How to achieve your wealth goals and life insurance needs with an investment-linked policy

A 5-part series from Great Eastern and Lion Global Investors to help you get your wealth in the best of health

Have you ever thought of fulfilling your wealth accumulation goals with an Investment-Linked Plan (‘ILP’), which comprises of an investment component as well as life insurance coverage. That is right, not only do you benefit from the performances of your underlying investments, you also receive insurance coverage. Let us guide you to find out how an ILP can help you achieve your wealth goals while enjoying life insurance needs concurrently.

What is an Investment-Linked Plan?

When a policyholder pays premiums on the ILP, the premiums are used to purchase units in one or more sub-funds.

Why is an ILP chosen for wealth accumulation or investment?

Since we are on the topic of the performances of the sub-funds, you can find out how an ILP helps a policyholder to achieve his/her short-term to long-term wealth goals.

1. Access ILP funds managed by professional managers

We are often so busy with our professional lives that we neither have the time nor the interest to learn the technicalities of investment. At the same time, we also recognize the importance of investment. Not to worry, that is where an ILP could be a viable solution as the funds are left in the good hands of professional fund managers.

For instance, GREAT Wealth Advantage and GREAT Invest Advantage invest into ILP sub-funds selected by you. Some of the funds available for your selection are managed by Lion Global Investors Limited (‘LGI’), an award winning and trusted name in fund management. Most recently, LGI added these awards to its long list of accolades:

• Insurance Fund House of the Year - Singapore by Institutional Asset Management Awards (IAMA) 2021

• Asset Management Company of the Year Singapore 2021 by Global Banking & Finance Awards®

• Best Fund House in ASEAN by Professional Investments Awards (Insights & Mandate) 2021

• Best Digital Wealth Management - Singapore by Asia Asset Management Best of the Best Awards 2021

• Best Institutional House since 2018 by Asia Asset Management Best of the Best Awards 2021

Source: Lion Global Investors Limited

With a long-term focus on business fundamentals and a disciplined investment approach, LGI and our appointed fund managers* are here to do the heavy lifting so that the policyholders can focus on doing what they do best in their everyday lives.

* Past performance of the manager is not necessary indicative of its future performance.

2. Customisation of investment portfolio to suit risk appetite and investment horizon

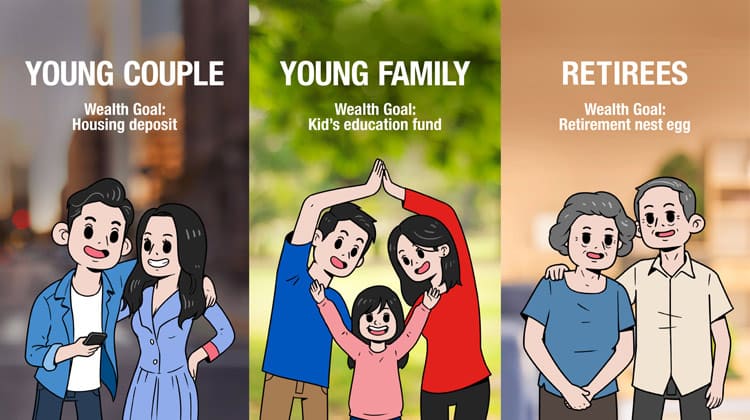

ILP is highly versatile as the underlying investment portfolio can be customised according to the policyholder’s circumstances. This can vary in terms of risk appetite, investment horizon, investment outlook as well as wealth goals. That is because each policyholder could be at different life stages – whether as a young couple saving for the all-important housing deposit, or as young parents accumulating an education fund or as retirees looking for low-risk investments.

Moreover, policyholders can perform fund switching for free as they continue to optimise their portfolios as they enter different life stages. GREAT Wealth Advantage and GREAT Invest Advantage offer flexibility to withdraw partial funds or for a full surrender should there be a requirement for emergency funds in the household.

3. Invest with different sources of funds

Another reason why ILP helps with your wealth accumulation goals is that it allows the policyholders to invest using their “untapped” funds. For instance, GREAT Invest Advantage allows policyholders to pay the premiums with funds from their CPF Investment Scheme (‘CPFIS’) or Supplementary Retirement Scheme (‘SRS’). This additional source of funding allows the policyholders to put more assets to work with the possibility of generating a potentially better financial return than leaving them untouched otherwise.

In addition, the regularity of the premiums is also flexible. Policyholder may want to (i) capitalise on a big downturn by investing a single premium or (ii) mitigate timing risks with dollar cost averaging by making regular premium payments.

All this flexibility in terms of payment options afforded by ILP provides a platform for investors to build long-term wealth.

Comprehensive financial advisory through Great Eastern financial representatives

Great Eastern financial representatives provide financial advice as to wealth accumulation solutions like GREAT Wealth Advantage and GREAT Invest Advantage to support wealth goals. Coupled with their professional training and experience, they are well placed to provide the most comprehensive financial advisory service that you will ever need.

An ILP meets dual objectives

Having explained how an ILP helps to achieve wealth goals while concurrently providing insurance coverage, you can speak to a Great Eastern financial representative to understand the key benefits of GREAT Invest Advantage and GREAT Wealth Advantage today. With them alongside you, you will find that you are one step closer to achieving your wealth goals.

Disclaimers:

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Investments in these plans are subject to investment risks including the possible loss of the principal amount invested. The value of the units in the fund(s) and the income accruing to the units, if any, may fall or rise. Please refer to Fund Details and Product Highlights Sheet for the specific risks of the fund(s). Past performance is not necessarily indicative of future performance.

For GREAT Invest Advantage, a single premium or recurrent single premium ILP, there is the flexibility for partial surrender anytime as long as the policy is inforce.

For GREAT Wealth Advantage, a regular premium ILP to achieve medium- and long-term goals, partial withdrawal is not encouraged in the first 10 policy years as penalty will be levied.

The information presented is for general information only and does not have regard to the specific investment objectives, financial situation or particular needs of any particular person.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

This is part 1 of the 5-parter series.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.