This e-publication is for internal sharing only and is not to be distributed outside of the company.

October 2022

Click below to read more.

Hear from Our Leaders

» Message from Patrick Peck

Highlights of the Quarter

» GREAT Critical Cover Series

» Great Eastern Cares – Helping cancer survivors #ReachforGreat in their rehab journey through Singapore Cancer Society

» Reach for Great with Great Eastern

Must-Knows

» Q4 Sales Challenge

Good-To-Knows

» MRO Champions League II

» GEFA Career Seminar: #GreatSuccess

» Sandwich generation: How can you effectively allocate your resources to buffer against the “What Ifs”

» Q4 2022 Market Outlook – A Summary from Products & Propositions (Funds)

» Not just 1, but 2! Great Eastern wins big at 7th Insurance Asia Awards 2022

» Sustainable living is a way of life

» Take charge and EMPOWER your future now!

» Welcome to our #GreatEastern family!

» The Doctors are in the House

From Good to Great

» Tree Planting by Great Eastern Financial Advisers (GEFA)

Click here for past TGC issues.

Message from Patrick Peck

Dear Leaders and Representatives,

The year is coming to a close and there’s no better time than now to rev up our engines for the final burst as we enter the final quarter of 2022!

It is undeniable that the market has grown more challenging over the course of the year due to the unstable macroeconomic environment and persistent inflationary pressures, but always remember that we are GREATER as one. This year, we have in our arsenal, many competitive product propositions, exciting activities and refreshed sales tools, designed to support and help you to be the best in the market.

I believe that out of adversity, comes opportunity. I’m confident that as long as we uphold the triple ‘A’ principles of ADAPT, ADJUST and ACCOMMODATE, we will remain resilient amidst uncertainties and weather the storm together.

Lastly, let’s always keep in mind that we are much more than an

insurance provider. We are a person’s life protector and a people’s hero.

Here’s wishing you a wonderful fourth quarter ahead. Let’s all race ahead to Reach for Great, together as ONE.

GREAT Critical Cover Series

Critical illness protection is an essential element of comprehensive healthcare financial planning. Great Eastern’s latest suite of Critical Illness plans - the GREAT Critical Cover Series - gives your customers protection against critical illnesses with 100% lump sum payout upon early, intermediate or critical stage critical illness. The plans are further augmented with the option for continued coverage with the Protect Me Again rider, for up to 2 additional critical illness episodes[1] even after a CI claim is made.

From now until 31 December 2022, customers who purchase either GREAT Critical Cover: Top 3 CIs or GREAT Critical Cover: Complete will enjoy 30% off first-year premium and 10% perpetual premium discount from the 2nd policy year onwards.

Learn more about the GREAT Critical Cover here.

1 Coverage restores to 100% after 12 months from the date of diagnosis for the most recently diagnosed critical illness, for a subsequent claim of a different critical illness. Coverage restores to 100% after 24 months from the date of diagnosis of the immediately preceding applicable critical illness for recurrent critical illness. Please refer to the Product Summary for more details on the benefit terms and conditions.

Great Eastern Cares – Helping cancer survivors #ReachforGreat in their rehab journey through Singapore Cancer Society

Join us as we raise funds to support the Singapore Cancer Society’s ‘Return to Role’ rehabilitation programme from now till 31 December 2022.

We kicked off this initiative through Great Eastern Cares, in conjunction with the launch of our latest GREAT Critical Cover Series – two comprehensive plans and a Protect Me Again rider designed to provide essential critical illness coverage to our customers.

Through #GreatEasternCares, we are championing cancer awareness, supporting cancer survivors as they resume their normal roles in life and continue to #ReachforGreat.

How YOU can help the brave cancer survivors to #ReturntoRole

- Every $30 donation can help provide 3 virtual rehabilitation sessions

- Every $50 donation can help provide 1 physical rehabilitation session

- Every $100 donation can help provide 1 compression arm sleeve for cancer patients with arm swelling

- Every $200 donation can help provide weekly rehabilitation sessions for one month

Great Eastern will match a dollar-for-dollar corporate contribution and donate up to a total of S$50,000 in addition to the monies raised to support the SCS Return to Role programme.

How to donate

Simply make a donation by clicking the link here: https://www.giving.sg/campaigns/SCS_Return_to_Role_Programme

Every dollar counts when we give as a community.

Reach for Great with Great Eastern

Celebrating our 114th anniversary, we’ve created a brand new chapter with a new brand promise - a commitment to help our customers achieve their aspirations by protecting them against life’s uncertainties and empowering their financial freedom through a delightful experience. This is a winning combination that only Great Eastern can offer: Expertise + Heritage + Inspiration.

We have evolved from helping consumers live healthier and better for over 10 years, to embrace a more multi-dimensional view of enabling goals and aspirations, whatever they may be.

The new promise, “Reach for Great”, looks to recognise, celebrate, and empower ‘Great’. We believe that Great is for everyone, no matter the scale, lifestage nor demographic.

We have now a greater purpose to lead the industry and helping our customers “Reach for Great” through times of financial adversity and illness. From a payor to an insurance partner that truly understands their needs and ambitions, who is able to provide tailored advisory and solutions to enable their financial aspirations.

Catch our new brand campaign island wide via free-to-air television, digital and social media, website and out-of-home advertising.

To watch the brand film and find out more, click here: https://www.greateasternlife.com/sg/en/about-us.html

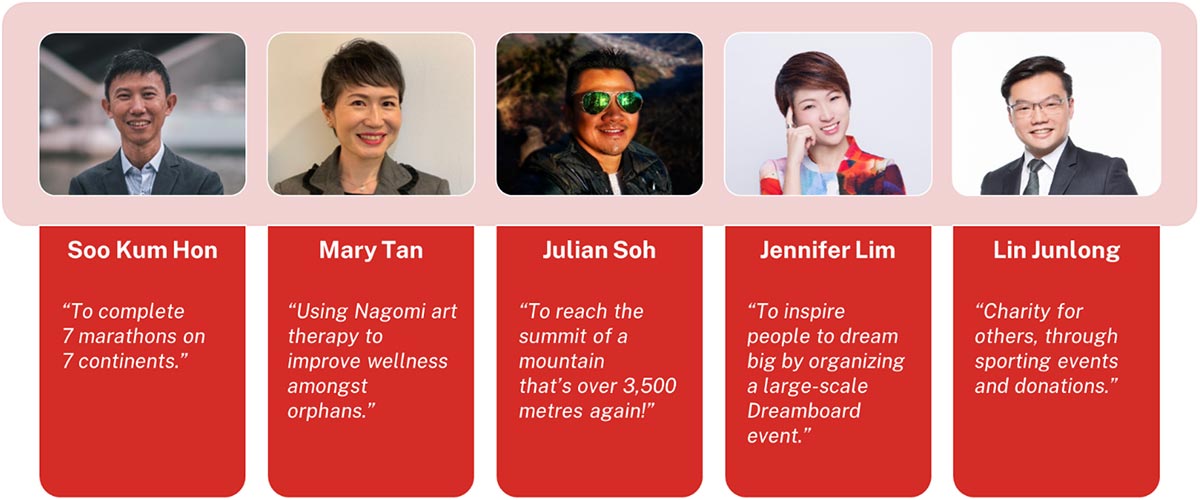

Congratulations to the following Financial Representatives/Advisers for winning the Reach for Great Contest!

Top Prize Winners ($5,000 Grant each)

Willis Lau

Lin Yekai

Consolation Prize Winners (iPad Air 256GB Wi-Fi + Cellular worth $1,319 each)

The prizes were given out during The Final Sprint by our GCEO, Mr Khor Hock Seng and MD, Group Marketing, Mr Colin Chan.

Q4 2022 Agency Sales Challenges

At the Final Sprint 2022, ABD unveiled a host of Sales Challenges to help the field force sprint to the finish line by ‘Breaking New Ground’ and achieve the $1 Billion TWNS Goal for 2022!

Q4 2022 Mega Cash Challenge

The ‘Q4 ’22 Mega Cash Challenge’ kicked off on a high note, fuelling the audience with excitement with cash incentives of up to $24,000. This challenge is in line with the 2023 Agency GELAC Convention to Zurich, where the reps could potentially earn up to $24,000 cash incentives to shop to their delight while at Zurich!

Q3 2022 Great Bali Challenge - October Extension

Additionally, to encourage our ‘Rookie’ reps (<2 years of business) to achieve the milestone of experiencing an overseas convention with Great Eastern, the Q3 ’22 Bali Challenge is extended to them, so they have an additional avenue to qualify for their first overseas Agency Great Kick Off, happening from 5th to 7th Jan ’23.

Q4 2022 October Fast Start

Having had a 2 year hiatus of hosting physical events & f2f engagements, we have planned a bespoke Fifa World Cup event to be held in Doha in November. This event is exclusive to just the top performing 150 Reps who made the cut in Oct ’22!

MRO Champions League II

To celebrate a successful year, ABD hosted a dinner for our MRO Champions at Grand Hyatt featuring Le Petit Chef -“𝑯𝒐𝒘 𝒕𝒐 𝑩𝒆𝒄𝒐𝒎𝒆 𝒕𝒉𝒆 𝑾𝒐𝒓𝒍𝒅'𝒔 𝑮𝒓𝒆𝒂𝒕𝒆𝒔𝒕 𝑪𝒉𝒆𝒇".

Following the success of the "Evening In The Wild" at Night Safari in June, we promised another unforgettable and immersive culinary experience for our truly deserving MRO Champions.

Our top 40 MRO Reps celebrated their success together with Managing Director RAFABA Patrick Peck, Head of Agency George Goh, and Head of ABD Glenn Yong and had an enjoyable time.

Let's continue to ride on the journey with Great Eastern to unfold the story of “𝑯𝒐𝒘 𝒕𝒐 𝑩𝒆𝒄𝒐𝒎𝒆 𝒕𝒉𝒆 𝑾𝒐𝒓𝒍𝒅'𝒔 𝑮𝒓𝒆𝒂𝒕𝒆𝒔𝒕 𝑨𝒅𝒗𝒊𝒔𝒆𝒓"! Check out the videos below.

GEFA Career Seminar: #GreatSuccess

Great Eastern Financial Advisers (GEFA)’s Career Seminar kicked off with an overwhelming response on 11th August 2022 @ VoltaGE, Great Eastern Centre.

In the opening address, Jesslyn Tan, GEFA CEO, shared that we should focus on our building strategies through the 3 ‘P’s of GEFA – Professional Consultants, Products and Partners. Being an exclusive Financial Advisory firm with a strong parentage under Great Eastern and a member of the OCBC Group, GEFA has a unique proposition to offer our consultants a meaningful career.

As the largest FA firm in Singapore, we focus on building our consultants’ professional competency and we are proud to share that 1 in 4 has attained MDRT in 2021. Our mission is to develop people and provide a platform for our consultants to attain great success.

Two consultants shared their career journey with GEFA.

An up and coming leader, Zhang Zheyuan, Senior Executive Manager, shared how he overcame his shyness and acquired business acumen from his mentor, through candid anecdotes of his career journey. Now, he is working towards developing a dream team to achieve Great Success together.

Senior Executive Manager, Annabel Yeo shared the turning points in her life which further strengthened her belief that financial planning is the right career choice for her. She inspired and encouraged the audience to Reach for Great with GEFA.

Rounding up the night was award-winning behavioural scientist, Nick Jarvis Tan, who specialises in maximising human performance, as well as fostering human connectedness in the workplace. Highly engaging, the audience learnt some basic facial recognition techniques to help build their career and foster meaningful social network.

The night ended with a networking and bonding session alongside free-flow of specially curated craft beer.

Build the dream, attain the skillsets, drive towards distinction and Reach for Great with GEFA.

Sandwich generation: How can you effectively allocate your resources to buffer against the “What Ifs”

If you are part of the sandwich generation, how can you effectively allocate your resources to buffer against the “What Ifs”?

Catch Mabel’s compelling interview story on MoneyFM89.3 on her financial planning tips as part of the sandwich generation, based on her own life experience and how open conversations with family about money, and insurance planned early in life could help hedge against the unforeseen such as critical illnesses.

View her interview at https://omny.fm/shows/moneyfm-midday-show/money-and-me-financial-planning-tips-for-people-in#.YzKZPvNInQA.link

Be inspired by her journey and share with your customers the importance of critical illness coverage today! Check out GREAT Critical Cover Series.

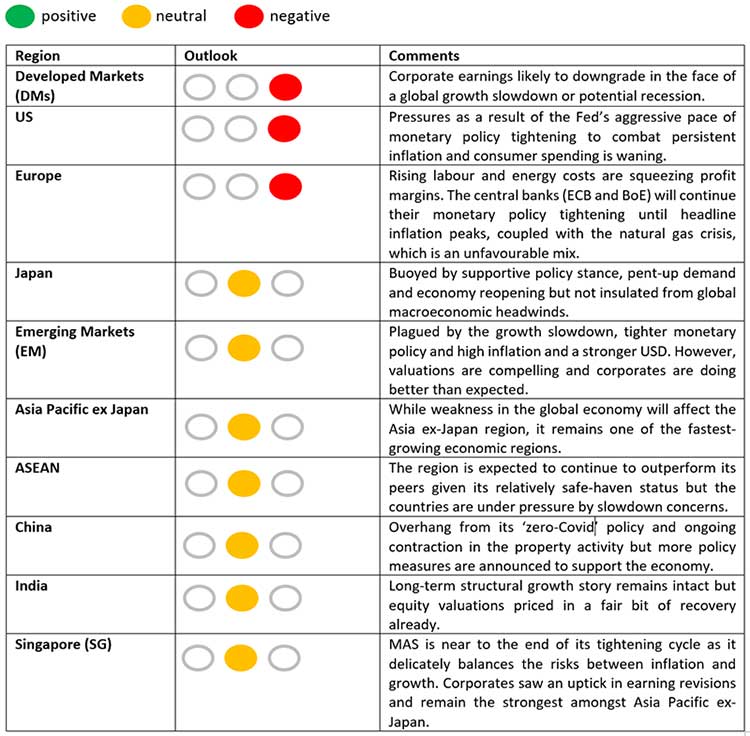

Q4 2022 Market Outlook – A Summary from Products & Propositions (Funds)

This quarter, we remain ‘underweight’ in global equities. Similarly, as a buffer against potential downsides amid higher market volatility, we downgrade Chinese and Singapore equities from ‘overweight’ to ‘neutral’. Global bond valuations have improved significantly, given the spike in bond yields and this asset class offers a good entry point for investors. However, market volatility remains due to the major central banks’ rhetoric in tightening monetary policy and combating persistent inflation.

Macro headwinds, such as elevated inflation, ongoing war in Ukraine, energy crisis in Europe, and central banks tightening their monetary policy to combat the inflationary pressures at the expense of economic growth, have not dissipated. However, global inflation is likely to peak at the current juncture as the commodity and energy prices are moderating and there are improvements on the supply side (fewer disruptions and lower delivery costs). Nonetheless, central banks need more evidence that inflation was indeed slowing down before relaxing their monetary policy tightening drive. Investors should remain cautious towards risk assets in anticipation of a global slowdown or recession over the next year.

Not just 1, but 2! Great Eastern wins big at 7th Insurance Asia Awards 2022

Great Eastern bagged 2 awards for our outstanding initiatives, products and services at the 7th Insurance Asia Awards 2022!

Forging on our digital transformation journey, to empower our financial representatives to do their business better, elevate their personal interactions with their customers, and level up their digital presence within a trusted and secure digital space, supported by Great Eastern, our Advisers Digital Platform won the Advisers Initiative of the Year award at the 7th Insurance Asia Awards 2022.

Our second win, the Education Insurance Initiative of the Year, is a testimony of our unstinting commitment to developing our financial representatives with the necessary competencies to help our customers live the greatest version of themselves.

Scan the QR code to view the achievements on Facebook.

The Insurance Asia Awards 2022 is presented by Insurance Asia, to recognise the insurance companies and their conscious efforts and contributions towards the advancement of the insurance industry in the Asia Pacific.

Sustainable living is a way of life

To raise awareness on sustainability, we are publishing a series of articles in the quarterly The Great Connect newsletter. The next issue will be out in January 2023. Here’s our inaugural story for your reading!

What is Sustainable Living?1

Sustainable living means understanding how our lifestyle choices impact the world around us and finding ways for everyone to live better and lighter.

It is an approach to living that aims to reduce our environmental and social impact. It includes making choices that are sustainable in the long term.

Now that you know what sustainable living is, how can you play a part in being more environmentally conscious and socially responsible?

The Importance of Sustainable Living1

Sustainable living is a lifestyle that includes practices that you can sustain indefinitely. These practices include using renewable energy, recycling, reducing water and air pollution, and conserving resources. The goal of sustainable living is to reduce the environmental and social impact of human activity.

Sustainable living is about creating a lifestyle that does not negatively impact the future generations. It is about living in a way that minimizes our environmental footprint and about taking care of ourselves, our families, and our communities.

Benefits of Sustainable Living1

The term sustainable living means living in a way that does not use more from the Earth than it can replace. Here are a few benefits of sustainable living to the environment to know more about it.

1) Reduced waste

Sustainable living is a way to live more responsibly and reduce the amount of waste you produce. There are many ways to do this, but one way is by reducing what you throw away.

2) A better place for generations to come

Sustainable living is about living in harmony with the natural environment. It means reducing the negative impact on the environment and using resources more carefully. It is a way of life that can make the world a better place for generations to come.

3) Decreased pollution

Sustainable living is to decrease pollution in our environment and saving money. The first step to reduce pollution is cutting off your dependence on fossil fuels. You can use renewable energy sources like solar power and wind power.

Another way to lessen your impact on the environment is by eating more plant-based food, decreasing the amount of animal agriculture and deforestation you are causing.

4) Minimum dependency on renewable natural resources

Sustainable living is a lifestyle that reduces our dependence on renewable natural resources. It means living in a way that does not use up more than the Earth can replace. It means using clean energy, recycling, and other ways to live without adding to the problems of climate change.

Check out 3 ways for sustainable living in the next issue!

Take charge and EMPOWER your future now!

Take the Empower Series – our very own in-house IBF-accredited course - to attain IBF Level 1 certification in Financial Planning. Best of all, this course can be done 100% online at your own pace, anytime, anywhere, without compromising your time for business. Plus, you’ll have the flexibility to complete the course as fast as you’d like or you can take as long as one month to complete.

The Empower Series comprises of six bite-size modules:

- Empower Leads Generation will aid in understanding the structured process of broadening your customer base through crafting and maintaining a well-constructed Client Acquisition Programme.

- Empower Financial Advisory aids you in acquiring the knowledge needed to develop personal financial plans for customers based on their financial needs and risk profiles.

- Empower Client Management seeks to help you build strong client relationships, understand customer segmentation, take an entrepreneurial approach to establish a client book, and use internal resources to assist your clients in their financial planning.

- Empower Financial Analysis aims to equip you with the knowledge to identify business revenue and expenses and derive the necessary statistics to help clients understand income statements and balance sheets. This understanding is primarily essential for advisory in business insurance.

- Empower Ethical Culture covers critical knowledge for learning, adopting and maintaining high ethical standards while carrying out financial services activities. The course will cover multiple case studies and industry-level guidelines.

- Empower Investing seeks to provide a basic understanding of the investment process that aids in the sound advisory of investment products.

Watch out for more information as we target to launch in November 2022.

Welcome to our #GreatEastern family!

Meet Zhao Jingyuan (PhD), Group Chief Data Officer. A strong advocate of Data & AI and extremely passionate in using data-driven insights to drive strategic business growth and empower everyone in Great Eastern to use data to make better decisions. Here’s her take on the most important quality of leadership:

“A leader needs to create a clear and inspiring vision, and mobilise the team and motivate people towards achieving the vision. A leader needs to build the trust, support the team through tough times, and help them meet both company and individual goals.

In addition, a leader should help raise the bar by challenging people’s limiting beliefs, encourage continuous learning, and create a culture of ownership.”

Meet Gary Soh, Head of Distribution Risk & Compliance. Having been in the insurance business for more than 20 years, he has accummulated vast working experience in governance, risk and all aspects of compliance, working with great teams and gained many lifelong friends along the way.

“Joining the Great Eastern family feels like a homecoming of sorts, with exisitng connections and new ones making me feel part of the family already. I’m looking forward to a Great journey.”

The Doctors are in the House

Critical Illness sales is all about having the knowledge, building the confidence and conviction to talk about its consequences with customers. In a positive way, of course!

As part of the Great Critical Cover launch, the A&H business team hosted a “Doctor-in-the-House Series” face-to-face panel discussion for over 400 reps in the afternoon of 12 October 2022.

Invited guests were three medical specialists, who are also our panel doctors - senior medical oncologist, Dr Richard Quek from Parkway Cancer Centre, cardiologist & heart specialist, Dr Soon Chau Yang from Mt Alvernia, as well as emergency physician, Dr Raymond Ong from Mt Alvernia, and a personal sharing by fin rep Jonathan Tan on his caregiving experience for a stroke patient.

The doctors provided good insights into risks, treatment options and impact (cost and recovery) of critical illnesses in their respective fields of expertise. From the effectiveness of the latest drugs, their costs, the Cancer Drug List, and the chance of a second heart attack and other illnesses, and of course the available treatment options.

Jonathan Tan, from Alan Loh and Associates shared his personal experience on the costs and the impact of being a caregiver to a stroke patient.

We trust that the knowledge sharing will enable the fin reps to be more confident in educating their clients on the importance and value of putting a CI plan in place, with sufficient CI coverage as well as the benefits of adding on the Protect Me Again rider to receive continued coverage beyond the first claim.

Tree Planting by Great Eastern Financial Advisers (GEFA)

Great Eastern Financial Advisers (GEFA), in support of NParks’s OneMillionTrees movement, has kick started the tree planting initiative with our top donors (Group category). This is part of Great Eastern’s effort to promote sustainability. The donation campaign that started in late 2021 was met with much enthusiasm. We achieved a total donation of 1,429 trees with 299 trees more than our initial goal of 1,130 trees!

Tree planting on 26 Aug 2022 at Rail Corridor

Advisors’ Clique with Mr. Tay Boon Sin (Director of Plant-A-Tree programme), Jesslyn Tan (GEFA CEO), Francis Seo (Sustainability), Gary See (GEFA SM TL) and Kate Poo (GEFA SM).

Tree planting on 28 Sep 2022 at Dairy Farm

The Credence Organization with Sim Aik Koon (Cluster Head), Francis Seo (RAFABA – Projects & Sustainability), Gary See (GEFA SM TL) and Kate Poo (GEFA SM).

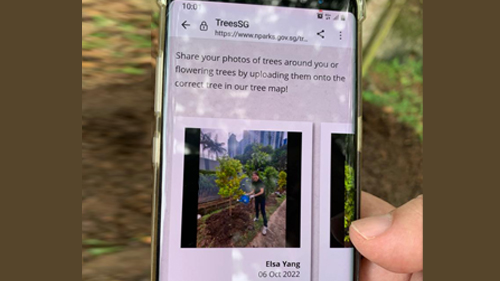

Tree planting on 6 Oct 2022 at Pandan Nature Way (West Coast Highway)

Altitude Alliance with Tong Mun Kit (Cluster Head), Francis Seo (Sustainability), Gary See (GEFA SM TL) and Kate Poo (GEFA SM).

This August, we engaged our top donor groups from Advisors’ Clique, The Credence Organization and Altitude Alliance (with total donation of $110,527) to kick off the tree planting journey and together, restore nature back to our city.

Top donor group Advisors’ Clique, together with Director of Plant-A-Tree programme, Tay Boon Sin and GEFA CEO, Jesslyn Tan gathered for the first planting session at Rail Corridor on 26 August, coincidentally Great Eastern’s 114th anniversary.

Mr Tay shared on the merits of nature to our garden city and the OneMillionTrees movement while our GEFA CEO, Jesslyn emphasised the importance of embracing Environmental, Social, and Governance (ESG) in Great Eastern’s culture by both corporate staff and the agency force.

Braving the wet weather and muddy soil, the team was eager and determined to complete the trees planting. Executive Senior Director, Colin Ong said: “Trees are like the agency force - we are all rooted together in Great Eastern. The roots grip everything together and because of that, Great Eastern is such a great company.” The tree planting continued at the next stop, Dairy Farm, and the group successfully planted a total of 150 trees.

Jesslyn Tan (GEFA CEO) addressing Advisors’ Clique

Mr. Tay Boon Sin (Director of Plant-A-Tree programme) addressing Advisors’ Clique

Exec Senior Director Colin Ong addressing Advisors’ Clique

The Credence Organization also gathered at Dairy Farm, for their initial tree planting session on 28 September. In his opening address, Director Fabian Chan commented that the group is happy to support the ‘Growing Stronger Together’ campaign. He said: “We see sustainability as a responsibility, not just to our clients, but to the community we serve in. Therefore, it is important to take tangible actions to build a greener Singapore.” The group contributed 109 trees to the movement.

Altitude Alliance's tree planting exercise at Pandan Nature Way (West Coast Highway) was on 6 October. Despite NPark’s restriction on the number of attendees at the selected site, the group took up the challenge and planted an average of 2 trees per person. Senior Director David Yang said: “Sustainability through restoration of nature via tree planting is a very meaningful engagement and we are paying it forward for the next generation. This will help transform Singapore and hopefully the whole world can engage in this green initiative.”

Look out for stories on other top contributor groups as they continue our tree planting journey in 2023.

Planting trees, sustainability for life, legacy for our future. Reach for Great with GEFA.

Catch the highlights here:

Awaiting the lightning warning to pass

Getting ready to start

Planting with gusto - braving the drizzle

NParks IC debriefing the team from Advisors’ Clique

Advisors’ Clique

The Credence Organization

The Credence Organization

Director David Yang with his tree at planting site (along the road)

Successful Geotagging on TreesSG website