- Customer Services

- Claims

- Medical / Hospitalisation

- Make a new medical and hospitalisation claim

Make a medical and hospitalisation claim under your Integrated Shield plans

Medical and hospitalisation claims are part of your Integrated Shield plan coverage, reimbursing eligible costs incurred during your hospitalisation or day surgery stay.

If you're making plans for a hospital stay, consider:

- Preserve your annual benefit limit by informing the hospital during admission that you wish to activate your employee benefit or other policies first

- Contacting the Great Eastern Medical Care Concierge for advice on where to seek treatment to best utilise your Great Eastern policies

If you want to make a claim for bills incurred before or after hospitalisation, visit the Make a pre and post hospitalisation claim page.

Topics covered

Claim coverage

When GREAT SupremeHealth, a MediSave-approved Integrated Shield Plan, is supplemented with GREAT TotalCare, up to 95%* of the total hospitalisation bill due to an illness or injury can be covered, keeping out-of-pocket expenses to a minimum.

Your coverage limits vary depending on your policy type. Contact our claims hotline at +65 6856 8548 on weekdays from 9.00am to 5.30pm or your Financial Representative for specific details.

*Applicable when the GREAT SupremeHealth plan is attached with either:

a) GREAT TotalCare A plan or GREAT TotalCare B plan;

b) GREAT TotalCare P Signature and for bills incurred at Panel Providers and/or at Restructured Hospitals; or

c) GREAT TotalCare P Optimum and for bills incurred at Restructured Hospitals.

Step-by-step claim guide

1. Submitting a claim

a. Check if your employer provides coverage

If you have coverage through your employer, consider initiating a claim under your employer’s group insurer to make the most of your policies. With the last-payer status of MediSave-approved Integrated Shield Plans, and in accordance with the Ministry of Health’s (MOH) claims protocol, other insurers providing similar medical coverage are required to refund the amounts paid out under your GREAT SupremeHealth plan. This can help to:

- Preserve your annual benefit limit for any future claims

- Reduce your out-of-pocket expenses

- Better manage the premium increment under the Claims-Adjusted Pricing framework for GREAT TotalCare P Signature plans

Once you know your surgery details and date, request a Letter of Guarantee (LOG) from your employer's group insurer. On the day of admission, inform the staff that you want to claim from your employer's group insurer and provide them with the LOG.

For more details, refer to Participate in claims recovery to fully utilise your policies.

b. Check your eligibility for electronic filing (e-filing)

E-filing is a process by which hospitals and accredited clinics in Singapore will help submit claims electronically on your behalf directly with Great Eastern. To be eligible, you must satisfy all of the following criteria:

- You are covered under GREAT SupremeHealth.

- You are a Singapore citizen or permanent resident.

- Your bills were incurred in Singapore.

Inform the hospital staff at the point of admission and they will handle the necessary paperwork for you. For accredited clinics, check with the clinic to see if they offer this option.

You'll be notified by SMS once we receive your claim, and when it has been approved.

Gather documents if not eligible for e-filing

If you are not eligible for e-filing, initiate a claim after discharge. Include these documents in your claim submission:

| Form | Purpose |

| Claimant's Statement | To be completed with details of your claim |

| ClinicalcAbstract Application | Allows us to obtain medical information relating to your hospitalisation from the medical institution(s) |

| Doctor’s Statement | Required only if your claim is more than SGD2,000 or more than your plan's deductible amount. Find out how you can obtain a copy from your attending doctor. |

You will also need to submit the following documents:

1. Final hospital and medical bills

2. Screenshot of MediSave payment and claims record (if bills were paid with MediSave)

- Retrieve it from the CPF website with a web browser using the following path:

my cpf > “My dashboards” under Healthcare > Latest healthcare payments and claims

3. Hospital discharge summary report (if available)

4. Reimbursement letter or discharge voucher from the insurer or employer (if there was previous

reimbursement from another insurer or employer)

5. A copy of your bank statement stating the account number and account holder's name (if you wish to receive

payment via direct credit)

- For faster payout, link your NRIC/FIN to your PayNow account using your banking app instead

Tips for submitting documents successfully

- Digital copies preferred: Submit the PDF copy if your clinic had provided one or download your bills from the HealthHub app if you had visited a restructured hospital.

- Clear photos get processed faster: View our guide for tips on taking good photos of medical bills and some examples for reference.

c. Submit via the following channels

Online form

Make an online submission with your completed forms and supporting documents.

Walk-in or post

Drop off the completed forms and supporting documents at our customer service centre (address below) or send them to us by post.

Attention to: Claims Department

The Great Eastern LifeAssurance Company Limited

1 Pickering Street

Great Eastern Centre #01-01

Singapore 048659

Alternatively, you can submit a claim via your Financial Representative, who can also help follow up on your specific needs.

2. Tracking claim progress

While your claim is being processed, you may receive updates from us via SMS or mail.

We will SMS you once we have completed the claim assessment. A letter with a breakdown of the claim reimbursement, including information about the claim outcome and a detailed breakdown of the final payout, will be available on the Great Eastern App within 2 working days.

Claims processing duration

While we strive to complete claims processing in a prompt manner, some claims may require additional time. The table below shows the median claims processing duration for the past month.

| Median claims processing duration (days) | 75th percentile processing claims duration |

| 0 (same day) | 0 |

Notes:

- Data period is from 1 to 31 Jan 2026.

- Median claims processing duration means that 50 out of 100 claims are processed by the insurer within the indicated number of days in the table.

- 75th percentile claims processing duration means that 75 out of 100 claims are processed by the insurer within the indicated number of days in the table.

- Our information is published on a monthly basis, whereas the Ministry of Health website publishes on a quarterly basis.

3. Getting claim payout

We will make payment directly to the hospital or clinic. This payment includes the amount paid using MediShieldLife, which is a component of the GREAT SupremeHealth Integrated Shield plan.

The hospital or clinic will finalise the bills and contact you regarding outstanding amounts or refunds (if any).

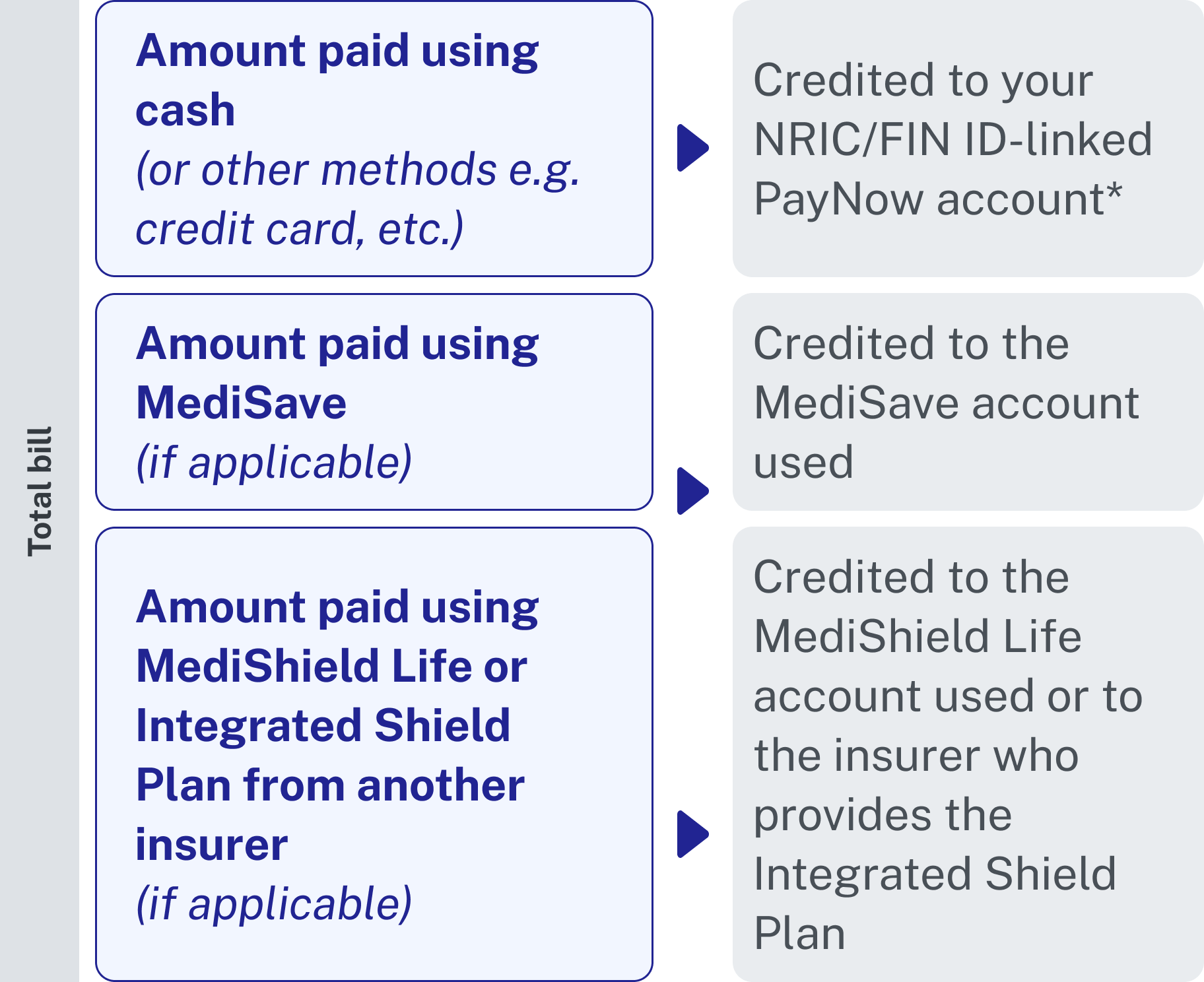

For claims made under Great Eastern’sIntegrated Shield Plans (i.e. GREAT SupremeHealth/GREAT TotalCare)

We will reimburse in the following order:

- Cash payment

- MediSave account

For claims made under Great Eastern’s non-Integrated Shield Plans (e.g. Premier Health Plan, Hospital & Surgical Protector)

We will reimburse in the following order:

- Cash payment

- MediSave account

- MediShield Life or MediSave-approved Integrated Shield Plan provided by other insurers

*If you do not have a PayNow account linked to your NRIC or FIN, you may link your NRIC/FIN to your PayNow account using your banking app for a faster payout. [new line without bullet] If you had provided your passport number during purchase, you will also need to update your NRIC/FIN using the Update of personal particulars form.

* If you do not have PayNow linked to your NRIC or FIN, you may:

- Link your NRIC/FIN to your PayNow using your banking app for a faster payout. Customers who had provided your passport number during purchase will also need to update your NRIC/FIN with us using the Update of personal particulars form

For enquiries

You can contact our customer service for queries.

| Hotline | +65 6856 8548 | Available weekdays from 9.00am to 5.30pm |

| medicalclaims-sg@greateasternlife.com | We will respond within 3 working days |

Questions and Answers

GREAT CareShield Advantage and GREAT CareShield Enhanced provides worldwide coverage. Follow these steps to file your claim if you are overseas:

a. Obtain the claimant's statement, or contact the our customer service centre to request for a copy to be mailed to you.

b. Submit the completed statement, together with any available medical reports (from registered practitioners in Western medicine)

- Provide the name, address and clinic of the doctor certifying your medical condition.

c. Upon receipt of the information, we will send the Assessor’s Statement to you doctor, who will assess the severity of your disability and send the completed statement back to us.

d. We will assess the claim and, where necessary, request your disability to be assessed by a specialist in your country of residence, to be appointed by us.

For claims made from overseas, we shall make every reasonable effort to assess the disability and make claim payments.

Under these circumstances, we may pay out the benefit in a single payment reflecting the present value of future benefit payments.

Yes, you will need to go for another medical assessment.

Yes, you will be be fully reimbursed for the fees upon admission of the claim.

Yes, assessors will take into consideration if an insured is suspected to be cognitively impaired.

Not all GPs would have undergone the rigorous training programme to learn how to assess disability. You will still be required to undergo disability assessment by an accredited assessor.

If you are staying in a nursing home, you may approach your nursing home for assistance to submit the Resident Assessment Form in place of the severe disability assessment.

Yes, you may be required to go to our panel assessor for periodic examination. We shall keep you informed when such requirements arise.

We will bear all charges for the reviews.

No. If we have assessed during the periodic review that your disability has worsened to the inability to perform 2 or more ADLs, the monthly payout from your plan will start 90 days from the date your disability is confirmed and certified to have worsened.

No, you will only be required to complete a single claim form and assessment for your both policies.

A Doctor’s Statement is required only if the claim amount exceeds the deductible amount. The deductible is the amount which must be borne by the policyholder before any benefit becomes payable under GREAT SupremeHealth. Check your policy contract for details on your deductible, which varies by age and ward type. You will be required to bear thecost of the Doctor’s Statement.

For claims less than S$2,000 or less than the deductible amount for GREAT SupremeHealth / MaxHealth / Premier Health Plan (with deductible), we may waive the medical report if there is sufficient documentary evidence to show the cause of hospitalisation or disability and period of disability. An example is a doctor's memo certifying certifying the date of accident, the injuries sustained and diagnosis.

The process is slightly different depending on the type of hospital at which your diagnosis was made. The Doctor's Statement can only be completed by the doctor who certified your condition.

For restructured hospitals

a. Download and print the Doctor's Statement template and bring it along with you to the hospital.

b. Apply through the hospital's Medical Report Office.

c. Make payment.

d. Your application may take approximately 6 to 8 weeks.

For private hospitals and specialist clinics

a. Download and print the Doctor's Statement template and bring it along with you to the hospital.

b. Pass the Doctor's Statement to your attending doctor to complete during your visit.

c. Make payment.

d. Your Doctor's Statement will be completed during your visit.