Great Eastern Reports 9M-22 Financial Results

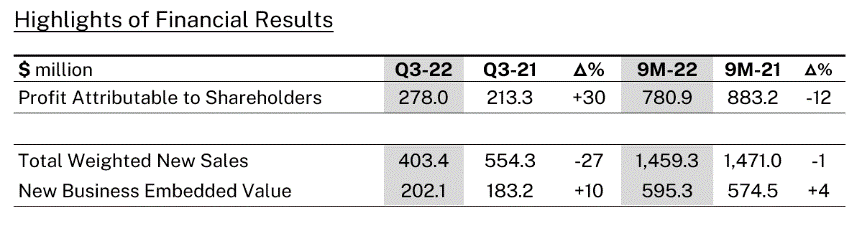

- Q3-22 Profit Attributable to Shareholders up 30% to S$278.0million; 9M-22 down 12% to S$780.9 million

- Q3-22 Total Weighted New Sales down 27% to S$403.4 million; 9M-22 down 1% to S$1,459.3 million

- Q3-22 New Business Embedded Value up 10% to S$202.1million; 9M-22 up 4% to S$595.3 million

Singapore, 2 November 2022 – Great Eastern Holdings Limited (the “Group”) today reported its financial results for the nine months ended 30 September 2022 (“9M-22”).

Profit Attributable to Shareholders

The Group’s Profit Attributable to Shareholders for Q3-22 rose 30% to S$278.0 million driven by higher Profit from Insurance Business. For 9M-22, Profit Attributable to Shareholders fell 12% to S$780.9 million largely reflecting the lower valuation of investments in the Shareholders' fund, given the challenging global investment climate. This was balanced by a stronger Profit from Insurance Business for 9M-22.

Total Weighted New Sales (“TWNS”) and New Business Embedded Value (“NBEV”)

The Group’s TWNS for Q3-22 decreased 27% reflecting lower sales from the single premium plans,offset by better performance in the regular premium sales. For 9M-22, the Group’s TWNS slightly declined by 1%, largely due to a softer third quarter performance. NBEV for Q3-22 and 9M-22 grew 10% and 4% to S$202.1 million and S$595.3 million as a result of a shift towards more favourable product mix leading to higher NBEV margins.

Regulatory Capital

The Capital Adequacy Ratios of the Group’s insurance subsidiaries in both Singapore and Malaysia remain strong and well above their respective minimum regulatory levels.

Commenting on the Group’s financial results, Group Chief Executive Officer Mr Khor Hock Seng said:

“The Group's New Business Embedded Value grew 10% and 4% for Q3-22 and 9M-22 despite a softer sales performance. This is as a result of our focus and disciplined execution of our product strategy.

With customer centricity at our core, we strive to deliver better products and bring greater value to our customers. Consumer surveys and research were done to harness deeper customer insights to better understand our customers' needs and concerns. This has led to the launch of our GREAT Critical Cover series of two critical illness (CI) plans, in response to customers' financial planning concerns and the need for holistic healthcare planning. Armed with key customers' insights, we will continually evolve our insurance solutions to be relevant for our customers, especially in the current volatile economic climate.

Looking ahead, the business climate will be challenging in the near to mid-term, reflecting geopolitical uncertainty, a difficult investment climate and inflationary pressures. Our focus remains on strengthening our business and distribution model, supported by data driven targeted propositions to meet the needs of our customers.”

About Great Eastern

Founded in 1908, Great Eastern is a well-established market leader and trusted brand in Singapore and Malaysia. With over S$100 billion in assets and more than 13 million policyholders, including 10.5 million from government schemes, it provides insurance solutions to customers through three successful distribution channels – a tied agency force, bancassurance, and financial advisory firm Great Eastern Financial Advisers. The Group also operates in Indonesia and Brunei.

The Great Eastern Life Assurance Company Limited and Great Eastern General Insurance Limited have been assigned the financial strength and counterparty credit ratings of "AA-" by Standard and Poor's since 2010, one of the highest among Asian life insurance companies. Great Eastern's asset management subsidiary, Lion Global Investors Limited, is one of the largest private sector asset management companies in Southeast Asia.

Great Eastern is a subsidiary of OCBC Bank, the longest established Singapore bank, formed in 1932. It is now the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with an Aa1 rating from Moody’s. Recognised for its financial strength and stability, OCBC Bank is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

#GreatEasternSG #ReachforGreat

This Media Release, together with the “Unaudited Financial Summary for 9M-22”, has been posted on SGXNet.

For more information, please contact:

Annette Pau

Head, Group Corporate Communications

Email: Corpcomms-sg@greateasternlife.com

Low Lai Fong

Senior Vice President, Group Finance

Email: investor-relations@greateasternlife.com