This e-publication is for internal sharing only and is not to be distributed outside of the company.

January 2023

Click below to read more.

Hear from Our Leaders

» Message from Patrick Peck

Highlights of the Quarter

» Get Real! Be Prepared! Stay United! The Great Kick Off 2023 shows you how

» Uplifting communities through the Great Eastern Women’s Run and giving.sg!

» 2022’s Q4 top performers worked hard to play harder!

Must-Knows

» Rev up for our Q1 challenge! Sure-Win scratch cards, Blackpink’s concert invites and potentially $50,000 could be yours!|

» No urban myth! Legacy planning as the way forward

» Q1 2023 Market Outlook

Good-To-Knows

» Chan for thought: when financial planning plays a role in economy, rising costs and more

» Don't wait till it's too late and end up spending more!

» Recycle right: Check|Clean|Recycle

» Event calendar

From Good to Great

» Nurturing money minds: Build the next gen’s financial literacy now

» Greening the region one tree at a time

Click here for past TGC issues.

Message from Patrick Peck

Dear Leaders and Representatives,

Happy new year! A big thank you for your relentless commitment throughout a very tumultuous 2022 to push boundaries. 2023 is looking to be even bigger and better for Great Eastern as we continue to Reach for Great together.

We cruised into 2022 on a high, before a sudden storm of inflation and rising interest rates threatened to knock us off course. Despite so, I am struck by the resilience and agility of our agency force to conquer all odds. You have exemplified the tenacity and ability necessary for success against all odds, and I am proud of all of you.

This year, let us focus on three pillars - BELIEF, MINDSET and WORK ATTITUDE. To stand out and thrive in a rapidly changing world, we must truly believe that we are agile, swiftly seizing all available opportunities as soon as they arise. Speed is key, because the only easy day was yesterday! Every day is an uphill climb, so act fast when you can and sell like there is no tomorrow; this work attitude will definitely carry us through the best and worst of times.

Here’s wishing everyone a most healthy and prosperous 2023. Let’s move as one to scale more pinnacles of greatness.

Get Real! Be Prepared! Stay United! The Great Kick Off 2023 shows you how

Idyllic Bali roared to life when 1,600 of our financial representatives gathered in person for Great Eastern’s annual motivational conference to celebrate the new year, with another 1,600 dialing in for the excitement that was the Great Kick Off 2023. Themed ‘Reach for Great Together – Get Real, Be Prepared, Stay United’, the dynamic event – a first for both the Great Eastern family as well as the insurance industry in Singapore – rallied to bring out the best in our reps by imbuing them with a strong sense of purpose and urgency to #ReachforGreat together and sell for good.

Mr Khor Hock Seng, Group CEO, fired the first salvo: to maintain Great Eastern’s market competitiveness in 2023, we must be keenly aware of key trends impacting the macro environment and focus on three key areas – Product Propositions to address the holistic needs of our customers across all life stages and segments, Digital Tools that support our quality advice and service, and excellent Operational Services to support our business.

Next was Patrick Peck, Managing Director of Regional Agency/FA and Bancassurance who reminded that nothing happens by accident and our every move was carefully planned in 2022. He shared the winning attributes for 2023 – Belief, Mindset and Work Attitude or the catchy BMW in short:

- One common Belief that we are agile and we adapt to the ever-changing world.

- A strong and always-on Mindset to constantly strive to thrive because the only easy day was yesterday.

- The hungry Work Attitude that we must sell like there’s no tomorrow.

Sharing various tools and initiatives to help the agency force boost their income, Jimmy Tong, Managing Director of General & Group Insurance, reminded what it takes to be a successful financial representative, and announced the Personal Lines Flying Start Campaign and Fly with Us Campaign to Hong Kong.

The energy continued to soar with George Goh, Head, Singapore Agency highlighting our Q1 Activate & Protect Challenge and peaked with the sharing of the very much-anticipated destination for our Great Eastern Life Achievers Club Convention 2024 – Paris, France.

As part of the Great Kick Off 2023, over 70% of our agency leaders also joined us at the Great Leaders Kick Off 2023 who exchanged their invaluable insights and experience on key agency matters from recruitment, products to culture and ethics at knowledge sessions.

Feeling inspired? Galvanised into action yet? Remember that Greatness is wherever somebody is trying to find it and Greatness is for everyone and that Greatness is YOU! Those target, those goals, are all within reach, so go for them!

Uplifting communities through the Great Eastern Women’s Run and giving.sg!

The Great Eastern Women’s Run made its Singapore comeback on 20 November 2022 as the first all-women’s physical run since 2019. Yet it was already a hive of activity behind the scenes from September to November 2022 for our Great Eastern employees and financial representatives who took up the Reach for Great Fundraising Challenge, held in tandem with the run, as part of our corporate social responsibility efforts.

Thanks to our hardworking fundraising teams who activated their networks and literally put their best feet forward to clock distance as well as our corporate partners, $220,000 was raised for Daughters Of Tomorrow and Singapore Cancer Society. The winning team JKLM comprising Great Eastern financial representatives Joanne See, Kristiana Anthon, Lydia Lee, and Marie Mak clocked over 2,600km and raised $40,341! Watch this video to find out what kept Team JKLM going.

Photo credit: Ministry of Culture, Community and Youth

This 16th edition saw over 4,000 participants on race day in the popular 5km and 10km categories, as well as the 2km Mummy + Me run for mothers and their daughters aged between five to 12. There was also a competitive 21.1km race, open to invited local female elite athletes. Mr Edwin Tong, Minister for Culture, Community and Youth and Second Minister for Law was Guest-Of-Honour.

And because Great Eastern Cares, Singapore Cancer Society’s ‘Return to Role’ rehabilitation programme is also receiving $13,761 from our campaign on giving.sg to help cancer survivors win the fight and get back on their feet. Great Eastern will match a dollar-for-dollar to boost the final tally to $27,522 and help our brave cancer warriors #ReachforGreat, in conjunction with the launch of our latest GREAT Critical Cover Series – two comprehensive plans and a Protect Me Again rider designed to provide essential critical illness coverage to customers.

To all our fundraisers and donors, thank you again for giving your time and resources so generously!

2022’s Q4 top performers worked hard to play harder!

Were you fast and furious enough to earn a coveted spot on the invite list? RAFABA paid tribute to our top performing 150 reps of October by holding a private live screening of the Fifa World Cup at Cafe Football in Woodleigh on 24 November 2022 for the showdown between Switzerland and Cameroon.

Being the first large-scale physical gathering in two years since the pandemic, everyone was thrilled to celebrate one another – never mind if you were rooting for different teams – and create fresh memories together while forging new friendships. The attendees bonded over warm-up games and the non-stop treats of delicious food and drinks. Then it was plenty of whoops and cheers during the match itself as well as the on-site lucky draw where one could walk away with a 55” Samsung TV, Dyson fan and more!

This exclusive ‘Fast Start’ event also served as a strong driver for the ‘Q4 2022 Mega Cash Challenge’ of which the top performing 11% – all 593 of you – qualified for the cash incentive that’s between $500 to $24,000. Congratulations to everyone who made it!

Rev up for our Q1 challenge! Sure-Win scratch cards, Blackpink’s concert invites and potentially $50,000 could be yours!

This Q1, our Activate and Protect Challenge spotlights protection and activates your incentive tier with First Year Commission for ALL products – up to $50,0000! BONUS: Receive a pair of VIP invitations to catch K-pop girl group Blackpink’s Born Pink World Tour in Singapore at the exclusive Executive Suite of National Stadium – if you are among the top six reps for each product category A&H, RP ILP and RP Protection.

That’s not all, from now till 6 Feb, the 兔gether (Together) as One Challenge is running in tandem!

As we leap into the Year of the Rabbit, we want to bring back the excitement of meeting customers and one another in person. Redeem a Sure-Win scratch card with every eligible policy and win up to $1,888.

So rise to the challenge of achieving your Q1 targets and get rewarded, many times over! For more details, please refer to the following notices:

001/23/ABD/Q12023A&PCHALLENGE

002/23/ABD/TOGETHERASONECHALLENGE

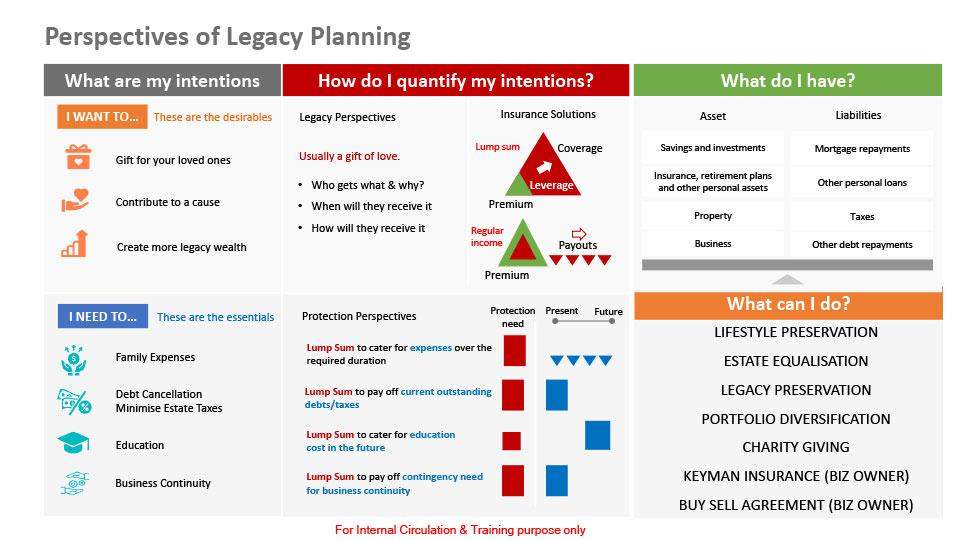

No urban myth! Legacy planning as the way forward

With the current high bank interest rates showing no signs of abating in the first half of 2023, advocating insurance as an attractive alternative to savings may not fly.

Why not shift the focus to protection: tell a heroic story of wealth and asset preservation that can outlive the creator to benefit generations of loved ones? When we are properly insured, there is guaranteed financial stability and security for peace of mind, especially when misfortune strikes.

Preparing for the worst may not be a trending conversation starter, yet. However, it is true that most among us would have financial commitments and liabilities that could potentially implicate and burden loved ones when we are no longer around.

While life insurance isn’t something that people will rush to buy, its importance is indisputable. In this light, how would you help clients with their legacy planning to safeguard their riches and extract maximum benefits for them and their loved ones? Here’re some guiding questions for customising your approach.

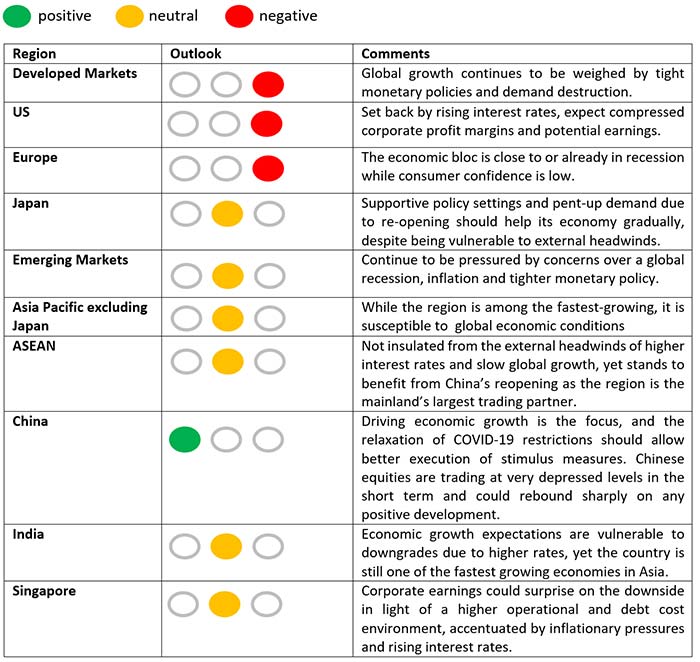

Q1 2023 Market Outlook

This quarter, we continue to underweight global equities. Global economic growth is set to slow further as central banks continue to push rates up to levels that restrict economic activity. Concerns over a global recession could be self-fulfilling when central banks can only engineer demand destruction to rein in inflation. The global bond sell-off in 2022 had reduced interest rate volatility, resulting in elevated yield levels that provided income opportunities for investors. However, in an inflationary environment, long-term government bonds may no longer be the safe-haven holdings. Investors would demand a higher-term premium (bond prices to fall) to hold them. Hence, we remain neutral in global bonds over the next three months.

The current mix of economic weakness and restrictive financial conditions is still challenging for investors, even though both the fixed income and equity markets rallied in the last quarter of 2022, with inflation starting to moderate from elevated levels. Recessionary risk in the major economies is rising - major central banks have reiterated their determination to tighten monetary policies and battle inflation at the expense of economic growth. These developments would impact corporate margins and potential earnings. Hence, the probability of a sustained rise in equity market valuations or a sustained decline in bond yields in 2023 remains low. Investors should adopt a cautious stance towards risk assets this year.

Chan for thought: when financial planning plays a role in economy, rising costs and more

100 Great Eastern senior corporate leaders and agency directors had a scintillating closed-door dialogue with Education Minister Chan Chun Sing to exchange views on the Singapore economy, rising costs of living as well the need to proactively manage healthcare cost by advocating a healthy lifestyle and financial planning. Great Eastern, who has been supporting financial literacy education programmes, also expressed interest in collaborating with the Ministry of Education closely for similar initiatives to engage and educate students on a wider scale.

This session was jointly organised by Insurance and Financial Practitioners Association of Singapore and Great Eastern, and hosted in our Centre for Excellence.

Don't wait till it's too late and end up spending more!

When and why should parents insure their children? Do you know that we can buy insurance plans for our children even before they are born? Read on for the interview highlights that Luke Yap, Senior Manager at Great Eastern who just became a father, shared on-air over CNA938 recently.

Tell us more about these before birth plans.

There are maternity policies that covers as early as 13 weeks into the pregnancy. Apart from covering complications, they also provide guaranteed distributed benefits. This ensures that when a child is born with conditions that may hinder him/her from buying insurance, the child will still be able to do so, due to the guaranteed insurability benefit.

Why is insurance for children important?

Young children can get into accidents. Another key plus point is locking in the health condition. You can buy insurance only when you have health.

Should parents think about having an investment or savings component to their children's financial plans and policies?

There are endowments or investment policies where parents can put aside money regularly for long term goals such as education. It's better to set money now and earn the interest than to take a university loan and pay the interest.

How much coverage would you recommend?

It depends on affordability - we all work with finite resources. A rule of thumb that most insurance planners usually work with is five times the monthly income as critical illness coverage, or 10 times the annual income as death coverage.

Any closing words of advice for parents?

Have a game plan and it all comes down to cash flow and budgeting.

Recycle right: Check|Clean|Recycle

If you recycle regularly, good for you! Make sure you’re doing it right, though. Based on a survey conducted by the National Environment Agency in 2021, three in five households in Singapore recycled regularly, yet many were not sure what cannot be placed into the blue recycling bins.

Half of those surveyed thought that soft toys and styrofoam items could be placed into the bins for recycling. However, this is incorrect, resulting in bin contamination and reduced recycling rate. With Semakau Landfill projected to run out of space by 2035, we must recycle more and recycle right.

Here’s a simple 3-step process to recycle right:

Step 1: CHECK your items before appropriately disposing them. Not sure what’s recyclable and what’s not? Find out here or download a handy list

Step 2: CLEAN recyclable food and drink containers and bottles by emptying and rinsing them before disposal.

Step 3: RECYCLE more by placing them in the blue recycling bins. Remember to dispose of e-waste at the right places.

This is the second in a four-part series on sustainability. Learn about good water saving habits in the next issue!

Nurturing money minds: Build the next gen’s financial literacy now

Over 70 of our employees and financial representatives engaged close to 930 secondary students from three secondary schools - Bukit Panjang Government High School, Evergreen Secondary School and Raffles Girls’ School - to raise their financial literacy as part of Great Eastern’s community outreach efforts in 2022.

Through a series of workshops in partnership with Junior Achievement Singapore, our volunteers imparted basic financial planning skills to the students for them to better manage budgets and cash flow as well as prompted them to think about possible career choices and goals.

Here’s what our enthusiastic volunteers enjoyed best about the teaching experience:

“The half-day workshop provided me with a new perspective of how the younger generations view their careers and goals (which was very different from my time!). hopefully they have picked up some useful financial knowledge and apply them in their lives!”

Li Kai Yuen, Group Finance

“It was a fun sharing session. Not only did the students learn about important concepts of financial planning in an interactive manner, we also learnt from their aspirations. Together with financial representatives in the same group - Serene Tan and Nora Bamadhaj, we shared our working experience and why we volunteered our time to conduct it – all in the spirit of educating our future generation. A great experience for us indeed!”

Francis Seo, RAFABA

“It was a great experience to be able to connect, share and guide the students. The opportunity to instil financial concepts into the minds of our future generation is a valuable one. We hope they enjoyed the learning as much as we enjoyed the sharing.”

Nora Bamadhaj, Financial Representative

We thank all volunteers for stepping up and there will be more such volunteering opportunities in 2023. Let’s keep contributing to a greater good and help others to #ReachforGreat!

Greening the region one tree at a time

While Singapore’s Great Eastern Financial Advisors are supporting NParks’s OneMillionTrees movement, our fellow Brunei counterparts also participated in tree planting initiatives. 20 GELB corporate staff and financial representatives worked with non-profit organisation GREEN BRUNEI to plant 100 saplings at Sungai Penyatang on 8 December 2022.