Supplement CareShield Life with GREAT CareShield

Early payouts and better ancillary benefits sets GREAT CareShield apart from the rest.

I have always been a big advocate of insurance that manages risks associated with disabilities. This is a risk that I take seriously as my household’s finances can ill afford any breadwinner being involuntarily absent from work for a prolonged period of time. My belief rubs off on my elderly parents as well – my mum is enrolled into ElderShield with a supplementary plan while my dad’s application was unfortunately rejected. Thankfully, I should be able to enrol both of them into CareShield Life from 6 November 2021* onwards. When evaluating the supplementary plans available in the market, what differentiates GREAT CareShield from the others are its early payouts and better ancillary benefits. Here are the reasons why I think you should consider GREAT CareShield as your CareShield Life supplementary plan.

The Importance Of Supplementary Plans

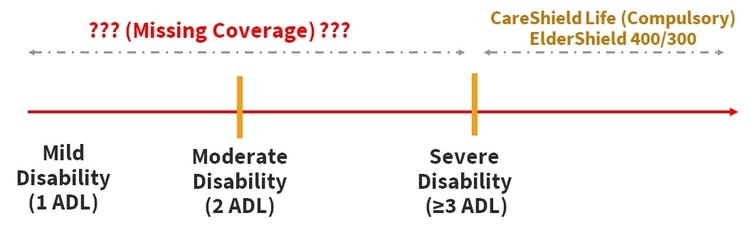

While it is true that all residents born in 1980 or later are compulsorily enrolled into CareShield Life, the coverage is only applicable for severe disability.

(Gentle reminder: There should be a recent deduction of CareShield Life premium in your MediSave during Oct, so do check it†)

With reference to the above diagram, it is shown that basic national programmes such as CareShield Life‡, and ElderShield only cover severe disability. Severe disability is defined as the insured being unable to perform at least 3 Activities of Daily Living (‘ADL’). There is an absence of coverage if one is down with only mild (1 ADL) disability or moderate (2 ADL) disability. Let us not forget that disability, whether due to accidents or underlying medical conditions, can happen to anyone regardless of age and lifestyle.

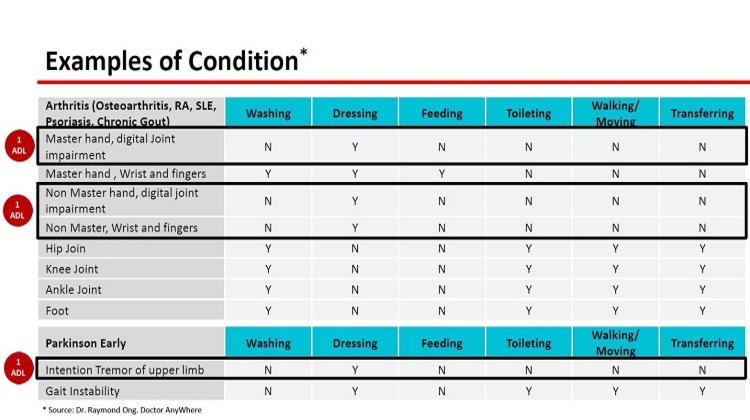

Contrary to belief, mild disability and moderate disability are not as uncommon as expected. According to Doctor Anywhere, Arthritis caused by Osteoarthritis, Psoriasis, Chronic Gout etc can lead to digital joint impairment which renders the patient incapable of dressing himself/herself independently (1 ADL). More examples are shown in the diagram below.

Even in the case of severe disability, we must also be mindful that payouts from ElderShield only last for 5 to 6 years. Stopping payouts after a limited period is definitely not ideal from a financial planning perspective, especially as the majority of severe disability cases may be long-term and with some even lasting for life. Therefore, these are just 2 reasons why I think it may be necessary to extend CareShield Life/ElderShield’s coverage, especially if the premiums are within one’s budget.

Extension of coverage comes in the form of purchasing supplementary plans and I have my fair share of experience with them. (Read my mum’s experience§, and my dad’s experienceǁ). Let us proceed to examine how GREAT CareShield addresses this gap.

Key Benefits of GREAT CareShield

I mentioned that GREAT CareShield is newly revamped and it comes with enhanced benefits compared to its previous plan versions – Enhanced and Advantage.

After reviewing the GREAT CareShield, I have prepared a summary stipulating the key benefits which can be found in table below.

| Summary of Key Benefits of GREAT CareShield | |||

| GREAT CareShield | Mild Disability | Moderate Disability | Severe Disability |

| No. of ADL | 1 | 2 | ≥ 3 |

| Initial Benefit | 3 times of Monthly Benefits | ||

| Monthly Benefit (Range: S$300 - S$5,000 in multiples of S$10) |

50% | 100% | |

| Caregiver Benefit | N.A. | 60% of Monthly Benefit for up to 12 months | |

| Dependant Care Benefit | N.A. | 30% of Monthly Benefit for up to 48 months | |

| Waiver of Premium | Yes | ||

1) Up-to-Lifetime payouts starting from as early as 1 ADL

As shown above, GREAT CareShield provides up-to-lifetime payouts from as early as the mild disability stage, i.e. when Life Assured is unable to perform 1 ADL. This starts with an Initial Benefit that is pegged to 3 times the Monthly Benefit upon diagnosis of mild disability. This lump sum payout is helpful in defraying any medical bills incurred to rehabilitate the Life Assured back to the pink of health. This is in addition to the up to a lifetime monthly payouts comprising of 50% of the Monthly Benefit, which is payable as long as the Life Assured continues to suffers from the inability to perform 1 ADL.

As long as the Life Assured continues to suffer from at least 1 ADL, the premiums payable will be waived. The cash payouts received will directly defray the associated long-term care expenses that comes with disability.

Currently, GREAT CareShield is a MediSave-approved supplementary plan available in the market that provides up to lifetime payouts starting from the mild disability stage. In addition, there is also no limit to the number of claims on the Initial Benefit. This means that the Initial Benefit will be paid again for subsequent episodes of disability that results in the Life Assured being unable to perform at least 1 ADL, as long as such disability(ies) is from a different or unrelated cause.

These benefits differentiate GREAT CareShield among the rest.

2) Better ancillary benefits for your loved ones

Upon the inability to perform at least 2 ADLs, the monthly payouts will be 100% of the Monthly Benefit. GREAT CareShield also extends additional financial support in the form of the Caregiver Benefit, which equates to 60% of the Monthly Benefit for a period of up to 12 months. This additional monthly payout is helpful in subsidizing the cost of a full-time caregiver, alternative care arrangements or other medical care.

To better help the family to cope with the new found scenario, the Dependant Care Benefit, pegged to 30% of the Monthly Benefit, will also be dispensed for a period of up to 48 months if you suffer from at least 2 ADLs and have a child under 22 years old at the point of claim. It will come in handy to ensure that loved ones continue to enjoy a basic level of income during the transition period.

Other benefits such as Initial Benefit and Premium Waiver will continue to remain intact.

3) Premiums payable by MediSave

Finally, GREAT CareShield is a MediSave-approved plan to get better disability coverage using your MediSave funds. As the MediSave Annual Withdrawal Limit is set at S$600 per calendar year per insured person, you will be able to receive additional disability coverage with little to no additional cash premium top-ups required if you enrol in GREAT CareShield whilst you are still young.

With reference to the GREAT CareShield brochure as shown in Diagram 4, the quote for a 30-year old is S$584 per annum, which is within the MediSave Annual Withdrawal Limit. This is because the premium is based on age last birthday at entry and it enables you to maximise your GREAT CareShield coverage with no or minimal cash outlay.

Based on the example above, Mike gets to enjoy a 20% discount on the premium and it will be applied perpetually throughout the premium term which ends at age 95. This discount is due to an ongoing promotion whereby policyholders get to enjoy a perpetual 20% off premium.

Therefore, it is true that the longer you wait, the more you may have to fork out in terms of premiums and cost of care.

Conclusion

Disability is real and can happen to anyone regardless of age and lifestyle. When it does happen, disability, more often than not, entails potentially high medical and caregiving expenses besides significant lifestyle disruption. It is therefore worthwhile to consider extending your CareShield Life or ElderShield coverage to ensure that you are covered against mild and moderate disabilities.

^Disclosure: This article is written by Heartland Boy in collaboration with Great Eastern. It is for information only and reflects my opinion and not that of Great Eastern.

Notes & Disclaimers:

1 Payouts of Monthly Benefit are payable for as long as the Life Assured suffers from the applicable number of disabilities, up to a lifetime.

2 The Initial Benefit is a lump sum payment equivalent to 3 times of the Monthly Benefit. In the event the Life Assured fully recovers from the disability, the Initial Benefit may be paid again for subsequent episodes of inability to perform at least 1 ADL. However, it is not payable if such subsequent disabilities arise from or are related to the cause of disability(ies) for which there was a previous claim for Initial Benefit.

3 All GREAT CareShield benefits stated in the article are subject to a Deferment Period. Please refer to the product summary and policy contract for full details.

4 Age stipulated refers to age last birthday.

5 Figures illustrated are rounded down to the nearest dollar.

6 Premium rates are not guaranteed and they may be adjusted from time to time based on future experience.

* Source: https://www.straitstimes.com/singapore/health/eligible-sporeans-prs-born-in-1979-or-earlier-can-join-careshield-life-from-nov-6

† Source: https://www.heartlandboy.com/careshield-life-premium-deduction-top-up-cpf-medisave-tax-relief/

‡ Source: https://www.heartlandboy.com/careshield-life-affect-insurance-coverage/

§ Source: https://www.heartlandboy.com/mum-ended-up-with-2-eldershield-supplements/

ǁ Source: https://www.heartlandboy.com/my-parents-application-for-eldershield-and-a-supplement-plan-got-rejected/

The information presented is for general information only and does not have regard to the specific investment objectives, financial situation or particular needs of any particular person.

GREAT CareShield can be purchased by CareShield Life (CSHL) or ElderShield (ESH) policyholders. If purchased by ESH policyholders before the transfer of ESH to Government administration, GREAT CareShield will be considered as an ESH Supplement regulated under the CPF (Withdrawals for ElderShield Scheme) Regulations. If purchased by ESH policyholders after the transfer of ESH to Government administration or by CSHL policyholders, GREAT CareShield will be considered as a CSHL Supplement regulated under the CareShield Life and Long-Term Care Act 2019.

This is only product information provided by us. You may wish to seek advice from a qualified adviser before buying the product. If you choose not to seek advice from a qualified adviser, you should consider whether the product is suitable for you. Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs.

If you decide that the policy is not suitable after purchasing the policy, you may terminate the policy in accordance with the free-look provision, if any, and the insurer may recover from you any expense incurred by the insurer in underwriting the policy.

This comparison does not include information on all similar products. Great Eastern does not guarantee that all aspects of the products have been illustrated. You may wish to conduct your own comparison for similar products. For more information, you can refer to www.careshieldlife.gov.sg

Protected up to specified limits by SDIC.

Information is correct as at 1 January 2024.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.