Key benefits

-

Comprehensive medical protection with various deductible options tailored to your needs

GREAT MediValue offers comprehensive medical coverage with various deductible options starting from RM500 per policy year. It covers medical expenses, including pre- and post-hospitalisation treatments, Intensive Care Unit expenses and surgical fees, emergency accidental outpatient treatment and accidental death1.

-

High overall annual limit that refreshes every year with no overall lifetime limit

GREAT MediValue offers a high annual limit of RM5,000,000, with no overall lifetime limit, ensuring continuous medical coverage as you age.

This plan gives you financial peace of mind to focus on your recovery without worrying about healthcare expenses.

-

Wide range of cancer coverage from genomic test to advanced medical treatments

GREAT MediValue provides innovative cancer coverage, including genomic testing to help doctors determine the most effective treatment.

-

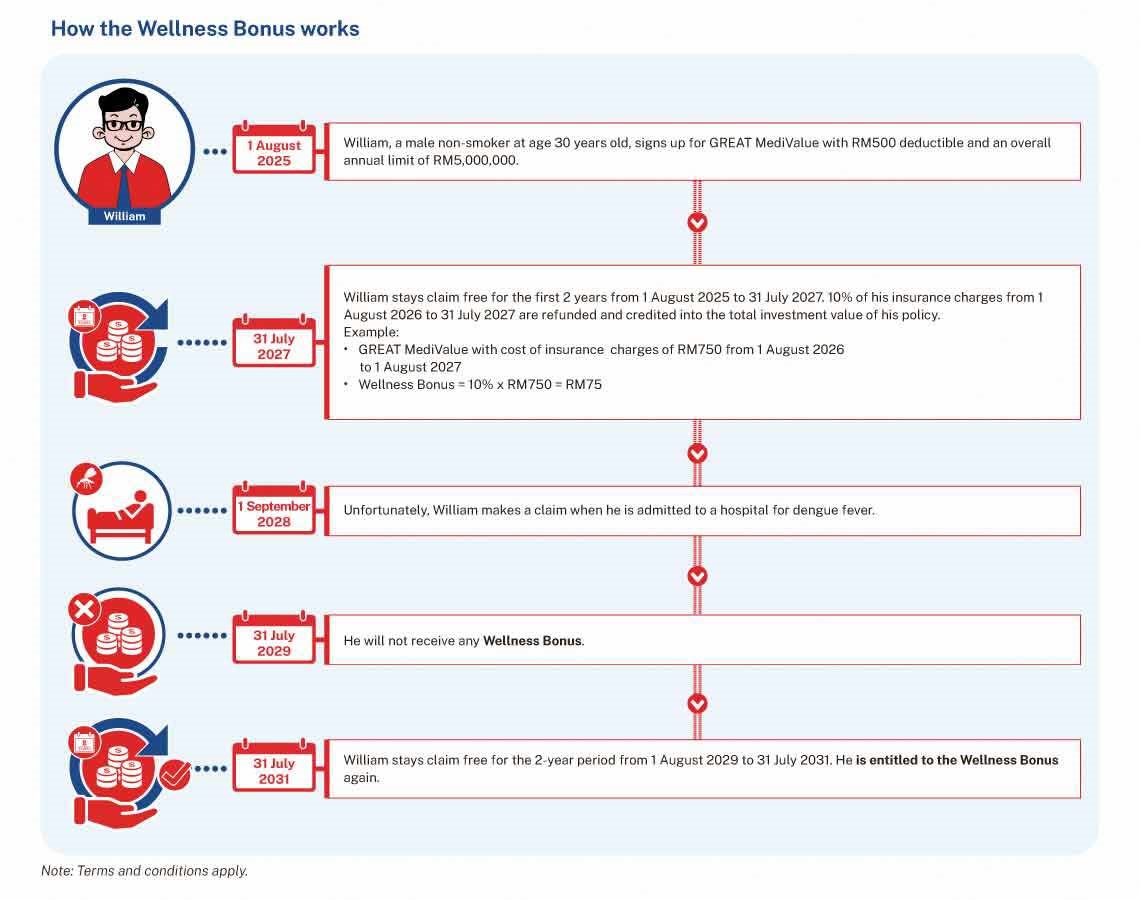

Enjoy Wellness Bonus every two years by staying healthy

GREAT MediValue rewards you for staying healthy and for not making any claims on your medical insurance. When you stay claim-free within every two-years period, 10% of the insurance charges charged in the year before each refund will be refunded and credited into the total investment value of your policy at the end of the two-years period1.

-

Introducing a designated medical pathway under The Great Journey

GREAT MediValue is our first medical plan that comes with a designated medical pathway under The Great Journey, that provides you with quality care and exclusive healthcare experience at clinics and hospitals nationwide under The Great Journey1.

Please click here for more information on The Great Journey.

Let our Life Planning Advisor

assist you to

Request a call back

Thank you for your enquiry. Fill in your details below and a Life Planning Advisor will get back to you within 48 hours.

Call times are Monday-Friday between 8.30am and 5.15pm (except Public Holiday).

Understand the details before buying

1Terms and conditions apply.

GREAT MediValue is a unit deduction medical riders attachable to selected regular premium investment-linked insurance plans. These plans are insurance products that are tied to the performance of the underlying assets, and are not pure investment products such as unit trusts. The insurance charge to be imposed will be deducted from the total investment value of your policy on a monthly basis. You may stop paying premiums under the policy and still enjoy protection as long as there is sufficient total investment value to pay for the insurance charge. However, there is a possibility of the policy lapsing when the required charges, including rider charges exceed the total investment value of the fund units available. Purchasing too many unit deduction riders may deplete the fund units.

You should satisfy yourself that these riders will best serve your needs and that the premium payable under the policy is an amount you can afford. A free-look period of 15 days is given for you to review the suitability of the Medical and Health Insurance (MHI) product. If a rider is cancelled during this period, the policy owner is entitled to the reinstatement of the units deducted for the payment of insurance charge after net of expenses incurred for the medical examination, if any. If you switch your Medical Policy/Rider from one company to another or if you exchange your current Medical Policy/Rider with another Medical Policy/Rider within the same company, you may be required to submit an application where acceptance of your proposal will be subject to the terms and conditions to be imposed at the time of Policy/Rider switching or replacement.

This above is for general information only. It is not a contract of insurance. You are advised to refer to the Product Disclosure Sheet and sample policy documents for detailed important features and benefits of the plans before purchasing the plans. The exclusions and limitations of benefits highlighted above are not exhaustive. For further information, reference shall be made to the terms and conditions specified in the policy issued by Great Eastern Life.

The terms “Great Eastern Life” and “the Company” shall refer to Great Eastern Life Assurance (Malaysia) Berhad.

PROTECTION BY PIDM ON BENEFITS PAYABLE FROM THE UNIT PORTION OF THIS POLICY/PRODUCT IS SUBJECT TO LIMITATIONS. Please refer to PIDM’s TIPS Brochure or contact Great Eastern Life Assurance (Malaysia) Berhad or PIDM (visit www.pidm.gov.my).

Information correct as on 31 January 2026.