Put disability misconceptions to rest

Shield yourself against disability misconceptions and long-term care costs with GREAT CareShield.

Sometimes, life surprises us with challenges and it’s important to be ready. Understanding disability and long-term care – things that we might not think about every day but are really important.

Join us as we uncover the insights garnered from the Great Eastern Long-Term Care Study 2023* to find out the challenges, preferences, and needs that shape our perspective of disability and long-term care planning. Let us be empowered with the knowledge crucial for navigating the path ahead.

On the topic of disabilities, the Great Eastern Long-Term Care Study of 1,000 Singaporeans and Permanent Residents aged between 30 and 64 revealed that:

Since the launch of GREAT CareShield (a supplementary plan for CareShield Life and ElderShield) in October 2020, Great Eastern has seen a growing number of young claimants with 4 out of 10¶ in their 30s. This shows that disability knows no age and boundary, and can strike when least expected.

An individual’s disabilities take a toll on loved ones too – something that’s on a lot of people’s minds.

But 80% are not confident of being financially ready for long-term care costs arising from disability.

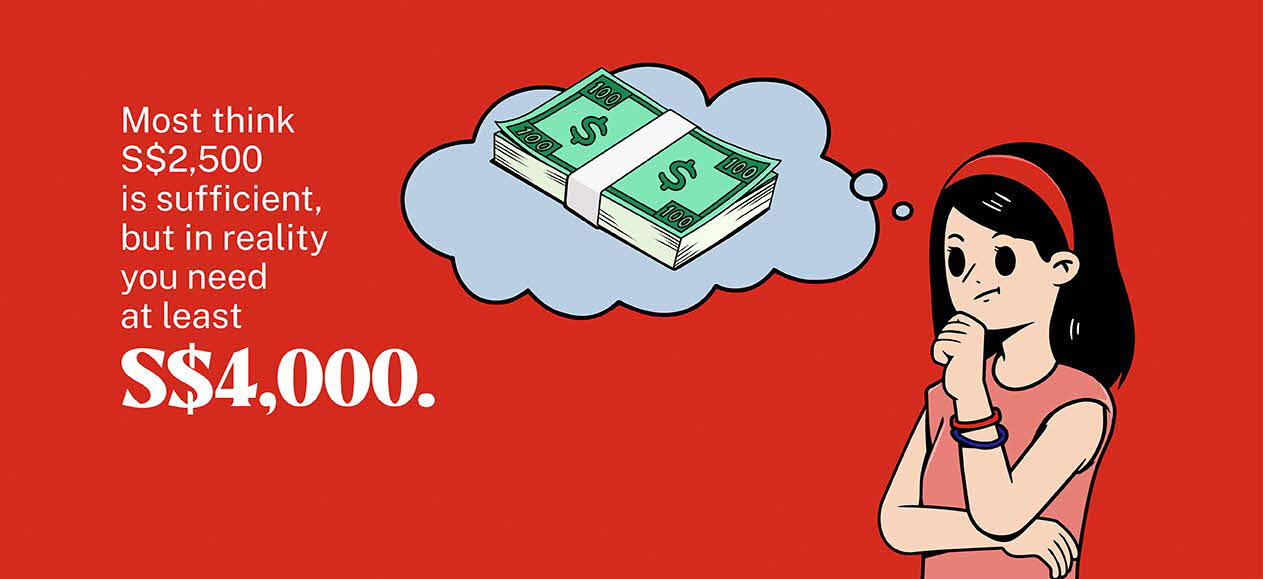

When asked to estimate disability care costs, the respondents’ answers were vastly different from actual home caregiving costs.

In reality, you need at least S$4,000/month^ for home caregiving costs with a domestic helper – which is 37% more than respondents’ estimates of S$2,500/month, which makes it extremely crucial to get yourself adequately covered with disability protection.

Disabilities can happen to a person out of the blue, regardless of age. Recovering from disability takes time, and it comes with long-term medical and caregiving expenses. Which is why it’s important to have assurance against such uncertainties.

With GREAT CareShield, monthly payouts1 start when you’re unable to perform just 1 out of the 6 Activities of Daily Living (ADL)2. Additionally, you will also receive a lump sum payout3 that can be claimed again in case of disabilities arising in the future due to a different and unrelated cause.

Reach for Great by enhancing your disability protection with GREAT CareShield and get 20% off premiums throughout your coverage. Sign up using your MediSave funds4 today.

Footnotes

* The Great Eastern Long-Term Care Study 2023, conducted independently by NIQ Singapore via online survey in June 2023.

¶ Great Eastern's GREAT CareShield claims data (10 Oct 2021 – 19 Jan 2023).

^ Source: Great Eastern's research. Estimates based on home caregiving with a domestic helper.

1 Subject to Deferment Period. Payouts of Monthly Benefit are payable for as long as the Life Assured suffers from the applicable number of disabilities, up to a lifetime.

2 The 6 Activities of Daily Living (ADLs) are: washing, toileting, dressing, feeding, walking or moving around and transferring.

3 Subject to Deferment Period. The Initial Benefit is a lump sum payment equivalent to 3 times of the Monthly Benefit. In the event the Life Assured fully recovers from the disability, the Initial Benefit may be paid again for subsequent episodes of inability to perform at least 1 ADL. However, it is not payable if such subsequent disabilities arise from or are related to the cause of disability(ies) for which there was a previous claim for Initial Benefit.

4 Subject to cap of S$600 per calendar year per insured person.

Disclaimers

Terms and conditions apply.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The information presented is for general information only and does not have regard to the specific investment objectives, financial situation or particular needs of any particular person.

GREAT CareShield can be purchased by CareShield Life or ElderShield policyholders. All Supplements are regulated under the CareShield Life and Long-Term Care Act 2019.

This is only product information provided by us. You may wish to seek advice from a qualified adviser before buying the product. If you choose not to seek advice from a qualified adviser, you should consider whether the product is suitable for you. Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs. If you decide that the policy is not suitable after purchasing the policy, you may terminate the policy in accordance with the free-look provision, if any, and the insurer may recover from you any expense incurred by the insurer in underwriting the policy.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Information correct as at 1 March 2024.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.