Home is where the insurance is

Giving your home the shield it deserves

2022 was an unfortunate year of numerous shocking fire-related fatalities. Though news of gut-wrenching incidents were making the rounds, home insurance is often viewed as an administrative addition, rather than an essential purchase.

Is your home really “fire-proof”?

Most homeowners already have mandatory fire insurance. Isn’t that sufficient? A 2015 survey reported that three in four homeowners are under the false impression that mortgage or fire insurance covers loss or damage to home items.

However, contrary to popular belief, mortgage fire insurance only covers structural fixtures and fittings. It is intended to protect the bank’s financial interest instead of yours.

Thus, the role of home insurance becomes even more evident. It covers what matters the most to homeowners – household contents and any additional renovations.

What’s inside matters more

What do you value most about your home? For those married with families, perhaps the playroom is a physical embodiment of all the heart-warming memories shared between you and your child. For singles, your collection of rare figurines could be your most cherished possession. No matter what you treasure most, we likely all have something or things we wish to protect in our homes. After all, it is what’s inside that makes a home one.

Great Eastern’s Great Home Protect offer essential coverage of Renovations, Household Contents and Personal Liability, including bicycles and other valuables such as antiques, artworks and jewellery. Customers may choose to add on optional coverage they deem fit, like Building, Personal Belongings and Family Personal Accident, or/and top up on the existing essential coverage. Specifically tailored to the exact needs of individual homeowners, they need not pay extra for unnecessary coverage.

An enhanced protection

Home insurance are either first loss or average loss policies.

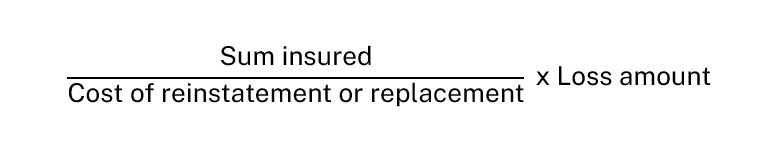

For most insurance policies, they go by Average Loss. This means that in the event of a claim, the insured must declare the exact reinstatement cost. Otherwise, averaging will be applied. If the sum insured is lower than the cost of reinstatement or replacement, the amount payable for the claim will be reduced proportionately.

In this scenario, you probably won’t have adequate funds to re-renovate your child’s precious playroom or recover your beloved figurine collection.

Great Eastern’s home insurance policy is underwritten on a First Loss basis meaning insured are not required to fully declare the total value of the contents & building. Payout will be up to the sum insured.

We recommend that you review the cover level purchased regularly, estimating the actual reinstatement value at a potential time of loss is often challenging. Hence, home insurance plans with a First Loss policy can be exceptionally instrumental.

In particular, Great Eastern’s HomeGR8 Essential and HomeGR8 Plus stand out as there is no penalty for under-insurance!

Keep your home’s interest at heart, even when far away

Whether you are a frequent traveller or a homebody, home insurance is important for everyone. Be there for your home even while physically far apart from just $0.14 a day.

According to an online survey which polled 1000 people aged 18 to 55, only 34% of Singaporeans and Permanent Residents have applied for home insurance. It is time to be part of this small but safe demographic.

While life may be an unpredictable rollercoaster ride, you can always take steps to manage risks for a more safeguarded future with the people and things that you love. Take charge today.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.