Key Benefits

-

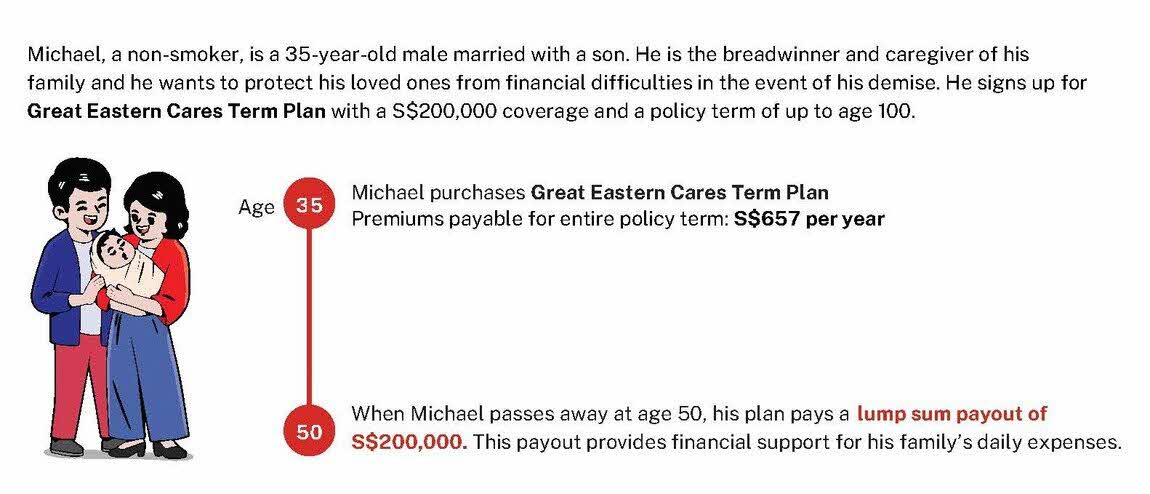

Affordable term protection from 33 cents* per day

Get basic protection against death and terminal illness.

-

Your choice on insurance coverage and duration of term

Choose your desired insurance coverage starting from S$100,000 to S$300,000 to plan for the financial support of your dependants. Decide between coverage terms of up to age 85 or up to age 100 to best suit your needs.

-

Get preferred term protection – specially for you

Exclusively offered to our selected charities and non-profit organisations, your protection is made most affordable to support your insurance needs.

Your questions answered

1. Who is eligible to buy this plan?

You must be:

- a Singaporean, Singaporean PR or a foreigner with valid passes (Employment Pass and Personalised Employment Pass holders, EntrePass holders, S-Pass holders, Dependant Pass holders, Long Term Visit Pass-Plus (LTVP+) holders, Selected Long Term Visit Pass holders, Work Permit holders); and

- a Special Needs Trust Company (SNTC) client. The policyholder must nominate the Person with Disabilities (PwDs) as the nominee and SNTC as the Trustee via irrevocable trust nomination. The policy will not be incepted and/or be considered void without a valid SNTC trust nomination.

2. What is the minimum and maximum entry age?

| Age Next Birthday | Minimum Entry Age | Maximum Entry Age |

|---|---|---|

| Life Assured | 17 | 75 |

| Policyholder | 17 | No limit |

3. What is the minimum and maximum sum assured?

The minimum sum assured is S$100,000 and the maximum sum assured is S$300,000.

The maximum sum assured is applied on a per life assured basis, and is subject to underwriting by the company.

4. Is there a minimum premium?

Great Eastern Cares Term plan has a minimum premium of S$120 a year.

5. What is payable in the event of a claim?

| Type of Claim | Benefit Payable | What happens to the policy after claim is paid out? |

|---|---|---|

| Death | If Death or Terminal Illness occurs before policy expiry, we will pay the Sum Assured or total premiums paid, whichever is higher. | Policy will terminate after the claim is paid out. |

| Terminal Illness |

6. What are the exclusions under this plan?

The full set of exclusions and conditions of payment are set out in the policy contract.

Death Benefit

The payment of the Death Benefit will not be made for death due to suicide while sane or insane within twelve (12) months from the Date of Issue or date of reinstatement (if applicable) of the Policy and the Policy will be rendered void. The Company will refund all premiums paid for the Policy without interest.

Terminal Illness Benefit

Terminal Illness in the presence of Human Immunodeficiency Virus (“HIV”) infection and Pre-existing Terminal Illness will be excluded.

7. Does Great Eastern have a panel of doctors?

Yes, the Company has a panel of doctors. The list will be provided should medical check-up be required.

8. Do I have to pay for the medical check-up?

You do not have to pay for the routine medical check-up which is requested by the company. However, should you decide to free-look the policy, the cost of the medical check-up will be deducted before refund of premiums. If further investigation/s are required, such cost shall be borne by the applicant.

9. What if I change my mind about the new policy, i.e. how do I freelook my policy?

This Policy may be cancelled by written request to the Company within 14 days after the Policyholder has received the policy document in which case premiums paid less medical fees (if applicable) incurred in assessing the risk under this Policy will be refunded.

If the policy document is sent by post, it is deemed to have been delivered and received in the ordinary course of the post 7 days after the date of posting.

10. Can I download my policy documents online?

You can access eConnect, our online self-help service, to check your policy information, and perform simple transactions:

- Visit our Great Eastern website at www.greateasternlife.com

- At the top of the homepage, select “Login” tab and choose “eConnect”.

- You will be directed to the eConnect login page. Key in your NRIC/ Passport number and password, and click “Log in”.

- Register for Security Authentication (2FA) and enter the OTP no. sent to your mobile phone via SMS. You can now access eConnect.

11. How do you inform me when premium is due?

You will not receive premium notices if you are paying by monthly mode. For all other modes of payment, premium notices will be sent via email/SMS.

12. What are the payment methods available?

Please refer to the Premium payment guidelines (PDF) and PayNow QR FAQ.

13. Will I receive any receipt after I pay my renewal premium?

An official receipt will be mailed to the policyholder upon receipt of the payment of renewal premium. No receipt will be issued for payment via GIRO or credit card.

14. What if I do not pay the premiums on time?

If premiums are not paid on time, your policy will lapse after the 30 days grace period. However, reinstatement of the policy is allowed within 3 years from the lapse date and usual reinstatement conditions apply.

15. What is the penalty for early termination of policy?

If you cancel your Policy within the free-look period i.e. 14 days from receiving your policy document, you will get a refund of your premiums paid less any medical fees. If you surrender your Policy after the free-look period, you will lose all of the premiums paid. Purchasing a new policy may require underwriting and may result in higher premiums and/or benefit exclusions due to your age and health status at the point of re-application.

16. How do I submit a claim?

You may download and print the claim forms from our Great Eastern website at www.greateasternlife.com

- Click on “Quick Links” and select “Submit a Claim”. Choose the relevant form you need from the list, and print it.

- Fill in the required forms and ask your doctor to complete the doctor’s statement.

- Submit all the required forms and supporting documents to us for assessment.

17. How do I check my claims status?

You may check on the status of your submitted claim through any of these options:

- Log on to e-Connect for online information about your policies.

- Email us at LifePAClaims-SG@greateasternlife.com

Policyholders may view your policy details via eConnect. Should you wish to contact us, you may do so in the following ways:

- Send an email enquiry to wecare-sg@greateasternlife.com

- Call our Customer Service Officers at 1800-248 2888

- Visit us at our Customer Service Centre.

We are located at:

- 1 Pickering Street #01-01, Great Eastern Centre, Singapore 048659

- 2 Tanjong Katong Road #13-01, Paya Lebar Quarter 3, Singapore 437161

- 1 Gateway Drive #18-00, Westgate Tower, Singapore 608531

We are open Monday to Friday: 9.00am to 5.30pm. Our cashier operating hours: 9.00am to 4.30pm.

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

*Daily rates are based on annual premium of an age 17, male non-smoker of sum assured of $100,000, policy term of up to age 85, divided by 365 days rounded to the nearest cent.

All ages specified refer to age next birthday.

All figures used are for illustrative purposes only and are subject to rounding.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

As this product has no savings or investment feature, there is no cash value if the policy ends or is terminated prematurely.

You may wish to seek advice from a financial adviser before making a commitment to purchase this product. If you choose not to seek advice from a financial adviser, you should consider whether this product is suitable for you.

This policy is protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

In case of discrepancy between the English and Chinese versions, the English version shall prevail.

Information correct as at 11 March 2024.