Retirees who did not plan for retirement at Greater Risk of Financial Exhaustion, Great Eastern Survey Reveals

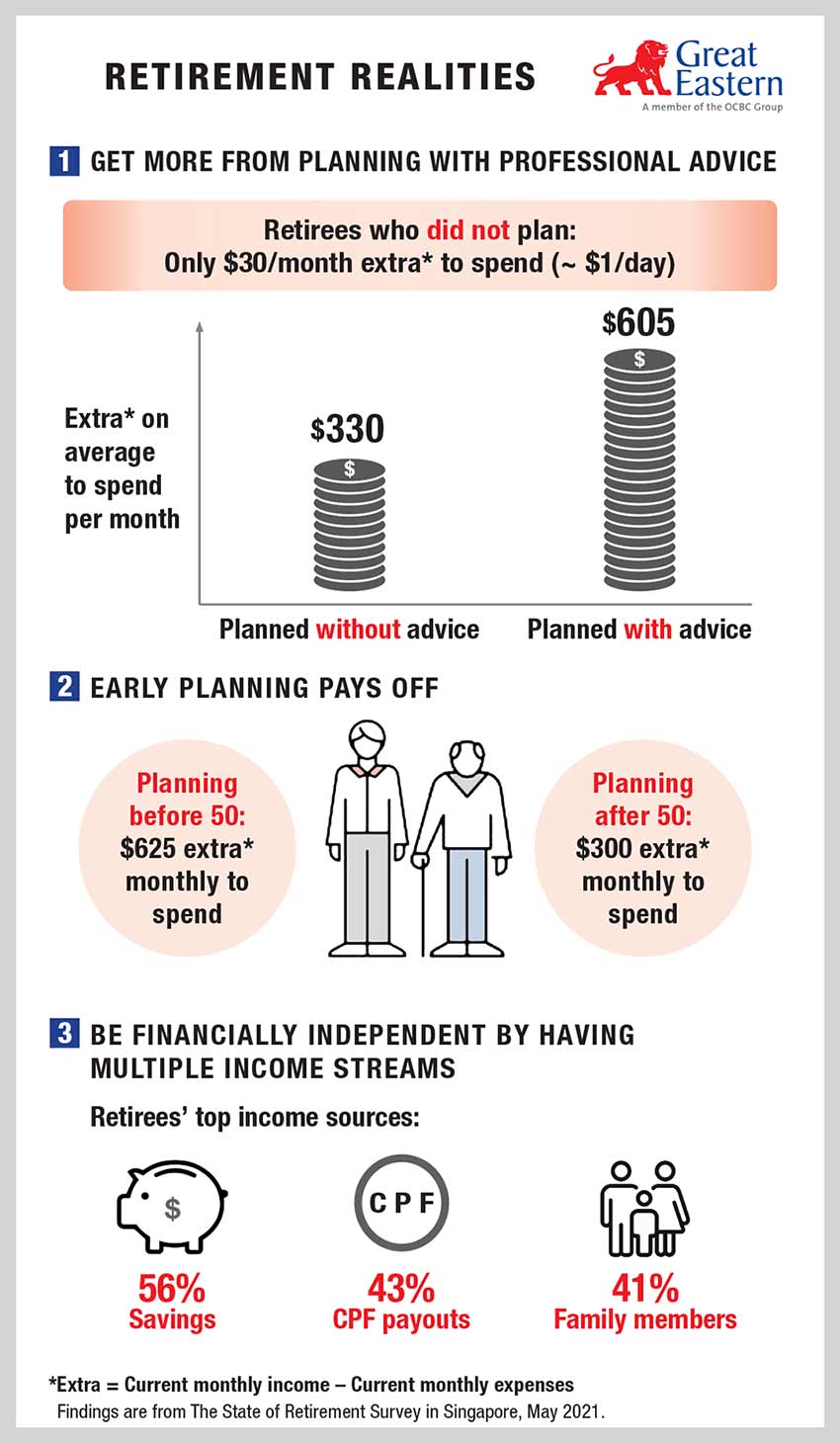

Singapore, 31 August 2021 – Leading insurer Great Eastern revealed in its “The State of Retirement in Singapore” survey that retirees who did not plan for their retirement and depended on a monthly retirement income (mainly from past savings, CPF payouts and family members’ allowances) of S$1,200, were barely meeting their basic monthly expenses and were left with only S$30 extra* each month. This translates to about one dollar a day, which does not enable them to meet unexpected or additional expenses such as medical costs should they fall ill.

Plan Early and Seek Professional Help

There are clearly advantages to early planning and doing so with professional advisory to secure financial independence later in one’s retirement years.

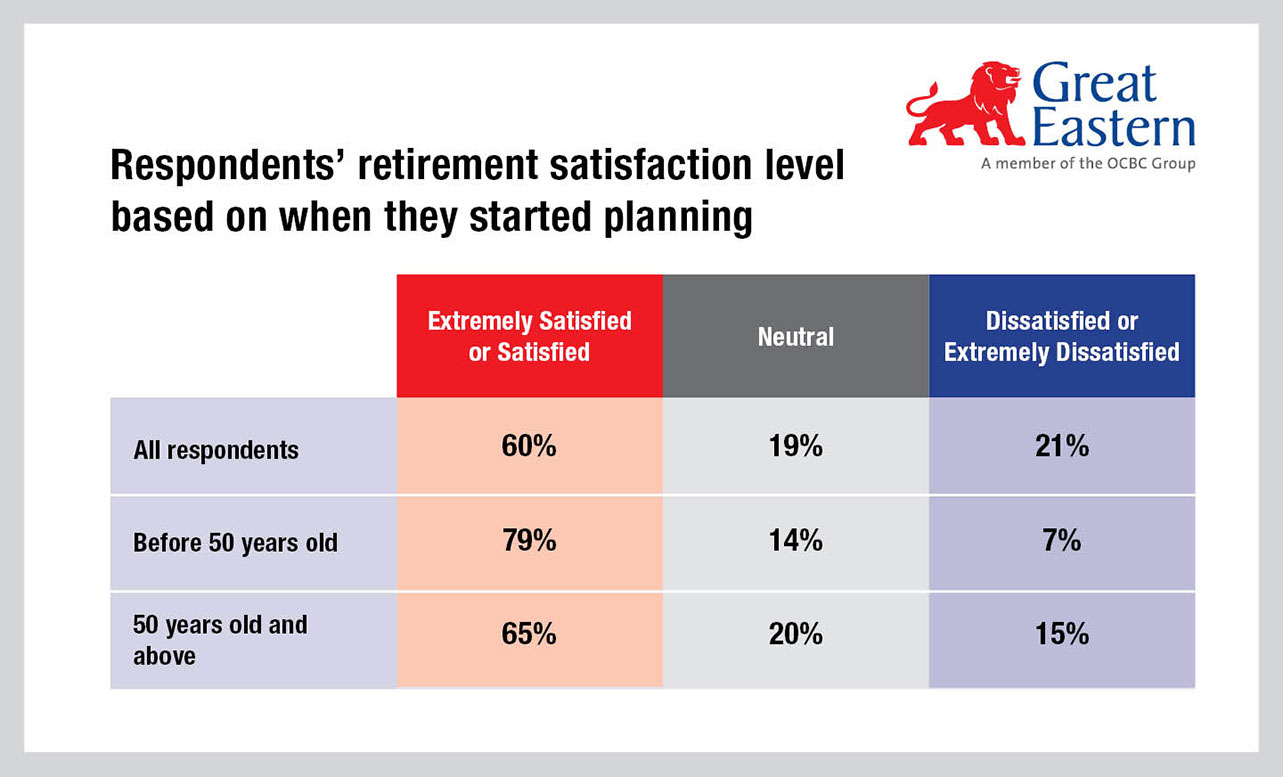

The survey findings showed that retirees who started planning before age 50, were in a stronger financial position with an average of S$625 extra* to spend monthly for any unplanned expenses. This is 20 times more as compared to those who did not plan for their retirement ($30). In contrast, retirees who planned after age 50 had S$300 extra to spend as compared to those who planned before age 50.

Retirees who had planned with professional advice had on average S$605 extra to spend as they wished. This was more than twice that of retirees who had planned for retirement without professional advice (S$330).

Starting Late and Not Seeking Professional Advice were among the Top Regrets of Retirees

Financial stability was strongly linked to contentment in retirement, with respondents

reporting significantly higher overall retirement satisfaction with their current finances, financial planning outcomes and CPF payouts.

Over 60 per cent of those surveyed regretted how they planned their retirement on hindsight, whereas 45 per cent of them shared that not planning earlier was a key regret. Most of the respondents said they wished they had 60 per cent more money to spend on a monthly basis. Clearly, their retiree lifestyles were limited by their retirement income and they were unable to realise their desired retirement spending ability.

Findings showed that retirees had to adjust their lifestyle expectations to manage their actual retirement incomes. They were also notably more vulnerable to large unexpected expenses, not having planned for their retirement holistically to take into account items such as medical costs which could easily snowball into sizeable amounts. In an earlier survey on critical illness (March 2021), Great Eastern found that more than S$250,000 was spent on medical and hospitalisation bills for Critical Illness patients and their caregivers1, leading to the rise of inadequacy of income for other necessaries.

Rising Singlehood, Lower Birth Rates, and a call for Women to be Financially Independent

The top three income sources of the survey respondents were past savings (56 per cent), CPF payouts (43 per cent) and allowances from family members (41 per cent), which formed the bulk of their income during retirement.

The survey also found that women did not prioritise their financial needs as much as men. Women were much more dependent later in life on their children and family members for monthly allowances (45 per cent) than men (39 per cent); and had less investment income (18 per cent) than the men surveyed (31 per cent). These findings point to a lack of financial preparedness affecting self-sufficiency during retirement years for women.

Data from Singapore’s Census 2020 has shown that singlehood and childlessness are on the rise2. This means that women are likely to be their sole financial contributors in life. Thus, it is important for them to prioritise retirement planning as life expectancy is expected to reach age 85.4 for women in Singapore by 2040.

Colin Chan, Managing Director for Group Marketing, Great Eastern said: “With longer life expectancy and the rising cost of living in Singapore, proactive retirement planning and starting early is more important than ever. While retirement planning might be a distant concern for many of us, the many uncertainties in recent times impacting people’s job security is a reality. We encourage people to get started early, no matter how small, so that they can have the freedom to make their own decisions to lead their desired retirement lifestyle with the help of professional advice.”

“As a leading insurer committed to improving people’s lives, we want to help and educate them to plan holistically so that they can live #Lifeproof. This includes looking at their long-term care needs as part of their retirement plan and plugging financial planning gaps, taking care of unforeseens which may arise later in life”, he said.

To encourage people to become financially independent and be empowered to make their financial decisions even after retirement, Great Eastern has launched “Don’t Lose the Freedom to Make Your Own Choices” campaign. This campaign reiterates the importance of leading our desired retirement lifestyles through forward retirement planning with Great Eastern’s financial storyboard tool. The campaign will be shared on various digital platforms.

Editor’s Note

”The State of Retirement in Singapore” Survey

Great Eastern’s survey was conducted in May 2021 with 304 respondents above age 63 in Singapore through an independent research consultancy. Online and qualitative interviews were conducted to better understand the current state of retirement in Singapore.

Annex A – Survey infographics and other data

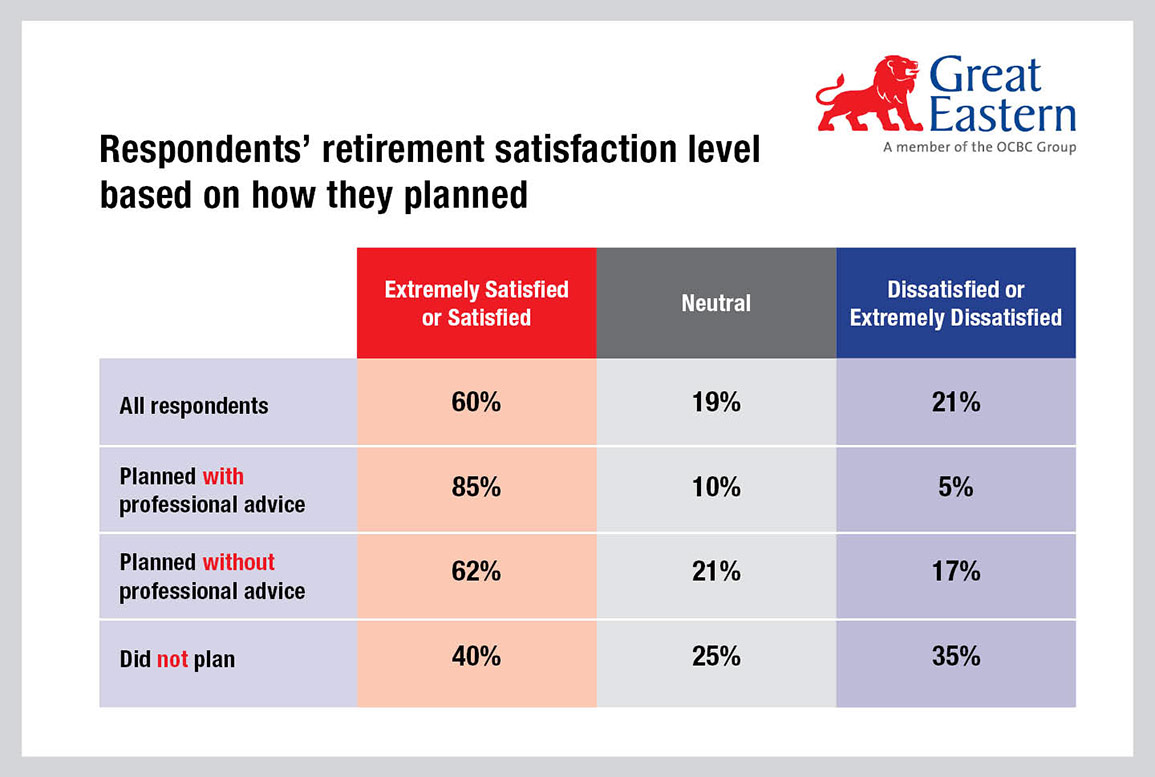

- In the survey, 28 per cent of retirees planned with professional advice compared to 33 per cent who planned without professional advice.

- Those who planned did so by setting aside money in savings or current account on a regular basis (66 per cent), investments in stocks/unit trusts/bonds (49 per cent), investments in fixed deposit plans (40 per cent), topping up their CPF Life (33 percent) and buying endowment insurance policies (33 per cent), or retirement insurance policies (32 per cent).

Retirement satisfaction breakdown:

Annex B – Great Eastern’s Retirement Solutions

Great Eastern has launched GREAT Retire Income and GREAT Lifetime Payout plans which give customers’ the choice to receive either monthly payouts over 10 or 20 years, or a lifetime of monthly cash payouts to help them achieve their financial freedom. For GREAT Retire Income plan, customers will be protected against disability if they are unable to perform two out of the six Activities of Daily Living3 during the payout period. Customers may purchase the plans via Great Eastern’s financial representatives or through OCBC Bank.

*Please refer to Annex A.

[1] Great Eastern Consumer Survey, Over 80% of Critical Illness patients (and their Caregivers) regret not buying more insurance coverage; medical bills and income loss are the biggest worries – Great Eastern consumer survey

[2] Department of Statistics Singapore, Singapore Census of Population 2020, Statistical Release 1: Demographic Characteristics, Education, Language and Religion,

[3] Activities of Daily Living (ADLs) are washing, toileting, dressing, feeding, walking or moving around and transferring. The Life Assured will receive 50% of the Guaranteed Monthly Income (capped at maximum Loss of independence (LOI) income benefit of S$2,500 per month) if the Life Assured is not able to perform 2 of the 6 ADLs; (ii)100% of Guaranteed Monthly Income (capped at maximum LOI income benefit of S$5000 per month) if the Life Assured is not able to perform 3 (or more) of the 6 ADLs.

About Great Eastern

Founded in 1908, Great Eastern is a well-established market leader and trusted brand in Singapore and Malaysia. With over S$90 billion in assets and more than 10 million policyholders, including 7.5 million from government schemes, it provides insurance solutions to customers through three successful distribution channels – a tied agency force, bancassurance, and financial advisory firm Great Eastern Financial Advisers. The Group also operates in Indonesia and Brunei and has a presence in China as well as a representative office in Myanmar.

The Great Eastern Life Assurance Company Limited and Great Eastern General Insurance Limited have been assigned the financial strength and counterparty credit ratings of "AA-" by Standard and Poor's since 2010, one of the highest among Asian life insurance companies. Great Eastern's asset management subsidiary, Lion Global Investors Limited, is one of the largest private sector asset management companies in Southeast Asia.

Great Eastern is a subsidiary of OCBC Bank, the longest established Singapore bank, formed in 1932. It is now the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with an Aa1 rating from Moody’s. Recognised for its financial strength and stability, OCBC Bank is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

#GreatEasternSG #TheLifeCompany #Lifeproof

Media Contacts

Lynette Wong / Jinnie Nguyen

BlueCurrent Group for Great Eastern

Email: GreatEastern@bluecurrentgroup.com

Annette Pau

VP, Group Corporate Communications

Email: Corpcomms-sg@greateasternlife.com

Abigail Han

AVP, Group Corporate Communications

Email: Corpcomms-sg@greateasternlife.com