Great Eastern reports FY-23 Financial Results

Full Year Group Profit Attributable to Shareholders increased 27% to S$774.6 million

Singapore, 26 February 2024 – Great Eastern Holdings Limited (the “Group”) today reported its financial results for full year ended 31 December 2023 (“FY-23”).

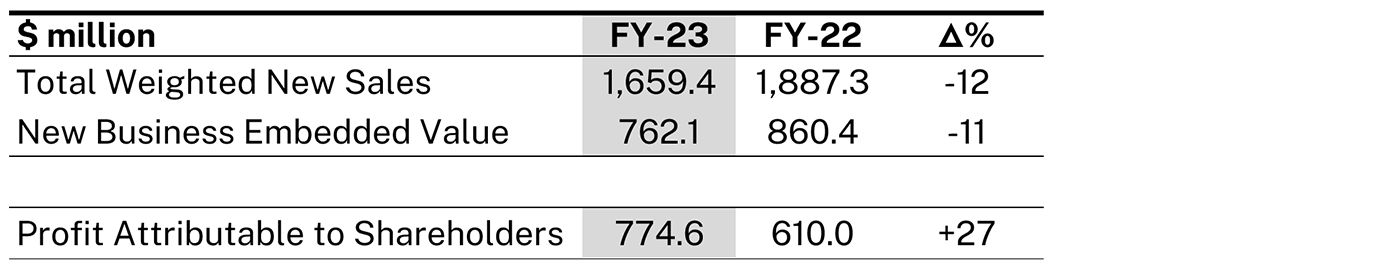

Total Weighted New Sales (“TWNS”) and New Business Embedded Value (“NBEV”)

FY-23 Group’s TWNS decreased 12% against the previous year, reflecting lower single premium sales in the Singapore market. The inverted SGD yield curve has made shorter term interest yielding investments more appealing than single premium products to some customers. Lower sales in single premium products were partially offset by growth in regular premium sales, particularly in protection and whole life plans through the Group’s core distribution channels. FY-23 Group’s NBEV fell by 11%, reflecting lower sales on the whole.

Profit Attributable to Shareholders

The Group has applied SFRS (I) 17 Insurance Contracts from 1 January 2023 and the comparative for prior periods has been restated accordingly.

The Group’s Profit Attributable to Shareholders for FY-23 increased 27% to $774.6 million, driven by favourable investment performance in our Singapore Life business and shareholders fund. Profitability of our insurance business is healthy, though dampened by higher medical claims.

The Group’s core business lines remain resilient and strong, with steady growth in new customer count. Across the Group, the total new customer base grew by over 400,000 in FY-23.

Regulatory Capital

The Capital Adequacy Ratios of the Group’s insurance subsidiaries are strong and well above their respective minimum regulatory levels. The Group’s and its subsidiaries’ Capital Adequacy Ratios were unaffected by the new accounting standards SFRS (I) 17 as these ratios are calculated based on the regulatory capital frameworks in each respective countries we operate in.

Dividend

The Board of Directors has recommended, for shareholders’ approval at the Annual General Meeting, the payment of a final one-tier tax exempt dividend of 40 cents per ordinary share. Upon approval, the final dividend will be payable on 17 May 2024. Including the interim one-tier tax exempt dividend of 35 cents per ordinary share paid in August 2023, the total dividend for FY-23 would amount to 75 cents per ordinary share. Against FY-23 Profit attributable to shareholders of S$774.6 million, the payout ratio is approximately 46%.

As announced on 3 August 2023 in connection with the 1H-23 dividend, the Company has adopted a dividend payment method that aims to pay a steady dividend amount twice yearly. Each twice yearly payment will be of an amount that targets a full year payout to shareholders that is based on sustainable profit level of the Group, and dividends will be progressive in line with the profit trend. Barring unforeseen circumstances, the Company aims to maintain that each dividend amount be no lower than the preceding one.

The recommended final dividend of 40 cents per ordinary share, if it is maintained for 1H 2024 following the dividend payment methodology, would amount to a yearly dividend of 80 cents per ordinary share.

Commitment to Net Zero by 2050

The Group is committed to building a business that is grounded on the principle of sustainability which the Group believes is in the long term interests of its customers, stakeholders, and communities. We will navigate the net zero transition through innovative insurance solutions, sustainable low carbon investments and operations. More details will be announced when we publish our 2023 Sustainability Report in April 2024.

Commenting on the Group’s financial results, Group Chief Executive Officer Mr Khor Hock Seng said:

“Despite the operating climate remaining challenging in 2023, we stayed focused on our core strategies of improving customer experience and developing new products to meet the evolving wealth and protection needs of our customers across the region.

In all the markets in which we operate, we continued to enhance our customer’s experiences through the re-designing of customer journeys, leveraging our digitalisation and data analytics capability.

On product solutions, we have launched an innovative single premium plan with an open-ended policy term that provides short term attractive returns to our customers whilst they contemplate their reinvestment options. To meet the growing demand for inter-generational wealth transfers, we introduced a market-first multi-generational plan which facilitates the transfer of wealth across multiple generations through its unique features of allowing changes of Life Assured and policy ownership. We have also launched a wealth accumulation insurance plan, offering policyholders guaranteed returns for three years with cover against death and total and permanent disability, with no medical underwriting required.

We continue to deepen our collaboration with existing partners and forge new partnerships to both engage existing customers and expand our reach into new customer segments. Our strong agency force of 37,000 financial representatives across the region and our synergistic bancassurance partnership with OCBC Bank continue to be a differentiating factor driving our success as we harnessed these channels to reach and serve our customers.

Expanding our partnerships and channels in Malaysia, we announced the proposed acquisition of AmMetLife Insurance Berhad (“AML”) and AmMetLife Takaful Berhad (“AMT”) in Malaysia, together with the entering of a twenty-year exclusive bancassurance and bancatakaful agreement for the distribution of life insurance and family takaful products through the distribution network of AmBank (M) Berhad and AmBank Islamic Berhad. This opportunity, which is pending regulatory approvals, will allow our Malaysian subsidiaries to provide insurance solutions to the banks’ customers as well as expand our distribution network to serve a wider pool of customers in Malaysia.

In Singapore, the Group continues to bolster its digital affinity collaboration with Singtel through a variety of innovative and tailor made insurance solutions for Singtel’s customers. We have also launched a new partnership with loyalty programme “yuu Rewards” as their exclusive insurance partner. This provides Great Eastern Singapore an additional channel to offer relevant insurance plans to yuu Rewards member base of more than 1.4 million, while allowing them to earn reward points through the purchase of insurance policies.

Moving ahead, we will continue to look at innovative ways to enhance our service level and enrich customer experience through digitalisation and analytics. We have built a strong foundation which positions us well to continue to serve our customers, and deliver profitable growth and long-term sustainable value to our shareholders.”

About Great Eastern

Founded in 1908, Great Eastern is a well-established market leader and trusted brand in Singapore and Malaysia. With over S$100 billion in assets and more than 16 million policyholders, including 13 million from government schemes, it provides insurance solutions to customers through three successful distribution channels – a tied agency force, bancassurance, and financial advisory firm Great Eastern Financial Advisers. The Group also operates in Indonesia and Brunei.

The Great Eastern Life Assurance Company Limited and Great Eastern General Insurance Limited have been assigned the financial strength and counterparty credit ratings of "AA-" by S&P Global Ratings since 2010, one of the highest among Asian life insurance companies. Great Eastern's asset management subsidiary, Lion Global Investors Limited, is one of the leading asset management companies in Southeast Asia.

Great Eastern is a subsidiary of OCBC Bank, the longest established Singapore bank, formed in 1932. It is the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with an Aa1 rating from Moody’s and AA- by both Fitch and S&P. Recognised for its financial strength and stability, OCBC Bank is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

#GreatEasternSG #ReachforGreat

For more information, please contact:

Keith Chia

Head, Group Brand & Marketing

Email: Corpcomms-sg@greateasternlife.com

Low Lai Fong

Head, Business Finance

Email: Investor-relations@greateasternlife.com