Over 2 million Singaporeans and Permanent Residents are currently covered under the Dependants’ Protection Scheme (DPS).

DPS is a term-life insurance scheme administered by Great Eastern Life to cover death, terminal illness1 and total permanent disability2 through your CPF. No cash needed3.

|

|

|

How can

we help

you today

How do you stay covered under DPS?

You are automatically enrolled when you make a valid CPF working contribution. Policyholder is encouraged to submit the Health Declaration for assessment on eligible coverage.

You can also apply for DPS as long as you are aged 16 and above but below 65.

Renewing your DPS policy

A renewal notification will be sent to you 30 days before your renewal date. You have a grace period of 60 days from the renewal date to make payment. Payment can be made via CPF, GIRO or other methods such as e-banking, AXS, cash or cheque.

If the deduction from your CPF account is unsuccessful, an unsuccessful deduction notification will be sent to you. If you would like to request to re-deduct from your CPF savings, please download the Change Payment Method & Authorisation Form and email it to us at dps-sg@greateasternlife.com.

For more information, please visit the FAQ section.

To change the payment method for your DPS policy, please download the Change Payment Method & Authorisation Form and email the completed form to us at dps-sg@greateasternlife.com.

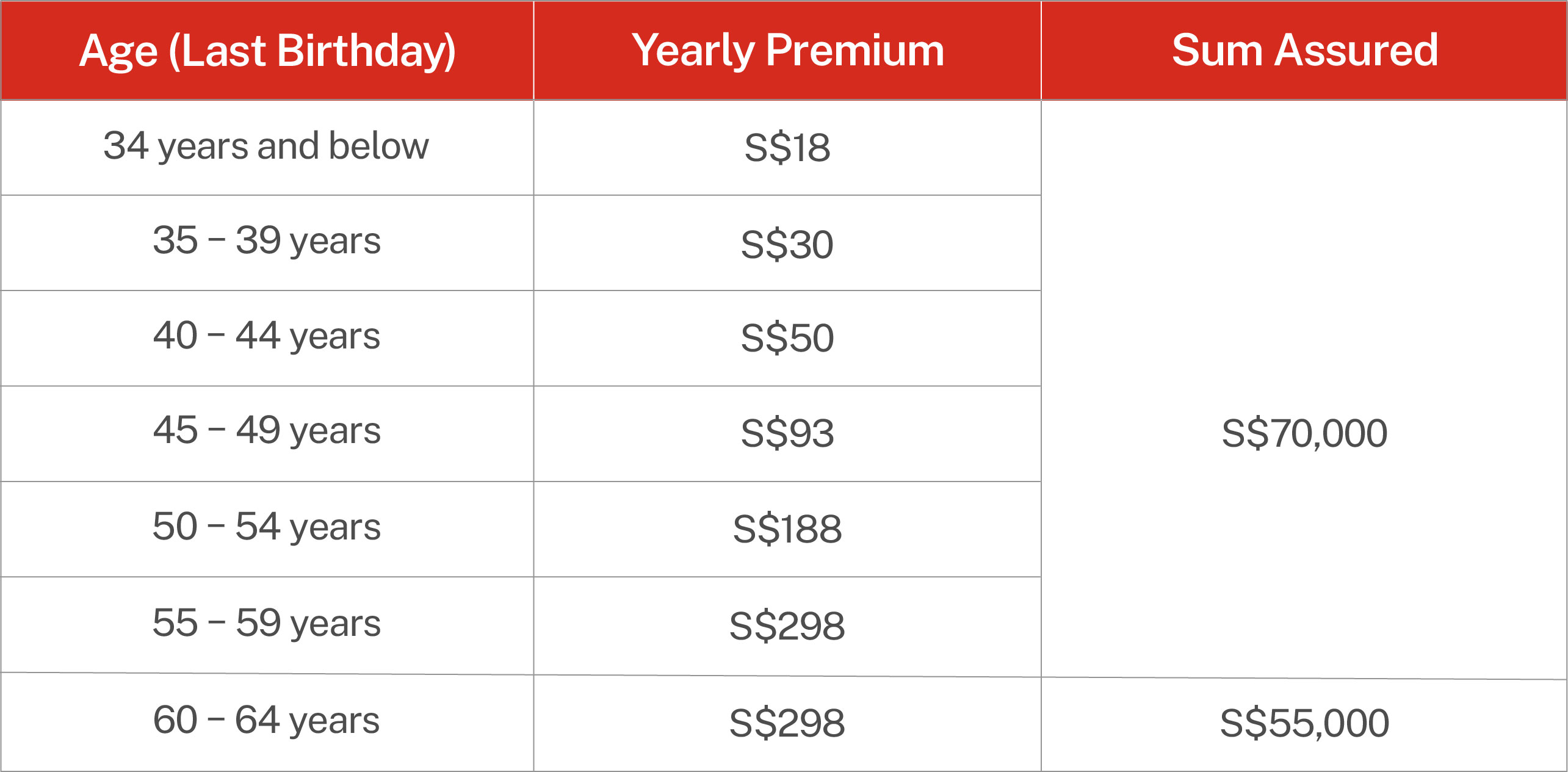

Premium Table

Get up to

4X

the protection with

GoGreat Term Life.

Exclusive to DPS members, receive up to S$300,000 additional coverage from just S$0.21 daily!

Learn more

Need to find out more about DPS?

Get all the answers you need, right down to the finer details.

Download product brochure

Coverage under the DPS is not compulsory. However, continuing with the DPS cover will provide some financial protection for the policyholder’s family.

Policyholders can contact Great Eastern Life to terminate their DPS cover any time by completing the opt out form.

Policyholders should consider the benefits of DPS carefully before terminating their DPS cover. If policyholder decides to re-join DPS in the future, the cover will be provided, subjected to him/her being in good health then.

It provides coverage against Death, Terminal Illness1 and Total Permanent Disability2.

CPF members who are Singapore Citizens or Permanent Residents, between the age of 21 and 65, are automatically extended with a DPS cover upon:

- the first valid working CPF contribution or

- a valid working CPF contribution if their DPS cover had lapsed on/after 1 April 2021 or

- a valid working CPF contribution after their Singapore Citizenship/Permanent Residency is restored.

CPF members aged between 16 and 20 can apply for a DPS cover directly with Great Eastern Life.

If you do not have a DPS and wish to join, you can:

- Click here to download the Proposal Form and return the completed form to us, or

- Get in touch with your Financial Representative, or

- Drop by our Customer Service Centre at 1 Pickering Street, #01-01 Great Eastern Centre, Singapore 048659.

If you have any questions, you may contact our customer service officers at +65 6839 4565 or e-mail us at dps-sg@greateasternlife.com.

If you are at least 18 years old and wish to have the death claim benefits paid to specific person/organization i.e. beneficiary(ies), you can make a revocable nomination by completing the DPS nomination form and submitting the completed form to us. To obtain the DPS nomination form, you may:

- Click here to download Form 4 Revocable Nomination

- E-mail us at dps-sg@greateasternlife.com

- Contact our customer service officers at +65 6839 4565 to request for the form to be sent via post

Kindly complete the form and return it to us at:

1 Pickering Street

#01-01 Great Eastern Centre

Singapore 048659

An acknowledgement letter will be sent after we process your request.

A DPS claim can be made when a Life Assured passes away or is certified to be suffering from terminal illness or total permanent disability.

a. Terminal illness refers to an illness that a registered medical practitioner under the Medical Registration Act certifies is expected to result in death within 12 months

b. Total permanent disability refers to (i) the inability to take part in any employment permanently, or (ii) the total permanent loss of physical function of both eyes, both limbs, or one eye and one limb, certified by a registered medical practitioner under the Medical Registration Act.

A claim under (a) or (b)(ii) can be made only if the terminal illness or total permanent loss of physical function started on or after 1 May 2016.

For more information regarding the claim procedure, please click here.

Understand the details before buying

Click here to read the full terms and conditions.

1 Terminal Illness refers to an illness that a registered medical practitioner under the Medical Registration Act certifies is expected to result in death within 12 months.

2 Total Permanent Disability refers to

- the inability to take part in any employment permanently; or

- the total permanent loss of physical function of both eyes, or two limbs, or one eye and one limb.

certified by a registered medical practitioner under the Medical Registration Act.

3 No cash payment required provided there are sufficient funds in your CPF account to pay for the minimum sum assured, or you have chosen to pay the full premium by cash.

All ages specified refer to Age Last Birthday.

Figures presented are subject to rounding.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the Dependants' Protection Scheme Terms and Conditions.

As this product has no savings or investment feature, there is no cash value if the policy ends or if the policy is terminated prematurely.

You may wish to seek advice from a financial adviser before making a commitment to purchase this product. If you choose not to seek advice from a financial adviser, you should consider whether this product is suitable for you.

This policy is protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Information correct as on 1 August 2023.