Your wealth goals will change as you move along life’s journey. From couplehood to parenthood, you work hard and save diligently for a better future, for your child’s education and for your own retirement. Wouldn’t it be great if you could make your money work even harder for you, by having a lifetime income stream payout for use, as and when needed?

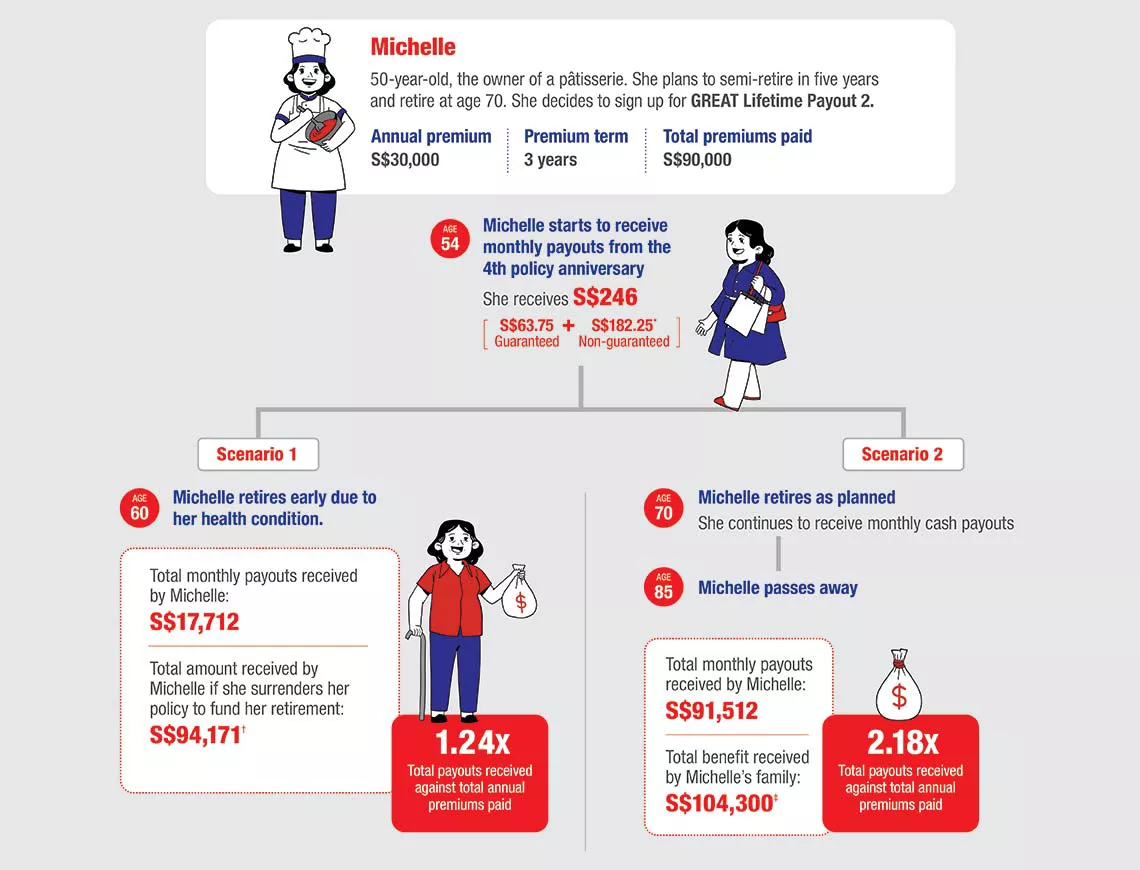

GREAT Lifetime Payout 2 is a participating whole of life plan that maximises your savings the smarter way, with the assurance of up to 3.28% per annum1 for a lifetime of monthly cash payouts. Your capital is 100% guaranteed after you’ve had the policy for 6 years2. You also have the flexibility to manage your payouts and policy value as your needs evolve.

It’s easy to start, with a short premium commitment of only 3 years, starting from S$10,000 a year and with no medical assessment required. You can pay your premiums using your cash.

Grow your wealth and secure your lifetime income towards financial freedom today.

Start receiving your lifetime payouts from the 4th policy anniversary with guaranteed payout (up to 0.85% per annum)1 and non-guaranteed payout (up to 2.43% per annum)1. Alternatively, choose to accumulate them for potentially higher returns3.

Leave a legacy for the next generation with a lump sum benefit of 105% of the total annual premiums paid plus any bonuses, in the event of your passing or contracting terminal illness to cover your expenses.

Talk to your Great Eastern distribution representative to see which insurance solutions are right for you. No Planner yet? Simply browse through our list of distribution representatives.

No. 17 & 18

Block B, Bangunan Habza

Simpang 150, Kampong Kiarong

Bandar Seri Begawan

Brunei Darussalam