Boost your financial health for better wellbeing

Understand how insurance planning can provide adequate financial protection for your future.

Why do you need adequate financial protection?

Life is filled with uncertainties and risks, and life insurance can support you and your family against unforeseen situations. It gives you and your dependants the much-needed financial protection against the financial loss that can happen after your death or the family funds needed if you encountered a total and permanent disability. Having a well-planned financial plan with life insurance can also work as a financial pillar in emergencies, support against healthcare costs as you age and even supplement your retirement income when you are no longer in employment.

How much insurance protection does one need?

The Monetary Authority of Singapore (MAS), in conjunction with the Association of Banks in Singapore (ABS), Association of Financial Advisers (Singapore) (AFAS) and Life Insurance Association (LIA), has launched a Basic Financial Planning Guide as basic financial guidance to help Singaporeans take steps to enhance their financial welling. This Guide serves to recommend protection coverage levels, together with investments and savings tips for six consumer archetypes, such as fresh entrants to the workforce, working adults with young children, working adults supporting aged parents and those approaching retirement.

Here are a few rules of thumb to guide Singaporeans in taking proactive steps to build a holistic financial plan, namely emergency funds, insurance protection, investment, retirement planning and legacy planning;

- Set aside at least 3 to 6 months’ of expenses for emergency needs;

- Obtain insurance protection of 9 times annual income for death and total and permanent disability;

- Ensure 4 times annual income to cover critical illness and recovery;

- Spend at most 15% of take-home pay on pure insurance protection which can also be customised to suit your needs, budget and preferences; and

- Invest at least 10% of take-home pay for your near- and long-term financial goals.

Should you find that your circumstances have changed and would like to check if your current insurance policies continue to suit your needs, please reach out to your Great Eastern Financial Representative and let us personalise a financial planning consultation for you.

Learn how you can build a holistic financial plan according to your life stages and needs

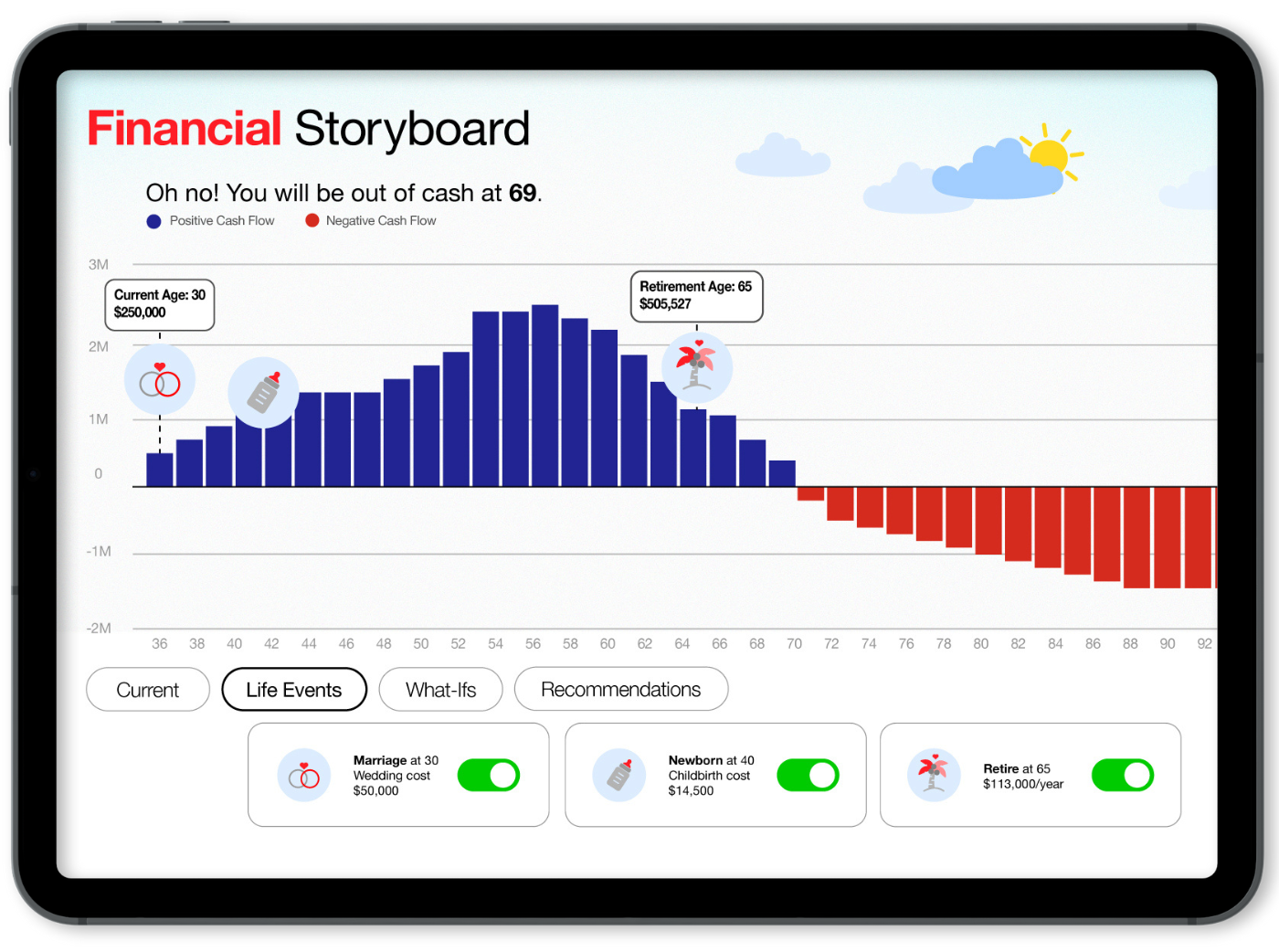

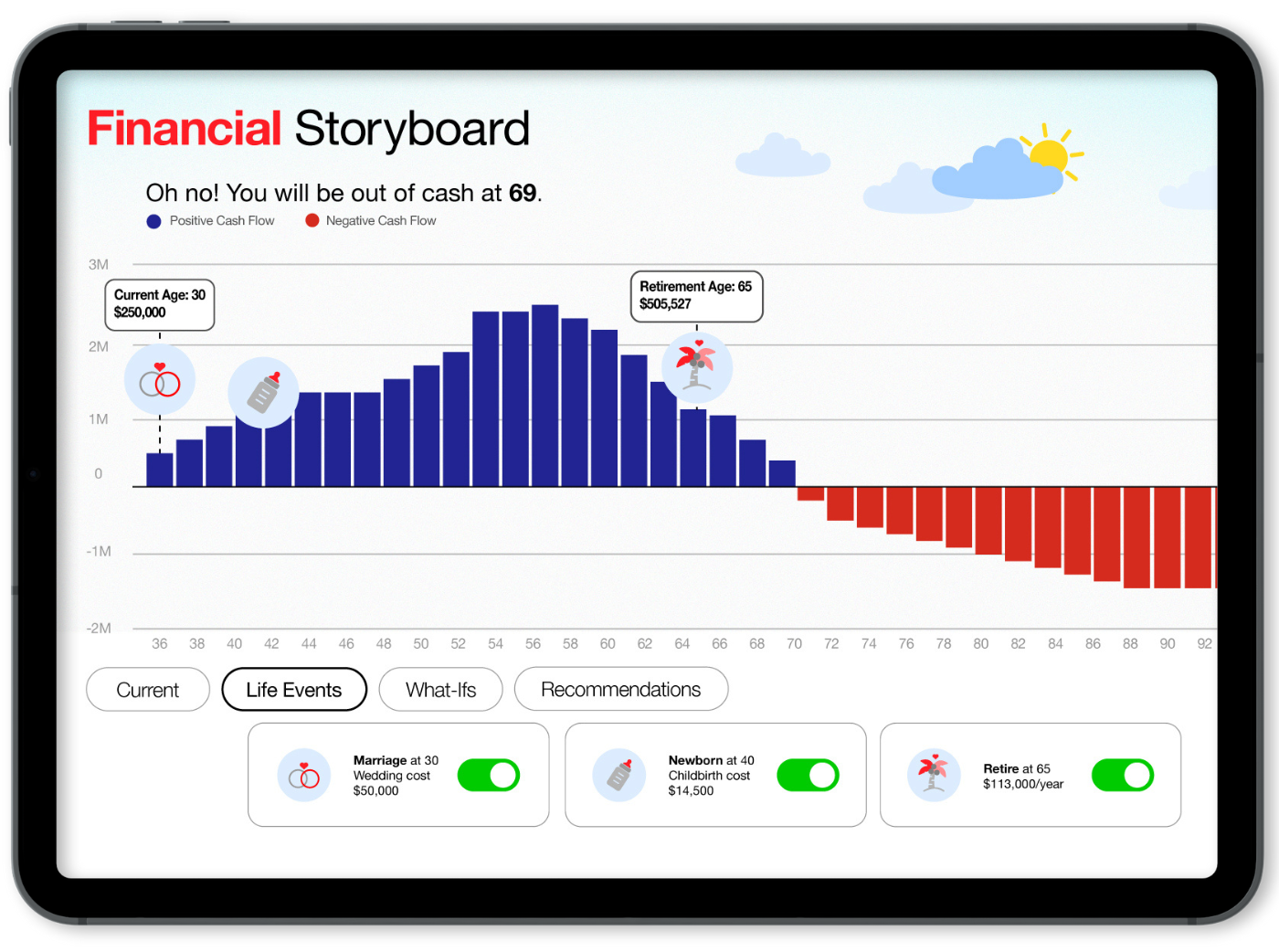

Be future ready with Financial Storyboard, our award-winning tool.

Get to see the big picture as Financial Storyboard consolidates your assets, goals and protection needs all in one place. Together with our Financial Representatives, you can simulate life events, see the impacts to your cashflow and make decisions for your future!

Awards

Professional guidance from our Financial Representatives.

Dedicated to helping you build a financially resilient future; our Financial Representatives will be with you every step of the way. Through continuous upskilling of our courses that are mapped to IBF Skills Competency Framework for Financial Services, you can be confident of the professional advice given to you.

Number of customers

500k+

Ready to be financially prepared for all of life’s twist and turns?

Our financial representative will answer any questions you may have about our products and planning.