Key benefits

-

Assurance of hospital cash payouts after 12 hours^

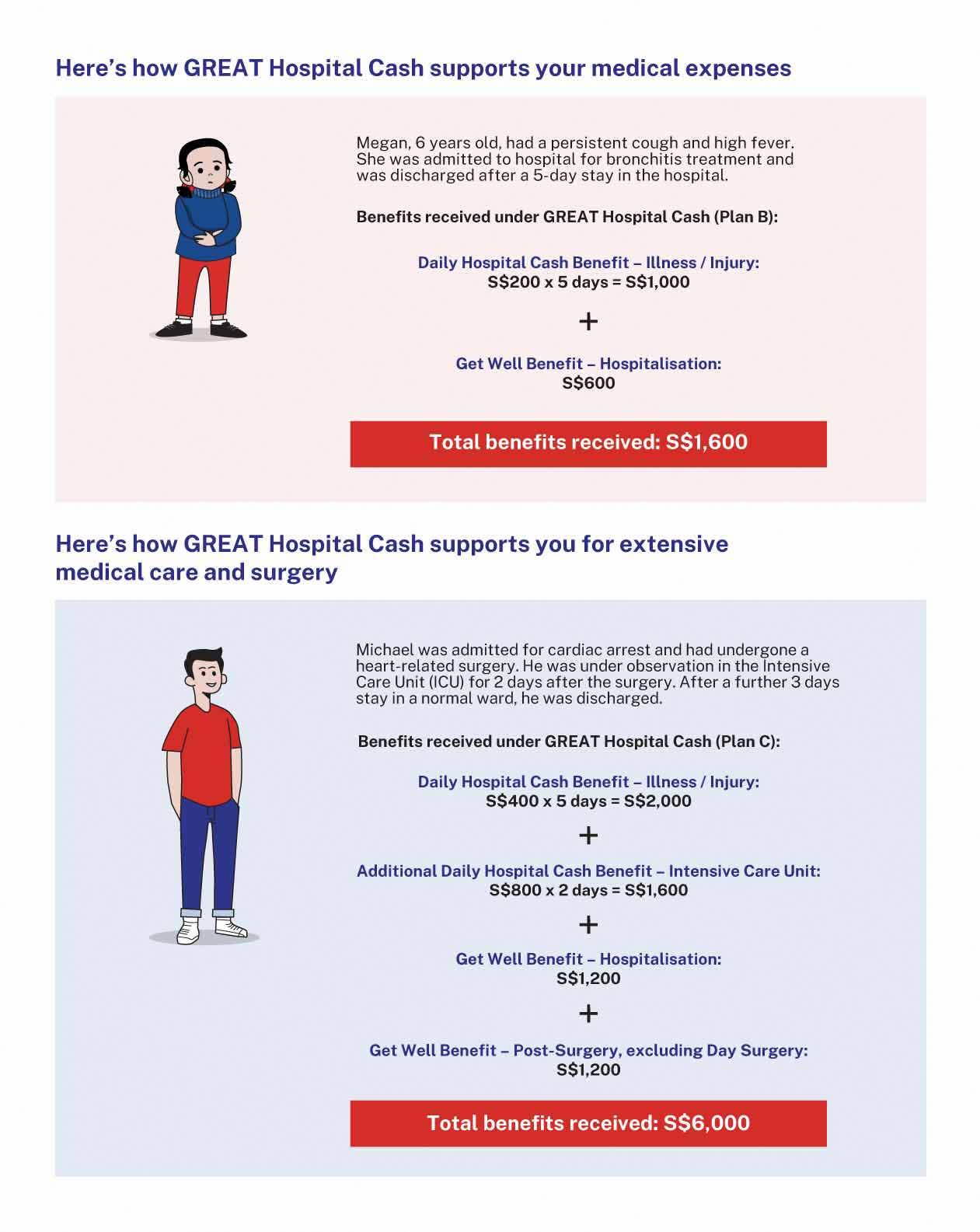

Receive up to S$600 per day when you are hospitalised for 12 hours^ or longer. You will also receive an additional payout of up to S$1,200# per day if you are warded in the Intensive Care Unit (ICU).

To extend our support for your recovery, you will get an additional lump sum up to S$1,800 with at least 3 days of hospitalisation, and another payout up to S$1,800‡ if surgery is needed.

-

Enjoy up to a lifetime of hospitalisation coverage

Complement your existing hospital and surgical plan with up to a lifetime of hospitalisation coverage†.

-

Enjoy more discounts on your premiums

Starting from the second year of your plan, you will get a 5% discount on your premiums when you renew, even if you have made a claim.

In addition, if you have GREAT SupremeHealth with us, you will get to enjoy an additional 20% discount on your GREAT Hospital Cash premiums for as long as you are insured under GREAT SupremeHealth.

-

Sign up online and start your coverage with ease

Enjoy a hassle-free online application with just 3 simple questions.

Your questions answered

1. How can GREAT Hospital Cash complement a Hospital & Surgical Reimbursement Plan?

Most hospital & surgical plans reimburse the hospital bills incurred up to the applicable benefit limits of said plans. GREAT Hospital Cash will provide cash payouts to cover your out-of-pocket hospital expenses and reimburses medical expenses arising from outpatient medical treatment due to injury at an Accident and Emergency department (A&E) in a hospital (treatment must be given within 72 hours of the occurrence of the accident).

2. Will the premiums increase with age?

Premiums of GREAT Hospital Cash will increase with age (by age bands) based on the age next birthday of the life assured. Premium rates for GREAT Hospital Cash are not guaranteed and may be adjusted based on future experience. We reserve the rights to amend premium rates and will provide notice of at least 30 days to the Policyholder.

3. Does GREAT Hospital Cash cover my pre-existing condition?

GREAT Hospital Cash will not pay any benefits or reimburse any medical expenses incurred in respect of, or arising from any pre-existing conditions.

Pre-existing condition refers to:

(a) Any injury, illness, disease, disability, defect or impairments from which the life assured was suffering prior to the commencement date of insurance; or

(b) Any injury, illness, disease, disability, defect or impairment of which signs or symptoms had existed in the 12 months immediately preceding the commencement date of insurance, for which:

(i) the life assured had sought or received medical advice or treatment, prescription of drugs, counselling, investigation or diagnostic tests, surgery, hospitalisation; or

(ii) an ordinarily prudent person would have sought medical advice or treatment, prescription of drugs, counselling, investigation or diagnostic tests, surgery, hospitalisation.

4. What is the difference between Get Well Benefit - Hospitalisation and Get Well Benefit - Post-Surgery, excluding Day Surgery? Can I claim for both benefits at the same time?

Get Well Benefit – Hospitalisation will be paid in a lump sum if the life assured undergoes hospitalisation for which at least 3 days of room and board charges were incurred, that the life assured undergoes due to an illness or injury.

Get Well Benefit - Post-Surgery, excluding Day Surgery will be paid in a lump sum for each hospitalization if the life assured undergoes Surgery (excluding day surgery) due to an illness or injury during his hospitalisation.

Yes, both benefits will be payable concurrently for a hospitalisation if at least 3 days of room and board charges were incurred and you had undergone surgery (except day surgery) during that hospitalisation.

5. Does GREAT Hospital Cash cover me when I am hospitalised overseas?

Yes, GREAT Hospital Cash covers hospitalisation outside of Singapore, provided that the life assured must not have resided outside of the Singapore for more than 180 days, whether continuously or otherwise during the period of insurance prior to the renewal date.

6. Is there a lifetime or annual limit for GREAT Hospital Cash?

No, there is no lifetime or annual limit for GREAT Hospital Cash.

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

*Treatment must be given within 72 hours of the occurrence of the accident.

^ Hospitalisation refers to confinement of the Life Assured in a Hospital or at home under Virtual Hospital Ward admission by a Restructured Hospital, which must be considered Medically Necessary and:

(a) for 12 consecutive hours or longer; or

(b) for which a room and board charge is made in connection with such confinement.

# Additional Daily Hospital Cash Benefit - Intensive Care Unit (ICU) will be payable for each day that the life assured undergoes hospitalisation in an ICU due to an illness or injury, up to a maximum period of 60 days for each hospitalisation. For such hospitalisation in an ICU beyond 60 days, we will treat such hospitalisation as that in a normal ward.

‡ Excluding day surgery, and subject to terms and conditions.

† Subject to the terms of renewal.

All ages specified refer to age next birthday.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract. This is only product information provided by us. You may wish to seek advice from a qualified adviser before buying the product. If you choose not to seek advice from a qualified adviser, you should consider whether the product is suitable for you. Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs. If you decide that the policy is not suitable after purchasing the policy, you may terminate the policy in accordance with the free-look provision, if any, and the insurer may recover from you any expense incurred by the insurer in underwriting the policy.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

In case of discrepancy between the English and Chinese versions, the English version shall prevail.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Information correct as at 26 August 2025.