Ensuring more affordable cancer treatments for everyone covered under our Integrated Shield Plans

Introduction of the Ministry of Health’s Cancer Drug List and why it matters to you

The cost of cancer drug treatment in Singapore has been soaring at a compound annual growth rate of 20%. As such, there is a need to ensure greater affordability of cancer treatments and the long-term sustainability of premiums.

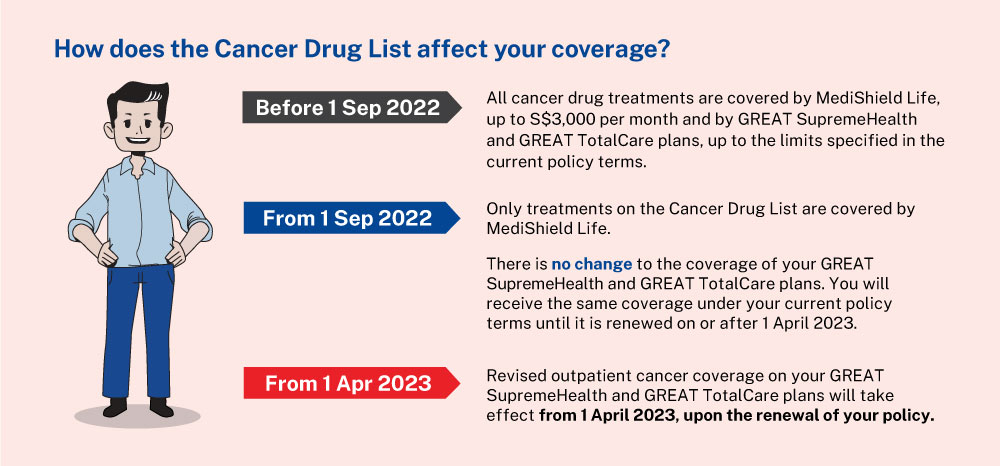

The Ministry Of Health (MOH) has developed a Cancer Drug List (CDL) comprising clinically proven and more cost-effective cancer treatments. These changes were announced on 17 August 2021 and recapped in a press release on 2 September 2022.

The use of MediShield Life and Integrated Shield Plans (IP) to reimburse outpatient cancer drug treatments will be allowed only for drug treatments on the Cancer Drug List. The Cancer Drug List currently covers most cancer drug treatments approved by the Health Sciences Authority (HSA). Ministry of Health (MOH) will update it every few months to keep up with medical advancements and the latest clinical evidence. As of 1 September 2022, more than 90% of cancer drug treatments approved by HSA are on the Cancer Drug List.

View here for the latest version of the Cancer Drug List.

How does the Cancer Drug List affect your coverage?

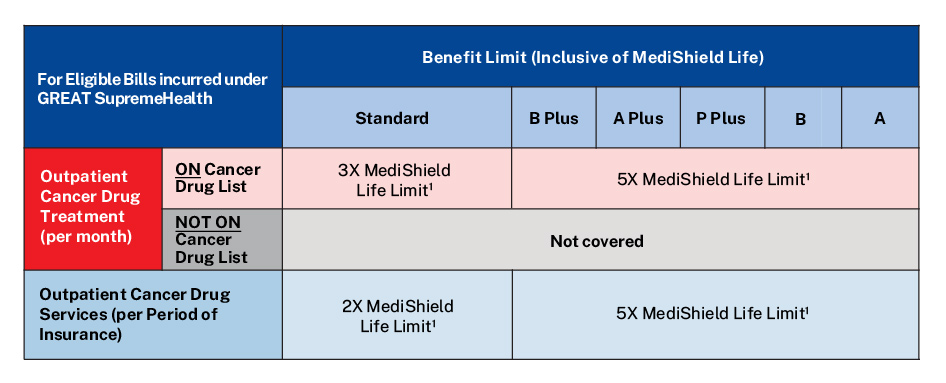

What are the changes to your GREAT SupremeHealth plan from 1 April 2023?

To ensure greater affordability of cancer treatments and the long-term sustainability of premiums, we have made the following changes.

GREAT SupremeHealth – From 1 April 2023, upon renewal of your policy, your policy’s Outpatient Chemotherapy and Immunotherapy benefit will be replaced with a new Outpatient Cancer Drug Treatment benefit and Outpatient Cancer Drug Services benefit.

- Outpatient Cancer Drug Treatment benefit – Only cancer drug treatments on the Cancer Drug List will be claimable. Selected cancer drug treatments beyond the Cancer Drug List will be claimable under GREAT TotalCare. If you are currently undergoing cancer drug treatment, please consult your doctor early on whether your treatment is on the Cancer Drug List.

- Outpatient Cancer Drug Services benefit – Services that are part of a cancer drug treatment (including such services for treatments not on the Cancer Drug List), such as consultations, scans, lab investigations, treatment preparation and administration, supportive care drugs and blood transfusions, will be claimable under the Outpatient Cancer Drug Services benefit.

To better support policyholders through these changes, we will not increase the premium rates for GREAT SupremeHealth from now until 31 August 2024 except for the following:

- when you have moved to a higher attained age with a published premium increase;

- when the Goods and Services Tax (GST) rate (from 7% to 8% in 2023 and from 8% to 9% in 2024) is revised in Singapore;

- GREAT SupremeHealth plans A and B, and standard plan where premium increase was announced on 1 April 2022. This will continue till this cycle of premium increases is completed on 31 March 2023.

This premium freeze does not apply to premiums of GREAT TotalCare and GREAT TotalCare Plus.

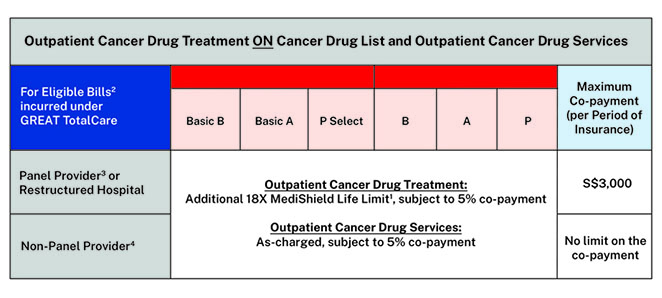

What are the enhancements to your GREAT TotalCare plan from 1 April 2023?

GREAT TotalCare – We will introduce a new Outpatient Cancer Treatment benefit to cover any remaining outpatient bill for cancer drug treatments on the Cancer Drug List as well as cancer drug services (i.e. the amount exceeding the claim limit under GREAT SupremeHealth). This new benefit will also cover selected outpatient cancer drug treatments that are not on the Cancer Drug List.

The Outpatient Cancer Treatment benefit and all other benefits will be subjected to the GREAT TotalCare annual limit per applicable plan type.

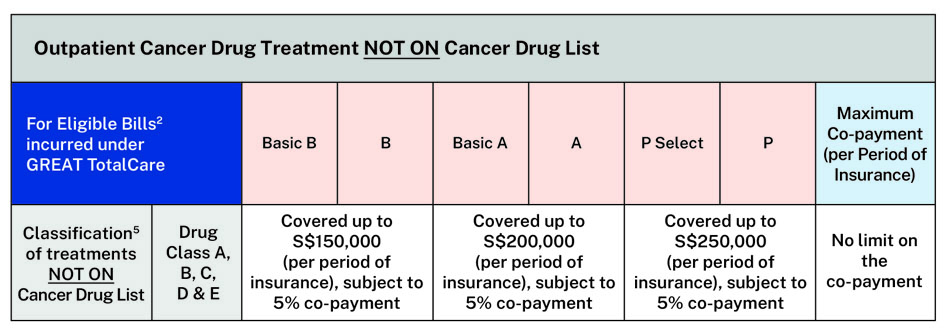

Outpatient cancer drug treatments NOT ON the Cancer Drug List are further classified into six drug classes5 (Drug Class A to Class F) according to the Life Insurance Association, Singapore.

For more information, you may refer here.

Your GREAT TotalCare plan will only cover treatments under Drug Class A to Drug Class E. Drug Class F is not covered.

Find out how your plan works, if the outpatient cancer drug treatment is ON the Cancer Drug List

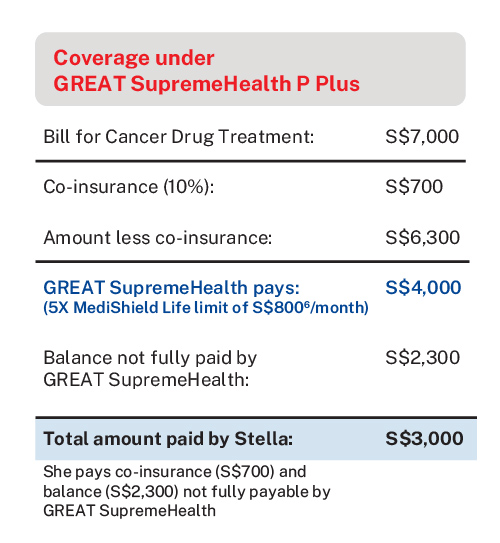

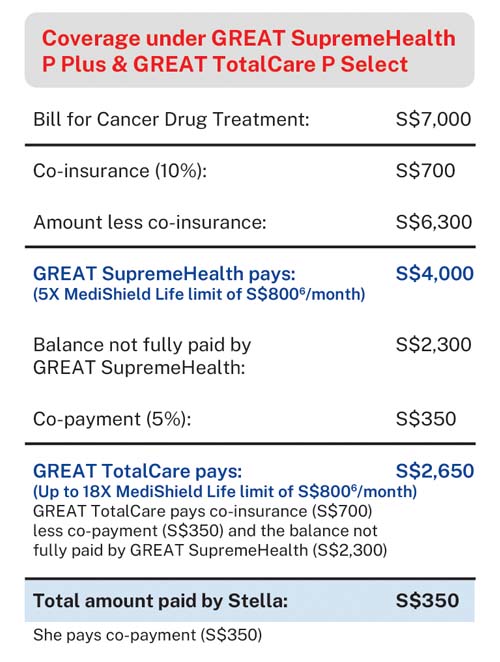

Stella, 32, a working mum is diagnosed with breast cancer. She undergoes breast cancer treatment at a Panel Provider or Restructured Hospital with drug treatment X on the Cancer Drug List (CDL).

If Stella only has GREAT SupremeHealth P Plus plan, she will be entitled to 5X MediShield Life limit claim per month for cancer drug treatment. In this case, as drug treatment X has a MediShield Life limit of S$8006 per month, she is able to claim up to S$4,0006 per month for her cancer drug treatment (inclusive of MediShield Life Limit). She will have to pay cash out-of-pocket, for any remaining balance not claimable fully by her GREAT SupremeHealth plan.

If Stella has a GREAT TotalCare P Select plan on top of her GREAT SupremeHealth P Plus plan, her co-insurance (10%) and remaining balance that is not fully payable under GREAT SupremeHealth can also be covered, up to 18X MediShield Life Limit (in this case, S$14,400), subject to minimum 5% co-payment. As she underwent treatment at a Panel Provider or restructured hospital, the minimum 5% co-payment is capped at S$3,000.

Find out how your plan works if the outpatient cancer treatment is NOT ON Cancer Drug List

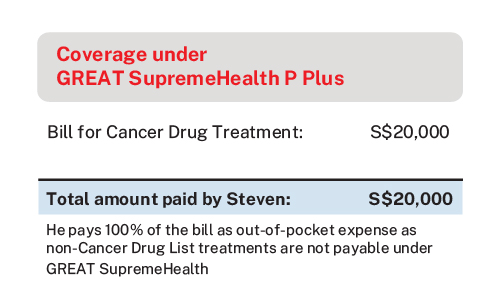

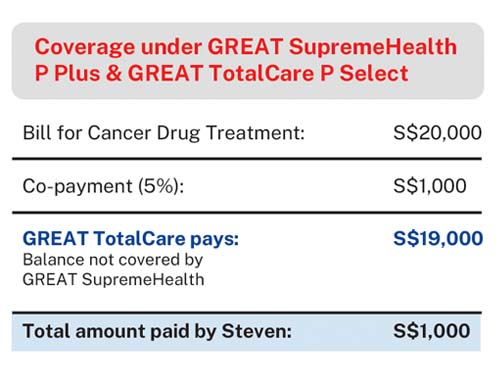

Steven 40, is undergoing prostate cancer treatment with drug treatment Y that is NOT ON Cancer Drug List.

If Steven only has GREAT SupremeHealth P Plus plan, he will not be able to claim from his GREAT SupremeHealth P Plus plan and MediShield Life. He will have to pay cash out-of-pocket for his outpatient cancer drug treatment.

If Steven has GREAT TotalCare P Select supplementary plan on top of his GREAT SupremeHealth plan, and if drug treatment Y falls under classification5 Class A to E of the Life Insurance Association's Non-CDL Classification Framework, he will be able to claim up to S$250,000 per period of insurance, subject to compulsory 5% co-payment with no co-payment limit.

Transitional support for patients undergoing Outpatient Cancer Drug Treatment

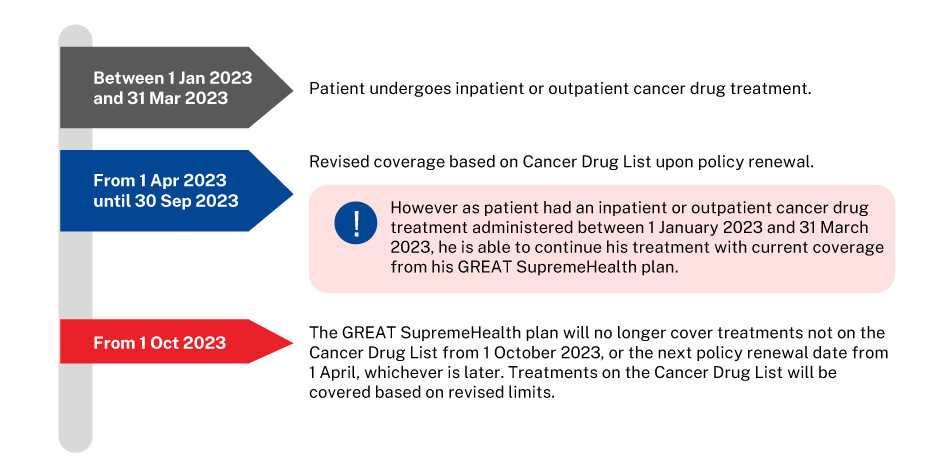

To allow sufficient time for affected patients to adjust to the new changes, if you undergo at least one inpatient or outpatient cancer drug treatment between 1 January 2023 and 31 March 2023, you will continue to receive current coverage until 30 September 2023 or your next policy renewal date from 1 April 2023, whichever is later.

What should patients do if they are undergoing Outpatient Cancer Drug Treatment that is NOT ON the Cancer Drug List?

Patients who are undergoing treatments not listed on the Cancer Drug List may wish to discuss with their doctors whether there are suitable alternative treatments on the Cancer Drug List. However, if switching to a Cancer Drug List treatment is not feasible, there is support available for those facing difficulties affording treatment.

If you are a subsidised7 patient, you can approach a Medical Social Worker (MSW) in your Public Healthcare Institution (PHI) for financial assistance such as MediFund.

If you are a non-subsidised7 patient in a PHI or a patient in a private medical institution, you can approach your doctor to refer you to subsidised care in a PHI, where financial assistance may be available. The PHI’s medical team will review your treatment plan and provide financial counselling (e.g. eligibility for subsidies) before you decide whether to proceed with the transfer.

Your questions answered

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.