Key Benefits

-

Lifetime protection of up to 13 times2 the premium paid

Invest with either a single premium or flexible premiums3 for 5 or 10 years, to create an immediate estate and enhance your legacy. The non-lapse guarantee4 ensures your protection for the first five policy years, regardless of market performance, allowing your investment to reach its full potential.

-

Potential growth with protection from market volatility

Based on your risk tolerance and financial aspirations, you can choose from 4 premium apportionment options between the Index Account(s) and Fixed Account:

Option 1 Option 2 Option 3 Option 4 Index Account(s) 100% 75% 50% 0% Fixed Account 0% 25% 50% 100% · Index Account(s): Choose from a selection of global indices and benefit from higher potential returns5 with the assurance of a guaranteed minimum floor rate of 0% p.a. to safeguard your account from market downturns.

· Fixed Account: Benefit from a guaranteed crediting rate of 4.20% p.a. for the first year. Thereafter, the rate will be based on the prevailing rate determined by Great Eastern, with a guaranteed minimum crediting rate of 2.00% p.a..

-

Flexibility to adapt to your life’s changing needs

• Opt for the automatic premium spread feature to distribute your net premium6 to your Index Account(s) across 12 months, reducing the impact of market fluctuations for stable long-term returns.

• Adjust your risk preferences by changing premium apportionments and/or reallocating the amounts held in your Fixed Account and/or Index Account(s) from the 3rd policy year.

• Extend the policy benefits by changing the life assured7 and passing the policy on to the next generation.

Begin your Year of the Horse with our Index Universal Life plans, built for resilient and long‑term wealth.

From now till 31 March 2026, enjoy an additional 38% segment participation rate on the S&P 500® Engle 6% VT TCA Index and the UBS Multi Asset Engle 6% Index, elevating growth while enhancing your protection value. Find out more.

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

1 Please be aware that if the US Dollar is not your home currency, you will be exposed to foreign exchange volatility risk.

2 Based on the illustration of a 40-year-old male, non-smoker, with a standard risk class, residing in Region S, with 100% Index Account premium apportionment and a sum assured of USD 0.5 million for a single premium policy. The actual premium payable varies based on the life assured’s age at entry, gender, smoker status, country of residency at inception, underwriting risk class, sum assured, premium apportionment mix and index account apportionment mix.

3 Flexible premiums refer to the planned premium amount payable during the selected premium payment term of 5 or 10 years. The initial planned premium as shown in the policy illustration must be paid before the policy is issued. Subsequent premium payments can be made at any time and with any amount, subject to approval and the amount meeting the minimum premium requirement. Please refer to the policy illustration and product summary for more details.

4 For single premium policies, the non-lapse guarantee feature is only applicable for the first 5 policy years provided that no partial withdrawals are made, there is no change to the life assured, there is no reduction in basic sum assured and no policy loan is taken. For flexible premium policies, the non-lapse guarantee feature is only applicable for the first 5 policy years provided that no partial withdrawals are made, there is no change to the life assured, there is no reduction in basic sum assured, no policy loan is taken, and the minimum premium requirement is paid to date during the non-lapse guarantee period.

5 The crediting rate for the Index Account(s) is calculated based on the performance of the underlying index, subject to the underlying index's applicable cap rates, applicable participation rates and a 0% p.a. floor rate, plus a loyalty crediting rate (if any). Please refer to the policy illustration and product summary for more details.

6 Net premium refers to the gross premium(s) less any applicable premium charge.

7 Applicable from the 3rd policy year onwards. For single premium policies, this is only allowed when there is no premium financing. Acceptance of the new life assured is subject to underwriting. Other terms and conditions apply.

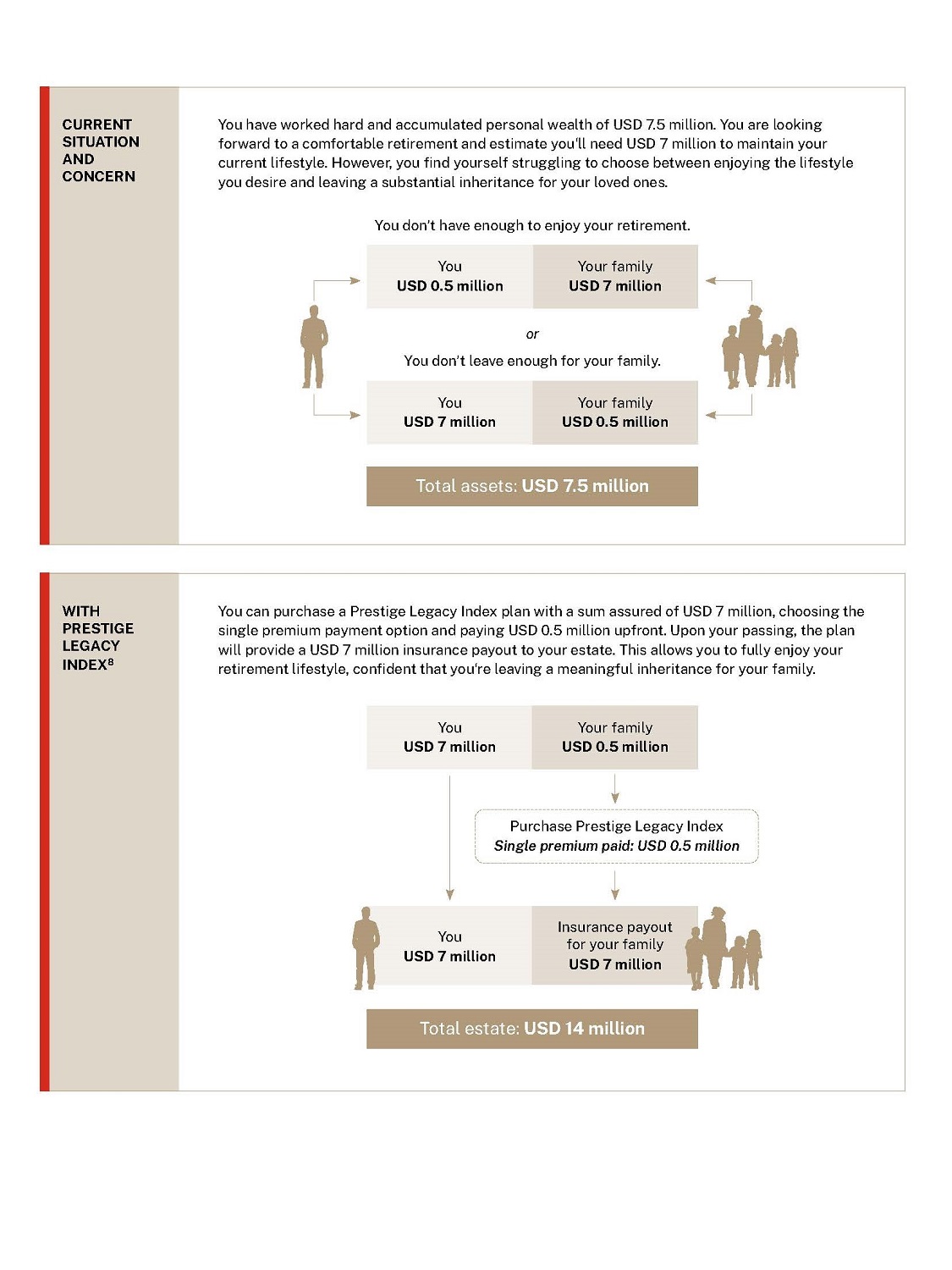

8 All figures are illustrated based on a 40-year-old male, non-smoker, with a standard risk class, residing in Region S, with 100% Index Account premium apportionment. Numbers are purely illustrative and not an indication of actual premiums. The actual premium payable varies based on the life assured’s age at entry, gender, smoker status, country of residency at inception, underwriting risk class, sum assured, premium apportionment mix and index account apportionment mix.

To learn more about the change of premium apportionment, account reallocation feature, partial withdrawal, surrender charges and the terms and conditions, please refer to the product summary for more details.

All ages specified refer to age last birthday.

All figures used are for illustrative purposes only and are subject to rounding.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance or a recommendation to buy an insurance product or service. This document does not take into account the specific investment and protection aims, financial situation or particular needs of any particular person. You may wish to seek advice from a financial adviser before making a commitment to purchase this product. If you choose not to seek advice from a financial adviser, you should consider whether this product is suitable for you.

The precise terms and conditions of this insurance plan are specified in the policy contract. If you are interested in the insurance product, you should read the product summary and policy illustration (available from us) before deciding whether to buy this product.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

In case of discrepancy between the English and the Chinese versions, the English version shall prevail.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Information correct as at 21 November 2025.