

(b) the use of two limbs at or above the wrist or ankle; or

(c) the sight in one eye and the use of one limb at or above the wrist or ankle.

Please refer to the product summary for details on other forms of TPD.

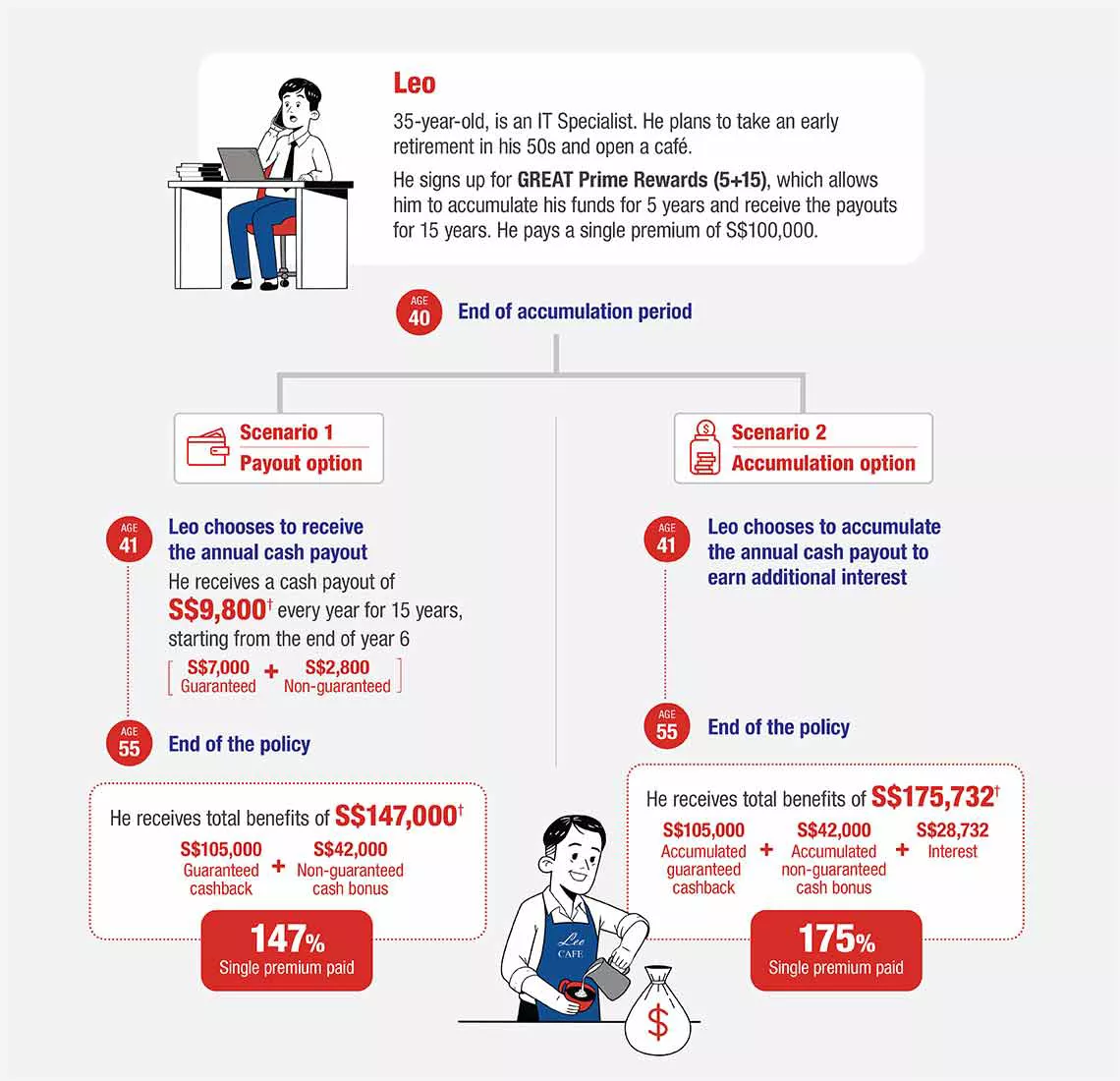

2 The prevailing accumulation interest rate is 2.50% p.a. based on Illustrated Investment Rate of Return (IIRR) of 4.25% p.a. and 1.00% p.a. based on IIRR of 3.00% p.a.. This rate is not guaranteed and can be changed from time to time.

Only applicable to GREAT Prime Rewards (5+15) with single premium of S$100,000 or more, under payout option.

All figures in the above illustration are based on IIRR of the participating fund at 4.25% p.a. and are subject to rounding.

† The figure comprises guaranteed and non-guaranteed benefits. The non-guaranteed benefit is illustrated based on assumption that the IIRR of the participating fund is at 4.25% p.a..

In Scenario 1, based on IIRR of 3.00% p.a., the guaranteed cashback is S$7,000 per year and the non-guaranteed cash bonus is S$1,500 per year. The total cashback + cash bonus that Leo receives over the course of the policy is S$127,500, which is 127.50% of the single premium paid.

In Scenario 2, the non-guaranteed accumulation rate is at 2.50% p.a.. Based on IIRR of 3.00% p.a., the total amount that Leo receives when the policy matures is S$136,823, which is 136.82% of the single premium paid, of which S$105,000 is guaranteed. The non-guaranteed accumulation rate is at 1.00% p.a..

As the bonus rates used for the benefits illustrated are not guaranteed, the actual benefits payable may vary according to the future experience of the participating fund.