Key benefits

-

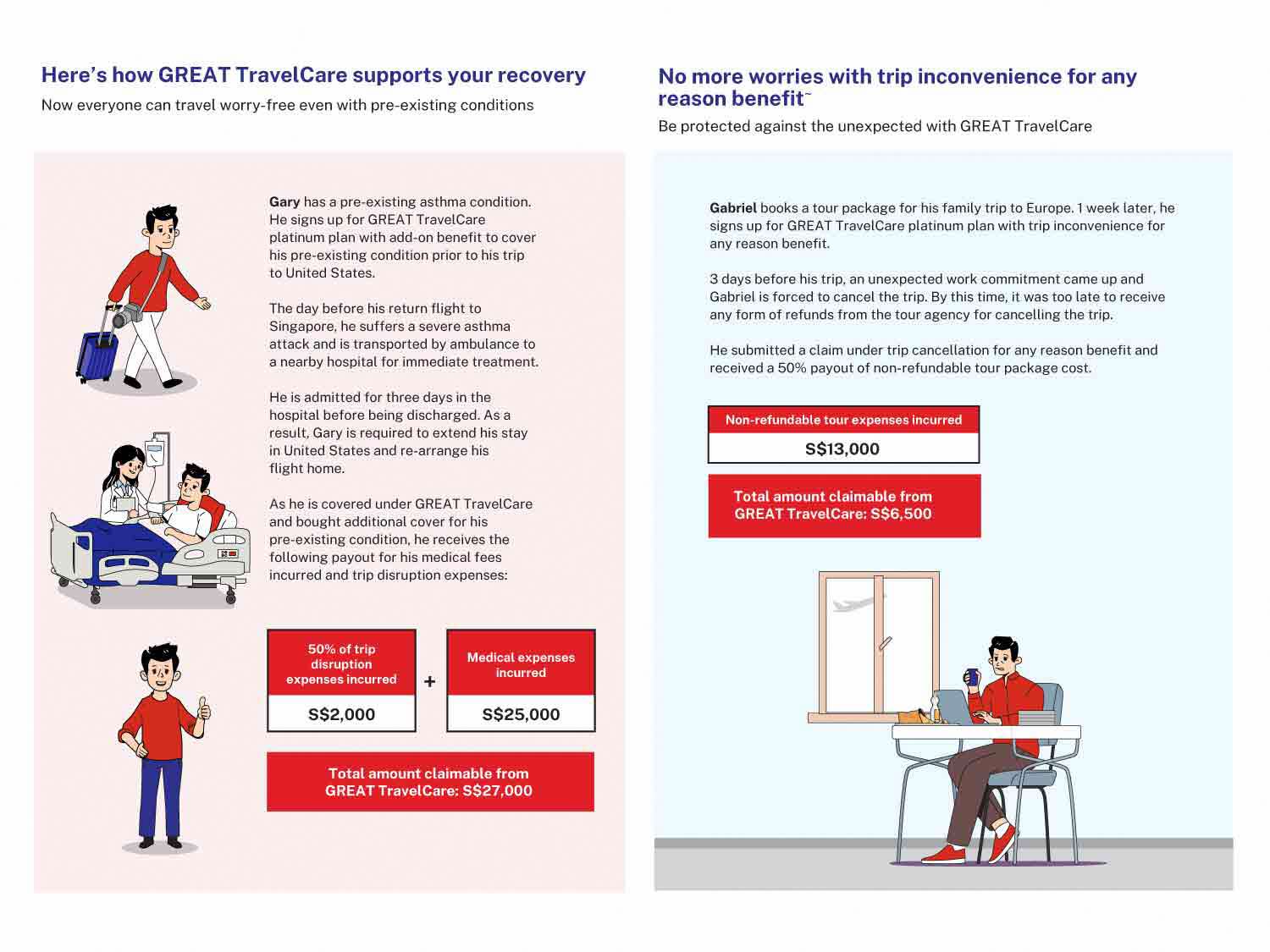

Coverage for pre-existing conditions†

Travel with peace of mind, even with pre-existing conditions like diabetes, high blood pressure, asthma, arthritis, stroke, or heart disease. Enjoy up to S$200,000 coverage for overseas medical expenses and up to S$15,000 for trip cancellations due to your pre-existing conditions.

-

Payout on trip inconveniences for any reason*

Get coverage for cancellation, postponement or shortening of your trip for any reason when you purchase our plan within 30 days of your initial travel booking.

-

Payout for travel or baggage delays

Receive a cash payout for travel or baggage delays starting from 4 hours‡, compensating you for any inconvenience caused.

-

Coverage for leisure adventure activities and sports equipment§

Indulge in adventurous leisure activities like mountaineering, bungee jumping, and scuba diving with peace of mind. Plus, enjoy additional coverage on your sports equipment during your exciting adventures.

Your questions answered

1. When will the coverage for my travel policy start?

Our pre-journey benefits provide coverage for trip cancellation, postponement and insolvency protection. For all other benefits, the coverage starts after departure from Singapore.

2. What is the maximum period of coverage for an overseas trip?

For Single Trip Policy: 182 consecutive days.

For an Annual Multi-Trip Policy: 90 consecutive days

3. What does " Trip inconveniences for any reason" benefit cover?

“Trip inconveniences for any reason" benefit is applicable for Gold and Platinum plan if the policy was purchased within 30 days from your initial travel booking. We will reimburse you up to 50% for all covered travel expenses incurred, capped at the maximum limits of your selected plan, if your trip was impacted by any of the following:

Trip cancellation for any reason: We will pay this benefit if you have had to incur a covered travel expense as a result of the entire trip being cancelled for any reasons not covered under trip cancellation benefit.

Trip postponement for any reason: We will pay this benefit if you have had to incur a covered travel expense as a result of the entire trip being postponed for any reasons not covered under trip postponement benefit.

Trip curtailment for any reason: We will pay this benefit if your trip has commenced for at least 48 hours, and you have had to incur a covered travel expense as a result of you having to return to Singapore before your planned return date for any reasons not covered under trip disruption benefit.

General exclusion applies, please refer to policy document for more information.

4. Are there any circumstances where I am unable to claim under “Trip inconveniences for any reason” benefit?

If your policy was purchased more than 30 days after your initial payment or deposit was made for the trip, this benefit will not be applicable. In addition, we will not pay for claims that are caused by events that fall under our general exclusions, such as travelling against medical advice or where your policy was purchased after a natural disaster was reported by the media or through travel advice issued by an authority. Please refer to the policy document for more information.

5. Will my sports equipment be covered if I bring it on my trip?

Yes, you will enjoy sports equipment coverage when you purchase our Platinum plan. We cover loss of or damage to sports equipment caused by an accident or theft during your trip overseas. Please refer to policy document for more information.

6. Does GREAT TravelCare cover adventurous activities?

Yes, you will enjoy adventurous activities coverage when you purchase our Gold or Platinum plan. GREAT TravelCare covers accidental injury or death when you participate in these activities for leisure purposes and safety procedures are adhered to.

- Artificial rock climbing

- Bungee jumping

- Hang-gliding

- Helicopter or airplane rides for sightseeing

- Hot-air-balloon rides for sightseeing

- Skydiving

- All-Terrain Vehicle (ATV) rides

- Jet-skiing

- Paragliding

- Parasailing

- Zip-lining or zip-riding

- Canoeing or white-water rafting

- Mountaineering, hiking or trekking

- Underwater activities involving breathing apparatus for diving

- Winter Sports

All insured persons must keep to the limitations set out in the policy wording.

7. Are any countries excluded from coverage?

GREAT TravelCare does not cover any travel in, to, or through UN sanction list of countries such as: Afghanistan, Belarus, Cuba, Democratic Republic of Congo, Iran, Libya, Liberia, North Korea, Russia, Somalia, South Sudan, Sudan, Syria, Yemen, Crimea, Donetsk, Luhansk, Kherson and Zaporizhzhia Region of Ukraine and any country where the Ministry of Foreign Affairs of Singapore advises against travelling to.

8. What is the definition of “pre-existing medical condition” under GREAT TravelCare?

Pre-existing medical condition refers to:

- any condition, illness, disease, injury, disability or birth defect which you have received medical advice for, been diagnosed with, received medical treatment for, been prescribed drugs for, been hospitalised for or undergone surgery for during the 12 months immediately before the start of the trip; or

- any signs or symptoms that appeared during the 12 months immediately before the start of the trip and for which a cautious person could reasonably be expected to have received medical advice or counselling, undergone investigations, had diagnostic tests, received medical treatment, had surgery, been hospitalised or been prescribed drugs.

For an annual multi-trip policy, any medical condition you have made a claim for in connection with a previous trip will be a pre-existing condition for subsequent trips.

9. Can I purchase GREAT TravelCare if I am suffering from a pre-existing medical condition?

Yes, you can. In general, pre-existing medical conditions are not covered as it is a general exclusion under the policy. To be covered for claims where the causes are directly linked to a pre-existing medical condition, you are encouraged to include the optional pre-existing condition cover (additional premium is applicable) when purchasing your policy.

10. Do I need to declare my pre-existing medical condition before purchasing GREAT TravelCare?

Declaration of medical condition is not required for application of GREAT TravelCare.

11. Who can purchase GREAT TravelCare?

To be eligible for GREAT TravelCare, you must meet the following criteria:

- You are a Singaporean or Singapore Permanent Resident; or foreigner with a valid Employment Pass, Work Permit, Dependant’s Pass, Student’s Pass or Long-Term Social Visit Pass residing in Singapore.

- You are at least 18 years old at the time of purchase (only required if you are the applicant).

- You are not travelling contrary to the advice of a qualified medical practitioner or for the purpose of obtaining medical treatment.

- You bought the policy before you leave Singapore on your trip.

12. What is the difference between GREAT TravelCare Basic, Gold and Platinum Plans?

The differences are in the policy features and maximum amounts payable per person per trip in the event of a claim. For the best cover and highest protection, we suggest you choose Platinum plan. You can view the travel policy document and compare the amounts payable for each of the policy features, to help you choose a suitable plan.

13. Who is considered Family under GREAT TravelCare?

For a single-trip policy or one-way trip policy, your family is:

- you and your husband, wife or unmarried partner; and

- all your biological or legally adopted children or grandchildren;

who are travelling from and back to Singapore together, at the same time.

For an annual multi-trip policy, your family is:

- you and your husband, wife or unmarried partner; and

- all your biological or legally adopted children.

The family members do not need to travel together on a trip, but any child under 10 must be accompanied by a parent or adult guardian for the whole trip.

14. Can I purchase GREAT TravelCare for my child who is traveling on a student exchange programme or field trip?

Yes, child below 18 years old can apply for any plans under an individual cover, provided the application is made in the parent or adult guardian's name. Child below 10 years old must be accompanied by an adult (parent or guardian) for the entire trip. Please note that child limit applies. The maximum period of coverage for a student exchange program or field trip is 182 consecutive days for single trip policy and 90 consecutive days for annual multi-trip policy.

15. Can I purchase travel insurance if I am already overseas?

No, you will need to purchase your travel insurance before setting off for your overseas trip from Singapore. We strongly encourage you to purchase early before departure as our travel insurance provides pre-journey coverage as well.

16. I will be travelling to more than two countries and will be back to Singapore before flying to the next country (e.g. Singapore > Bangkok > Singapore > Seoul> Singapore). Can I purchase one single trip policy for the entire journey in this case?

Sounds like a great trip! In this case, you will need to purchase 2 separate single trip policies because the coverage for a single trip policy ends when you return to Singapore. Alternatively, if you travel more than 3 times a year, an annual policy would be recommended as your insurance costs will be considerably cheaper compared to purchasing a single trip travel policy each and every time.

17. I’m travelling to more than one country during my trip. Can I still get a policy?

Yes, please select all destinations on your itinerary.

18. If I am travelling overseas to seek medical treatment, can I take up travel insurance?

Our policy covers people who are travelling overseas for business or for holiday. It is not intended to cover people who are travelling to seek medical treatment.

19. If I am only travelling one-way, will I be able to purchase travel insurance?

Yes, please select one-way trip. Your cover will cease when you arrive at your place of residence or workplace in the destination country within 4 days, or 3 hours after you have cleared immigration in the destination country, whichever is earlier.

20. Does the policy cover business travel?

Yes, your policy will cover you for business travel except for:

- any loss, damage or liability arising as a result of manual work or hazardous materials;

- travel relating to your job as a licensed tour guide or staff of a travel agency;

- you taking part in naval, military, air force, civil defence or police training, duties, services or operations.

The exceptions outlined above are not exhaustive, please refer to the policy wording for the full exclusion list.

21. What is the age limit for GREAT TravelCare?

For single trip policy, the insured person must be at least 1 month old to 99 years old.

For annual multi-trip policy, the insured person must be at least 1 month old to 80 years old for new applications.

22. What do I indicate as the period of insurance?

You will need to indicate the start date and end date of your trip for the period of insurance. The start and end date will be based on Singapore time.

- Start date: The date you are departing from Singapore (e.g. If you are departing from Singapore on 01 June 2025 23:50, you should indicate the start date as 01 June 2025).

- End date: The date you are arriving in Singapore (e.g. If you are arriving in Singapore on 10 June 2025 00:30, you should indicate the end date as 10 June 2025).

23. If the Ministry of Foreign Affairs of Singapore (MFA) issues a travel advisory against travelling to my destination country, am I still covered under GREAT TravelCare?

Travelling against the travel advisory issued by the Ministry of Foreign Affairs (MFA) is not covered under GREAT TravelCare. Please visit the Ministry of Foreign Affairs website (mfa.gov.sg) for the latest notices issued by the Singapore government.

24. Am I covered if I purchase GREAT TravelCare after a natural disaster has already been reported by the media?

Any claims arising from a known event will not be covered unless you purchased the policy before the known event was publicised or reported by the media or through travel advice issued by an authority (local or foreign) before you took out the policy.

25. Will I receive a premium refund if I decide not to proceed with my Trip?

Cancellation for Single Trip & One-Way Trip Policy:

The policyholder may cancel this Policy at any time prior to the commencement of this Policy coverage and the cancellation will apply from the date we receive the notice of cancellation. We will refund the premium paid less S$25 administrative charge. However, there will be no refund if we receive the notice of cancellation on or after your trip departure date.

Cancellation for Annual Multi-Trip Policy:

If this Policy is issued as an annual multi-trip Policy, it may be terminated by either party by giving 1 month’s written notice. If this Policy is terminated by us, a pro-rata refund of premium will be granted to the Insured for the remaining part of the Policy Period. If the Insured terminates this Policy, the refund of premium will be based on the following scale:

| Policy Is In Force | Percent of Annual Premium Refundable |

| Up to 60 days | 60% |

| Between 61 and 120 days | 40% |

| Between 121 and 180 days | 20% |

| More than 180 days | Nil |

26. Can I amend the starting date of my travel policy?

Unfortunately, it is not possible to amend the starting date of your policy. The existing policy would need to be cancelled and replaced with a new policy. Please note that you cannot cancel a single trip travel policy once you have passed the designated start date of the policy.

27. Who can I contact if I wish to make an amendment to my travel details?

You may email to GICare-sg@greateasterngeneral.com or inform your servicing agent who can also assist you with the amendment.

28. Can I extend the period of cover if I decide to extend my vacation while I am overseas to visit more attractions?

Extension of period of cover for single-trip policies is allowed midway through travel, provided there are no known circumstances or events that may lead to a claim. An additional premium may apply. You may email us at GICare-sg@greateasterngeneral.com to request for such an extension before your policy coverage expires.

29. What should I do if I am severely sick or encounter an accident abroad?

Please contact our 24-hour Emergency Assistance Services if you need emergency medical or travel assistance while travelling.

- Phone (Hotline) : (65) 6708 7453

- WhatsApp : +1 888 831 7667

- Click-to-Call

30. How do I file for a claim?

Claims submission can be submitted via our online travel claim portal here. Kindly submit full particulars and full facts of the claim including its occurrence, detailed circumstances and extent of loss, with any supporting documents as soon as reasonably possible but no later than 30 days after the incident. For more details, please refer to this page.

For general enquiries:

Please contact our Customer Service Hotline at 6248 2888, Mondays to Fridays, 9am to 5.30pm (excluding public holidays) or email us GICare-sg@greateasterngeneral.com.

Alternatively, you can inform your servicing agent who can also assist you with the claim.

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

* Applicable for Gold and Platinum plan.

† Applicable as an add-on benefit for Gold and Platinum plan with additional premium.

‡ Applicable for Platinum plan only.

§ Leisure adventurous activities coverage is applicable for Gold and Platinum plans; sports equipment coverage is applicable for Platinum plan only.

~Trip inconvenience for any reason benefit is applicable when you purchase our travel plan within 30 days of your initial payment or deposit for your trip.

This brochure is for general information only. It is not a contract of insurance. Please refer to the policy documents for the precise terms and conditions of the insurance plan.

This policy is subject to the Premium Before Cover Warranty Clause, which requires the premium to be paid and received on or before the inception date of the policy.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information onthe types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the General Insurance Association (GIA) or SDIC websites (www.gia.org.sg or www.sdic.org.sg).

GREAT TravelCare is underwritten by Great Eastern General Insurance Limited, a wholly-owned subsidiary of Great Eastern Holdings Limited and a member of the OCBC Group.

Information correct as at 25 March 2025.