Key benefits

-

Lifetime monthly payouts up to 3.15% per annum1

Receive monthly payouts of up to 3.15% per annum1 after holding your plan for just 3.5 years.

You can also choose to receive your payouts each month or let them accumulate for potential higher returns2 in the future.

-

Guaranteed capital and protection in a single plan

Enjoy 100% protection on your fully paid 3 year premiums and coverage against death and terminal illness to support your loved ones.

-

Option to receive additional guaranteed returns

Choose to add on the GREAT Lifetime Payout Rider to cover GREAT Lifetime Payout 3 premiums in the 2nd and 3rd year. This single premium non-participating rider also offers a guaranteed maturity benefit at the end of the 2nd policy year, giving an uplift to your returns.

Your questions answered

1. What is GREAT Lifetime Payout 3?

GREAT Lifetime Payout 3 is a regular premium participating whole life insurance plan with a limited premium payment term of 3 years. It provides a monthly payout for life at the end of each policy month, starting from the 43rd policy month. It is also capital guaranteed1 from the end of the 3rd policy year.

1 Capital guarantee is on the condition that premiums are paid by annual mode and no policy alterations are made.

2. What is the coverage under GREAT Lifetime Payout 3?

GREAT Lifetime Payout 3 provides you with financial protection against death and terminal illness.

If the life assured suffered from any of the above events during the policy term, we will pay a lump sum benefit of 105% of the total standard annual premiums paid plus bonus (if any), less any debts. The policy will end after we make this payment.

There are certain situations when we will not pay the benefits under this policy. You can refer to the product summary for more details.

3. What will I receive in the monthly payout?

From the 43rd policy month onwards, you will receive a payout at the end of each policy month till a claim is admitted, or the plan is terminated, whichever is earlier. Alternatively, you may also choose to keep the payout with us to earn non-guaranteed interest. Please note that the non-guaranteed interest is subject to change without prior notice.

Each payout during the 43rd – 48th policy month comprises:

- Guaranteed survival benefit, also known as monthly income

Each payout starting from the 49th policy month comprises:

- Guaranteed survival benefit, also known as monthly income; and

- 1/12 of the yearly cash bonus that is declared yearly, starting from the 4th policy anniversary.

- the performance of the participating fund and its future outlook, which you should receive around the second quarter of each year after bonus is declared for your policy; and

- an annual statement regarding bonuses for your policy, which you should receive around the second quarter of each year after bonus is declared for your policy. For policies with cash bonus, you should receive the relevant statement within one month from your policy anniversary only when the cash bonus is due.

For annual premium S$30,000 and above Payout starting from |

Guaranteed survival benefit | Non-guaranteed cash bonus* | Total monthly payout | |

| Annual payout expressed as % of Total Standard Annual Premiums | 43rd to 48th policy month | 3.15% p.a. | - | 3.15% p.a. |

| 49th policy month onwards | 0.85% p.a. | 2.30% p.a. | 3.15% p.a. | |

*Based on an Illustrated Investment Rate of Return (IIRR) of 4.25% p.a.. Based on an IIRR of 3.00% p.a., the non-guaranteed payout is up to 1.24% p.a. of the total standard annual premiums paid.

| For annual premium less than S$30,000 Payout starting from | Guaranteed survival benefit | Non-guaranteed cash bonus^ | Total monthly payout | |

| Annual payout expressed as % of Total Standard Annual Premiums | 43rd to 48th policy month | 3.00% p.a. | - | 3.00% p.a. |

| 49th policy month onwards | 0.80% p.a. | 2.20% p.a. | 3.00% p.a. | |

4. What other form of bonus(s) will I be receiving?

You will also receive the terminal bonus (if applicable) in a lump sum when you surrender your policy or when there is a claim admitted under the policy that terminates the policy, whichever event occurs first.

We usually review the terminal bonus yearly.

5. How will I be updated on the performance of the policy?

You will receive an annual bonus update that will include the following:

When there is a change in the rate of bonuses declared, you can ask us for an update of the illustrated values.

6. What is GREAT Lifetime Payout Rider?

The GREAT Lifetime Payout Rider is an optional single premium non-participating endowment rider with a rider term of 2 years. It provides a seamless premium payment experience by paying a guaranteed yearly payout benefit at the end of the 12th and 24th policy months to pay for the annual premiums of the GREAT Lifetime Payout 3 base plan, when they fall due.

At the end of the 2 years, the rider matures and pays a guaranteed maturity benefit.

7. Can I add on the GREAT Lifetime Payout Rider to my existing GREAT Lifetime Payout Series policy?

The GREAT Lifetime Payout Rider is available only when you apply for a new GREAT Lifetime Payout 3 policy. It cannot be added on to existing policies.

8. What happens if you surrender the policy and/or rider early?

If you surrender your policy and/or its attached rider after the 14-day free-look period, you may lose part or all of the premiums paid. This is because the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

If you surrender only the GREAT Lifetime Payout Rider, you must continue paying the future premiums of the GREAT Lifetime Payout 3 plan when they fall due, to avoid the policy from lapsing. Partial surrender of the rider is not allowed.

9. What happens if you do not pay your premiums on time?

If you do not pay your premiums within the 30 days grace period, your policy may lapse. However, you may reinstate the policy within 6 months from the date it lapsed and usual reinstatement conditions apply. This is not applicable if you attach the GREAT Lifetime Payout Rider to your plan because the rider will pay for the annual premiums for the remaining years when they fall due, provided it is not surrendered.

10. What are the fees and charges?

We have included fees and charges when working out the premium and you will not be separately charged for these. Please refer to the Product Summary for details of the fees and charges.

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

1 For a Standard Annual Premium of S$30,000 and above, based on an Illustrated Investment Rate of Return (IIRR) of the participating fund at 4.25% p.a., the guaranteed payout of 3.15% p.a. is only applicable from the 43rd to 48th policy month. From the 49th policy month onwards, based on IIRR of the participating fund at 4.25% p.a., the guaranteed payout is 0.85% p.a. and the non-guaranteed payout is up to 2.30% p.a.. At an IIRR of 3.00% p.a., the guaranteed payout is 0.85% p.a. and the non-guaranteed payout is up to 1.24% p.a. of the total annual premiums paid.

For a Standard Annual Premium below S$30,000, based on an IIRR of the participating fund at 4.25% p.a., the guaranteed payout of 3.00% p.a. is only applicable from the 43rd to 48th policy month. From the 49th policy month onwards, based on IIRR of the participating fund at 4.25% p.a., the guaranteed payout is 0.80% p.a. and the non-guaranteed payout is up to 2.20% p.a.. At an IIRR of 3.00% p.a., the guaranteed payout is 0.80% p.a. and the non-guaranteed payout is up to 1.18% p.a. of the total annual premiums paid.

The actual benefits payable may vary according to the future experience of the participating fund.

2 The prevailing accumulation interest rate is 3.00% p.a. based on an IIRR of 4.25% p.a. and 1.50% p.a. based on an IIRR of 3.00% p.a.. This rate is not guaranteed and can be changed from time to time.

3 Capital guarantee is on the condition that premiums are paid by annual mode and no policy alterations are made.

4 If the GREAT Lifetime Payout Rider is surrendered, the policyholder must continue paying the future premiums for GREAT Lifetime Payout 3 when they fall due, to prevent the policy from lapsing.

All figures used for illustrations are based on an IIRR of the participating fund at 4.25% p.a. unless otherwise stated.

* The rate of the guaranteed maturity benefit for your Rider will be based on the applicable rate for the date on which you submitted the application, assuming you have paid for your policy, and it is in force.

You should refer to your policy documents for the applicable maturity benefit rate. The Company reserves the right to amend the Rider’s rates payable for the maturity benefit at any time without prior notice. Such amendments will not affect any applications which have been submitted or policies that are in-force. Please refer to your policy illustration for your Rider’s applicable maturity benefit.

The Company also reserves the right to invalidate any application where both the GREAT Lifetime Payout 3 and Rider have not turned in-force within 7 days from the date of submission of the application. Please approach your Financial Representative for more information about the prevailing maturity benefit rate.

** Based on an IIRR of 3.00% p.a., the payout per month from age 54 is S$157.00 (S$63.75 guaranteed + S$93.25 non-guaranteed).

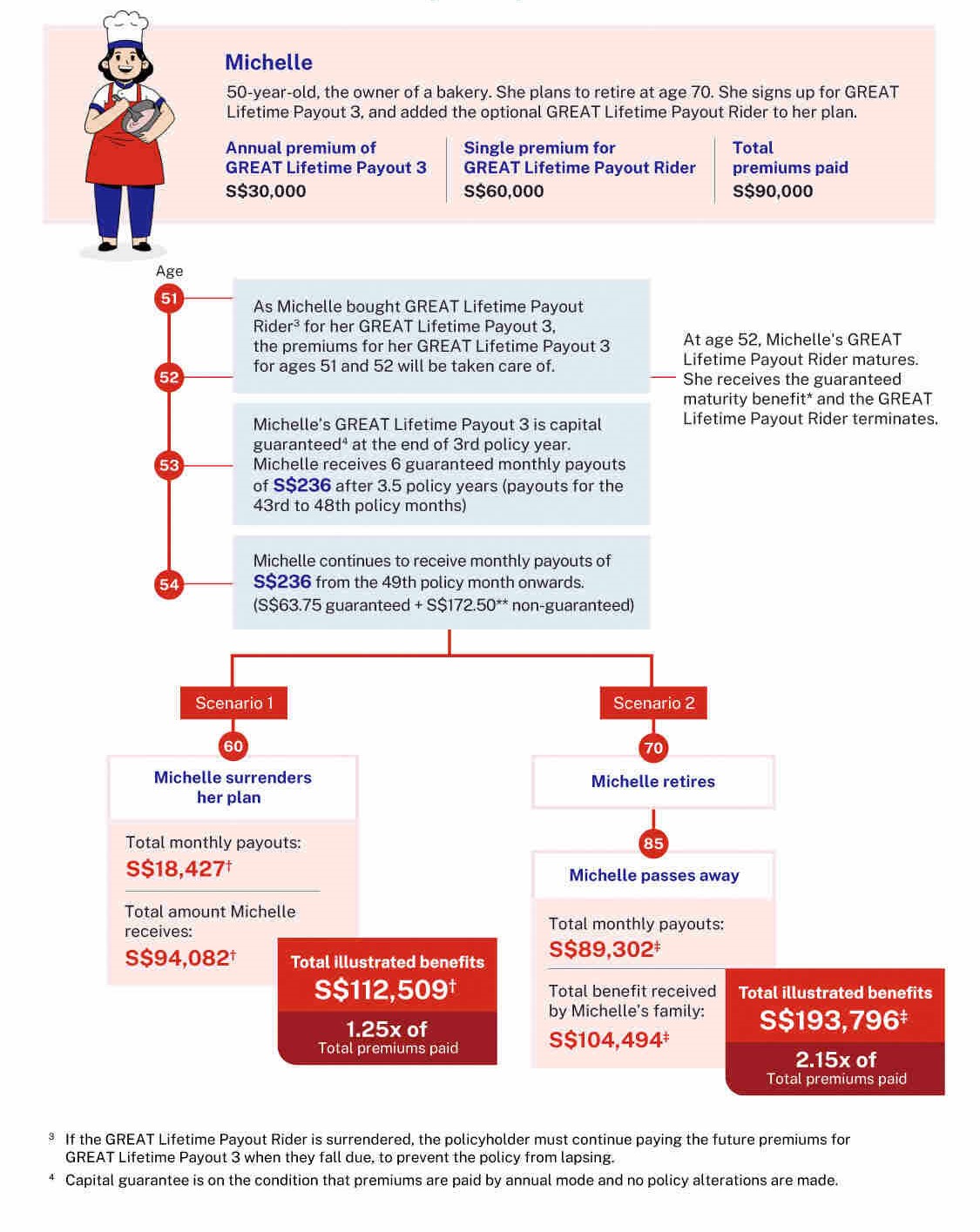

† The total amount upon surrender includes total guaranteed and non-guaranteed surrender value plus remaining declared but unpaid cash bonus and non-guaranteed interest earned on unpaid monthly cash bonus. This amount does not include the guaranteed maturity benefit from GREAT Lifetime Payout Rider. Based on an IIRR of 3.00% p.a., the total monthly payouts received by Michelle is S$12,721, the total amount upon surrender is S$92,074 and the total illustrated benefits are S$104,795 (1.16x of total premiums paid).

‡ The total benefit received by Michelle’s family inludes total guaranteed and non-guaranteed death benefit plus remaining declared but unpaid cash bonus and non-guaranteed interest earned on unpaid monthly cash bonus. This amount does not include the guaranteed maturity benefit from GREAT Lifetime Payout Rider. Based on an IIRR of 3.00% p.a., the total monthly payouts received by Michelle is S$59,821, the total benefit received by Michelle’s family is S$99,112, and the total illustrated benefits are S$158,933 (1.76x of total premiums paid).

All ages specified refer to age next birthday.

All figures used are for illustrative purposes only and subject to rounding.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

In case of discrepancy between the English and Chinese versions, the English version shall prevail.

Information correct as at 28 January 2026.