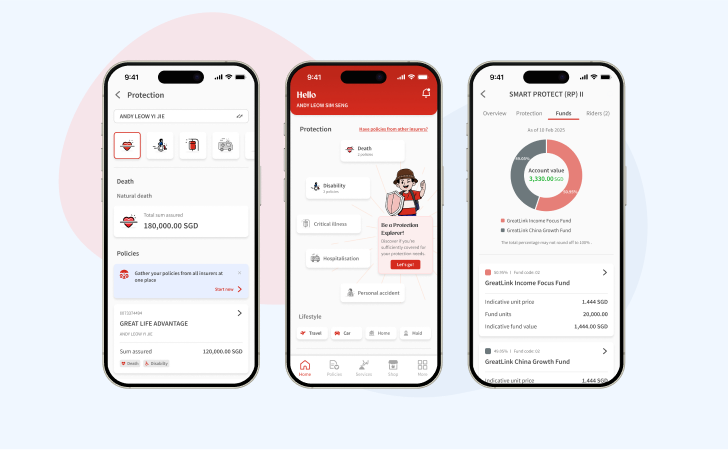

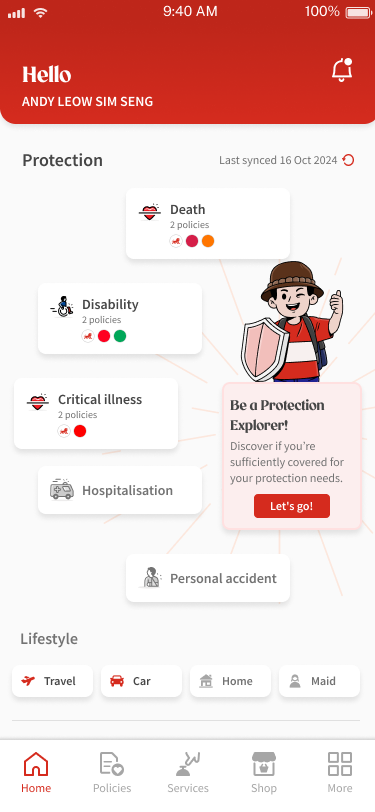

Great Eastern App

Manage your insurance plans in a snap

Access these features on the go

Reach for Great protection for your future with the Great Eastern App

Whether it’s staying protected from the unexpected or keeping track of your wealth — get the information you need on the Great Eastern App.

Make the best use of Great Eastern App to assess your protection needs

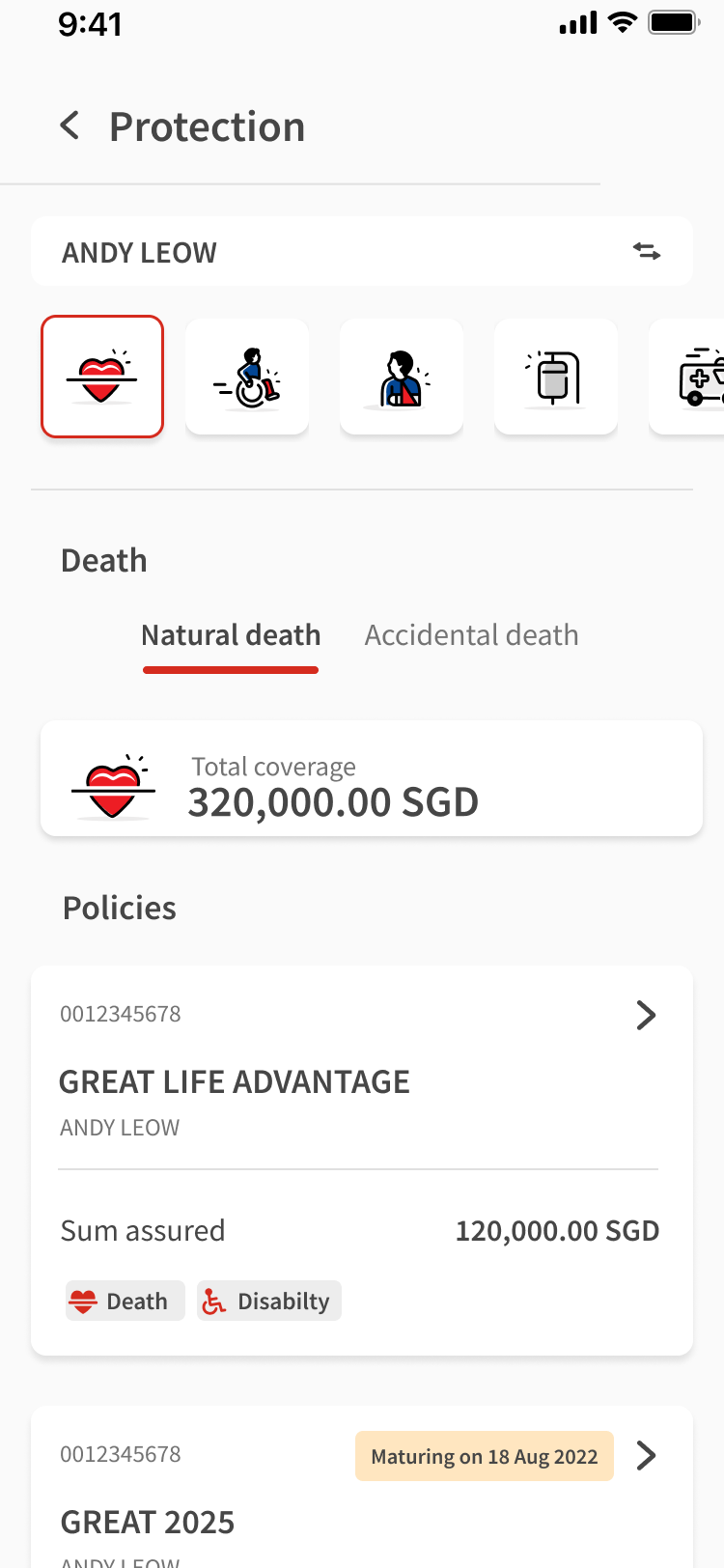

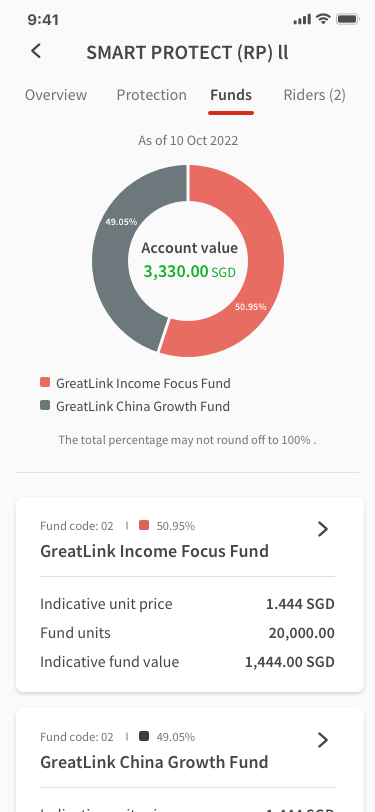

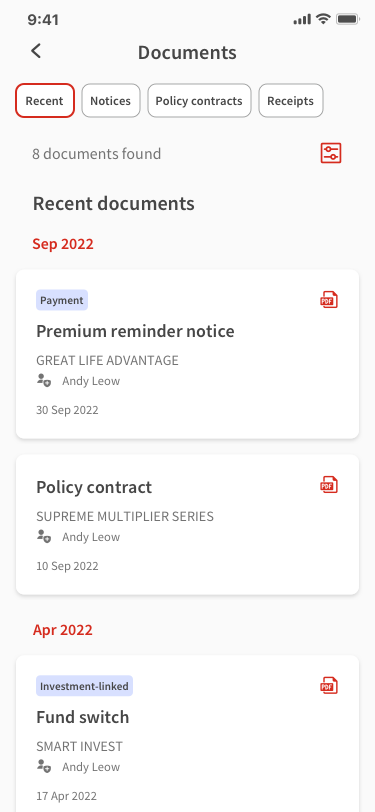

A one-stop policy management app

Gain access to all your Great Eastern policy details and common policy services all in one app.

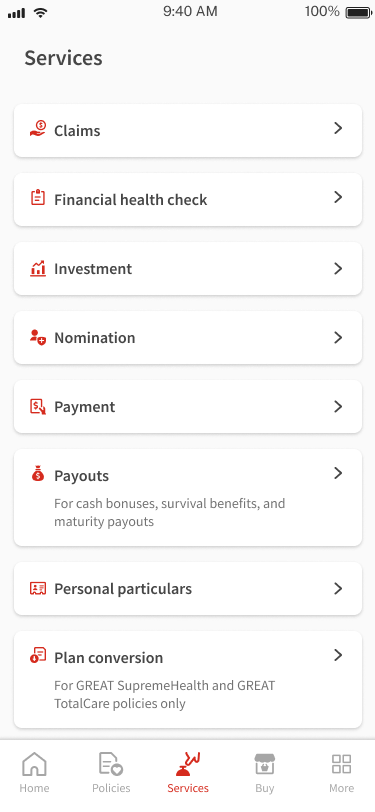

Make changes on the go

Update personal particulars, switch funds and more using the self-service features.

Secure and convenient

Conveniently access this app and all Great Eastern digital platforms using Great ID, our single sign-in identity.