Dollar cost averaging vs lump sum investing- what works best for an ILP

A 5-part series from Great Eastern and Lion Global Investors to help you get your wealth in the best of health

One of the flexibilities of an Investment-linked Plan (‘ILP’) is that it allows easy implementation of 2 broad investment strategies:

(i) Dollar Cost Averaging and

(ii) Lump Sum Investing.

Add this to the fact that investors are also free to customise their investment portfolios to suit their respective risk appetites and investment horizon, and you can understand why ILP can help you achieve your wealth goals.

The Dollar Cost Averaging Investment Strategy

Dollar Cost Averaging (‘DCA’) is an investment strategy in which an investor divides up the total amount to be invested across periodic purchases of a target asset. The main objective is to reduce the impact of volatility brought by the exigencies of the market. Let us illustrate this with an example of an investor who makes his investment via an ILP across 6 months.

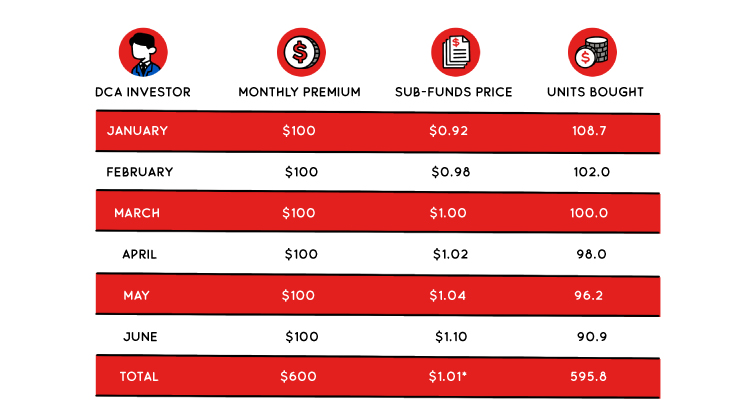

Diagram 1: Dollar-cost averaging across 6 months *Refer to the average price of the sub-funds.

Diagram 1: Dollar-cost averaging across 6 months *Refer to the average price of the sub-funds.

As shown in Diagram 1, the investors enjoy these advantages from DCA:

- Avoid the stress of having to monitor the highs and lows of the market. Instead, the investor commits to investing $100 monthly and hence does not time the market for an ideal entry point.

- Market volatility and risks have been significantly reduced in his portfolio. For example, the investor need not risk buying in only at a high price of $1.10 in June. Instead, his average buying in price was $1.01 as a result of DCA.

- In addition, the Investor can gain confidence and time by starting with smaller amounts initially before progressing to invest more in later years as his earning power increases.

Ultimately, with the regular savings discipline instilled via a DCA approach, the investor is likely to experience slower but surer long-term positive financial returns.

*Refer to the average price of the sub-funds.

The Lump Sum Investing Investment Strategy

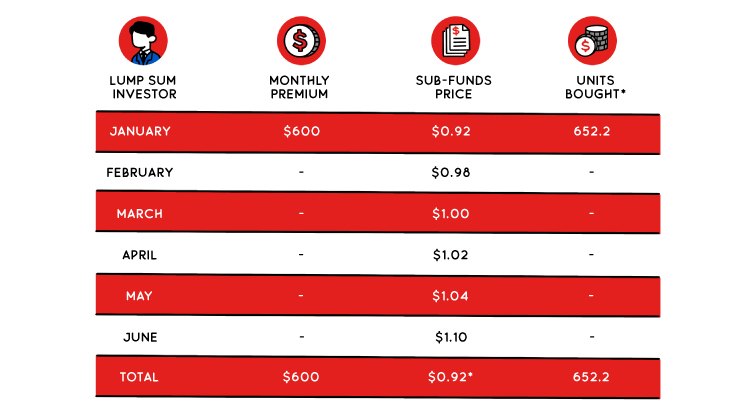

On the contrary, lump sum investing refers to the investment strategy of putting in the entire intended investment amount at one go. This provides a longer time horizon for the power of compounding to work its magic and return better performances compared to DCA. Returning to Diagram 1, if the investor practises lump sum investing, he would have invested all $600 in January and incurred an average buy-in price of $0.92 for 652.2 units.

Although the lump sum investor may have gained 56.4 more units in this scenario, he would have to commit to bigger financial output and also may be at a disadvantage if his entry price is on the high side.

*Refer to the average price of the sub-funds.

*Refer to the average price of the sub-funds.

For the astute investor, a lump sum investing strategy means that he or she can capitalise on market dips to invest opportunistically with the dry gunpowder that has been set aside. However, as no one can predict the outcome of the market with certainty, the investor must be able to stomach the short-term market volatility that comes with lump sum investing.

Quality of Underlying Investment Equally Important

As every investor is different, there isn’t a common investing strategy to suit everyone. Therefore, DCA may work perfectly for one but not for the other. However, what is often neglected in the consideration is the quality of the underlying investment itself.

Great Eastern conducts selective screening of fund managers by assessing their track records before introducing top performing funds to support our customers. One of our fund managers, Lion Global Investors, an award-winning and trusted name in fund management, was awarded the coveted Insurance Fund House of the Year – Singapore at the Institutional Asset Management Awards (IAMA) 2021*. One of their funds, the LionGlobal Japan Growth Fund SGD was awarded Best Fund over 3 Years at the Refinitiv Lipper Fund Awards 2021*.

*Source: Lion Global Investors

Note: Past performance of the fund and the manager is not necessarily indicative of its future performance.

In addition, through Great Eastern financial representatives, investors can undertake their preferred investment strategies with 2 available wealth solutions which invest into ILP sub-funds selected by you:

A. GREAT Wealth Advantage – This is a regular premium whole life investment-linked plan that comes with additional features such as Welcome Bonus and Loyalty Bonus that boost your investments. Premiums must be paid in cash and this is ideal for a DCA investment strategy.

B. GREAT Invest Advantage – This is a single premium or recurring single premium whole life investment-linked plan whereby the premiums can be paid with funds from CPFIS or SRS. Since CPF and SRS funds are most probably sitting idle, you can consider using these for lump sum investing. There is also no lock-in requirement, ensuring that the cashflow is entirely under the investor’s control.

Besides gaining access to these professionally managed funds, an investor also gets more value from the ability to customise his portfolio as well as enjoy life insurance coverage against death and terminal illness without undergoing any medical assessment. In addition, for the case of GREAT Wealth Advantage, investors are also covered for total and permanent disability as well.

Having explained the differences between DCA and Lump Sum Investing, you can speak to a Great Eastern representative to understand the key benefits of GREAT Invest Advantage and GREAT Wealth Advantage today. With them alongside you, you will find that you are one step closer to achieving your wealth goals.

Disclaimers:

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Investments in these plans are subject to investment risks including the possible loss of the principal amount invested. Please refer to Fund Details and Product Highlights Sheet for the specific risks of the fund(s). Past performance is not necessarily indicative of future performance.

A product summary and a Product Highlights Sheet in relation to the funds may be obtained through Great Eastern or its financial representatives. Potential investors should read the product summary and the Product Highlights Sheet before deciding whether to invest in the funds. Returns on the units of the funds are not guaranteed. The value of the units in the funds and the income accruing to the units, if any, may fall or rise.

The information presented is for general information only and does not have regard to the specific investment objectives, financial situation or particular needs of any particular person and should not be construed as an advice or recommendation to invest in the funds.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

This is part 2 of the 5-parter series.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.