This e-publication is for internal sharing only and is not to be distributed outside of the company.

March 2022

Click below to read more.

People

» Real Talk with Patrick Kok, Managing Director of Group Operations

» New Year, New Possibilities

» Going Beyond 2.0 to Break New Records

» Getting Strong Together

» Supporting Financial Fitness among Indonesian Consumers

» Raising Funds for Underprivileged Children

» Exploring Possibilities with The Apprentice: Great Eastern Challenge

Business & Customers

» Actionable Consumer Insights – Delivering the Value Consumers Value

» Going Green the Digital Way

» DIGI FUN DAY: Putting the Fun in Digital!

» Launch of i-Great Heritage Assurance

» Launch of i-Great Inspirasi

» Awards from Around the Region

Read & Win

» Read & Win: December Issue Quiz Winners & New Quiz

Click here for past TGT issues.

Real Talk with Patrick Kok, Managing Director of Group Operations

1. Please share about your role as MD of Group Operations and what your team oversees.

My role is to lead the Customer Service, Underwriting and Claims departments across the Group, with a strong focus on delivering customer service excellence.

My team and I establish operation standards in accordance with the company’s governance and compliance policies, to achieve growth and operational efficiencies. We drive process and service improvement while ensuring that we build a customer-centric culture across all entities.

As Group Operations, we expect ourselves to adapt quickly and harness technology to meet operational challenges in a fast-moving digital environment.

We aim to provide market-leading one-stop service for our customers’ needs through policy administration, transaction processing, new business underwriting, customer service and claims management.

2. How has operations and customer service changed over the years, and how can we keep customer-centricity at the heart of our business?

Customer service has evolved from the early days of call centre where the phone was the only communication channel to the omni-channel world of today, where customers can contact us via the phone, live chat, email and social media.

With instant communication such as email, Twitter, Facebook, Instagram at their hands, a singularly bad experience can be shared easily with the masses.

Today’s customer expects a high quality of customer service on a 24/7 basis, via channels that is most convenient to them. In a world where an answer to almost anything is just a click away, customer patience is extremely limited.

That’s why we need to put our customers first and at the heart of everything we do. For all businesses across all industries, this becomes an important element in our business today.

Here, customer-centricity is at the heart of our business. We have made good progress with our customer-centric strategy and investment in new technology to improve customer experience, and will continue to transform to meet the needs and expectations of our customers.

3. What are some of the new initiatives that the team has introduced/ implemented to support our customers?

On the Operations side, since the start of the year, we have realigned the Touchpoints team into an Omni-channel platform for our customers on four key channels - calls, live chat, emails and walk-ins. We are focusing on a one-touch customer satisfaction for all resolutions of incoming customer interactions.

In underwriting and claims, we are continually reviewing processes to make it simple for customers to do business with us. Last year, we implemented predictive underwriting i.e. leveraging on data analytics that enabled us to achieve straight-through processing for more than 60% of life, CI and TPD applications and shortening the overall turnaround time from a few days to instantaneous approval for these applications. In addition, we have also introduced the Claims hotline for our customers who need to reach us urgently for such matters.

4. What do you think are the opportunities for an insurer like Great Eastern in the area of customer service?

Insurance is a people business.

In today’s age of digitalisation, customer service continues to be an important bridge between the customer and the insurer. The support that we offer to our customers in their journey with us - from their product purchase, to the care and empathy at the ‘Moment of Truth’ when the customer makes a claim, will be the key differentiating factor that separates Great Eastern from our competitors. Our customer service can become the ‘springboard’ that grows the customers’ loyalty with us.

Customer service is also about minimising friction so that a customer’s interactions with Great Eastern continues to bring great customer satisfaction, and even better, customer delight.

5. In your opinion, what makes a good leader / or what is your mantra you practice as a leader?

In my view, integrity, accountability, empathy, intellectual honesty, humility, resilience, vision, influence and positivity – are all essentials in a good leader.

To share a quote from Steve Job:

A good Manager can persuade people to do things they do not want to do, while a good leader can inspire people to do things they never thought they could.

6. What inspires you, and how would you like to inspire others?

Belief. And I don’t just mean religion although that’s part of it. The belief that I am talking about is the ability to have faith in oneself when times are hard. Keeping the confidence that things will be fine even when it doesn’t seem so. This continues to inspire me.

People are inspired by many different things and there are so many inspirations in this world. Instead of asking me how I would like to inspire others, I think it is more crucial that you know what inspires you and keeps you going on in life. It can be ambition, adventures, friends, family, and a whole lot more.

7. What is the one thing you would like employees to know about the business of Customer Service?

People often forget that in the words of ‘Customer Service’, the word customer comes first and with service comes empathy and care.

Don’t let high-tech replace high-touch completely. Our customers will appreciate both.

New Year, New Possibilities

To welcome employees back to the office, Human Capital worked their magic across the various offices in Singapore to usher in the New Year with a celebratory vibe. Employees based at GE Centre and GE Changi also received a pleasant surprise – a delectable snack bar installed at every floor! In addition, senior management presented a bar of Royce chocolate to each staff as a token of appreciation.

The celebrations continued with the arrival of Chinese New Year in February. In the annual CNY walkabout, Group CEO and the management team distributed oranges and greetings to employees at the various offices.

To the delight of employees, a CNY Lucky Draw was also introduced and 65 individuals walked away with prizes of up to $888. About 1,000 employees participated in the hybrid event, which brought much cheer and excitement across the offices.

To top off the celebrations, all permanent employees received a Sennheiser headset and a healthy box of snacks to equip and fuel them for an exciting year of success ahead as we Move Together as One!

Keeping the Focus

Our first Staff Townhall of the year was organised on 22 February 2022, in the form of a hybrid session held onsite at CFE and online. Everyone was raring to go, if attendance was anything to go by, with over 950 staff attending this GREAT kick-off - our highest attendance to date.

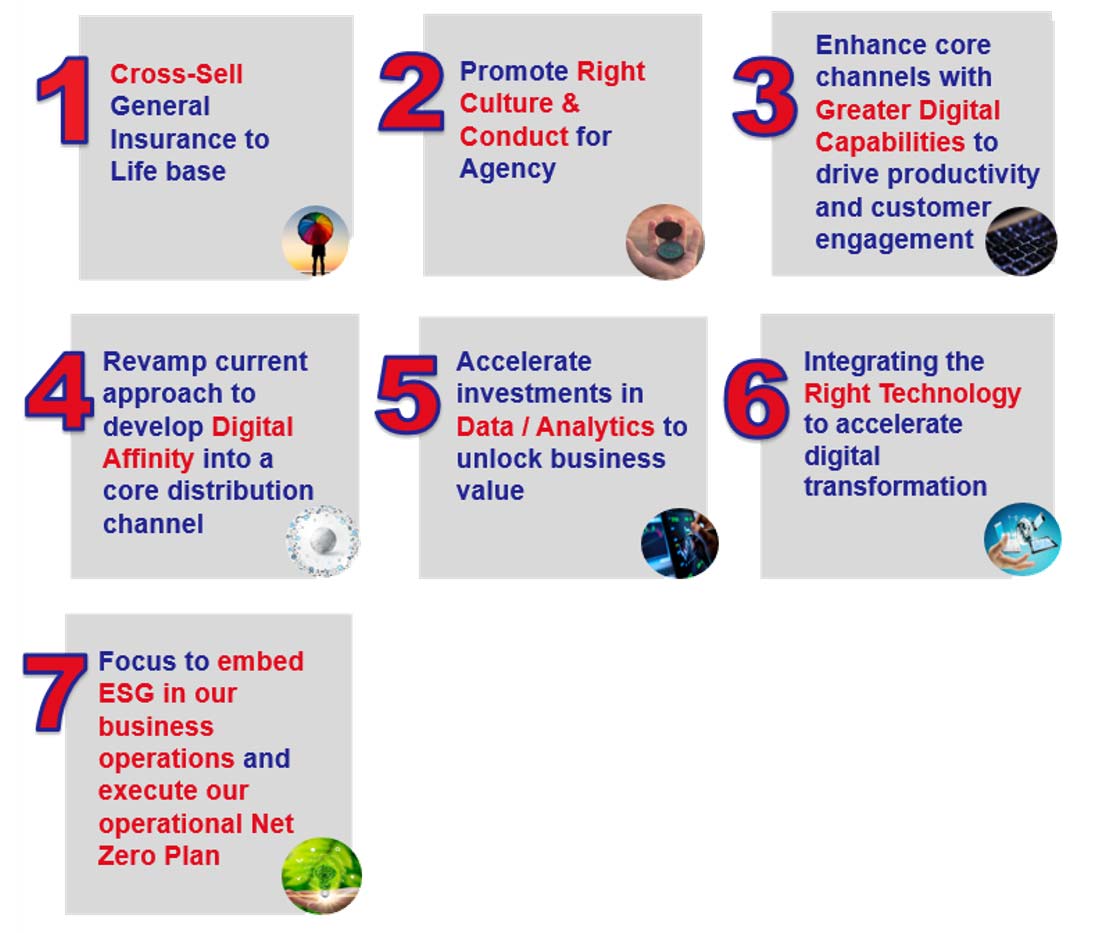

Group CEO Khor Hock Seng kicked off the session with a recap of the FY2021 financial results, where the company turned in a solid performance as a Group and we maintained our leadership position. He rallied one and all around the need to keep up the momentum to stay in the lead. Moving into 2022, he talked about seven focus areas to continue our growth trajectory.

Colin Chan, MD of Group Marketing (GM), shared how GM will continue to support the organisation to maintain its leadership position across the region by focusing on the below key focus areas and pointed to how customers drive our growth.

To better understand what customers are looking for, the team has embarked on a brand refresh project, with the new brand message: Great Eastern helps customers achieve their aspirations by providing protection and financial freedom through a delightful experience with us.

He also shared that the company would focus on aligning the marketing strategy across the Group to reach key segments effectively. From the point of view of product and solutions, customer-focused propositions would be the way to go to support our agency force in reaching out to key customer segments, supported by digital marketing to engage consumers anytime, anywhere.

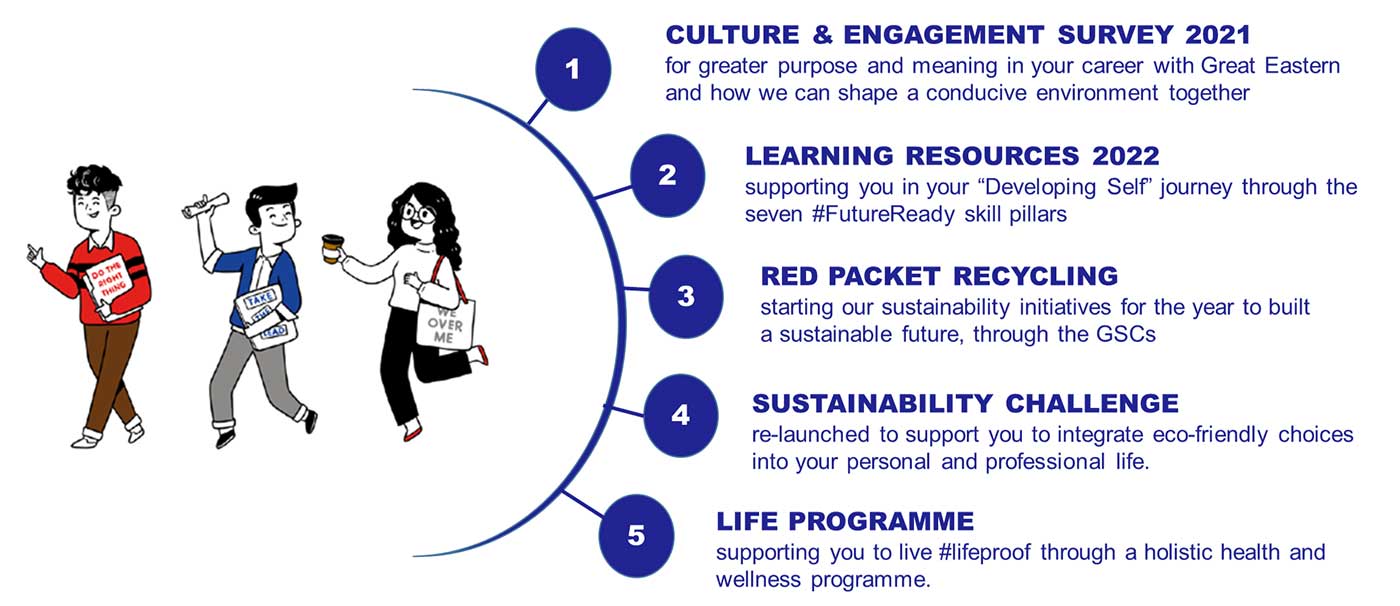

James Lee, MD of Group Human Capital, wrapped up the first staff Townhall of the year by reiterating how Culture and the Generic Skills and Competencies will be pivotal in enabling us all to develop an effective workstyle for a productive and conducive workplace.

James shared how results of the Culture & Engagement survey completed in 2021 would be shared with divisions for action in the new months, so that all can get onboard with how best to support employees in their career with Great Eastern for a win-win!

James also invited employees to learn more about 2022’s learning offerings here. Our #FutureReady Framework has a suite of learning programmes to help employees to be future-ready by building up their technical competencies and generic competencies which equips them to be a productive and effective team player in their teams and for the good of the organisation.

Going Green with Red Packet Recycling

Employees were encouraged to start the year right by developing a “green” way of life. A little goes a long way but together, we can make an impactful contribution to a low-carbon economy.

Following the CNY festivities, employees in Singapore and Malaysia were encouraged to recycle their used red packets in February. The total amount of red packets collected was 491 kg for both Singapore and Malaysia.

In Singapore, the top three divisions with the highest contribution per headcount also received a department welfare fund of up to $1,000. Congratulations to Group Human Capital, Group Legal and Secretariat and Group Marketing! Employees are also encouraged to participate in the next initiative on our sustainability journey, to integrate eco-friendly choices into their personal and professional life while taking care of their health and wellness – learn more about the Sustainability Challenge and the LIFE Programme!

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Going Beyond 2.0 to Break New Records

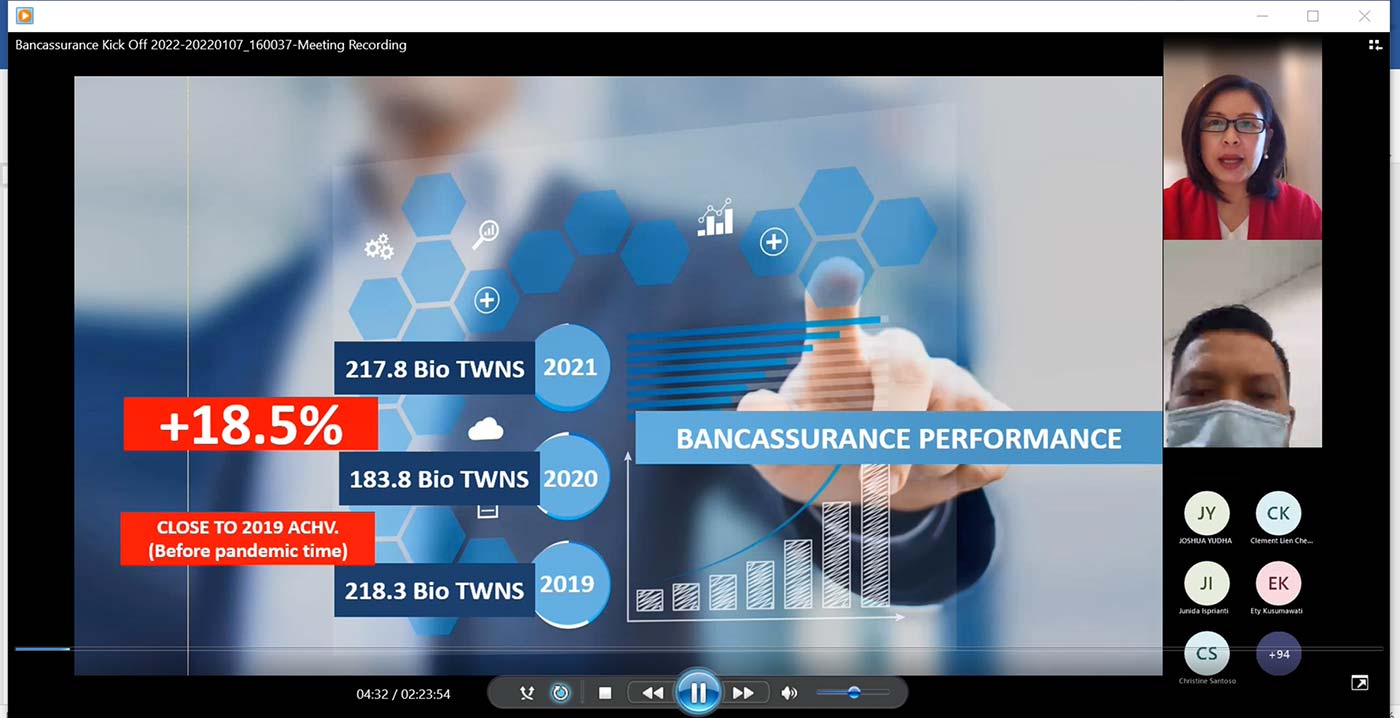

Starting the new year of 2022, Great Eastern Life Indonesia (GELI) held its Kick-Off Meeting for the bancassurance team on 7 January with the theme “BEYOND 2.0 (BrEak Your OwN recorD) through Digital Acceleration”.

President Director Clement Lien celebrated the hard work of the teams and their contribution to our strong performance in 2021 and encouraged all to stay focused on how we can serve our customers more effectively and efficiently.

Nina Ong, Director of Bancassurance, followed with the business update. TWNS grew 18.5% from the previous year, almost at 2019 level before the pandemic. A robust strategy and strong collaboration with bank sellers contributed to this achievement, she said.

In 2022, GELI will continue to support its distribution channels by offering relevant new products, improving new business and underwriting process for easier implementation, rolling out O2O (online to offline) marketing initiatives, providing digital support and training and development for its financial Advisors.

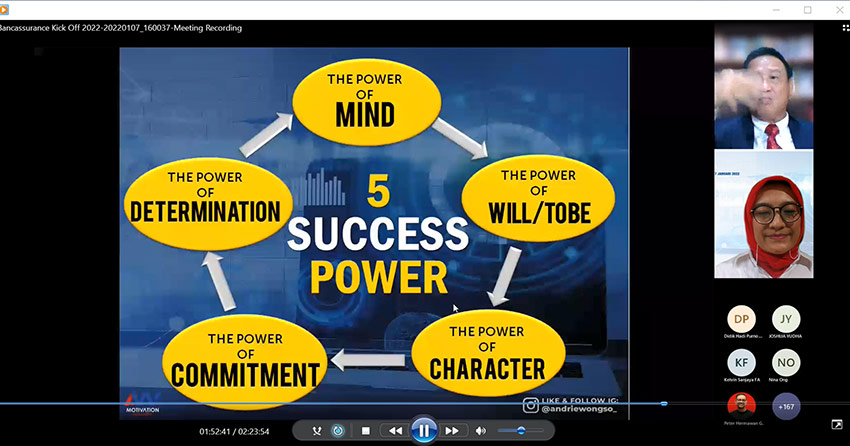

The session continued with a recognition segment that achieved the highest TWNS and active seller, updates from Head of Marketing Roy Hendrata and Head of CFE Peter Hermawan, and an insightful sharing by motivational speaker Andrie Wongso on the five powers of success - the power of mind, will, character, commitment and determination.

Getting Strong Together

Great Eastern General Insurance Indonesia (GEGI) held its virtual Agency Kickoff on 26 January 2022 to share the 2022 company strategies, challenges ahead and overall updates for the new year. Themed “Recover Together and Get Stronger”, over 200 participants across Indonesia attended the session, making it the largest virtual event GEGI has organised.

President Director Aziz Adam Sattar expressed his pride and gratitude to all agents for their contribution to the company in 2021. In the midst of a difficult economic recovery period impacted by Covid-19, the company was able to achieve excellent results for 2021. Premiums grew by 22.2% from the previous year to Rp. 435 billion, with a profit of Rp. 36 Billion.

Cong Chun Ling, Marketing Director, presented the company performance in 2021 and how we can improve our communications and service in 2022 to all business partners, while Finance Director Andy Soen updated on the company’s strong financial performance. Despite the challenges posed by the pandemic, GEGI achieved tremendous growth and the agency business remains one of the main pillars of the company. Lee Pooi Hor, Operations Director, presented the system and IT updates & support and new projects going forward.

To continue the strong momentum in 2022, the company will continue to focus on affinity development and digital sales, expand its list of banking partners, strengthen communication with business partners and provide continuous training and development for agents on both product knowledge and soft skills.

Following an interactive Q&A session with agents, guest speaker Ahmad Enver, Economic Analysist of Bank OCBC NISP, shared his insights and optimistic economic outlook for 2022, to strengthen our agents’ confidence to face any challenges and opportunities in the year ahead.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Supporting Financial Fitness among Indonesian Consumers

Great Eastern supported Bank OCBC NISP through its Financial Fitness Festival to promote the importance of financial planning to consumers. The event was held from December 2021 till February 2022 with a series of activities organised both online and offline at the Ciputra World Surabaya Mall, with both Great Eastern Life Indonesia (GELI) and Great Eastern General Insurance Indonesia (GEGI) participating in the festival.

GELI organised 5 classes and a half day workshop, with over 213 participants attending in total, covering topics such as Financial Check-Up, New Year, New Financial Resolution, Sharia Insurance, and How to Choose Proper Health Insurance. GEGI also collaborated with OCBC to introduce general insurance and our products to 64 participants through 2 classes.

Working with OCBC NISP, we raised Great Eastern’s visibility and awareness among consumers as an insurance company always ready to protect Indonesians with solutions for all their protection and financial needs.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Raising Funds for Underprivileged Children

To support the needy and vulnerable impacted by Covid-19 in Malaysia, Great Eastern Life Malaysia (GELM) organised “Pledge Now, Pay Later” in 2021, a fundraising activity where donors could pledge the amount they would like to donate and make the payment later. This was in view of the fact that the country was still under multiple movement control orders (MCO) and many colleagues were working from home. In total, RM6,500 was raised through the fundraising campaign.

With the funds raised from this campaign and through other fundraising efforts, GELM donated shopping vouchers worth RM37,500 to 15 Jabatan Kebajikan Masyarakat (JKM) children homes during the festive season to bring cheer to the children. In addition, it also contributed RM21,480 to six JKM children homes to ease their financial burden and support their operations during this challenging time.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

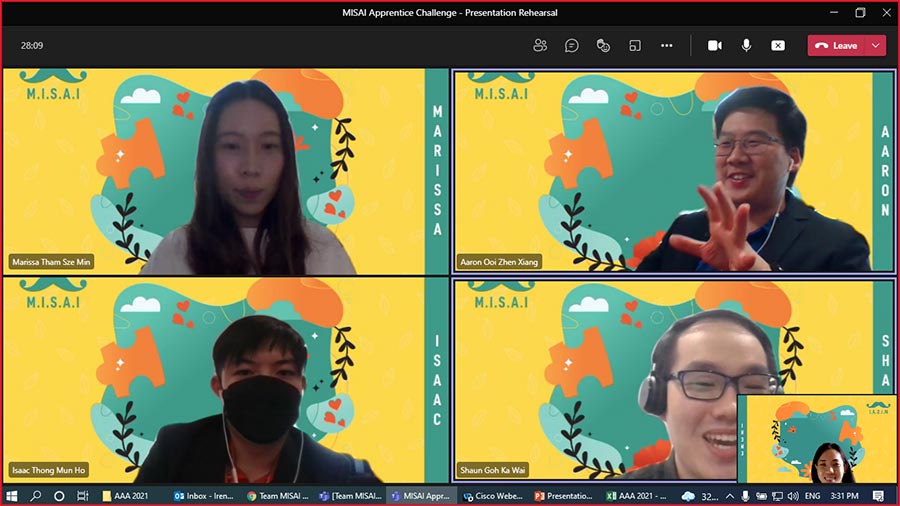

Exploring Possibilities with The Apprentice: Great Eastern Challenge

As part of the #MyGreatCulture Programme organised by the Culture Crew of GELM’s Human Capital, employees were given the opportunity to table their ideas on building a more sustainable Great Eastern through The Apprentice: Great Eastern Challenge.

Aligned to the SDGs Climate Action and Good Health and Well-being, participating teams embarked on an exciting and insightful journey to bring changes that can create a more sustainable Great Eastern. Within their teams, they brainstormed, presented their ideas to leaders, and even ran a pilot run with several chosen departments to validate their ideas, focusing on solutions that tackled either environmental sustainability or people sustainability.

The finalist teams were Team M.I.S.A.I., whose project revolved around mental health awareness at the workplace; Team Digital Transformation, who looked at electric utilisation in Menara Great Eastern, specifically on reducing the use of centralised air conditioning; and finally Team The Green Print, who focused on the crucial issue of food waste and creating awareness on urban farming.

Winners of the challenge were announced during the virtual Annual Appreciation Awards 2022, with winning teams taking away cash prizes to commemorate their extra efforts. Check out the photos of their pilot run and here’s what the teams have to say on their experience in participating in the challenge!

“The experience was inspiring and brought us together as a team working towards a common goal. Our mentor was very supportive throughout our journey and provided many improvement points for us to grow as a team.” – Team Digital Transformation

“The overall experience of the challenge has been fulfilling and eye-opening. Working together to organise a Mental Wellness Week for CFE department has been fun and it has been rewarding to bring something heartfelt and useful for everyone. It was a good learning experience for starting a business or initiative. It widened our perspective of what could be done for sustainability at the workplace.” – Team M.I.S.A.I.

“As our team members are all from the same department, it was easier to coordinate our time for discussions and we all understand each other well to know how best to function as a team. We nevertheless were still pleasantly surprised to discover many hidden talents and new ideas which would not have surfaced during our day-to-day work interactions. Overall, it was an enjoyable and impactful experience!” – Team The Green Print

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Actionable Consumer Insights – Delivering the Value Consumers Value

Understanding consumer value is critical in today’s rapidly changing world. Whether it is in how a new product is developed and positioned, or when a company comes under attack for mishandling a crisis, consumers are constantly rethinking the brands they feel comfortable and safe with.

Consumers are increasingly evaluating the value companies bring beyond the provision of goods and services. This value can be monetary, functional, social, environmental, or even, psychological. For instance, consumers these days want to be associated with brands that adhere to ethical and sustainable practices. Knowing what consumers value can help companies gain marketplace advantages over their competitors.

Occasionally, a values mismatch can occur between what an organisation thinks its customers value, and what its customers truly value. One example is the SGFinDex platform which has since seen low user adoption after its launch. The idea behind SGFinDex is a good one, but why has it not lived up to expectations? Why don’t consumers see the value in having an integrated platform for all their banking information? Should we simply frame this as an issue of publicity and awareness or could it be something deeper around the concerns of data and upselling fears? Would insurance data, when uploaded at the end of 2022, be the real value that Singaporeans want, even as they have concerns over sharing their banking information?

An example closer to home would be our SP products – customers could have continued to grow their money by opting for “maturity rollover”, but why have a significant number of them preferred not to? Actionable Consumer Insights (ACI) Lab worked closely with Group Marketing to uncover the answers to these questions through our consumer research which was completed recently.

By understanding what customers really value, it may be possible to make decision-making easier for them. What goes on in the minds of Critical Illness Plan customers when they have to make a decision between the 3 CI and 50+CI plans? If many can see the value of getting coverage for the top “3” critical illnesses, would they pay more for another “47”? What enables the shift of value from “core protection” to “value for money”? Through speaking with several consumers at an intimate level of interviews, ACI Lab and Group Marketing found that it is possible to “guide” consumers on this value continuum. Value can migrate because consumers do not have a single frame on where value should sit.

The ACI Lab explores the complex topic of consumer value in its latest issue of From the Ground – read more here!

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Going Green the Digital Way

Over the last 12 months, our Takaful operations have gone through a digital transformation. Prior to Covid-19, paper or hard copies of documents were an integral part of our operational processes - service request forms, claim documents and letters were all in printed copies.

Perhaps the one silver lining of COVID-19 was that it reduced the dependence on hard paper copies and documentation, as the business had to pivot quickly to remote advisory and support our customers through digital means. This led to new customer-centric initiatives that also support the environment. Below are the key highlights:

- Front-End Scanning was swiftly implemented within 4 months in 2021. With cases being scanned upfront, operations teams were able to retrieve the images immediately for processing, instead of relying solely on hardcopy documents. This helped to minimise disruption to business process.

- In our continuous move towards a paperless environment, majority of our customer letters were migrated into i-Get In Touch (iGIT) in 2021. iGIT is our newly-developed one-stop self-service portal that enables customers to view details of their takaful coverage, download letters, and submit online transactions including changing personal details, updating their nomination, changing payment mode/method and contribution. Simply put, customers are now able to access their portfolio, electronically and securely, anytime, anywhere.

- The Digital Transformation Team collaborated with the Operations Team to implement Robotic Process Automation (RPA) initiatives to reduce processing time and the dependency on onsite staff to physically process policy servicing requests. An example would be updating close to 40,000 customer information in the core system - this took only 9 weeks with the bot as oppose to 38 weeks if done manually! These improvements have really gone a long way in enabling the company to reallocate resources efficiently, deploying valuable headcount to focus and deliver on higher level functions.

We continued the digital momentum with the launch of EZ Form to accelerate the growth of our corporate Takaful business. In the past, group Takaful agents would conduct face-to-face roadshows and collect hardcopy proposal forms. The pandemic put a stop to this and posed a challenge for the business.

With EZ Form, agents can now conduct virtual roadshows and at the end of the sessions, customers are able to submit their applications by scanning the QR code and completing the digital form in less than 10 minutes! Once the applications are accepted, customers can access their certificate electronically via iGIT – providing a truly seamless digital experience.

Kudos to the GETB team for kick-starting their digital journey in 2021 and making things better for our customers and the environment at the same time. We can look forward to more exciting initiatives in 2022, such as its very first chatbot! Stay tuned for more updates!

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

DIGI FUN DAY: Putting the Fun in Digital!

Great Eastern Life Indonesia (GELI) held its first DIGI FUN DAY at the start of the year. A collaboration between CX, Marketing, and Human Capital, the event was organised to created greater digital awareness among employees and to help them embrace technology as an important tool to serve our customers better. A great customer experience starts with the employee, thus it is important to have both the right customer-centric mindset and the technology to provide a good customer experience.

The event was conducted over 2 batches - Batch 1 was held on 11 and 18 January, with Batch 2 a month later on 15 and 22 February. The internal staff speakers shared knowledge and experiences from their respective roles and departments. On the first day, President Director Clement Lien emphasized the three pillars to achieve the company goals in 2022-2023 – A Customer-Centric Mindset, Digital Mindset, and Problem Solving.

Speakers for Batch 1 included Alfi Yani (Head of Customer Experience and Digital Services) who shared on why we should place our customers first and that it should start from the employees, and Guntur Parikesit (Head of Customer Digital) who explained how FOMO (Fear Of Missing Out) is driving people to be more digital-savvy and provides us with the opportunity to reach out to new customers through digital services.

For the February sessions, Saldy (Head of IT Digital Transformation) explained how technology can bridge the gap between generations and Antonius Rudy Nurdjaya (Head of Human Capital) spoke on the importance of education and training in adapting to new technologies. Human Capital will continue to provide training and development to reskill/upskill our employee so they can embrace these changes and opportunities.

Participants also enjoyed the talk show sessions where the speakers discussed relevant topics such as the benefits of the Great Eastern Corporate App and how it has provided customers with greater convenience and transparency, the differences in the usage of application across customer segments, and the increase in customer expectation with modern technology and how we can work together to understand and meet their needs.

Through this event that was both informative and fun, GELI employees were motivated to develop a more customer-centric and digital mindset in their daily work and to build a strong culture based on these values.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Launch of i-Great Heritage Assurance

Great Eastern Life Indonesia (GELI) recently launched i-Great Heritage Assurance on 11 January, its first Sharia personal insurance product with Bank OCBC NISP.

With the largest Muslim population in a country, the product was developed to support Indonesians in financial planning according to Sharia principles. Data from AASI (Association Insurance Syariah Indonesia) also showed the significant potential as the industry recorded a gross contribution of Rp.16.89 trillion as of September 2021.

Held through Zoom with invited media partners, the launch event was opened by Mr Umar Alhaddad M.Ag (Member of Great Eastern Life Indonesia Sharia Supervisory Board). In the talk show segment led by Fauzi Arfan (Director from GELI), Mahendra Koesumawadhana (Head of Unit Usaha Syariah, OCBC NISP), and guest speaker Nadya Harsya (Certified Financial Planner), they highlighted the key features and advantages of i-Great Heritage Assurance. The plan offers life protection up to the age of 99 with one simple payment contribution, insurance benefits of up to 48 times the paid contribution, and the opportunity to support charities through the Waqf feature of up to 45% of the insurance benefits.

The event continued with a ceremonial act of passing the bidara plants from Fauzi to Mahendra as a Waqf symbol that the benefits will continues to flow from generation to generation. To reinforce the charity component of sharia insurance products in helping others, Director Nina Ong presented a donation to Daarul Rahman Foundation, received by Saiful Habib as head of the foundation and the children of the orphanage.

For more details, please see below:

Press Release: https://www.greateasternlife.com/id/in/tentang-kami/pusat-media/siaran-pers-terbaru/11012022/launching-igha.html

Event recording: https://www.youtube.com/watch?v=E3q8N8e4m9w&t=209s

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Launch of i-Great Inspirasi

Great Eastern Takaful (GETB) launched i-Great Inspirasi on 21 February 2022, a unique and affordable plan that provides protection against selected infectious disease and critical illness with hospitalisation benefit and four times the coverage for accidental death.

Check out its key features below:

- Coverage of up to RM200,000 with RM0.60 daily*

- A lump sum payment of RM5,000 if you are diagnosed with any of the 4 listed Infectious Diseases - Dengue Haemorrhagic Fever, Malaria, Yellow Fever, and MERS-COV

- An additional 100% of your basic sum covered if death occurred due to mosquito-borne disease

- Daily income benefit of RM50 a day for a maximum 30 days per certificate year in the event of hospitalisation due to illness or injury caused by an accident. No limit per lifetime.

- 50% of your basic sum covered will be payable in the event of any of these 5 Critical Illnesses - Cancer, Heart Attack, Coronary, Stroke and Kidney failure

- Free consultation with doctors from anywhere and at your convenience via chat, phone or video call under our Outpatient Teleconsultation Services benefit

The enrolment is also hassle-free as you do not need to go through any medical check-up. This plan is suitable for those who are looking for an affordable yet essential health and accidental coverage. It can also be a top-up plan to further enhance your existing coverage.

In addition, the Takaful benefit provides you with lump sum payment starting at RM50,000 to RM200,000 for immediate financial assistance to your loved ones in the event of death. By nominating your loved ones as beneficiaries (under the concept of conditional Hibah in Takaful) they will immediately receive the Takaful benefit upon your demise. All you need to do is fill up the nomination form and remember to review and update it as and when needed.

Click here for more details on i-Great Inspirasi.

*Terms and conditions apply

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Awards from Around the Region

Indonesia

- Media Asuransi Award 2021

Great Eastern General Insurance Indonesia received the 2021 Insurance Award by Media Asuransi magazine for the Best General Insurance with Equity Rp 500 billion – Rp 1.5 trillion category. The achievement is testament to the resilience and growth of the company and made possible through the teamwork of the entire GEGI team, agents and business partners.

- Indonesia Excellence GCG Award 2022

Great Eastern Life Indonesia won the Indonesia Excellence GCG Award 2022 for Excellence in Good Corporate Governance Implementation on Expanding Insurance Product and Services Integration in the Life Insurance category by Warta Ekonomi. This award is presented to companies that implemented good corporate governance so that they can increase their business growth, especially during the Covid-19 pandemic.

- The Best IT Award 2022 from Economic Review

Great Eastern Life Indonesia has been awarded The Best IT Award 2022 for Private Company, Life Insurance category from Economic Review. This award is given to companies that have succeeded in building a strategic plan for developing Information Technology well in order to meet the needs of customers.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Read & Win: December Issue Quiz Winners & New Quiz

A big “Thank You” to all readers who took part in the last issue’s quiz.

Congratulations to the following winners with the correct answers! You have won 2,000 GREAT Dollars (worth S$20)!

- Raymond Choo Ming Hui

- Teo Jing Ming

- Tee Wee Lun

- Koh Jing Hiang

- Lim Kim Gek

- Linda Chew Wai Ying

- Joeven Zhuo Honghua

- Louis Giam Sing Kai

- Samantha Halim

- Rachel Chua Xinjie

The points will be credited into your Great Eastern Rewards account in April 2022. Keep a lookout for them!

And now for the next quiz. Answer all the three questions below correctly and stand to win 2,000 GREAT Dollars (worth S$20)! Ten lucky winners with the correct answers will be picked.

1. What is the total amount of red packets collected by employees in Singapore and Malaysia through the red packet recycling?

2. What was the name of the fundraising campaign organised by GELM where donors could pledge the amount they would like to donate and make the payment later?

3. Which award did GELI receive from Economic Review?

Send your entries to tgt-sg@greateasternlife.com by 29 April 2022. Open to GELS staff only. Winners will be announced in the next TGT issue in June.