Great Eastern launches new mobile app to provide customers with active policy management capabilities and better visibility of wealth and protection policy benefits

SINGAPORE, 1 Jul 2020 – Great Eastern has launched a new mobile app to give its Singapore customers 24/7 access to and one-glance overview of all their insurance and investment-linked policies anytime anywhere. This is a significant boost in the insurer’s digital transformation and innovative customer-centred solutions to provide greater visibility and convenience with enhanced security features, for customers to actively manage their insurance portfolio from their mobile devices.

Industry-leading features prioritised for mobile-first insurance customers

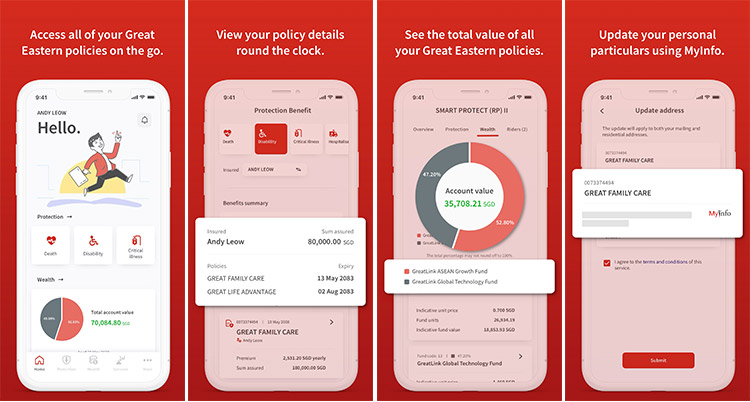

With the Great Eastern App, customers can now actively manage their investment-linked policies with more agility and simplicity through their mobile devices. With the ability to track and view fund values, customers now have the ability to track investment performance, make fund switches, fund withdrawals and premium apportionments at any time.

Instant access to comprehensive policy information, such as aggregated wealth and protection value where monthly or annual premium amounts as well as the instant viewing of maturity or expiry dates of policies and payments, can help facilitate easier policy administration for customers.

To provide better visibility for customer claims, key policy information such as benefits can be viewed easily across categories – for example death, disability, critical illness, hospitalisation, personal accident, travel, motor and home. A customer with Dependents’ Protection Scheme, Great Family Care and Great Life Advantage policies can now find out the total benefits or sum assured of all the three life policies in one overview, instead of going through policy documents one by one.

Mr Ryan Cheong, Managing Director for Digital for Business, Great Eastern said, “This is a big leap in Great Eastern’s digitalisation journey and a step in the right direction for insurers to put accessibility into the hands of our customers. Our new mobile app aims to put the customer first in terms of putting relevant information with the best user experience design and functionalities tested against feedback from our customers and financial representatives.

It will allow our customers make timely decisions on their protection and wealth portfolios, and manage them with unparalleled ease. For the digital customer of today, this addresses the need for secure and seamless accessibility to their policy portfolio with information at their fingertips”.

Innovating for Security

Among the security features supported in the Great Eastern App are biometric authentication and GREAT ID - customers’ single sign-in identity for all Great Eastern digital platforms. Customers also have the ability to securely update their personal particulars such as mobile number, email and mailing addresses with instant information populated via MyInfo and SingPass.

“The ability for customers to update their personal data on our app using MyInfo and SingPass is also an industry-first feature, which in turn helps to safeguard user privacy, prevent fraud and save paperwork without the hassle of uploading supporting documents,” added Mr Cheong.

The Great Eastern App aims to provide an optimised mobile experience for its Singapore-based customers and is already available on both the Apple AppStore for iOS users and Google Play Store for Android users. Since June 1, the app has garnered over 9,000 downloads, and is scheduled to roll out more value-added services in the next few months.

Empowering Customers and Financial Representatives Digitally

Great Eastern has launched services on digital platforms progressively since 2018 as part of its digital transformation strategy to provide better customer engagement, at the same time empowering its financial representatives to deliver quality service.

Customers can already purchase various general insurance solutions via Great Eastern’s digital affinity partners, and access policy information or perform selected transactions via Great Eastern’s E-Connect web portal.

Great Eastern’s two apps, GETGREAT and UPGREAT, empower and reward customers and the community to live healthier and better. GETGREAT is the first-of-its-kind wellness platform with a wellness coach powered by artificial intelligence, which offers personalised coaching 24/7 to nudge users towards their personal wellness goals. UPGREAT provides a single mobile platform where customers can seamlessly enjoy all their loyalty benefits and rewards digitally anywhere, any time.

The company has accelerated its roll-out of digital tools for customers and financial representatives amid the COVID-19 pandemic. Since as early as February, Singapore-based residents have been able to purchase certain life insurance products online. Great Eastern customers have also been able to engage with its financial representatives through non face-to-face channels through video calls to provide remote or tele-advisory services since March.

Its Great Digital Advantage platform first rolled out in 2019 to digitally empower its financial representatives to provide a better advisory experience to customers – offers interactive life storyboards and planning tools which help customers map their insurance needs to every stage of their life. This platform also allows financial representatives to better manage their customer relationships, monitor their sales activities and performance outcomes, thereby improving their productivity and efficiency with digital innovations.

Note to editors : More information on the Great Eastern Singapore App.

About Great Eastern

Founded in 1908, Great Eastern is a well-established market leader and trusted brand in Singapore and Malaysia. With over S$90 billion in assets and more than 8 million policyholders, including 5 million from government schemes, it provides insurance solutions to customers through three successful distribution channels – a tied agency force, bancassurance, and financial advisory firm Great Eastern Financial Advisers. The Group also operates in Indonesia and Brunei and has a presence in China as well as a representative office in Myanmar.

The Great Eastern Life Assurance Company Limited and Great Eastern General Insurance Limited have been assigned the financial strength and counterparty credit ratings of "AA-" by Standard and Poor's since 2010, one of the highest among Asian life insurance companies. Great Eastern's asset management subsidiary, Lion Global Investors Limited, is one of the largest private sector asset management companies in Southeast Asia.

Great Eastern is a subsidiary of OCBC Bank, the longest established Singapore bank, formed in 1932. It is now the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with an Aa1 rating from Moody’s. Recognised for its financial strength and stability, OCBC Bank is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

#GreatEasternSG #TheLifeCompany #Lifeproof

Media Contacts

Annette Pau

VP, Group Corporate Communications

Email: Corpcomms-sg@greateasternlife.com

Crystal Chan

AVP, Group Corporate Communications

Email: Corpcomms-sg@greateasternlife.com

Annex

Customer Quotes on the Great Eastern App

(from Apple App Store & Google Play Store)

"It's easy to use. Great Job!"

"Excellent app. Makes it very convenient to keep track and manage all policies. It’s user friendly and efficient."

"Smooth installation and I am able to see my policies within one location."

"Clear cut, fuss free and neat."

"Finally there is an app to check all my policies!"