Key Benefits

-

Enjoy high protection with certainty

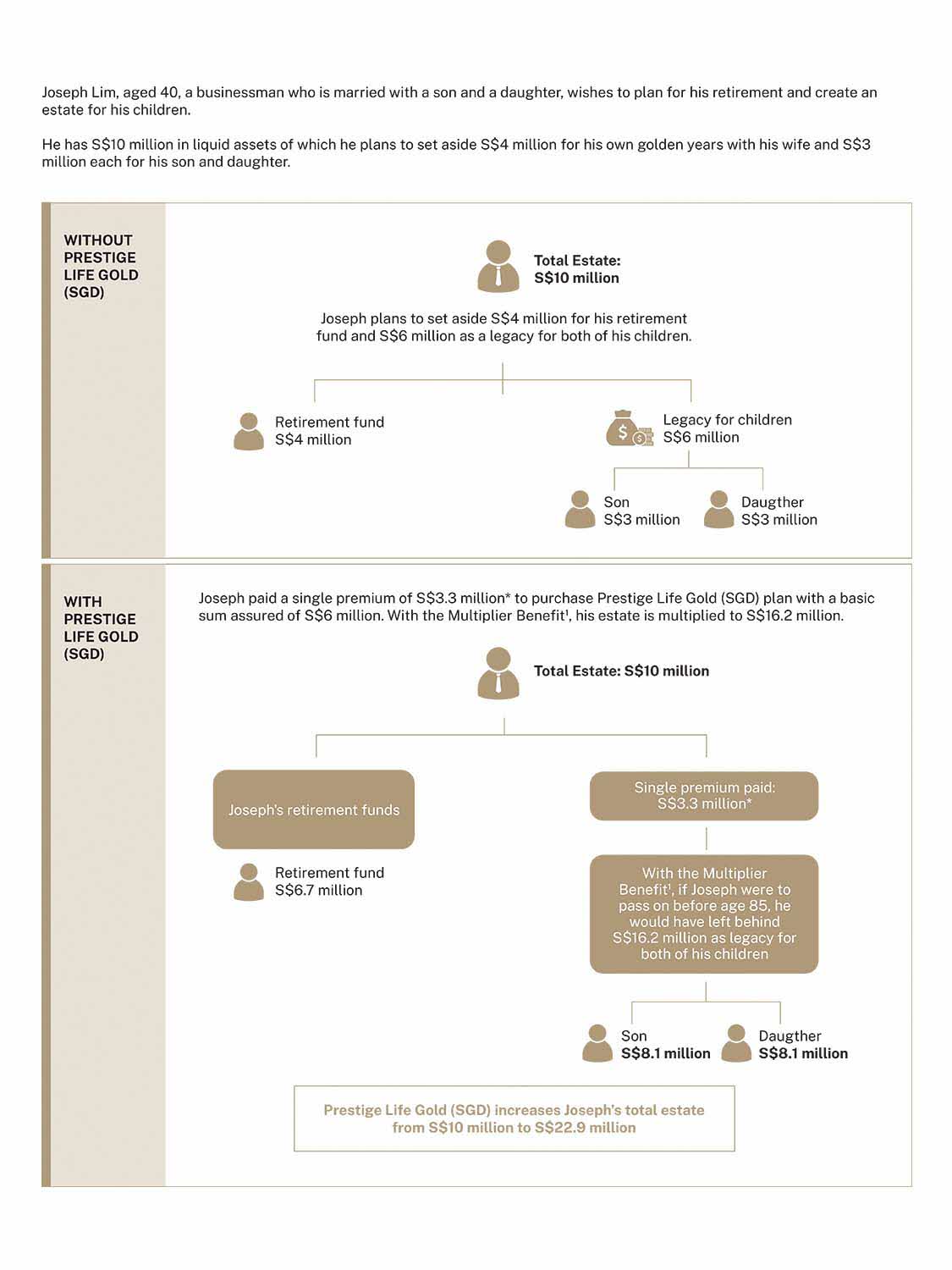

Lifetime coverage against death and terminal Illness that can be multiplied up to 3.15 times1 or 3.45 times1 of the basic sum assured for the SGD and the USD plans respectively.

-

Make the best choices at the right time

Ensure that you are well covered with the option to continue enjoying the multiplier benefits of the plan when you opt to extend your multiplier expiry age from 85 to 100.

Whether your policy is purchased for your personal planning or business needs, you have the option to change the life assured as the need arises.

-

Maintain liquidity and financial flexibility

Enjoy the assurance of having a minimum cash surrender value of at least 80% of your single premium from day 1. What’s more, with non-guaranteed bonuses added on to this plan, you can further enhance the cash value of your policy.

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

1 The Multiplier Benefit is a multiple of the basic sum assured, with such multiple depending on the life assured’s age next birthday at entry when the policy commences. It will expire on the policy anniversary on which the life assured’s age next birthday is equal to the multiplier expiry age of 85, unless the expiry age is extended to 100, using the Multiplier Extender. The life assured has the option to extend the multiplier expiry age from age 85 next birthday to age 100 next birthday during every 3rd policy anniversary from the date of commencement, provided that the option is utilised before the life assured is age 70 next birthday and if there are no previously approved claims and no current application(s) for a claim under this Policy or any other policies and riders issued by the Company on the same life assured. For more details, please refer to the Product Summary.

* The figures used here are in SGD, but the plan is also available in USD. Numbers are purely illustrative and not an indication of actual premiums. To get the exact premium based on your desired sum assured, we will need to take into consideration the currency of the plan, age at entry, gender, smoker status, country of residency at inception and underwriting risk class.

All ages specified refer to age next birthday.

The figures used are for illustrative purposes only and are subject to rounding. Please refer to the policy illustration and product summary for the exact values.

Prestige Life Gold (SGD) and Prestige Life Gold (USD) consist of a participating whole of life insurance plan and a non-participating term rider that covers both death and terminal illness. Please be aware that if the US Dollar is not your home currency, you will be exposed to foreign exchange volatility risk.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

In case of discrepancy between the English and the Chinese versions, the English version shall prevail.

Information correct as at 15 May 2024.