Diversify to achieve better investment outcomes

A 5-part series from Great Eastern and Lion Global Investors to help you get your wealth in the best of health

There is a saying that goes “Don’t put all your eggs into one basket”. This advice can be applied to our daily life situations, including how to manage your investment portfolio. Diversification can help to reduce the market risks and volatility associated with each individual investment asset. That is because diversification involves spreading the risks across different types of investments. As a result, the diversified portfolio would consist of investment assets that perform differently in a market event. Thus, preventing the likelihood of a single catastrophic event wiping out the entire investment portfolio. For clients who are considering Investment-Linked Policies (‘ILP’),it is important to adopt the diversification approach in their investment portfolios. There are several ways to diversify your ILP portfolio, but one of the easiest approach might be to adopt the popular “Core-Satellite” investment strategy.

What is the Core-Satellite investment strategy?

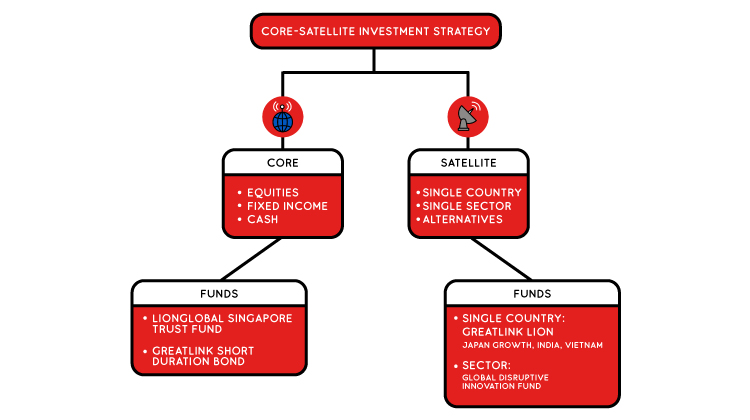

Core-Satellite Investing is a simple and easy to understand approach towards portfolio construction, and it is designed to minimise costs and volatility while providing a possibility to outperform the broader market. In an ILP, the Core portion could consist of underlying funds that invest in equities, fixed income and cash. The portfolio is then supplemented by the Satellite portion, made up of assets that may have the potential for higher growth but usually associated with higher risks. Diagram 1 explains the components within a Core-Satellite investment strategy, and using funds managed by Lion Global Investors (‘LGI’), to illustrate a hypothetical example on how to achieve a diversified mix.

Diagram 1: An example of a Core-Satellite investment strategy. Note: The diagram is for illustrative purpose only.

Diagram 1: An example of a Core-Satellite investment strategy. Note: The diagram is for illustrative purpose only.

Ideally, the Core portion should comprise of traditional investment asset classes (i.e equities, fixed income and cash) and preferably come with income payouts to provide some assurance of margin. Also, the Core portion provides a medium-to-long term potential that supports wealth accumulation for investors. For example, the GreatLink Diversified Growth Portfolio can be considered as a core holding to mitigate unforeseen market volatility. The fund is a globally diversified fund comprising equities and bonds with 3 exchange-traded funds and 5 unit trusts.

The Satellite component could potentially be made of funds that provide narrower exposures to specific country, sector, commodity and even non-traditional asset classes, known as alternatives. Its holdings in a portfolio can be either supplementary or concentrated in a way that reflects the investor’s personal views and provide potential higher returns than the holdings in the Core portion.

Lion Global Investors is the fund manager of single-country equities funds such as the GreatLink Lion India, GreatLink Lion Vietnam, as well as, the GreatLink Lion Japan Growth. These funds may serve as proxies to these countries’ economic growth.

Note: The funds mentioned above are for illustrative purposes only, and does not consider your specific investment objectives, financial situation or needs and not intended as an offer or recommendation.

Diversification through Customisation

Customisation is another approach to achieve diversification in an ILP. In this sense, an ILP is highly versatile as the underlying investment portfolio can be customised according to the policyholder’s circumstances. This can vary in terms of risk appetite, investment horizon, investment outlook as well as wealth goals. That is because each policyholder could be at different life stages – whether as a young couple saving for the all-important housing deposit, or as young parents accumulating an education fund or as retirees looking for low-risk investments.

Moreover, policyholders can perform fund switching at no extra charges as they continue to optimise their portfolios when entering each different life stage. GREAT Wealth Advantage^ and GREAT Invest Advantage^^ offer flexibility to withdraw funds partially or for a full surrender should there be a need for emergency funds in the household.

ILP that provides diversification

Lion Global Investors Limited, an award-winning and trusted name in fund management, manages well-diversified ILP funds that help investors achieve their wealth goals. Some of these funds are available in wealth solutions distributed by Great Eastern financial representatives. Do speak to a Great Eastern financial representative to understand the key benefits of GREAT Wealth Advantage^ and GREAT Invest Advantage^^. With them alongside you, you are never alone in this journey towards achieving your financial life goals.

^GREAT Wealth Advantage, a regular premium ILP, partial withdrawal/full surrender is available anytime but not encouraged in the first 10 policy years as partial withdrawal/full surrender charges are applicable.

^^GREAT Invest Advantage, a single premium ILP, there is the flexibility for partial surrender anytime as long as the account value is positive.

Note: Past performance of the manager is not necessary indicative of its future performance.

Disclaimers:

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Investments in these plans are subject to investment risks including the possible loss of the principal amount invested. Please refer to Fund Details and Product Highlights Sheet for the specific risks of the Fund(s). Past performance is not necessarily indicative of future performance.

A product summary and a Product Highlights Sheet in relation to the Fund(s) may be obtained through Great Eastern Life Assurance Co Ltd or its financial representatives. Potential investors should read the Product Summary and the Product Highlights Sheet before deciding whether to invest in the Fund(s). Returns on the units of the Fund(s) are not guaranteed. The value of the units in the Fund(s) and the income accruing to the units, if any, may fall or rise.

The information presented is for general information only, and does not have regard to the specific investment objectives, financial situation or particular needs of any particular person, and should not be construed as an advice or recommendation to invest in the Funds.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

Protected up to specified limits by SDIC.

This is part 3 of the 5-parter series.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.