This e-publication is for internal sharing only and is not to be distributed outside of the company.

April 2022

Click below to read more.

Hear from Our Leaders

» Message from Patrick Peck

Highlights of the Quarter

» Hit your Q2 targets and get exciting rewards!

» Back to school again! – Financial literacy workshops for students

Must-Knows

» Lianhe Zaobao business feature on Great Eastern’s strategy - Interview with GCEO, Mr Khor Hock Seng

» “Meet” the friendly team from Great Eastern (East) cluster!

» 2nd quarter 2022 market outlook – A summary from Agency Propositions and Portfolio Management

» Calendar of events

From Good to Great

» Winning awards are not everything

Click here for past TGC issues.

Message from Patrick Peck

Dear Leaders and Financial Representatives,

It has been a great Q1 2022 so far, and I am upbeat about our continuing strong performance in the months ahead. Thank you for all your hard work starting fast right from the word GO at the beginning of the year.

For us to reach greater heights as an agency force, we must not rest on our laurels but always seek to better ourselves. To do this, we must strive to have an always-on learning attitude. Let us be the best agency force in the market that is always ready for change, taking on and overcoming challenges with a never-say-die attitude.

With the recent easing of Covid-19 measures, we have a pipeline of exciting events and initiatives coming up. Our first physical events since 2020, will be held in the month of May. These are our Achievers Day and Achievers Night, where we look forward to celebrating the successes of our top performers. These events will take place in May, and I am personally looking forward to meeting you all and to celebrating these well-deserved achievements together with the team. I fully expect to experience in real life, the full energy and dynamism of our Great Eastern agency spirit once again too! Another piece of news I have for you is that very soon, we will resume our roadshow activities. These will really fire up our face-to-face interactions with potential customers, and give us boundless opportunities for lead-generation. We will also be collaborating with various partners for upcoming roadshows, so watch this space as we re-explore new ways of growing our business.

Now that we can gather in larger social groups, I plan to catch up with you in person over lunch or coffee. I’m sure you will agree that building the Great Eastern team camaraderie is important, such as welcoming our new colleagues in person, who have joined us in these last two years! I am also looking forward to welcoming more of you back to our office premises and to saying my hellos to you along the corridors.

In the meantime, even as we work hard to achieve our targets, please take care of your health as your well-being is important to us.

Last but not least, let us continue to strive to succeed as ONE. Together, let’s make 2022 a fulfilling chapter in our journey to help our customers live #LifeProof with Great Eastern.

Hit your Q2 targets and get exciting rewards!

Yes, we are in Q2 right now and what a big bang we are drumming this time round!

To ramp up our Q2 Bounce Up! Challenge launch initiative, we held ground-activation events at Picotin (Waterboat House and Katong) in April with Agency Directors, and had agency walkabouts to spur the sales force on the exciting rewards in store for them.

We also made these activations even more interesting and memorable by giving sports balls printed with our Q2 Bounce Up! Challenge logo to remind our folks to stay focused on the Q2 challenge!

1. MRO Champions League 2022 (1 Apr – 30 Apr 2022)

Be one of our 30 reps to achieve the highest Total Weighted Premiums for qualifying Regular Premium and Single Premium Life policies which are reinvested from Matured Rollover (MRO) policies, to enjoy a memorable 'Evening in the Wild' all-inclusive dining experience! You will be treated to a feast with free flow of wine at the Night Safari!

2. Q2 BounceUp! Challenge (1 Apr – 30 Jun 2022)

Hit a minimum of S$1,500 Qualifying First Year Commission (FYC) by 30 April 2022 and get rewarded with at least 150% incentive multiplier based on your Qualifying FYC amount. So the higher your Qualifying FYC is, the higher your incentive multiplier will be (up to 300%)!

3. GREAT CareShield (GCS) Supreme Challenge (1 Apr – 30 Jun 2022)

Receive S$100 for every two GCS cases (minimum S$400 yearly premium per case) approved, capped at S$5,000. So it’s time to share GCS, a first-in-market plan which gives monthly payouts based on the insured person’s inability to perform one Activity of Daily Living, to help manage their long-term care needs.

Take up these challenges to hit your Q2 targets and get rewarded at the same time! For more details, please refer to the following Notices:

015/22/ABD/MROCHAMPIONSLEAGUE2022

016/22/ABD/Q2BOUNCEUPCHALLENGE

017/22/ABD/2022Q2GCSSCHALLENGE

Back to school again! – Financial literacy workshops for students

Face-to-face volunteering is back again now that Singapore has eased back into the swing of things.

On 31 March 2022, over 20 staff volunteers and financial representatives went back to school literally, to share practical life skills through fun-filled financial literacy activity-based learning such as good money management to some 250 secondary two students for over four hours.

This was part of our Great Eastern Cares CSR programme organised by Group Corporate Comms to support Financial Literacy as a key pillar of Doing Good and giving back to our community.

From as early as 7am, our volunteers gathered at the school, bright and chirpy and all brimming with excitement, and ready to share basic understanding of setting career goals and managing budget with the students. These financial literacy workshops were done in partnership with Junior Achievement Singapore, a non-profit organisation that inspires and prepares young people for success through education - imparting life skills such as financial literacy and entrepreneurship, for them to succeed in life.

“Really glad that we finally got round to re-igniting volunteering under Great Eastern Cares after the two-year COVID-19 hiatus. Happy to have gotten a great turn out of both corporate staff and financial reps in this first initiative for the year, and stepping out to give their time this morning to deliver a great curriculum around helping our teens look at elements of managing their money! We look forward to setting up more sessions to facilitate additional learning as the opportunities arise. If you haven’t already signed up – do join us”, said Annette Pau, VP, GCC

Our reps had much to say about the hard work they put into bringing financial planning to life with the teens they taught :

“Sharing about financial planning is a topic that is close to what we do, and it’s meaningful that we can educate youths on good money management habits. It is even more meaningful for me as I am sharing these with my juniors (I am a school alumnus). As they are our future generation, it is important that we impart the necessary skills and knowledge, as well as inspire them with the right mind-set and values.”

Alvin Yeo, Financial Representative

“I spent a meaningful session this morning as I engaged Secondary 2 students on skills, interests and values which aims to help them in decision making, career goals, and personal finance (budgeting).”

Jerome Lim, Financial Representative

To find out more about our CSR initiatives and how we help the community to live #Lifeproof, visit Great Eastern Cares. If you have missed this volunteer opportunity, do look out for our next financial literacy workshop to help impact young lives!

Lianhe Zaobao business feature on Great Eastern’s strategy - Interview with GCEO, Mr Khor Hock Seng

In a recent interview with Lianhe Zaobao, Mr Khor Hock Seng, our Group Chief Executive, shared on how the insurance industry has changed arising from the COVID-19 pandemic and how Great Eastern has risen to the challenge to help customers live #LifeProof.

In case you missed it, here’s a short translated summary of the interview.

Mr Khor Hock Seng, Great Eastern Group Chief Executive: Reverting to face-to-face consultation after COVID-19 pandemic

The COVID-19 pandemic accelerated the digitalisation of the insurance industry. However, customers still expect face-to-face communication even though they appreciate the convenience and efficiency of online financial advisory services and offerings. This also means that financial advisors and insurance brokers are still regarded as important to customers when it comes to their financial planning.

When COVID-19 first emerged, a large part of the insurance business shifted from offline to online. With the easing of measures as the pandemic situation improved, Mr Khor shared that 75 per cent of insurance purchases were done through online and the remaining 25 per cent through face-to-face sales. This is vastly different from pre-COVID times when only 25% of online insurance purchases were made. Most of these online insurance purchased products were

However, Mr Khor added: "I still firmly believe that people need to seek advice, especially for life and health insurance matters as insurance is quite complex to understand for most people.", and as these are longer-term commitment plans, people will need to seek advice before making an informed decision. That is the important role and necessity of having insurance brokers, bancassurance or financial advisors provide the required financial advice for them.

Although people are more familiar with using digital channels, they are sometimes dissatisfied with the services provided by digital channels and want omni-channel options. Many young people perceive that it is the younger generation who likes to use digital channels, but this is not the case. Hence, Great Eastern serves customers through omni-channels such as live chat, call centre, email consultation and financial advisory services.

Another change brought about by the pandemic is the increased awareness and importance of health and life insurance, and financial security. This has enabled the insurance industry to achieve good growth in the past two years. Although the first half of 2020 was hit by the pandemic, the business rebounded in the second half, and the total weighted new business premiums for the whole year still increased by 3 per cent. In 2021, it achieved double-digit growth, with total weighted new premiums rising 23 per cent to S$5,380.7 million. Great Eastern Holdings' full-year new business weighted total premiums rose 28 per cent to S $1,971.6 million last year, while new business embedded value surged 21 per cent to S$808 million.

The Group launched the Centre for Design, Insights and Innovation in 2020, and set up a team to better understand customers’ needs.

"It turned out to be very valuable, especially during the pandemic, when consumer behaviour patterns started to change, and we did not understand what they were thinking," Mr Khor said.

For example, the team realised that during the pandemic, people were looking for higher interest yielding products in a low interest rate environment. This led the Group to launch a series of single- premium products to meet this demand.

In addition, due to the growing market demand for environmental, social and governance products, we also launched Singapore’s first green insurance product, a short-term endowment plan to invest assets in climate change projects, supporting renewable energy, green buildings and electric vehicle charging stations.

The team also uncovered that customers expect more information to be readily available to them, and the Group’s mobile app enables them to find out about their insurance policies on-the-go.

When asked about the impact of the pandemic on the insurance industry, Mr Khor emphasised that companies must continue to strengthen their ability to adapt and evolve.

“Meet” the friendly team from Great Eastern (East) cluster!

Here’s your chance to “see” and know who our ABD folks are at GE East cluster! They have specially prepared a short video clip to share more about themselves, and remember to “hi” them the next time you see any of them too!

You can also look forward to “meeting” the rest of the ABD folks from other clusters in our upcoming TGC issues. So stay tuned!

2nd quarter 2022 market outlook – A summary from Agency Propositions and Portfolio Management

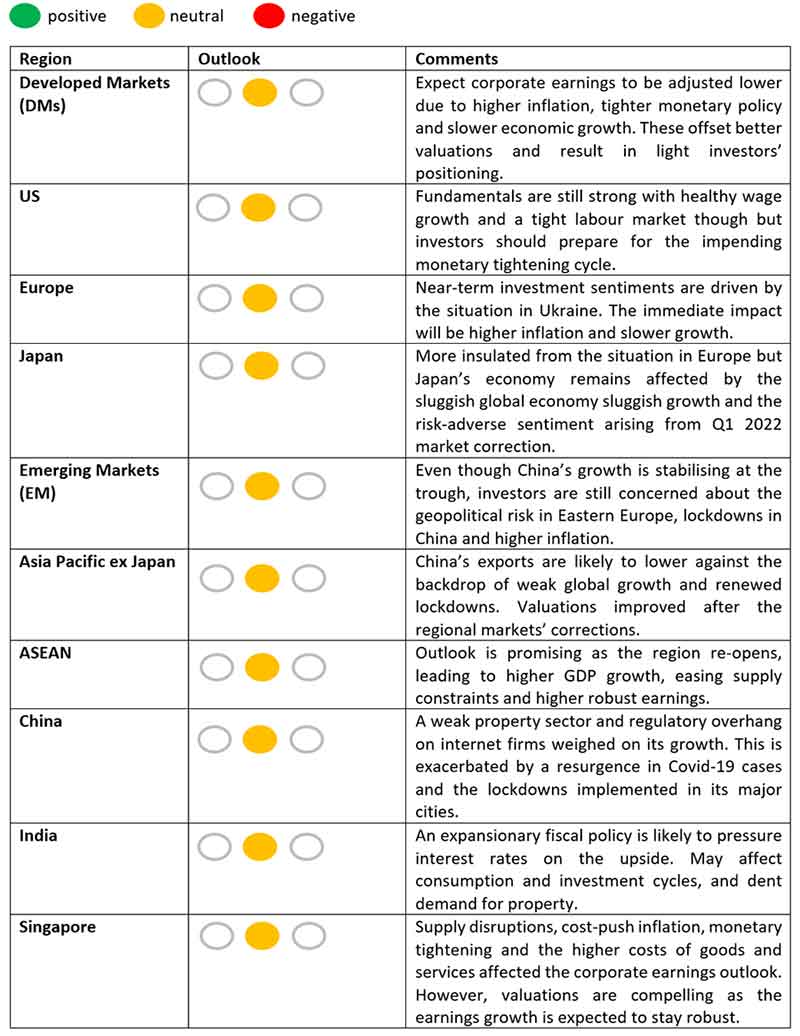

We downgrade our view on global equities to neutral on a tactical 3-month basis. As a buffer against potential downsides amid higher market volatility, we downgrade Europe and Japan equities from positive to neutral. We continue to hold a negative outlook on global bonds with rising interest rates.

Global markets face significant uncertainties against the backdrop of rising inflationary pressure, monetary policy tightening and interest rate hikes, as well as geopolitical tensions between Russia and Ukraine. Hence, global economic growth may slow significantly in the near term. Investors are encouraged to take a more cautious and neutral stance towards risk assets amid these developments.

Calendar of events

Get updated on our latest Apr and May calendar of events for you to have a bird’s eye view of our latest training, major events and recruitment events as well.

Simply click the below links to find out more!

Winning awards are not everything

For Tng Zhi Jian whose first career is with Great Eastern as a financial representative since 2018, he has achieved remarkable success and has even won the coveted Top of the Table award. But awards are not what he defines success to be. Let’s hear what he has to say.

1. When you embarked on this entrepreneurial career as a first-jobber, what did you tell yourself to ensure you could do well in this career?

I know that every job has its unique challenges. I tell myself that I need to have a positive mindset when faced with work challenges, and to continually develop myself by taking up courses which will help me in my career.

2. Do you have a mentor or inspirational figure in your career?

Yes, my Director - Ms Tan Soon Hwa, has been my mentor since I joined in 2018.

She is a 33-year veteran at Great Eastern who willingly shares her wealth of knowledge with me and our team members. I have gained so much by learning from her as she always reminds me to put customers first and not my sales targets, and to uphold integrity in all that I do.

She also encourages new joiners (like me) not to be disheartened by setbacks as this is part and parcel of this job, and not to let rejections from customers affect me. I attribute what I have achieved today to her guidance.

3. Are awards important to you as a mark of success in your career?

Awards are important as they are a recognition of my hard work. However, awards are not what I define as success. I believe that being a trusted and competent financial representative to my customers is more important than winning awards.

4. Please share your number 1 success tip.

It is to focus on my customer’s financial planning needs and doing the right thing for them, and success will follow.