Key benefits

-

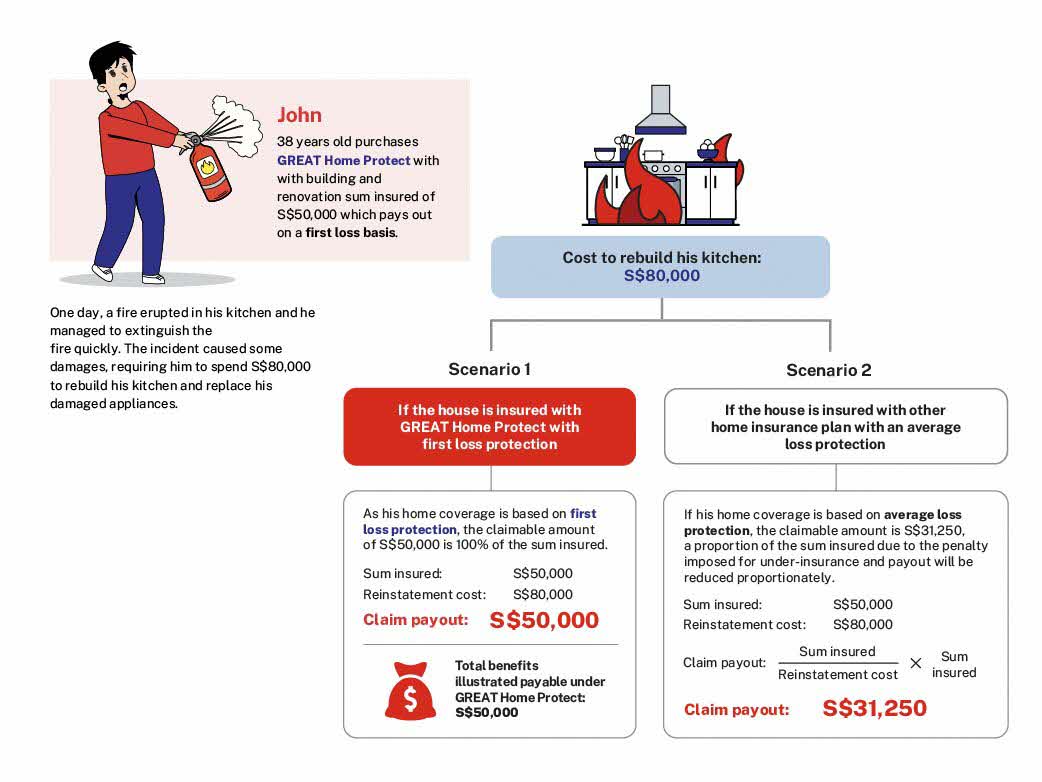

Enhanced coverage with first loss protection

Your home coverage comes with our first loss assurance to provide up to the maximum sum insured in an event of a covered loss or damage to your renovation and home contents. There is no penalty for under-insuring your home.

-

Up to S$25,000 additional coverage with green home benefit

In case of a covered loss, our green home benefit provides up to S$25,000 coverage for solar panels, and up to S$10,000 for Electric Vehicle (EV) Charger. As part of Great Eastern's Sustainability efforts you can enjoy a 5% green discount on your premiums*.

-

24/7 Emergency Home Assistance

Be protected when in need of emergency services such as locksmith, plumbing, electrical, air conditioner repairs, pest control services, up to 2 events per policy year.

Your questions answered

1. What does GREAT Home Protect cover?

GREAT Home Protect covers all-risks for accidental loss or damage to your household contents, building and renovations, unless the losses are specifically excluded.

2. Who is eligible to purchase GREAT Home Protect?

The policyholder must be the owner of the property in Singapore that they are insuring for and for residential purpose only. The policy will also be available to tenant who is currently renting premise.

3. Who is the Homeowner, and Tenant in the context of home insurance?

· Homeowner

The Homeowner has legal ownership of the property. He may purchase insurance coverage to insure his own belongings and the property’s building and renovations.

· Tenant:

The Tenant does not own the property and is renting the property. He may purchase insurance coverage to insure his own belongings but not the property’s building and renovations.

4. I already have a mortgage fire insurance policy from my bank, do I still need to buy GREAT Home Protect?

Yes. Mortgage fire insurance is meant to protect the bank’s financial interest and not yours hence your own financial interests such as household contents and renovations are normally not covered by the bank’s mortgage fire insurance.

You can get insured under the GREAT Home Protect policy to cover your household contents and any additional renovations or improvements which you have made to your home.

5. I am required to take up the compulsory HDB fire insurance, do I still need to buy GREAT Home Protect?

Yes. The compulsory HDB fire insurance covers only the internal building structure, fixtures and fittings based on the original standards of HDB flat when it is handed over to the first lessee.

You can get insured under the GREAT Home Protect policy to cover your household contents and any additional renovations or improvements which you have made to your home.

6. My Management Corporation Strata Title (MCST) has fire insurance for the condominium, do I still need to buy GREAT Home Protect?

Yes. Most MCST insurance covers only the internal building structure and fixtures and fittings done by the developer and not your household contents.

You can get insured under the GREAT Home Protect policy to cover your household contents and any additional renovations or improvements which you have made to your home.

7. Is the GREAT Home Protect coverage active immediately or is there any waiting period?

There is no waiting period. You are covered from the moment you purchase the GREAT Home Protect insurance policy and the premium is paid. This is subject to no claim prior to policy inception.

8. Is there any discount available if I purchase a 2-year plan?

You will be entitled to a 10% discount if you choose to buy the 2-year plan option.

9. Can my property be covered by more than one GREAT Home Protect policy?

If you have more than one GREAT Home Protect policy that covers the same property, we will only pay from the policy with the highest coverage amount.

10. What is the definition of the terms “household contents”, “building” and “renovations”?

· Household contents

Refers to any movable household items in your home except for:

· Motor vehicles, watercrafts, and their accessories;

· Money, securities, certificates, and documents of any kind (unless specially mentioned in the policy;

· Pets or livestock; and

· Property owned or held by you or your family in connection with any business, profession, or trade.

Building

The structure of your home (not including its foundations) and the permanent fixtures and fittings provided by the developer or the HDB (Housing & Development Board) as standard, except those in common areas that you do not own. If your home has a garden or land, it also includes garages, walls, gates, fences, swimming pools, ponds, terraces, footpaths, patios, and driveways that you own.

Renovation

Fixtures and fittings you or any previous owner or tenant have provided in your home.

11. How do I determine the appropriate coverage levels required for the household contents, building and renovation of my property?

The GREAT Home Protect customer journey is catered to recommend the appropriate sum insureds depending on your property type.

For household contents

The level of household contents cover you need will depend on the amount of household contents you have. The best way to estimate this amount would be to take a full inventory of the items in your residence. Please note that while there is no “per item” limit for furniture, home appliances and, valuables are subject to a maximum of S$2,000 per article (Standard and Superior plan) and S$5,000 per article (Premier plan).

For building and renovation

You may refer to General Insurance Association website as a general guide for the replacement cost of your property. Alternatively, you can seek professional advice from a qualified property valuator or quality surveyor at your own cost.

12. Are valuables such as antiques, works of art and jewellery covered?

Yes. Valuables are defined as jewellery, handbags, musical instruments, cameras, bicycles, watches, works of art, mobile phones, laptops, computers, wines, or collectibles belonging to you or any member of your family.

Valuables are covered under Section 2 where each item, set or pair is subjected to a maximum cover of S$2,000 (Standard and Superior plan), S$5,000 (Premier plan) and up to a total of 35% of the sum insured under the household contents section for all valuables.

13. Do I need to submit proof of ownership for my possessions?

There may be certain occasions during claims where you may be asked to verify asset value and ownership. We would advise you to keep receipts for big ticket items, such as your valuables, to assist us in handling your claims.

14. Do I need to itemise the household contents that I want to insure?

You do not need to. However, please note that certain household contents have limits as to how much we will pay in the event of a claim. Please refer to the policy document for full details.

15. I am a landlord with a GREAT Home Protect coverage, can I claim on my policy for the loss to my tenant’s belongings if they are damaged due to an accidental loss or damage?

No. This policy only covers your belongings as a landlord, it does not cover your tenant’s belongings. We will however indemnify the homeowner’s legal liability for damage to the tenant’s belongings under Section 3 of the policy, subject to the policy terms and conditions.

16. I am a tenant with a Great Eastern GREAT Home Protect coverage, can I claim on my plan for the loss to the homeowner’s belongings for accidental loss which occurred at the property (for example, my rented room)?

No. This policy only covers your belongings (as a tenant), it does not cover the homeowner’s belongings. We will however indemnify the tenant’s legal liability for damage to the homeowner’s belongings under Section 3 of the policy, subject to the policy terms and conditions.

17. What does the family personal accident benefit cover?

This benefit covers you, your spouse and up to three children below aged at least 12 months below age of 19 (or 26 if studying full-time in a recognized institution of higher learning) against death, permanent disability within three calendar months of accident that cause it.

The maximum amount we will pay for each insured person is S$10,000 in total during any one policy year.

18. What does the emergency home assistance cover?

If there is an emergency at your home during the period of insurance, we will reimburse up to S$150 per event (for up to two events during any one policy year) for any of the following services:

1. Electrical services

2. Plumbing services

3. Locksmith services

4. Air-conditioning services

5. Pest-control services

19. What is the advantage of having a home insurance policy that is on a first loss basis?

GREAT Home Protect is a first loss basis home insurance policy which covers a specified amount or value of property against loss or damage, rather than the full value.

Example of claims computation with First Loss Basis cover (GREAT Home Protect):

Actual Reinstatement Cost: |

S$500,000 |

Sum Insured: |

S$300,000 (Under-insured by 40%) |

Loss Amount: |

S$100,000 |

Amount Payable: |

S$100,000 (No Penalty for Under-Insurance) |

Example of claims computation without First Loss Basis cover:

Actual Reinstatement Cost: |

S$500,000 |

Sum Insured: |

S$300,000 (Under-insured by 40%) |

Loss Amount: |

S$100,000 |

Amount Payable: |

S$60,000 (only 60% of the loss amount payable) |

20. What is the Green discount and how can I be eligible for it?

The Green discount is a 5% additional discount provided by Great Eastern to reward our customers who have environmentally friendly homes. Policyholders must declare that their home is environmentally friendly during policy purchase to be eligible for this discount.

Great Eastern reserves the right to withdraw or amend the Green discount without prior notice.

21. What does Green home benefit – build back greener cover?

This benefit provides additional coverage of up to 10% of the sum insured to replace or rebuild using green products and methods. The amount we pay for this cover will not be deducted from the sum insured under section 1 or 2.

22. What does green products and methods refer to?

This means:

· Sustainable technologies, environment friendly or energy efficient materials;

· LED (light-emitting diode) lights;

· Energy/water efficient household products having following energy efficiency rating ticks under the Mandatory Energy Labelling Scheme (MELS), Voluntary Water Efficiency Labelling Scheme (VWELS) or Mandatory Water Efficiency Labelling Scheme (MWELS):

23. What are some examples of green products and methods?

Some examples of green products and methods include:

· Using eco-friendly paints that are non-toxic and does not contain volatile organic compounds (VOCs)

· Using reclaimed wood furniture

· Switching to eco-friendly and energy saving household appliances

24. Can I use this coverage to replace my old aircon model with a newer eco-friendly model?

Yes, provided that the lost, damaged, or stolen item is replaced with a brand new, like-for-like replacement value or one of an equivalent specification.

25. How would I be notified on the renewal of the insurance?

A renewal notice will be sent to you at least one month before the expiry of the policy.

26. How do I renew my home insurance?

| Ways to renew | How to renew | Payment options |

| Online | Using the QR code provided in your renewal notice, you may renew your policy online instantly | Credit card (Visa and MasterCard) Paynow to Great Eastern General Insurance Limited (UEN: 192000003W) |

| Send your renewal notice to: GICare-sg@greateasterngeneral.com | ||

| Send your renewal notice to: Great Eastern General Insurance Limited, 1 Pickering Street, Great Eastern Centre, Singapore 048659 |

Alternatively, you may inform your servicing agent who will be able to assist you with the renewal request.

27. How may I cancel my policy?

You may cancel this insurance policy by giving us within 30 days’ notice via email at GICare-sg@greateasterngeneral.com or contact or our Customer Service Hotline at 6248 2888, Mondays to Fridays, 9am to 5.30pm (excluding public holidays)

28. Will I receive a refund if I cancel my policy?

We will grant a short rate refund of the premium paid corresponding to the unexpired Period of Insurance provided no claim has been submitted prior to the cancellation of this Policy.

| If policy is in force | Refundable Premium |

| Up to 1 month | 80% |

| Up to 2 months | 70% |

| Up to 3 months | 60% |

| Up to 4 months | 50% |

| Up to 5 months | 40% |

| Up to 6 months | 30% |

| Up to 7 months | 25% |

| Up to 8 months | 20% |

| Up to 9 months | 15% |

| Up to 10 months | 10% |

| Up to 11 months | 5% |

| Up to 12 months | No refund |

Please note that we will not refund any premium below S$25.00 (exclusive of GST).

29. If I move to a new address, do I have to cancel my current policy and take up a new policy?

You may submit a request to change your address, however, such requests are subject to review and approval by us (Great Eastern General) as the insurer. If there is material change in risk, we may choose not to continue with cover.

30. How do I file for a claim?

| Step 1 | Notify Relevant Parties At the occurrence of the incident, contact your agent, broker, or call our hotline at +65 6248 2638. Make a policy report within 24 hours if the loss or damage is due to theft or burglary. |

| Step 2 | Mitigate Loss & Collect Information Take all necessary measures to prevent and avoid further loss or damage to your home or items by separating the dry and undamaged items from the wet or burnt items. Do not dispose of any damaged items without our prior written consent. Take photographs of the damaged items and retain the items for our inspection. Assist and cooperate with the loss adjuster who may be sent to assess the situation. In cases involving damage to property or bodily injury of a third party: Note down the particulars of the third party. Obtain the details of the nature and extent of claim. Do not admit liability, negotiate, or make any settlements without our prior written consent. Immediately inform us when you receive any letter of demand, Writ of Summons, etc. from the third party. |

| Step 3 | Complete the Claim form For Property Damage Claim, the claim form can be downloaded here. For Personal Liability Claim, the claim form can be downloaded here. For Personal Accident Claim, the claim form can be downloaded here. |

| Step 4 | Attach copies of all receipts and relevant supporting documents Police report / investigation results & incident report (if applicable) Photographs of damaged property At least two quotation(s) for repair/replacement of the lost or damaged property Assessment report from repairer on the cause and extent of the damaged property Invoices / purchase receipts of lost or damaged property Letters, writ of summons from third party, if applicable Please note that this list of documents is not exhaustive. Other documents may be requested if necessary. |

| Step 5 | Submit your documents Email your claim to NonMotorClaims-SG@greateasterngeneral.com or mail in to: Attention: Claims Department Great Eastern General Insurance Limited 1 Pickering Street, #01-01 Great Eastern Centre, Singapore 048659 Alternatively, you can inform your servicing agent who can also assist you with your enquiries/ claim. Note: Retain all original receipts and documents for the next 6 months in case they are required for further investigation. |

31. What is an Excess?

An Excess is the first amount of any claim that the claimant must bear.

For example, if your claim for household contents damages is S$1,000, and your excess is S$100, S$100 will be deducted from the claim amount and the balance of S$900 will be paid out under the policy.

32. I have a household contents insurance policy with another insurer. Will I still be able to claim on Great Home Protect?

We will assess your claim eligibility under the GREAT Home Protect policy together with any other policies you may have.

33. How can I contact Great Eastern General Insurance Ltd if I have any enquiries?

Please contact our Customer Service Hotline at 6248 2888, Mondays to Fridays, 9am to 5.30pm (excluding public holidays) or email us GICare-sg@greateasterngeneral.com.

Alternatively, you can inform your servicing agent who can also assist you with your enquiries/claim.

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

*Subject to green discount eligibility.

This brochure is for general information only. It is not a contract of insurance. Please refer to the policy documents for the precise terms and conditions of the insurance plan.

This policy is subject to the Premium Before Cover Warranty Clause, which requires the premium to be paid and received on or before the inception date of the policy.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the General Insurance Association (GIA) or SDIC websites (www.gia.org.sg or www.sdic.org.sg).

GREAT Home Protect is underwritten by Great Eastern General Insurance Limited, a wholly-owned subsidiary of Great Eastern Holdings Limited and a member of the OCBC Group.

Information correct as at 23 May 2024.