This e-publication is for internal sharing only and is not to be distributed outside of the company.

Hear from Our Leaders

Highlights of the Quarter

» Catch the highlights of the Achievers Day Congress!

» Great Eastern’s latest brand campaign promotes the importance of critical illness protection

» Enhanced Dependants’ Protection Scheme is Now Bigger and Better with GoGreat Programme!!

» GREAT news for our new GREAT leaders!

Must-Knows

» Bundle GREAT Supreme Health with GREAT Total Care plan for comprehensive coverage!

» Great CareShield Birthday Savings for our customers!

» Up your game with the upcoming Complete MultiPay CI Webinar!

» Upcoming Revisions in Illustrated Investment Rates of Returns for Participating Policies

» New Product Launch: Complete Living Care Rider

» 2nd Quarter 2021 Market Outlook – A Summary from Agency Propositions and Portfolio Management

» Calendar of Event

From Good to Great

» Up your game as you munch on these bite-sized motivational tips!

People

» Gift of empathy: A cancer survivor on a mission - Zoe Yap, a Great Eastern Agent of Life

» Life’s a gift – One of our Agents of Life, Lin Hanwei, tells his organ donation story

Click here for past TGC issues.

Message from Patrick Peck

Dear Leaders and Financial Representatives,

In just a blink of an eye, we have entered the second quarter of 2021, there is no better time than now to reflect on the importance of staying relevant and being adaptable, in an industry constantly and rapidly evolving.

We too have put together a refreshed The Great Connect (TGC) e-newsletter just for you! Moving forward, you can expect to see bite-sized information and must-know nuggets to help you up your game. TGC will be packed with informative content ranging from product highlights to market outlook updates, and articles aimed at sharing best practices to better your skills and professionalism.

Q2 2021 will be another exciting chapter and I am looking forward to some event highlights, including our first-ever hybrid Achievers Day Congress, which will be followed by the Achievers Night Awards. What a long way we have come from the last year of virtual events. I am ever enthusiastic for the opportunity to explore new ideas where the sky is the limit!

As we embrace digitalisation in our people business, we continue to place great emphasis on the human touch. Face-to-face interaction remains a key priority for our advisory business. At the same time, openness and sensitivity in our attitudes to providing support to all prospects, remembering our purpose as Agents of Life, and serving our clients to the best of our ability as professional advisors.

On this note, I’d like to leave you with 3 key attributes of a successful Financial Representative that I shared recently in an interview with Asia Advisers Network:

Empathy (from the heart)

Entrepreneurial (as a mindset)

Evergreen (as an attitude)

Here’s wishing you a fantastic Q2 ahead!

Catch the highlights of the Achievers Day Congress!

2021 Achievers Day Congress, themed “Maximizing opportunities for the new future”, happened on 29 April 2021, at the Singapore Expo. This was our first-ever hybrid Achievers Day Congress event to celebrate those who have performed extraordinarily well last year! The event kicked-off with a flag ceremony and the Achievers’ Club Council’s march-in.

This year, we had 1,560 Great Eastern Life Achievers Club (GELAC) Achievers and 1,336 Million Dollar Round Table qualifiers. Mr Khor Hock Seng, Group CEO, announced that this was the record number of MDRT qualifiers despite 2020 being one of the most challenging years!

Mr Khor and Patrick Peck, Managing Director of Regional Agency/FA and Bancassurance, congratulated the winners and reps for the hard work and effort they have put in to lead Great Eastern to claim Singapore’s Number 1 position for the overall business and Agency in 2020.

Jiang Jia, inspirational and emotional intelligence speaker and founder of Wuju Learning, shared his journey of his ‘100 Days of Rejection’ to encourage reps not to feel dejected when they face rejections. The biggest takeaway that you should have? Rejection may not be a necessary evil! By forging on despite your fears of being rejected, you could have a positive response some day!

We also had a breakout session for Leaders and Producers where Great Eastern Directors and Achievers shared their experiences, knowledge and tips! Which breakout session were you in? Which stories resonated most with you? Regardless, we hope that you enjoyed the session and learnt something from it!

Sim Siang Cheng, one of our financial representatives, shared her touching story of how she came back better and stronger from her fight with cancer to be an advocate of insurance. Since then, she has been on the roll to educate her prospectives and clients on the importance of financial planning.

Tony Gordon, author of best-selling book, “It Can Only Get Better” and also a former president of MDRT, was our keynote speaker. He encouraged the reps to have a goal, and constantly upskill to achieve greater success. He said, “We can achieve anything we want to achieve if we have the courage.”

Tony shared that his secret to sales is to ask people what they want, instead of focusing on what they need. Why, you may ask? He explained that customers may not feel like they need to buy insurance now as they don’t see any urgent need to do so.

The event closed with Esther Teng, the Achievers Club Council Chairman, motivating the reps to succeed and sharing her dream that we will have 2000 Achievers next year!

Catch more stories and the pictures from the Achievers Day Congress in our July issue!

We want to thank all participants who joined in the show both online and offline. Lastly, congratulations to all winners! We hope you continue to achieve and see you in Sapporo, Japan!

Great Eastern’s latest brand campaign promotes the importance of critical illness protection

Do your customers think critical illness (CI) insurance is important?

Statistics from Great Eastern’s “The Impact of Critical Illness in Singapore” survey in December 2020 will show you just why they should review their protection coverage with you to address their protection gap with Great Life Advantage (III) with Complete MultiPay CI Plus Advantage Rider.

We surveyed over 500 people and found that:

Over 50% of CI patients and their caregivers depend on insurance payouts to manage their financial expenses.

Almost 1 in 3 (30%) of them incur more than S$250,000 in medical and hospitalisation bills for their entire recovery duration with nearly 2 in 5 (40%) with no income for at least 12 months.

Over 50% of the Experiencers believe that they will be hit by CIs more than once.

According to the Life Insurance Association Protection Gap study, Singaporeans are under-insured1 with a 80 per cent protection gap.

Why your customers should buy Great Life Advantage (III) with Complete MultiPay CI Plus Advantage Rider:

It provides multiple CI coverage for life against 120 CI conditions across different stages and gives up to 3 times coverage against all stages of CI.

Customers will receive 100% of the coverage amount for each claim too!

If this is not enough, share our “I Don’t Want to Miss a Thing” brand campaign with them. Launched in March, the campaign hits home with its emotive message of the importance of critical illness protection so that customers can continue to enjoy life and not miss out on its important milestones, if multiple occurrences of CIs strike unexpectedly. Scan the QR code below to catch this moving film!

Lastly, check out “The Truth About Critical Illness” placemat, and let the visuals do the talking! You can download this e-version on LifeHub to share with your customers.

As you work to give your customers comprehensive coverage, refresh your product knowledge about our health insurance products!

1. CLCR (upcoming launch in May!)

2. MPCI Rider

3. Great Supreme Health

4. Great Careshield

5. GREAT Family Care

6. Smart Multi Critical Care

Check out this page for our full health insurance product listing,

Need some articles for your sharing?

1. Critical illness plans vs early critical illness plans: Which should you get ?

2. Working adults short of critical illness insurance cover, says LIA.

3. MediShield Life Council report shows rising cancer prevalence among Singaporeans.

4. So let’s all gear up and help our customers with their protection coverage now!

1. Source: Life Insurance Association Singapore 2017 Protection Gap Study - https://www.lia.org.sg/media/1332/protection-gap-study-report-2017.pdf

Enhanced Dependants’ Protection Scheme is Now Bigger and Better with GoGreat Programme!!

Grab the opportunity to share with your customers about the BIGGER and GREATER benefits that they can enjoy with the Enhanced Dependants’ Protection Scheme (DPS)!

Here’s a snapshot of the Enhanced DPS benefits that your customers can enjoy:

Maximum age of coverage has increased from age 60 to age 65;

DPS members who are below age 60 will enjoy a higher sum assured of S$70,000, which is 1.5 times more from the previous S$46,000 coverage; and

DPS members aged 60 to 65 will be covered for a sum assured of S$55,000.

They can conveniently access their DPS policy information anytime, anywhere by downloading the Great Eastern App available on both the Apple AppStore for iOS users and Google Play Store for Android users.

Your customers can also look forward to a wide array of benefits available through GoGreat Programme, tailored just for DPS members.

Here’s what they can look forward to:

- Special deals worth over S$2,000 which DPS members can redeem via UPGREAT app – an all-in-one rewards platform

- Birthday rewards and access to health and wellness programmes with incentives to stay fit and healthy

- Easy financial planning with their exclusive access to a full suite of financial tools such as an innovative financial storyboard to map their life planning needs at every life stage

Just for DPS members (age 40 and below), they can also enjoy one of the lowest term premiums for as low as S$0.35 a day for up to S$500,000 coverage with GoGreat Term Life! Check out the plan right here.

Keep your customers peeled for more exciting updates and offerings of GoGreat Programme coming your way!

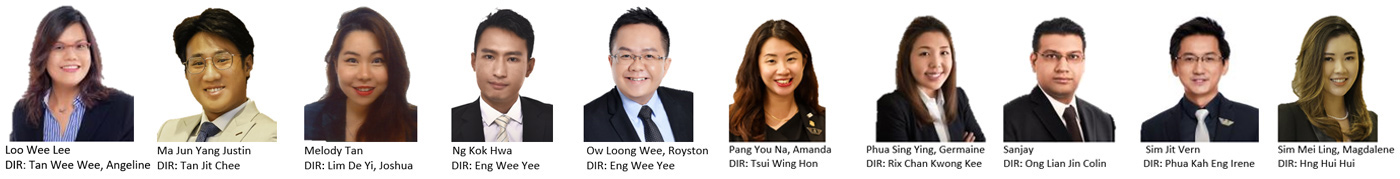

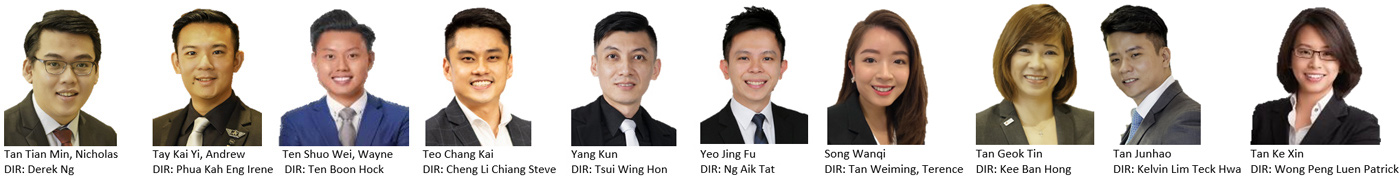

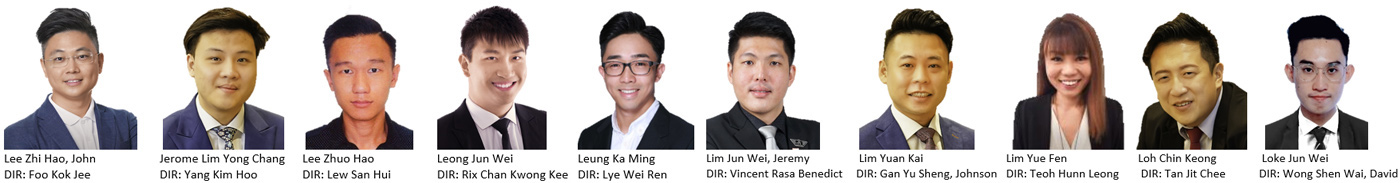

Great news for our new Great leaders!

Spot any of your colleagues in this promotion list?

Give your heartiest congratulations to our colleagues, who have taken up a higher appointment, for a job well done!

Bundle GREAT Supreme Health with GREAT Total Care plan for comprehensive coverage!

Lifeproof your customers’ hospitalisation plans for life with GREAT SupremeHealth and GREAT TotalCare!

GREAT TotalCare gives your customers:

The lowest out-of-pocket expenditure on hospitalisation bills in the market.

Affordable premiums with access to the most comprehensive list of benefits in the market, covering exclusive benefits such as additional $10,000 coverage for outpatient cancer treatment, access to world-class overseas medical treatment facilities for planned & emergency treatments for coverage up to $450,000 and pre-psychiatric treatment up to $25,000!

20% premium savings on first year premiums for new1 customers who purchase GREAT TotalCare Elite P or Classic P.

20% premium savings on first year premiums for existing customers who are transiting into the new GREAT TotalCare Elite P or Classic P.

Check out the refreshed sellers kit for your use on LifeHub!

You may visit edGE to view your renewal listing. In this listing, you are able to view, by month, your list of customers who are renewing their GREAT SupremeHealth & GREAT TotalCare plans. For instructions to help you find the list of customers who are renewing their policies, you may contact A&H_Business@greateasternlife.com.

1 New customers need to purchase GREAT TotalCare Elite P or Classic P from 1 April 2021 to 30 September 2021. Terms and Conditions can be found here.Great CareShield Birthday Savings for our customers!

Shower your care on your customers with our GREAT CareShield Birthday Campaign!

Your customers will save up to $590# when they purchase GREAT CareShield upon receiving the promotional EDM two months before their birthdays.

Here’s why they should get GREAT CareShield – our disability insurance plan, with you today:

- Anyone at any age is at risk of being disabled which can lead to a loss of income over a prolonged period.

- Customers can use MediSave to pay the premiums for both GREAT CareShield Advantage and GREAT CareShield Enhanced plans, without forking out cash.

- Payouts from GREAT CareShield will help one to manage ongoing medical and living costs.

- No premiums to be paid for the duration of the disability if one is unable to perform at least one activity of daily living (ADL)* with GREAT CareShield Advantage plan. A lump sum payout (3 times of his monthly payout) will also be made.

- If one is unable to do 2 ADLs with this plan, monthly payouts will be given for life.

Did you know?

For a 30-year old male who pays S$600 yearly from his MediSave for GREAT CareShield Advantage, he will receive:

- S$1,300 monthly benefit for life (if unable to perform at least 2 ADLS) which is on top of his CareShield Life monthly payout which starts at S$600 in 2020.

- A lump sum payout of $3,900 (3 times of his monthly payout) the moment he is unable to perform at least one out of the six activities of daily living.

Act now!

As this campaign will run till end 2021, do share this great birthday savings with your customers today on GREAT CareShield and let them know how it can #Lifeproof them!

# This is the Premium Savings illustration (rounded to the nearest ten dollar) for females aged 30 purchasing GREAT CareShield Advantage (Premium Payment Term up to 80) with a Monthly Benefit within the S$600 MediSave annual limit as of 28 Feb 2021.

Premium Savings is defined as the difference between the total premium paid at your current age till the end of the policy term and the total premium paid on your next birthday till the end of policy term.

* Activities of daily living refer to washing, toileting, dressing, feeding, walking or moving around and transferring.

Up your game with the upcoming Complete MultiPay CI Webinar!

We launched the Complete MultiPay CI Plus Advantage Rider in January this year, an optional CI rider that can be attached with GREAT Life Advantage III (GLA) plan.

If you are thinking of how you can better pitch this plan to your customers, check out our critical illness survey statistics in this article and this online article on what happens if one is under-insured!

You can also find information in our upcoming webinar session on Complete MultiPay CI Plus Advantage Rider where you can find out about:

1. Customers’ insights on being afflicted by critical illnesses.

2. Why your customers need to get GLA with Complete MultiPay CI Plus Advantage Rider.

Here’s a quick recap on the rider’s benefits to your customers:

- Provides coverage against 120 critical illness conditions across all stages of critical illness – early, intermediate and critical, including subsequent cancer strike, heart attack and stroke.

- Multiple CI coverage for life and the sum assured is restored after each claim.

- Get up to 3 times coverage against all stages of CI.

- Affordable premiums from as low as $1200.

Can’t wait to attend the webinar? Look out for the upcoming notice with the webinar and registration details!

Upcoming Revisions in Illustrated Investment Rates of Returns for Participating Policies

We launched the Complete MultiPay CI Plus Advantage Rider in January this year, an optional CI rider that can be attached with GREAT Life Advantage III (GLA) plan.

If you are thinking of how you can better pitch this plan to your customers, check out our critical illness survey statistics in this article and this online article on what happens if one is under-insured!

You can also find information in our upcoming webinar session on Complete MultiPay CI Plus Advantage Rider where you can find out about:

1. Customers’ insights on being afflicted by critical illnesses.

2. Why your customers need to get GLA with Complete MultiPay CI Plus Advantage Rider.

Here’s a quick recap on the rider’s benefits to your customers:

- Provides coverage against 120 critical illness conditions across all stages of critical illness – early, intermediate and critical, including subsequent cancer strike, heart attack and stroke.

- Multiple CI coverage for life and the sum assured is restored after each claim.

- Get up to 3 times coverage against all stages of CI.

- Affordable premiums from as low as $1200.

Can’t wait to attend the webinar? Look out for the upcoming notice with the webinar and registration details!

New Product Launch: Complete Living Care Rider

Look out for our new rider plan in May- Complete Living Care Rider (CLCR) which protects your customers against all stages (early, intermediate and critical) of a critical illness (CI). This rider also covers against Total Permanent Disability and death.

This new rider will be attractive to your customers because CIs can strike anyone at any time. Based on our recent survey, more Singaporeans including younger people (age 15 to 34) are getting diagnosed with CIs such as cancer. It is then important to start planning early for your customers to have sufficient protection, and that’s where CCLR can benefit them.

You would be excited to know that in addition to the current Living Care Rider, your customers will be able to buy this CLCR with GREAT Term plan.

We will be arranging product briefing sessions for you to find out more about the benefits of CCLR and how you can better #Lifeproof your customers. So keep a lookout for the notice on the briefing sessions coming your way!

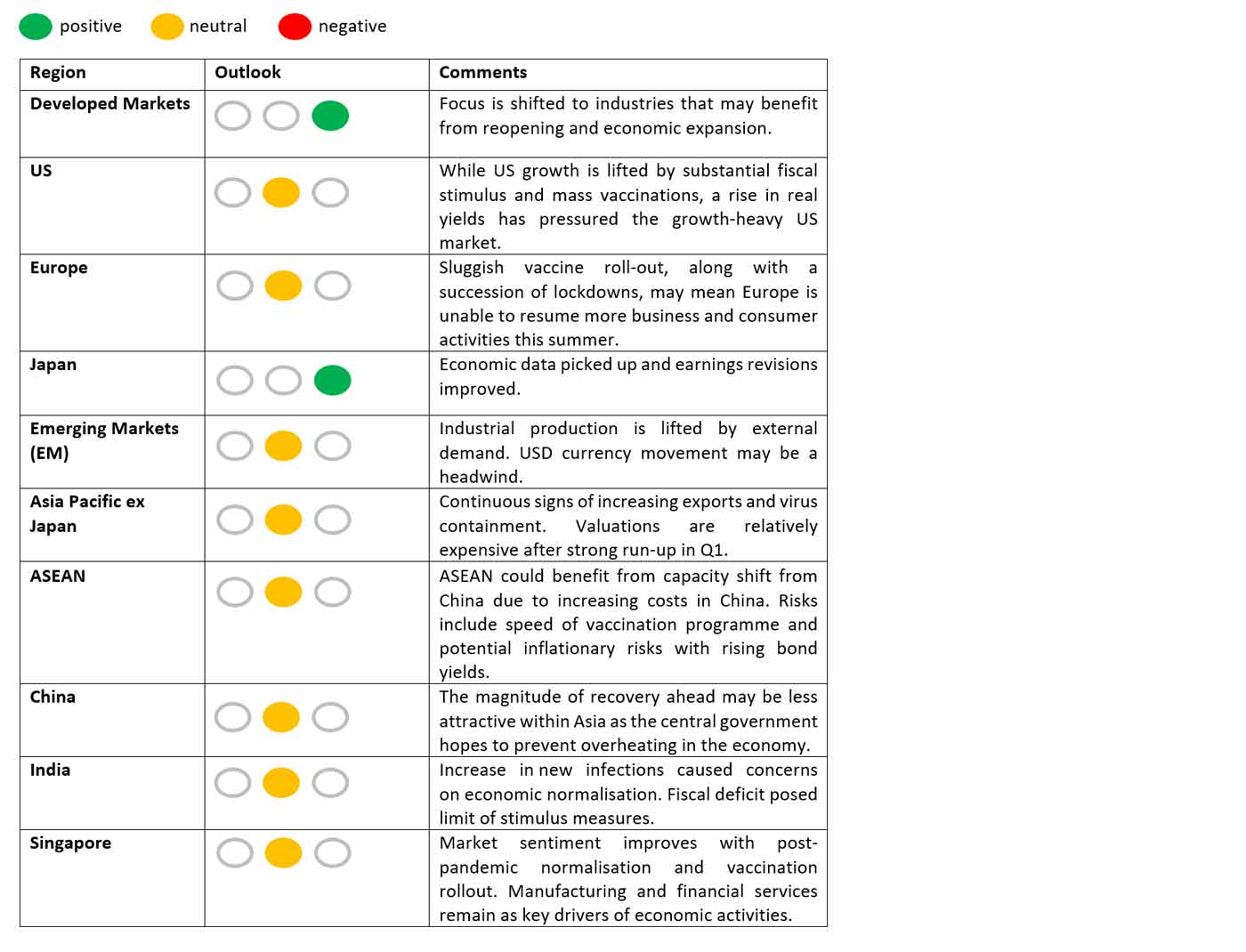

2nd Quarter 2021 Market Outlook – A Summary from Agency Propositions and Portfolio Management

We have a positive outlook on equities and are neutral towards the performance of bond funds.

The global economy is gradually recovering as vaccine rollouts gather momentum with significant fiscal stimulus and monetary policies from countries around the globe. Investors should seek diversified and dynamic portfolios that invest in sustainable long-term growth opportunities. This includes investing in bonds as they are a portfolio diversifier.

Did you know?

In 2020, 21 GreatLink funds delivered double-digit positive returns and 22 funds outperformed their respective benchmarks over the 1-Year period.

For more information about the fund info, please go to Great Eastern’s home page > Quick Links > Fund Tools & Documents.

Year-to-date, our 26 out of 34 GreatLink funds delivered positive returns as at 31 March 2021.

Calendar of Events

Stay up-to-date on Great Eastern’s upcoming activities and events for its financial reps. You can login to Lifehub to view the calendar.

Up your game as you munch on these bite-sized motivational tips!

In this issue, we have Ellappan Elangkovan to share his top three tips to that will help new joiners to succeed!

1. Be Prepared

“Before anything else, preparation is the key to success” - Alexander Graham Bell

You must always be prepared to present on the spot to explain your recommendations to your prospectives and address their queries.

This is what I do before meeting prospective clients and it has worked for me.

Always prepare different presentations for different customer types as what a customer needs to know could be different from another customer, who may have a different set of concerns.

Know your customer and show how you can value-add to his needs by being prepared at all times when you share your financial expertise with them.

2. Be Positive

“If you are positive, you’ll see opportunities instead of obstacles” – Mencius Confucius

Do not doubt what you can achieve as it can have negative effects on your mental health!

After a presentation, you should reflect on areas of improvement so that you can continue to refine and hone your skills. However, do not forget to give yourself a pat on the back for what was done right!

Always stay positive so that you can move onward and upwards to greater things! I know that clients would prefer to meet people who are positive themselves too!

3. Be customer-centric

“Success doesn't come from what you do occasionally. It comes from what you do consistently” – Marie Forleo

When you engage with your customers and place their needs as a priority, you will be able to build stronger and more lasting relationships with your clients. They will also naturally connect with you and entrust you to help them with their financial planning.

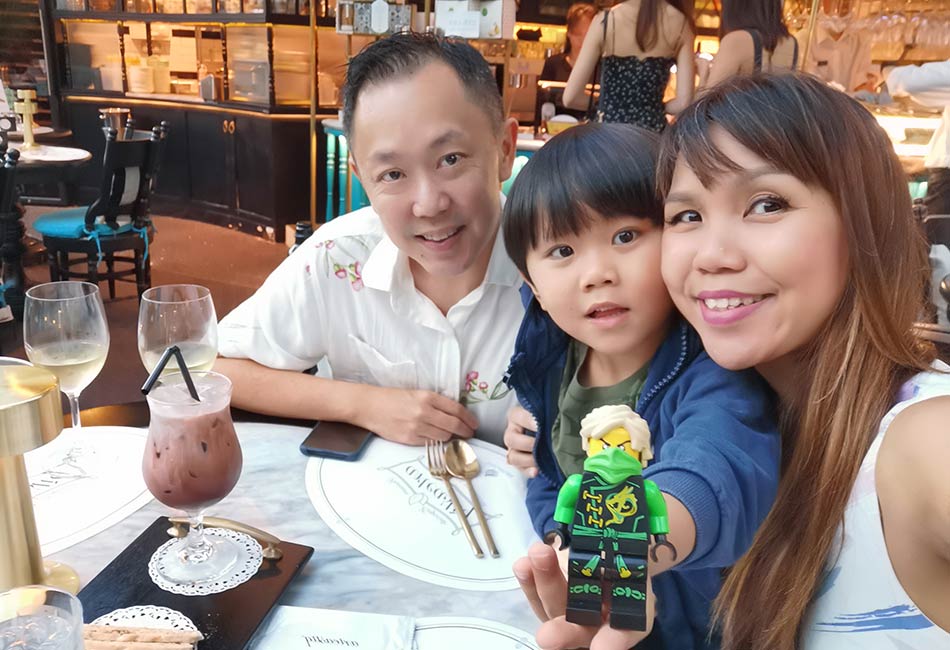

Gift of empathy: A cancer survivor on a mission - Zoe Yap, a Great Eastern Agent of Life

Zoe Yap, our very own Great Eastern Agent of Life is a four-time cancer survivor. Bursting with energy and positivity, it is hard to believe that she has been battling cancer for six years.

The first time Zoe felt something was wrong was in the third trimester of her pregnancy. She felt discomfort when passing motion but was told it was part and parcel of pregnancy.

It was only after her one-month maternity confinement that she went for further medical checks as she continued to feel discomfort. That was when she was told by the doctor that she had stage-three rectal cancer.

From the ecstasy of being a first-time mom after trying for a child for five years to being told that she had only a 60-70 per cent survival rate from her cancer, her world tumbled.

Yet, Zoe walks around today with this sunny disposition that shines through her personality.

Fight or flight

“When facing tough situations, you either fight or flight. I chose the former,” she said.

How does she keep her optimism and spirits up in her long-drawn fight with cancer?

She said, “First, we must have faith. Faith will propel you when the journey is challenging.”

Paying it forward

Looking back, she said she was fortunate to meet her financial representative from Great Eastern, who is her husband’s friend.

“At that time, I was a vegetarian for over 20 years. I felt super fit! I was running marathons, and I did not smoke. So, I never imagined anything bad would happen to me,” she shared.

But because of her financial representative’s persistence and professionalism, she started her financial planning and got herself comprehensively covered. Never did she know that her early financial planning paid off and her insurance plans helped to cover all of her hospitalisation and medical bills when she was struck with cancer.

As she recovered, she volunteered at Singapore General Hospital and societies such as the Singapore Cancer Society. However, she realised that the help she could offer as a volunteer was limited.

Her experience taught her that it was important to be able to pay the hefty medical and hospitalisation bills, especially if one is unable to continue working or lost his job. This started her thinking, “Why don’t I be the angel that brings them the financial support when something unfortunate happens?”

Today, Zoe is an Agent of Life at Great Eastern. To Zoe, Great Eastern was her obvious employer choice. Her personal experience in making claims with Great Eastern gave her the confidence that the company would continue to help those in need.

On a mission

Zoe’s fight with cancer continues and so does her fighting spirit. However, filled with a sense of mission, Zoe is motivated to work even harder to help more people.

“My time is limited, but it makes me work even harder. If my financial representative did not share with me and I did not do any planning, I would not know how I could face all the bills and debts. I cannot laugh my way out of them,” she said. “Every insurance plan sold is for the health of others, and never the wealth of mine.”

If you are feeling down, remember that there is always something positive in every negative situation! In the wise words of Zoe, “Happiness is a choice; choose happiness.”

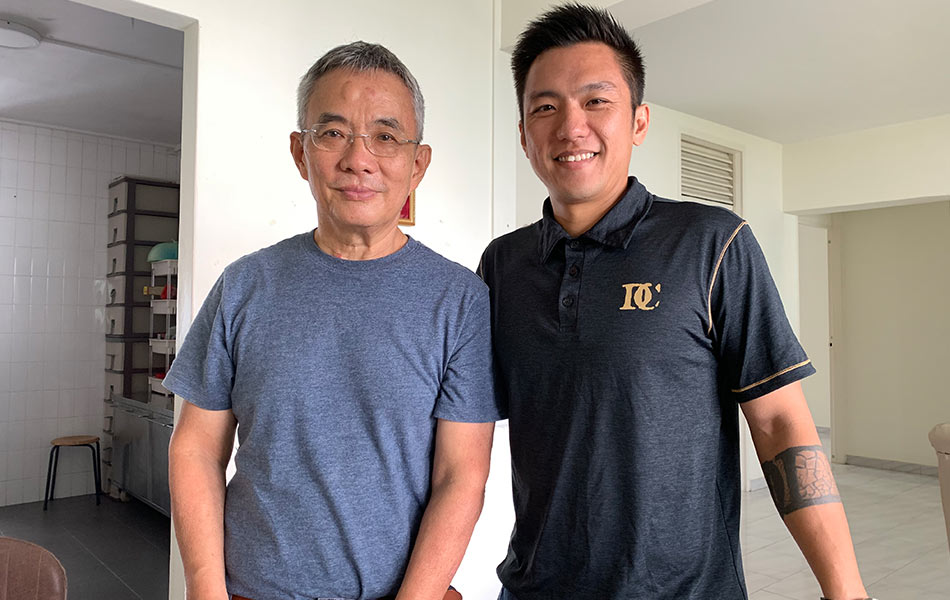

Life’s a gift – One of our Agents of Life, Lin Hanwei, tells his organ donation story

Hanwei standing next to Mr Eddie Tan, the recipient of his liver.

Organ donation is not a walk in the park, much less the action of donating to a complete stranger. But that was what one of our Agency Leaders, Lin Hanwei did.

When Hanwei saw a Facebook post for an urgent appeal for a liver donor, he did not hesitate to respond to the appeal on the social post. The post was made by a son who wanted his father – Mr Eddie Tan, who was battling with end-stage liver disease, to have a new lease of life.

Hanwei was on the operating table in six days to be the life-saver.

What prompted Hanwei who enjoys extreme sports to take this plunge? Was he not afraid of the possible complications from organ donations?

“What my brother was for me is what I want to be for others.”

Hanwei shared, “My brother was the source of inspiration for me. He first donated his organ to someone he didn’t know nine years ago, and since then I’ve always wondered if I could do the same.”

Hanwei would have to watch his diet and be on the sidelines for his favourite sport, football for the next few weeks. However, compared to the life he could save by donating his liver, these were trivial sacrifices to him.

Hanwei and his brother all dressed up!

“It is truly in giving that we receive so much more. It’s also what I love most about being an Agent of Life – being able to make a real difference to someone else’s life.”

To Hanwei, his act of donating his liver was not heroic. Rather, it was another one of his ways of showing empathy by helping someone in need.

Hanwei carries the same spirit into his job as a financial representative, which is to make a positive impact on people’s lives as he educates people on the importance of financial planning.

Forming a Lasting Bond

Eddie and his family are filled with gratitude for Hanwei’s selfless act. However, what matters most to Hanwei, was that he saved a life.