4 ways to start your financial planning journey

The key is to focus on starting well, here are 4 free ways to get you started on your journey

As the Tao Te Ching says, “千里之行,始于足下”, or “The journey of a thousand li, begins with a step” when translated. The good news is, that first step doesn’t have to cost you much time, or a single cent!

It’s always good to begin with getting a holistic perspective on how much you’re earning, saving, spending, and investing.

There’s no need for fancy software – a free tool like Google Sheets can do the trick to help track all your transactions.

Separating them into needs and wants is useful to get a better overview of your spending habits – for example, do you find yourself spending a significant proportion of your income on subscription services? It might be worth cancelling one or two.

Now that you have the how, you need to know the why.

In a collaborative effort with the Singapore government, a Basic Financial Planning Guide was developed to give you some basic information for those looking to take proactive steps.

Alternatively, if you prefer self-help solutions such as e-learning, attending talks and workshops, do check out the Institute of Financial Literacy for more resources.

They have an excellent e-learning video series that covers several topics including REITs, Bonds and ETFs into accessible bite-sized chunks, and it’s all free!

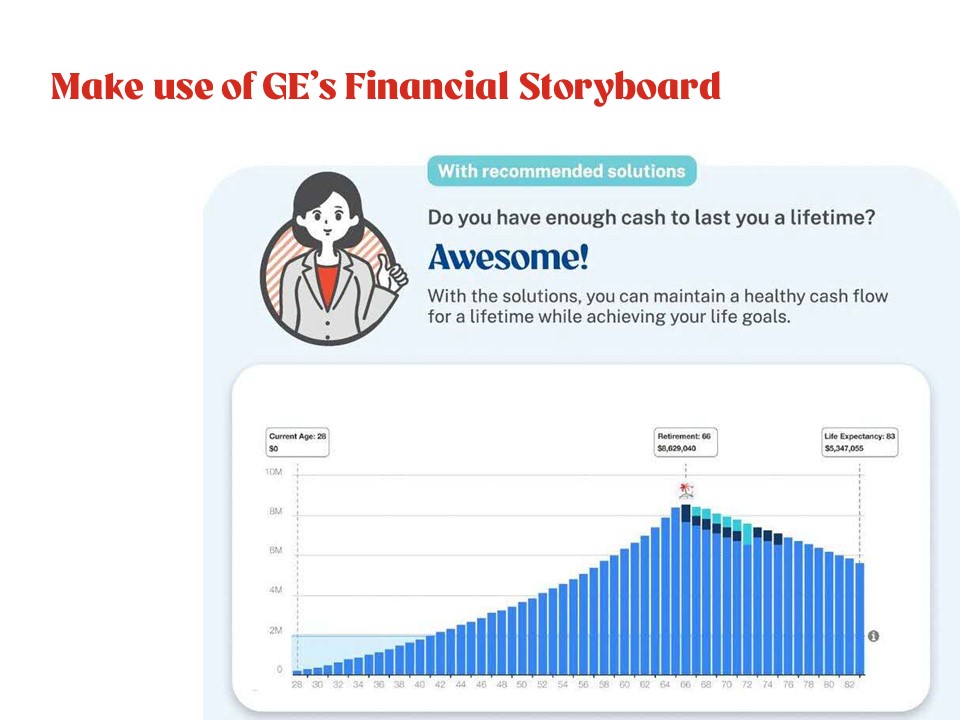

If spreadsheets are not your thing, don’t worry! Check out our very own free financial planning digital service – the Financial Storyboard.

You’ll get a customised report that informs you the state of your financial health. You can find out whether you’re doing well on any of these financial metrics:

- Cash flow

- Savings rate

- Emergency funds

- Debt levels

- Amount invested

- Protection needs and possible gaps

Pretty neat!

While all these information are free and readily available, you ultimately would want something tailored to your specific financial situation.

This is where a certified financial representative comes in. By understanding your current and future life goals, they will help you better plan how you can make your finances work for you.

A certified financial representative will be able to help you see how you may be adequately covered in unforeseen situations, such as death and total permanent disability.

They can also assist with annual reviews, especially to adapt to any changes in your financial situation. For example, an increase in your income, or taking on new liabilities like a property loan. Getting the perspective of a certified financial representative is always helpful to ensure that you not only take the first step of your financial planning journey, but that you keep taking steps.

Wouldn't it be nice to have your own Financial Storyboard?

Receive a full personalised financial report at the end of a financial planning consultation.