This e-publication is for internal sharing only and is not to be distributed outside of the company.

July 2021

Click below to read more.

Hear from Our Leaders

» Message from Patrick Peck

Highlights of the Quarter

» Mid-Year Boost 2021 – TIME IS ESSENCE

» Reliving the Achievers' Leaders Congress

» Get Protection Tips on the Go!

» GEFA Turns 10!

» Stay Woke and Relevant with Patrick Peck

Must-Knows

» Revisions to Participating Policy Illustrations

» Maximise your Customers’ Savings with GREAT Lifetime Payout Plan

» FINALLY! Introducing GREAT Maternity Care Plan with First-in-Market Features!

» Powering Up our Sustainability Push with Singapore’s First Green Life Insurance Plan - GREAT Green SP!

» More Protection (FREE!) with GREAT Covid Care Plan

» 3rd Quarter 2021 Market Outlook – A Summary from Agency Propositions and Portfolio Management

» Calendar of Events

From Good to Great

» Get Going with Great Sales Tips!

People

» A Heart for the Community

Click here for past TGC issues.

Message from Patrick Peck

Dear Leaders and Financial Representatives,

There is no better time than now to reflect on the milestones and achievements of the first half of the year, and to do a mid-point check on where we are with our year-end goals in mind.

We held our agency virtual Mid-Year Boost (MYB) event with the theme “Time is essence” on 8 July, and the one key message that struck a chord with me was “Time is of the essence. It’s never too late to start, but there is no better time to start than NOW.”

We had the pleasure of hearing from our distinguished guest speakers, Tom Abott and one of our top performing producers Cody Chen, who further emphasised this message as they separately shared what it takes to be successful and encouraged all to stay focused. I hope you have been inspired and are ready to rev up your engines to achieve even more as we race to finish our 2021 race well.

As we work towards our achieving our goals, we should focus on and continually improve our three key pillars - Sales process, Manpower capabilities and Customer Experience. These pillars, bolstered by our digital tools and our strong operational foundation, will enable us to reach our target. I trust that you are as excited as I am about all the upcoming initiatives that will be launched in Q3 2021 to boost your sales too.

As you know, we launched the Great Covid Care Plan on 25 June to support and encourage your customers to get vaccinated earlier with an added peace of mind. This is an excellent way to grow your customer base as the coverage is free for your new and existing customers upon signing up. I urge all of you to grasp this opportunity and spread the word today! Sign up yourselves, get your families onboard, and certainly share it with your customers well before end September 2021 for this complimentary post-vaccination plan open to all Singapore residents.

Wishing you a great second half of the year, and stay safe!

Mid-Year Boost 2021 – TIME IS ESSENCE

We held our virtual Mid-Year Boost 2021 – Time is Essence on 8 July and had over 3,000 reps watching it live. Here are the Highlights just for you!

- Group Chief Executive Officer, Mr. Khor Hock Seng, encouraged all representatives to be always-on and ready to seize opportunities with new insurance solutions in the second half of 2021. He rallied the reps to share the GREAT Covid Care Plan with their customers and get them to sign-up. This is a complimentary post-vaccination plan to all Singaporeans residents against COVID-19 even after getting their first dose. Remember - stay focused and disciplined – to maintain our leadership in the industry!

- Sales, Manpower & Customer Experience – Excel in that and success will follow! Powered by our Operations and Digital departments as we continually enhance our processes, Mr Patrick Peck, Managing Director of Regional Agency / FA and Bancassurance shared that we have come up with AI forms that are added into the Financial Needs Analysis process as well as incorporated digital elements into our recruitment processes. There will be more updates. So keep a lookout!

- Mr. Colin Chan, Managing Director of Group Marketing introduced some of the latest plans including GREAT Lifetime Payout and Prestige Life Rewards 4. Don’t wait to share these plans with your customers today!

- SurGE ahead with our new Digital Platform for General Insurance (GI)! With a newly improved and redesigned look to better fit your needs, Mr. Bernard Tan, Vice President, Personal Lines, Great Eastern General Insurance shared that the platform will have features such as a personalised dashboard and list of competitive pricing for motor insurance to get on top of their game. What are you waiting for? Jump on the SurGE platform and surge forward to empower your customers with our GI products!!

Are you ready to rev up your engines and charge full-on ahead? Be prepared to put on your thinking caps to “Think and Grow”! As Glenn Yong, Head of Agency Business Development aptly shared, we all need to have a growth mindset and not remain stagnant as we continue to challenge ourselves to reach our new goals.

We hope that you are all caught up with the updates from MYB 2021 and you will strive towards the GELAC Convention 2022, in Sapporo!

Reliving the Achievers' Leaders Congress

We’re sure everyone had a great time at the Achievers’ Day Congress, as well as the Achievers’ Night! Here’s a quick recap on both events to help you relive them.

Achievers’ Day Congress

The Achievers’ Day Congress, themed “Bridging into Greatness & Illuminating Leaders”, was held on 29 April 2021. We invited motivational speaker Mr Jia Jiang, who gave us tips on overcoming rejection, and Mr Tony Gordan who shared the what’s and how’s of his MDRT success.

Our audiences were also treated to two breakout sharing sessions where Agency Leaders, as well as the GELAC and MDRT qualifiers shared their motivations and secrets to their success. The Leaders session was held in an interview style where we dug deep to uncover their motivations on being an Agency Leader, their challenges and strategies to build a successful agency. In the other breakout session, our representatives took away powerful methodologies and frameworks which were tried and tested by our top producers –including having a “can-do” mindset, a willingness to learn and upskill, the importance of body language and tips to engage your clients.

Relive the happenings in the pictures below!

Achievers Night

The Achievers’ Awards Night, held on 7 May, was filled with festivities as we gathered our 1,300 achievers to celebrate their wins. Themed “Achievers of Life”, the hybrid session had over 30 Top Achievers together with our management team who gathered at Marina Bay Sands Hybrid Studio to attend the Awards Ceremony. More than 1,200 Achievers logged in to join the live broadcast celebration and they had a blast. Check out the great feedback we received from the event!

We cheered our Top Achievers for the year as they received their awards! Food (as it always is) was one of the key event highlights. Whilst our on-site participants had a sumptuous dinner in the dining ballroom, our Achievers who watched online were treated to a feast at their homes with meals from 3 Embers. Tantalise your tastebuds once more with food shots from this video.

At the same time, we also held a “Best Plated Main Course” contest for the Achievers watching online. The contest received a very enthusiastic response as many vied to win the top prize - a S$3,500 fine dining experience by 3 Embers!

It was an entertaining and enjoyable evening as we had a well-known local band, JiveTalkin who belted out favourites during the dinner. And not forgetting the Grand Lucky Draw that got everyone very excited with attractive prizes to be won!

If you would like to reminisce the Achievers’ Awards Night highlights and fun moments, watch the Fly Through video below!

Congratulations again to our Top Achievers and to all financial reps! We hope you were motivated by these Achievers’ events to strive towards the GELAC Convention 2022 which will be held in Sapporo.

Get Protection Tips on the Go!

Do you need some informative and insightful protection must-haves to share with your customers? Check out these two podcasts where Colin Chan, Managing Director of Group Marketing, shares on the importance of having critical illness and disability insurance in two bite-sized and insightful episodes on The Business Times’ Money Hacks. Click on the podcast links below.

Podcast 1: Critical Illness Protection

Age does matter in the purchase of critical illness insurance, and this podcast shows you exactly why your customers should plan ahead to be #Lifeproof!

You can also give them a little push by sharing our brand campaign that hits home the message on the importance of critical illness protection.

Podcast 2: The ABCs of Disability Insurance Plans

Disability doesn’t discriminate. Did you know that 50% of disabilities can be caused by unforeseen events such as accidents or major illnesses like strokes and cancers*?

Instead of scrambling to get covered only when accidents happen, Colin shares why your customers should plan ahead and how disability insurance can help them. In addition, find out how much disability insurance can typically cost and how your customers can use their CPF Medisave to pay for premiums of up to S$600 a year.

*Source: Ministry of Health Singapore and University of Washington - The Burden of Disease in Singapore, 1990 to 2017

GEFA Turns 10!

Did you know that Great Eastern Financial Advisers (GEFA), Singapore’s largest financial advisory firm, celebrates its 10th anniversary milestone in 2021?

With an initial distribution force of fewer than 300 financial consultants, it has now has grown 10-fold over 10 years.

GEFA commemorated this special occasion with their 10th anniversary webinar celebration event on 1 July with a memorable video of their beginnings, milestones and achievements over the years.

Naturally, no anniversary celebratory event would end without a toast from Mr Khor Hock Seng, GEFA’s Chairman, Mr Patrick Peck and Ms Jesslyn Tan, GEFA’ Chief Executive Officer to thank the GEFA team for all their hard work and contribution to its success.

As GEFA crossed its 10-year mark, let us first trace GEFA’s beginnings and suss out the three ingredients of GEFA’s success in brief.

When GEFA was first set up in 2011, it was then the industry’s first exclusive financial advisory firm with a robust duo engine - combining the strength of Great Eastern with a wider offering of financial advisory services firm. Backed by Great Eastern, GEFA could leverage on its established heritage, strong brand, sound financial strength, infrastructure and resources to chart its growth journey.

Secrets to GEFA’s Success

1. Staying relevant with changing trends

Going digital to support GEFA’s growing business needs by leveraging Great Eastern’s digitalisation transformation capabilities to provide a seamless advisory experience is key to GEFA’s continued success. The urgency to adopt and accelerate digitalisation is especially more so critical during this COVID-19 period, which has changed the way business processes and customers’ interactions are being done.

To stay ahead in the wealth management business, GEFA was the first amongst the financial advisory firms at the start of this year to provide an end-to-end support system and process to assist affluent customers looking to set up Family Offices in Singapore. This is an emerging trend as Singapore becomes an increasingly appealing enclave for the offshore high net worth segment.

2. Being customer-centric

To this, Jesslyn said: “Being customer-centric is and must continue to be a part of our DNA. We continue to engage with our customers through both online and traditional platforms to respond to their evolving needs. Though digital communications will be the norm, we cannot replace the human-to-human engagement between financial consultants and our clients.”

Customer-centricity is also about using digital means such as data analytics which GEFA is using to provide further insights into their customers’ investment patterns and needs, so as to continue to provide relevant and innovative product offerings to them.

3. Future-proofing distribution force

Supporting the growth and development of GEFA’s distribution force to be future-proof and future-ready through upskilling is one of GEFA’s winning formulas. GEFA believes in grooming young talent, and equipping existing financial consultants with the right training, technological tools and products to remain as relevant and trusted financial consultants in this new world.

As Jesslyn said: “Continually growing our distribution strength and developing their competencies would always be my priority. As we move into the new decade, I would like to continue building up what we have been doing right and plugging in any gaps for us to progress even further. Our financial advisory business is all about being people-centric.” We wish GEFA all the very best for their continued success in many more years ahead!

Stay Woke and Relevant with Patrick Peck

Here’s the chance for you to catch Patrick’s interview with Asia Advisers Network if you have missed it!

In this interview, Patrick shares his thoughts about the changing insurance landscape and how you can one-up the competition with our digital tools and comprehensive training. Get inspired and know that by staying customer-focused and daring to dream big, you will achieve success!

Revisions to Participating Policy Illustrations

From 1 July this year, all life insurers will lower the caps of illustrative investment returns to be used in Singapore-dollar denominated Participating Policy Illustrations. Let’s find out why, how and what this change means for you and your customers.

Why are the illustrated investment rate of return (IIRR) being revised downwards?

The Life Insurance Association (LIA) made this revision due to the current sustained low interest rate environment and to provide consumers with a more realistic range of projected investment returns to make better informed financial decisions.

What will be the new IIRR caps for participating plans from 1 July 2021?

The upper illustration rate will be capped at 4.25% p.a. and the lower illustration rate will be capped at 3.00% p.a.

Are the revised IIRR caps here to stay for a long time?

LIA will do a yearly review of these caps to ensure that they are relevant and appropriate, as well as take into account any changes to the long-term outlook of economic markets.

How does Great Eastern respond to the reduced illustration caps?

We have reviewed our current suite of participating plans. Upon the review, we redesigned and repriced the product propositions for the new suite of participating plans which will be launched on and after 1 July 2021.

Do the revised IIRR caps apply for those participating plans that have been withdrawn since 30 June 2021?

The withdrawn participating plans are designed with the investment assumption of up to 4.75% p.a. The revised illustration caps effected from 1 July 2021 will not change the investment assumption used for these plans.

However, the actual returns of these policies will still depend on future economic conditions, actual asset class returns, and asset allocation of the participating fund. The eventual actual returns received by policyholders may be higher or lower than those reflected in the Policy Illustration. Please note that the upper and lower illustration rates also do not represent the upper and lower limits of the investment performance of an insurer’s Par Fund.

RI.CH Insurance Solutions

In view of the revised IIRR caps, here’s a quick peek at our range of solutions, including the to-be-launched plans from 1 July 2021 to enable your customers to have RI.C.H. insurance solutions!

- Retirement Income

- Prestige Life Rewards 4 (SGD): Repriced and relaunched. This is a single premium participating whole life plan which gives lifetime monthly payouts from the 2nd policy anniversary.

- GREAT Lifetime Payout: This is a 3-year participating whole life plan with lifetime monthly payouts payable from the 4th policy anniversary. It offers capital guarantee by the end of the 6th policy year.

Upcoming: GREAT Prime Rewards III and GREAT Retire Income will be launched on 27 July and 25 August respectively.

- Cash Accumulation

- GREAT Wealth Multiplier II: Repriced and relaunched. This is a regular premium participating endowment plan which offers capital guarantee by the end of the 15th or 20th policy year. Customers can choose to either partially or fully surrender this plan to meet their different life stage needs. This plan will mature when the customer reaches 120 ANB.

Upcoming: GREAT FlexiGoal 15 will be launched in October this year.

- GREAT Wealth Multiplier II: Repriced and relaunched. This is a regular premium participating endowment plan which offers capital guarantee by the end of the 15th or 20th policy year. Customers can choose to either partially or fully surrender this plan to meet their different life stage needs. This plan will mature when the customer reaches 120 ANB.

- Health and Protection

- GREAT Flexi Living Protect 2 and GREAT Complete Flexi Living Protect 2: Repriced and relaunched. The GREAT Flexi Protect series (whole life plans) enable your customers to customise their coverage according to their’ financial needs and give multiplied coverage of up to S$1.05 million for critical illness (early and intermediate stages).

- Prestige Life Gold 3 (SGD): This is a whole life plan with coverage of up to 315% of the Basic Sum Assured, depending on the age of entry.

Upcoming: GREAT Flexi Protect 2 will be launched in October this year.

Do look out for our upcoming products and more updates from us!

Maximise your Customers’ Savings with GREAT Lifetime Payout Plan

With GREAT Lifetime Payout, your customers will enjoy a steady stream of income for life, while preserving their capital to keep up with different life stage needs, such as for their retirement, to manage unexpected expenses or to pay for their child’s education.

Let’s dig in for more benefits of GREAT Lifetime Payout:

- Get lifetime monthly payouts of up to 3% per annum1 of the total annual premiums paid, starting from the 4th policy anniversary

- Option to accumulate the lifetime payouts for potentially higher returns2

- 100% capital guaranteed from the end of the 6th policy year3

- Short three-year premium commitment from S$10,000 per year

- Enjoy 1% discount off if you make a lump sum premium payment

- No medical assessment needed to sign up for this plan

- A legacy for your loved ones to receive a lump sum benefit of 105% of the total annual premiums paid (plus any bonuses) upon death or terminal illness

- Insure your child for this plan so that they can receive the payouts over a longer period

- Option to assign the policy to your child as your gift of legacy

Don’t hesitate to share this new plan with your customers and make their money work harder in a smarter way.

1. Monthly payout comprises guaranteed survival benefit (1% p.a.) and non-guaranteed cash bonus (up to 2% p.a.). 3% p.a. of total annual premiums paid is based on an Illustrated Investment Rate of Return (IIRR) of the Participating Fund at 4.25% p.a.. At IIRR of 3% p.a., the monthly payout is 1.94% p.a. of the total annual premiums paid. The actual benefits payable may vary accordingly to the future experience of the Participating Fund.

2. The prevailing accumulation interest rate is 2.50% p.a. based on IIRR of 4.25% p.a. and 1% p.a. based on IIRR of 3% p.a.. This rate is not guaranteed and can be changed from time to time.

3. Capital guarantee is on the condition that premiums are paid by annual mode and no policy alterations are made.

FINALLY! Introducing GREAT Maternity Care Plan with First-in-Market Features!

If you know of any parents-to-be who may be feeling the jitters from the arrival of their little ones, this is the time to share the GREAT Maternity Care (GMC) plan with them.

Here’s why:

- First-in- Market Features:

a) For mothers: Offers coverage for pregnancy complications such as breech delivery* and miscarriage, as well as termination of pregnancy due to life threatening conditions, in addition to other pregnancy conditions.

b) For newborns: Gives a lump sum payout if the newborn needs to undergo surgery when any of his five major organs – the brain, heart, liver, lungs, or kidneys, fails.

- Guaranteed Issuance Benefit: Expectant moms and their newborns can purchase this plan without the need to undergo medical underwriting. The plan also covers the newborn’s pre-existing conditions diagnosed even before the purchase of GMC.

- Psychology consultations for mothers: For mothers experiencing pre and post-pregnancy stress, they can consult a psychologist from our medical panel. We will cover them for up to S$100 per consultation, capped at three consultations.

Excited to share this competitive GMC plan with your customers? Go forth and share the good news today!

*Breech delivery refers to a baby is born with his legs out instead of the head first, which may lead to the risk of the baby being suffocated during the delivery process.

Powering Up our Sustainability Push with Singapore’s First Green Life Insurance Plan - GREAT Green SP!

A BIG thank you to all reps for sharing with your customers about GREAT Green SP where we closed the tranche within 48 hours of its launch! This first-in-market green life insurance product is our first foray into offering your customers sustainable insurance solutions to support their desire to build a sustainable future together. So stay excited as we are committed to be a sustainability-driven insurer for you and your customers!

The 1.55% p.a three-year endowment plan invests its portfolio assets to achieve significant positive environmental impact. We are happy to have introduced such a plan to allow our customers to buy into solutions that help the environment. That’s not the end to our environmental efforts! We will be donating a portion of proceeds raised to a local charity, Zero Waste SG to support its programmes to educate and advocate the mindful usage of natural resources, driving towards a zero waste future in Singapore.

Reiterating our sustainability commitment, Group Chief Executive Officer Khor Hock Seng said: “This initiative is part of our overall sustainability approach to achieve a low-carbon economy, improve people’s lives and drive responsible business practices. We note there is a growing group of customers who are environmentally conscious and seek to contribute towards sustainability outcomes through their purchasing decisions, including financial products. We are pleased to provide customers with access to such green insurance solutions, starting with GREAT Green SP, which enables them to make a positive difference to the environment with their financial decisions.”

Stay tuned as we bring you more updates of our sustainability efforts as our staff and financial representative network gear up to support sustainability in the months to come!

More Protection (FREE!) with GREAT Covid Care Plan

Here’s some good news for you and also to share with your customers!

We just launched our GREAT Covid Care Plan, a post-vaccination protection plan which offers all Singapore residents complimentary hospitalisation cash of up to S$2,000, not just if you are admitted to hospitals in Singapore but also overseas.

The GREAT Covid Care Plan is our latest effort to support Singapore’s vaccination programme by offering additional protection to you, our customers and the community.

This free coverage applies to:

- Any Singapore resident who has completed his/her first dose of a COVID-19 vaccine approved for use by the Health Sciences Authority or supplied under the Special Access Route (SAR); and

- Children who have been vaccinated. Parents may register on behalf of their children who are under age 18.

Sign Up Now!

Simply register here to get the free coverage by 30 September 2021. Do note that applicants must also complete their first vaccination dose by 31 December 2021 to qualify for this coverage.

The coverage will be valid for 12 months from the date of registration or when the individual receives his/her first dose of COVID-19 vaccine, whichever is later.

What are you waiting for? Share this good news with your customers and sign up for the free coverage to stay protected today!

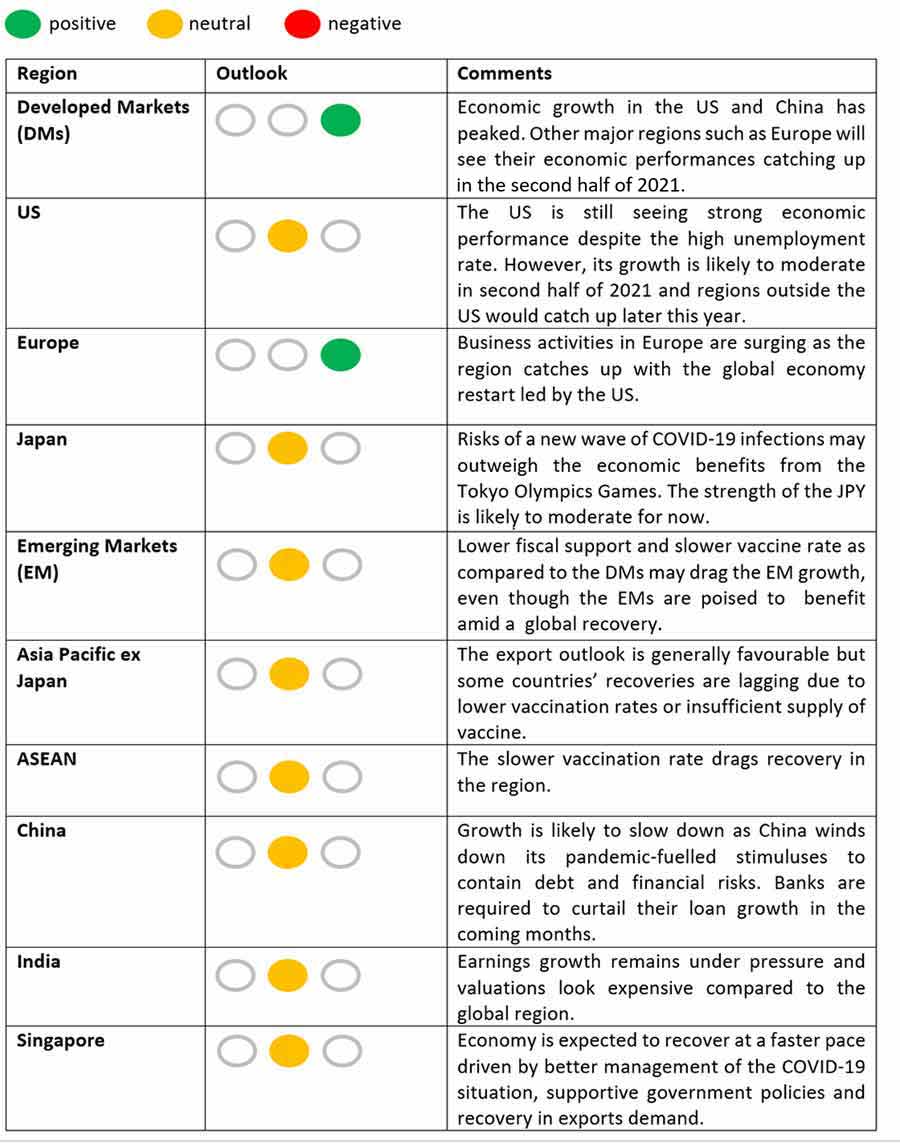

3rd Quarter 2021 Market Outlook – A Summary from Agency Propositions and Portfolio Management

We have a slightly positive outlook on equities and are neutral towards the performance of bond funds.

Stronger consumers’ demand for goods and services, as well as a flurry of business activities may raise the growth and inflation expectations. This may also lead to higher global bond yields in the near term. As the demand for bond yields would remain intact, investors may consider having bonds as a portfolio diversifier and a source of income.

Did you know?

In Q2 2021, all 34 GreatLink funds delivered positive returns in Q2 2021.

For more information about the funds, please go to Great Eastern’s home page > Quick Links > Fund Tools & Documents.

About two-third of GreatLink funds did better than other funds with similar investment strategies in Singapore, over the 3-Year period as at June 2021.

Calendar of Events

Stay up-to-date on Great Eastern’s upcoming activities and events for its financial reps. You can login to Lifehub to view the calendar.

Get Going with Great Sales Tips!

Are you searching for some tips to help you through this period of mainly non-face-to-face meetings with your clients? Fiona Chen, provides some tips if you are running out of ideas!

1. Have you encountered difficult clients before and how do you overcome these situations?

Yes, I have encountered my fair share of difficult clients.

When that happens, I would not let myself feel upset but focus on how I can better engage with them. I would also remind myself to be tactful and will do what I can to help my clients to resolve their problems.

2. How do you keep up with your clients in this period where it is difficult to physically meet with them and build rapport?

I keep in contact with my clients periodically and check in on them through Zoom and phone calls. I also make it a point to send birthday well-wishes to them by using Great Planner which tracks our clients’ birthdays. This gesture is simply an appreciation from me to thank them for their trust and support.

I make it a point to support my clients by easing administrative work to be as seamless and hassle- free for them.

For example, I use tools such as Adobe to enable our clients to complete application forms and e-sign them for the company to process.

3. Can you share your top 3 prospecting tips to seek new clients?

1) Don’t be afraid to ask your clients if they may know of anyone who may be interested in financial planning.

2) Keep regular contact with your clients by updating them on any changes in their policies (or anything else that may affect their financial plans), so that you can build your clients’ trust with their financial plans. They will also be able to sense your sincerity whenever you help them on any policy servicing matters, and they will naturally refer you to their friends and family members.

3) Engage in your hobbies and enlarge your social circles and be present in active groups. Naturally, when people have insurance needs, they will seek you out. For example, if you are into volunteering, you can actively participate in volunteer groups and build relationships with the people that you meet. Chances are, that you may get approached for financial advice when they find out that you can help them with their financial planning.

4. Do you have a top tip for your online meetings with clients?

You must remember to prepare yourself! Have all the materials you want to share on hand so that your meetings can be more effective for both you and your clients.

A Heart for the Community

Volunteering does not only require your time, it also requires a heart to help those who are in need. Jeremy Tang, one of our financial reps, shares his volunteering experiences.

1. When did you get started on charity work and why?

I have been doing charity work for about three years as I’ve always wanted to help those in need and give back to the community.

2. Which charity/charities have you been working with?

I do ad-hoc voluntary work with the Thye Hua Kwan disabled home and mainly volunteer with the Singapore Indian Development Association (SINDA).

3. Can you share more about your charity work with SINDA?

SINDA carries out various activities to support the Indian community in Singapore.

I am involved in a few of their long-term programmes, such as the ‘door knocking exercise’, which reaches out to beneficiaries at their doorstep. The organisation then assists them and provides them all types of assistance such as financial and even medical assistance, as well as referring them to social workers that provide counselling.

SINDA also carries out outreach events, one of which is the Reading Programme where volunteers like myself will teach young children with reading difficulties how to read.

One of my most memorable experiences with SINDA was during a Reading programme when President Halimah visited SINDA to understand the work of the organisation. During her visit, I shook her hand and was even featured in a photo on her Instagram page!

4. Why did you choose to be a financial representative with Great Eastern? Do you see your work or role as a financial rep tied to your passion or heart for the people?

I chose to be a financial rep because I want to spread the awareness of the importance of proper financial planning and help people in need to meet their financial goals. This ties in with my heart for people as I help them to be prepared for any unexpected events.

I also believe that everyone needs to make their money work harder for them!