Fully utilise your policies with Claims Recovery

GREAT SupremeHealth (GSH) policyholders can consider utilising the benefits from other parties, such as your employer's group hospitalisation and surgical plan, instead of claiming from your GSH policy.

There are 2 benefits of doing so:

1. It preserves that annual benefit limit under your GSH policy for any future claimable events. The premiums can also be kept affordable in the long run for consumers across the board.

2. You can receive up to $200* via PayNow** as a token of our appreciation upon sucsessful recovery of your GSH claims.

Step-by-step claim guide

1. Submitting a claim

There are 2 ways to carry out the claim recovery process with your employer's group hospitalisation and surgical plan.

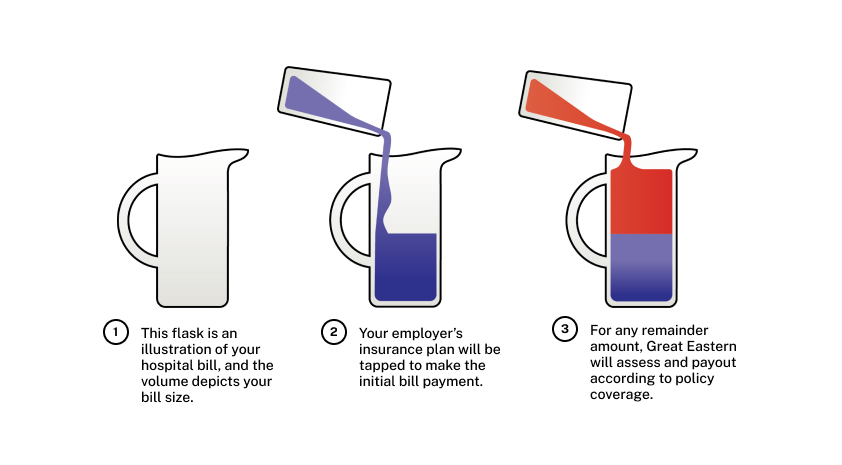

a. Claim from your employer first

How it works

Consider this if:

- You are in the process of planning for your surgery.

- Your condition is not critical or does not require urgent care/surgery.

- You are able to obtain a Letter of Gurantee (LOG) from your employer's group insurer. You may approach your HR for more information on the steps to obtaining an LOG.

Follow these steps:

1. Confirm the surgery details and date.

2. Request for a Letter of Gurantee (LOG) from your emplotyer's group insurer.

3. On the day of admission, inform that staff that you would like to claim firstly from your employer's group insurer and provide the LOG to them. If there's any balance amount due, let them know that you would like to use your personal hospitalisation insurance (GREAT SupremeHealth and Great TotalCare) for payment and to send the details to Great Eastern.

4. Great Eastern will assess your claims and make payment directly to the hospital for the balance amount due.

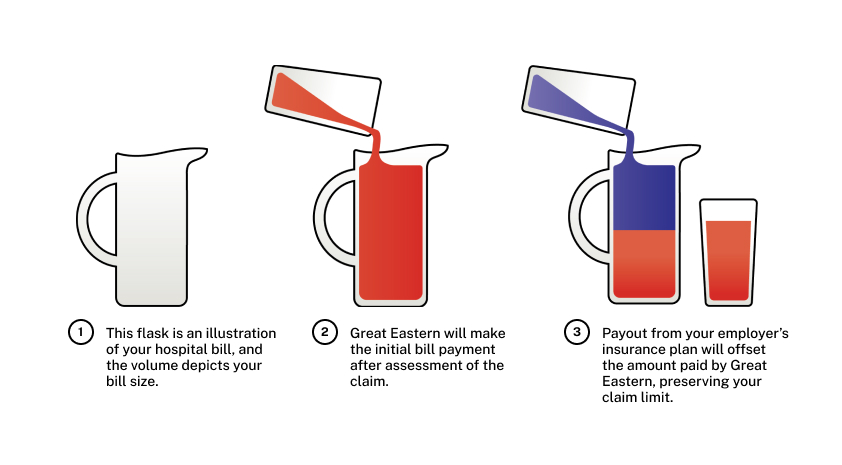

b. Claim from Great Eastern first

How it works

Consider this if:

- Your condition is urgent requiring emergency surgery.

- Your surgery date is approaching soon and you might not be in time to request for a Letter of Guarantee (LOG) from your employer's group insurer.

- Your application for a Letter of Guarantee (LOG) with your employer's group insurer was unsuccessful.

Follow these steps:

1. On the day of admission, inform the staff that you would like to utilise your personal hospitalisation insurance (GREAT SupremeHealth and Great TotalCare) for payment.

2. After discharge, check with your HR on the steps for submitting a claim from your employer's group hospitalisation and surgical plan. You may refer to this guide for general step.

3. Complete the Shield Claims Recovery Authorisation Form that was attached to your settlement letter and send it to us via email at MedicalClaims-SG@greateasternlife.com

Before you proceed to make a claim, you may wish to check with your Human Resource (HR) colleagues for details on your coverage and how you can go about submitting a claim.

The following provides a generic guide for making a claim from an employer's Group Hospitalisation & Surgical Plan.

1. Obtaining the following documents and submit them to HR or via the online portal/ app.

(a) Group hospitalisation claim form. This can be downloaded from most group insurer's websites or claim can be submitted via online submission portal arranged by your company's HR.

(b) Original final and itemised bills.

(c) Hopsital (or Inpatient) Discharge Summary.

(d) GREAT SupremeHealth claim settlement letter - For each approved claim, we will send out the settlement letter to you providing details on claim payment made.

2. Your company's HR will liaise with your employer's group insurer for appropriate reimbursements.

To allow us to follow up on your claim recovery, you will also need to provide Great Eastern with a completed Shield Claims Recovery Authorisation form that can be found attached to your copy of the settlement letter. Send it to us via email to MedicalClaims-SG@greateasternlife.com.

If you require any assistance from us, you can contact us at 1800 248 2888.

Upon successful reimbursement from your employer's Group Hospitalisation & Surgical Plan to Great Eastern, you can expect to receive up to $200* via PayNow**.

If your initial claim was made with your employer's Group Hospitalisation & Surgical Plan, do send us a copy of the finalised settlement letter from your company's insurer at MedicalClaims-SG@greateasternlife.com. You should receive up to $200* via PayNow** within one month of us receiving the letter.

*Please note that the value of your voucher depends on amount successfully recovered. The Company reserves the right to replace the voucher/credits with an item of similar value at any time.

** Alternatively, we can process the incentive through direct credit to your bank account.