Key benefits

-

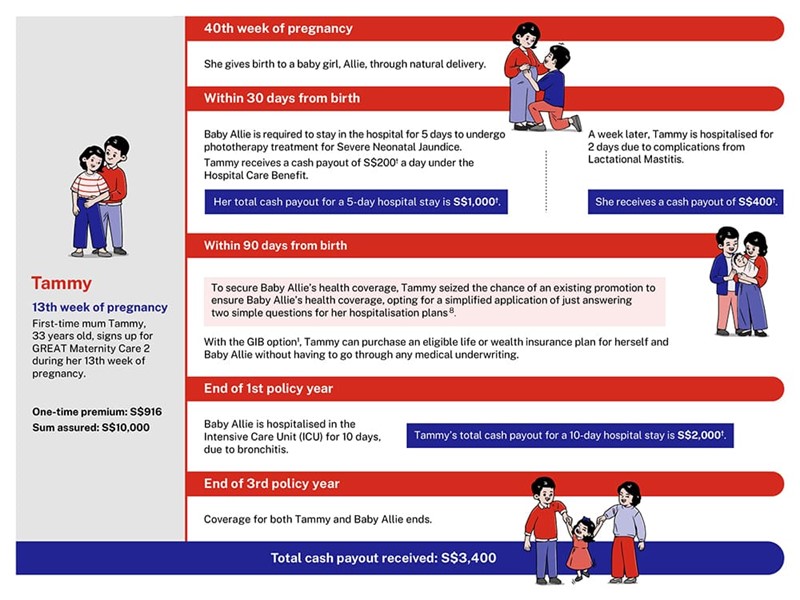

Comprehensive coverage that begins before your child’s birth

Enjoy coverage against 18 pregnancy and childbirth complications2, along with psychological consultations3. Additionally, your child is covered for 26 congenital conditions4 and 15 juvenile illnesses from birth until the end of third policy year.

-

Financial coverage for mother and child’s medical needs

Receive up to S$200 daily hospital cash payout5 on a covered hospitalisation event for both the mother and child. Some of the commonly encountered hospitalisation events are complications of Lactational Mastitis for the mother, and Phototherapy or blood transfusion for Severe Neonatal Jaundice, Hand, Foot and Mouth Disease (HFMD) and other infectious diseases for the child.

-

Safeguard you and your child’s future for life

With the GIB option1, you can insure yourself and/or your child under an eligible life or wealth plan without medical underwriting within 90 days from birth of child. Any pre-existing conditions diagnosed in your child prior to the purchase of the new policy via the GIB option1 will also be covered6.

-

Mum Again Benefit for your subsequent pregnancy

Underwriting will be waived7 on your next eligible maternity plan providing coverage on your subsequent pregnancy.

Awarded for one of the most comprehensive maternity plans

Your questions answered

1. What are the benefits of GREAT Maternity Care 2?

GREAT Maternity Care 2 is a 3-year, non-participating, single premium maternity term plan that offers protection for life assured (mother) and insured child(ren). Life assured (mother) must be between 13th to 36th weeks of pregnancy to be able to apply for this plan. Below are the benefits covered:

| Members | Benefits | Benefit Limit and Expiry |

| Life Assured (Mother) | Death or Total and Permanent Disability (TPD) Benefit | 100% of the Basic Sum Assured is payable once. Covers up to end of policy term. |

| Pregnancy and Childbirth Complications Benefit | 100% of the Basic Sum Assured is payable once. This benefit expires 120 days from the date of birth of the insured child(ren). | |

| Hospital Care Benefit | 2% of the Basic Sum Assured is payable per day, up to a maximum of 30 days. This benefit expires 120 days from the date of birth of the insured child(ren). | |

| Psychological Consultations Benefit | S$100 per consultation, up to a maximum of 3 consultations. This benefit expires 120 days from the date of birth of the insured child(ren). | |

| Mum Again Benefit | Eligible, subject to terms & conditions | |

| Guaranteed Insurability Benefit | Eligible, subject to terms & conditions | |

| Insured Child(ren) | Death Benefit | 100% of the Basic Sum Assured is payable once. Covers up to end of policy term. |

| Congenital Illness Benefit | 100% of the Basic Sum Assured is payable once. Covers up to end of policy term. | |

| Juvenile Illness Benefit | 100% of the Basic Sum Assured is payable once. Covers up to end of policy term. | |

| Hospital Care Benefit | 2% of the Basic Sum Assured is payable per day, up to a maximum of 30 days. Covers up to end of policy term. | |

| Major Organ Benefit | 50% of the Basic Sum Assured is payable once. Covers up to end of policy term. | |

| Guaranteed Insurability Benefit | Eligible, subject to terms & conditions |

In the event that the life assured (mother) is pregnant with more than one foetus in the same pregnancy, the benefits will apply to each insured child separately.

2. I am pregnant with multiple babies, can I buy this plan?

GREAT Maternity Care 2 provides coverage up to 2 foetuses (twins).

In the event that the life assured (mother) is pregnant with twins, she only needs to purchase one GREAT Maternity Care 2 policy and the benefits will apply to each of the twins separately.

3. Will my plan terminate after a claim is paid?

Each benefit is payable up to its respective benefit limit or benefit expiry date.

After a claim under a benefit is made, the remaining benefits for the life assured (mother) and the insured child(ren) will continue up to the respective benefit limit or benefit expiry date, whichever comes earlier.

The policy will only terminate on the earliest of the following dates:

(a) when the life assured (mother) dies and this results in the death of the foetus(es);

(b) when the death benefit for the life assured (mother) and all insured child(ren) are paid;

(c) when all the benefits are fully paid;

(d) when the policy term expires; or

(e) when we receive your written request for termination of the policy.

However, do note that as this product has no savings or investment feature, there is no cash value if the policy ends or if the policy is terminated prematurely.

4. What is Mum Again Benefit?

Mum Again benefit provides the life assured (mother) with the option to purchase an eligible maternity plan that provides similar benefits made available by us, on herself without medical underwriting for her subsequent pregnancy, subject to all the conditions below:

(a) the current GREAT Maternity Care 2 policy which is issued to life assured (mother) has been medically underwritten;

(b) this benefit is to be exercised within 5 years from the commencement date of the medically underwritten GREAT Maternity Care 2 policy;

(c) no claim was made on the life assured under the current medically underwritten GREAT Maternity Care 2 policy; and

(d) the life assured, at the point of exercising the benefit,

(i) is between 18 to 40 years of age next birthday;

(ii) has a pregnancy that is at less than or equal to 16 weeks of gestation;

(iii) conceived naturally with no more than 2 foetuses; and

(iv) no pre-natal genetic testing was conducted on the pregnancy.

Do note that only policyholders of GREAT Maternity Care 2 that have been medically underwritten by us are eligible to utilise the Mum Again Benefit to purchase an eligible maternity plan that provides similar benefits.

5. What is Guaranteed Insurability Benefit (GIB) option?

GIB option gives the life assured the option to purchase on her own life and/or the insured child(ren) an eligible plan (which we make available from time to time at our discretion) that provides:

(a) Death benefit;

(b) TPD benefit;

(c) Terminal illness benefit; and/or

(d) Critical illness benefit

without medical underwriting.

To exercise the GIB option, the following conditions need to be adhered to:

(a) The GIB option is to be exercised before the end of 90 days from the birth of the insured child(ren), which is the benefit expiry date;

(b) The GIB-issued policy must be on the life assured’s own life and/or the insured child;

(c) The GIB option can only be exercised once for the life assured and once for each insured child. In the event that the life assured is pregnant with more than 1 foetus in the same pregnancy, the GIB option can be exercised once for each insured child; and

The eligible plans and maximum sum assured limits per life per plan that the life assured and/or the insured child can purchase under the GIB option will be determined by us. The list of eligible plans and their sum assured limits may change from time to time at our discretion.

6. My child has a condition detected after birth. Will this condition be covered under the new life plan purchased under GIB option?

In the event the insured child who is less than 6 years old is diagnosed with, or undergoes a surgical procedure for, a condition covered under a critical illness benefit; and such condition is directly or indirectly due to a pre-existing condition, a claim under the critical illness benefit for any early, intermediate or critical stage condition, special benefit, juvenile illness benefit, benign tumour benefit or other benefit under the new policy which is similar to any of the foregoing benefits, shall be payable.

This benefit is payable once and is limited to S$30,000 on the same insured child. The policy will continue with remaining coverage, if there is any, with reduced premium.

In the event the the life assured/insured child dies or suffers from TPD due to a pre-existing condition within 12 months from the date of issue and/or date of reinstatement of the new policy, the policy will be terminated. We will refund all premiums paid under the new policy without interest, less any debts owed to us.

7. What happens if I surrender GREAT Maternity Care 2 policy early?

There will be no protection under the policy if you surrender your policy early. As this product has no savings or investment feature, there is no cash value if the policy ends or if the policy is terminated prematurely.

Buying a new policy may mean we need to reassess the life assured’s health and circumstances and may result in higher premiums and/or benefit exclusions due to the age and health status.

For more details on GREAT Maternity Care 2, please refer to the product summary. Alternatively, you may also speak to your financial representative or call us at 1800 248 2888 (9am to 5.30pm, Mon- Fri).

8. If my baby is suffering from a pre-existing condition that he/she had before signing up for a hospitalisation plan under the campaign, will the pre-existing condition be covered?

No, any pre-existing conditions that the Life Assured had before signing up for the hospitalisation plan will not be covered.

Pre-existing Condition refers to:

a) any illness, disease, disability, defect or impairments from which the life assured was suffering prior to the commencement date of insurance; or

b) any illness, disease, disability, defect or impairment of which signs or symptoms had existed in the 12 months immediately preceding the commencement date of insurance, for which:

i. the life assured had sought or received medical advice or treatment, prescription of drugs, counselling, investigation or diagnostic tests, surgery, hospitalisation; or

ii. an ordinarily prudent person would have sought medical advice or treatment, prescription of drugs, counselling, investigation or diagnostic tests, surgery, hospitalisation.

9. If my baby is born before 37 gestational weeks or has a health issue / pre-existing condition, can I still apply for a hospitalisation plan for my baby under the campaign?

No, you will not be able to apply for a hospitalisation plan under the campaign if your baby is born before 37 gestational weeks or has a health issue / pre-existing condition. However, you can still purchase the hospitalisation plans for your baby, subjected to full underwriting.

10. How many hospitalisation plans can I purchase for my baby if I am eligible for the campaign?

You can purchase one of each of the below plans for your baby:

• GREAT SupremeHealth

• GREAT TotalCare

• GREAT TotalCare Plus

• GREAT Hospital Cash

11. Am I eligible for this campaign if I have bought a GREAT Maternity Care policy instead of a GREAT Maternity Care 2?

Yes, you will be eligible for this campaign if you have an in-forced GREAT Maternity Care. Your baby must be born on or after 37 gestational weeks and be at least 15 days old and discharged from the hospital, but not be more than 90 days old at the point of applying for a hospitalisation plan under this campaign.

12. My baby already has GREAT SupremeHealth B Plus plan which was bought under the campaign. I would like to upgrade the GREAT SupremeHealth B Plus plan to a GREAT SupremeHealth A Plus plan. Would the simplified application apply to the upgrading of plan too?

No, this campaign does not apply to upgrade of existing plans. It only applies to purchasing a new plan.

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

1 The Guaranteed Insurability Benefit (GIB) option can only be exercised once for the mother, and once for the newborn. GIB option must be exercised within 90 days from the birth of the child. The list of eligible plans, and the maximum sum assured limit per life per plan that can be purchased on the life of the mother and/or the newborn are subject to change as determined by Great Eastern. The list of eligible plans excludes all hospitalisation plans such as GREAT SupremeHealth and GREAT TotalCare. The precise terms and conditions of the insurance plan are specified in the policy contract.

2 The Pregnancy and Childbirth Complications Benefit is only payable once regardless of the number of foetuses.

3 We will pay S$100 for each session of psychological or psychiatric consultation, capped at 3 sessions. This benefit will end once the limit has been reached, or 120 days from the birth of the insured child, whichever comes earlier.

4 If the mother is carrying twins, the Congenital Illness Benefit is payable once for each child respectively.

5 Hospital Care Benefit for the mother is payable up to a maximum of 30 days. The insured mother is still eligible to claim for Death or Total and Permanent Disability (TPD) Benefit, Pregnancy & Childbirth Complications Benefit and Psychological Consultations Benefit even though the Hospital Care Benefit of maximum 30 days has been utilised. If the mother is carrying twins, the Hospital Care Benefit is payable up to a maximum of 30 days for each child respectively. The child is still eligible to claim for Death, Congenital Illness Benefit, Juvenile Illness Benefit and Major Organ Benefit even though the Hospital Care Benefit of maximum 30 days has been utilised.

6 If the insured child is diagnosed with a covered condition as a result of a pre-existing condition before he/she attains 6 years old, we will pay out the claim subject to an overall limit of S$30,000. Claim payout due to pre-existing conditions is only payable once, coverage (if any) will continue with reduced sum assured and premium.

7 Subject to terms and conditions.

8 For simplified application of hospitalisation plans for GREAT Maternity Care campaign, terms and conditions of the campaign apply. Applicable to child born on/after 37 gestational weeks and be at least 15 days old and discharged from hospital but not be more than 90 days old at the point of application. Any Pre-existing Condition from which the Life Assured is suffering prior to the effective date of the eligible plans will not be covered. Please refer to the precise terms and conditions of the eligible plans specified in their respective policy contracts.

* Terms and conditions of the respective campaign offers can be referred to on Great Eastern’s website.

† 2% of the sum assured for each day of hospital stay.

All ages specified refer to age next birthday.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

As this product has no savings or investment feature, there is no cash value if policy ends or is terminated prematurely.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Information correct as at 17 September 2024.