Great Eastern Reports 1H-20 Financial Results

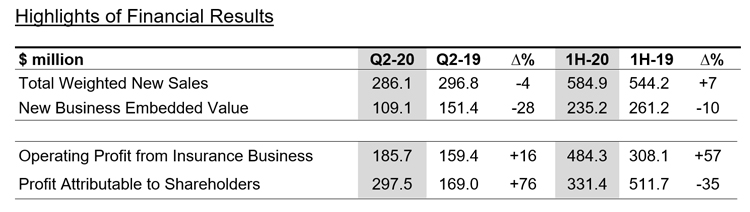

- 1H-20 Profit Attributable to Shareholders down 35% to S$331.4 million; Q2-20 up 76% to S$297.5 million

- 1H-20 Operating Profit up 57% to S$484.3 million; Q2-20 up 16% to S$185.7 million

Singapore, 28 July 2020 – Great Eastern Holdings Limited (the “Group”) today announced its financial results for half year (“1H-20”) ended 30 June 2020.

Total Weighted New Sales (“TWNS”) and New Business Embedded Value (“NBEV”)

The Group’s TWNS was 7% higher for 1H-20 compared to the same period last year. This was driven by the Singapore business, which registered a strong growth for the first six months of the year. The Group’s TWNS for Q2-20 was 4% lower compared to the same period last year due to the restricted business activities amid COVID-19. NBEV for 1H-20 and Q2-20 was lower at S$235.2 million and S$109.1 million respectively.

Profit Attributable to Shareholders

Operating Profit remains healthy, 1H-20 and Q2-20 grew 57% and 16% respectively compared to the same periods a year ago, driven by improved contribution of our core markets. The Group’s Profit Attributable to Shareholders reported a 35% decrease for 1H-20 amid unfavourable financial market conditions in Q1-20. For Q2-20, the Group’s Profit Attributable to Shareholders reported a 76% increase due to the higher Operating Profit and the higher valuation of investments as a result of improved financial market conditions during the quarter.

Regulatory Capital

The Capital Adequacy Ratios of the Group’s insurance subsidiaries in both Singapore and Malaysia remain strong and well above their respective minimum regulatory levels.

Dividend

The Board of Directors has declared an interim one-tier tax-exempt dividend of 10 cents per ordinary share for the financial year ending 31 December 2020, to be paid on 26 August 2020.

Commenting on the Group’s financial results, Group Chief Executive Officer Mr Khor Hock Seng said:

“Sales in our core markets for Q2-20 were affected by the tighter movement restriction measures implemented due to COVID-19. Bancassurance channel was significantly impacted as sales activities, which were largely conducted at bank branches were restricted. Our agency force in Singapore was able to adapt swiftly and transition to operate digitally on the back of the major digital and technology infrastructure initiatives that we have embarked on in the past two years. This has helped to cushion the impact of restricted sales activities. We remained accessible and responsive to our customers through a number of touchpoints during this period; ensuring quality customer service is delivered to them.

We have launched Great Comprehensive Care in Singapore, to meet the protection needs of the self-employed, freelancers and gig economy workers in Singapore in light of COVID-19. It is the first plan in the market to offer Hospitalisation Income, Personal Accident Coverage and Outpatient Care in a single policy. In addition, it provides for up to 12 virtual medical consultations, which can be shared among family members.

Looking ahead, uncertainty over the global economic outlook is likely to persist amid the unprecedented nature of the COVID-19 pandemic and rising geopolitical risks. We expect the economic outlook to be challenging, volatility in the financial markets and the low interest rate environment to continue, and this could impact the performance of the Group. We will continue to monitor and assess market developments closely, responding swiftly to meet the challenges faced in this rapidly shifting business landscape to meet customer and stakeholders needs.”

About Great Eastern

Founded in 1908, Great Eastern is a well-established market leader and trusted brand in Singapore and Malaysia. With over S$90 billion in assets and more than 8 million policyholders, including 5 million from government schemes, it provides insurance solutions to customers through three successful distribution channels – a tied agency force, bancassurance, and financial advisory firm Great Eastern Financial Advisers. The Group also operates in Indonesia and Brunei and has a presence in China as well as a representative office in Myanmar.

The Great Eastern Life Assurance Company Limited and Great Eastern General Insurance Limited have been assigned the financial strength and counterparty credit ratings of "AA-" by Standard and Poor's since 2010, one of the highest among Asian life insurance companies. Great Eastern's asset management subsidiary, Lion Global Investors Limited, is one of the largest private sector asset management companies in Southeast Asia.

Great Eastern is a subsidiary of OCBC Bank, the longest established Singapore bank, formed in 1932. It is now the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with an Aa1 rating from Moody’s. Recognised for its financial strength and stability, OCBC Bank is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

#GreatEasternSG #TheLifeCompany #Lifeproof

Media Contacts

Annette Pau

VP, Group Corporate Communications

Email: Corpcomms-sg@greateasternlife.com

Crystal Chan

AVP, Group Corporate Communications

Email: Corpcomms-sg@greateasternlife.com