Great Eastern Reports 9M-20 Financial Results

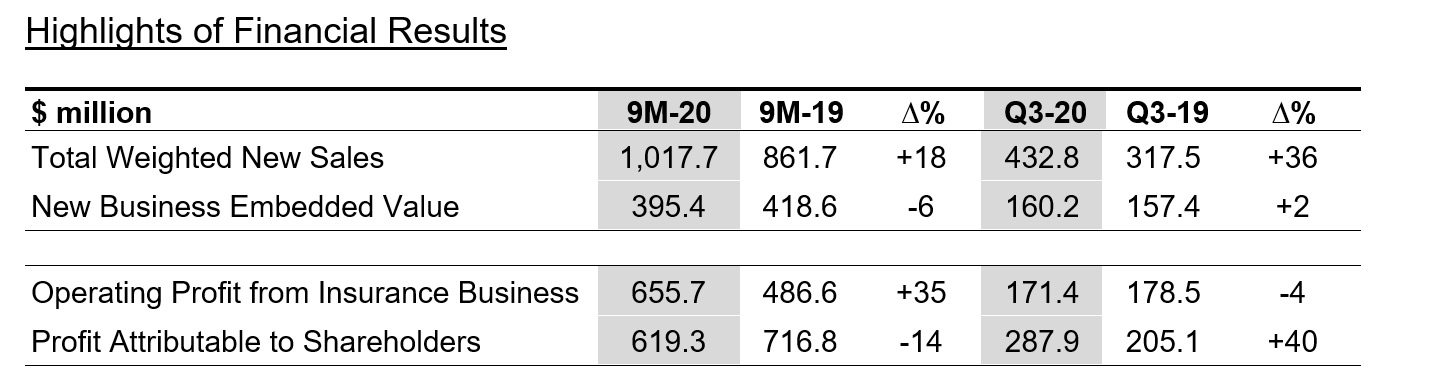

- 9M-20 Profit Attributable to Shareholders down 14% to S$619.3 million; Q3-20 up 40% to S$287.9 million

- 9M-20 Total Weighted New Sales up 18% to S$1,017.7 million; Q3-20 up 36% to S$432.8 million

Singapore, 04 November 2020 – Great Eastern Holdings Limited (the “Group”) today reported its financial results for nine months (“9M-20”) ended 30 September 2020.

Total Weighted New Sales (“TWNS”) and New Business Embedded Value (“NBEV”)

The Group registered strong TWNS growth for both 9M-20 and Q3-20, reporting an increase of 18% and 36% respectively. TWNS growth for the first nine months was driven by strong momentum from the Singapore business, while growth for the third quarter was contributed by the pick-up of activity across all markets. NBEV was 6% lower at S$395.4 million for 9M-20 and 2% higher at S$160.2 million for Q3-20.

Profit Attributable to Shareholders

Operating profit in Q3-20 was slightly lower due to higher new business strain because of higher sales in Singapore. For 9M-20, Operating Profit recorded a strong growth of 35%, driven by improved contribution across all markets. The Group’s Profit Attributable to Shareholders reported a 14% decrease for 9M-20 amid unfavourable financial market conditions in Q1-20, while Q3-20 reported a 40% increase mainly due to the higher valuation of investments, as a result of improved financial market conditions during the quarter.

Regulatory Capital

The Capital Adequacy Ratios of the Group’s insurance subsidiaries in both Singapore and Malaysia remain strong and well above their respective minimum regulatory levels.

Commenting on the Group’s financial results, Group Chief Executive Officer Mr Khor Hock Seng said:

“The Group’s focus on strengthening our distribution capabilities paid off in the first nine months of the year. Our agency force was able to adapt swiftly in the current operating environment, capitalising on the digital and technology infrastructure provided by the company and this has contributed to the Group’s strong sales performance. Across the region, our agency force size has surpassed 30,000 financial representatives through the consistent execution of our recruitment strategy to grow and strengthen our agency channel. We are committed to boost hiring and offer opportunities amid employment uncertainties. In Singapore, we have hired more than 1,000 financial representatives, welcoming recruits from a range of diverse backgrounds, such as fresh graduates and mid-career individuals.

Our major digital and technology infrastructure initiatives have helped us cushion the impact of movement controls, which restricted sales activities and we will continue to make headway on that front. We have recently launched a Great Eastern mobile app to provide customers with active policy management capabilities and better visibility of wealth and protection policy benefits. Also, we have been actively expanding our digital reach and in Singapore, have partnered Singtel to launch a range of general insurance products, which span home, motor and travel and feature telco-centric benefits to address customers’ unique needs arising from their increasingly digital lifestyles.

In the near future, uncertainties are likely to persist. Nonetheless, it remains critical that we continue to strengthen our reach and continue to innovate to better serve the needs of our customers.”

About Great Eastern

Founded in 1908, Great Eastern is a well-established market leader and trusted brand in Singapore and Malaysia. With over S$90 billion in assets and more than 8 million policyholders, including 5 million from government schemes, it provides insurance solutions to customers through three successful distribution channels – a tied agency force, bancassurance, and financial advisory firm Great Eastern Financial Advisers. The Group also operates in Indonesia and Brunei and has a presence in China as well as a representative office in Myanmar.

The Great Eastern Life Assurance Company Limited and Great Eastern General Limited have been assigned the financial strength and counterparty credit ratings of "AA-" by Standard and Poor's since 2010, one of the highest among Asian life insurance companies. Great Eastern's asset management subsidiary, Lion Global Investors Limited, is one of the largest private sector asset management companies in Southeast Asia.

Great Eastern is a subsidiary of OCBC Bank, the longest established Singapore bank, formed in 1932. It is now the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with an Aa1 rating from Moody’s. Recognised for its financial strength and stability, OCBC Bank is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

#GreatEasternSG #TheLifeCompany #Lifeproof

The “Unaudited Financial Summary for 9M-20” is posted on SGXNet.

For more information, please contact:

Annette Pau

Head, Group Corporate Communications

Email: Corpcomms-sg@greateasternlife.com

Low Lai Fong

Senior Vice President, Group Finance

Email: investor-relations@greateasternlife.com