Over 80% of Critical Illness patients (and their Caregivers) regret not buying more insurance coverage; medical bills and income loss are the biggest worries – Great Eastern consumer survey

Key Findings:

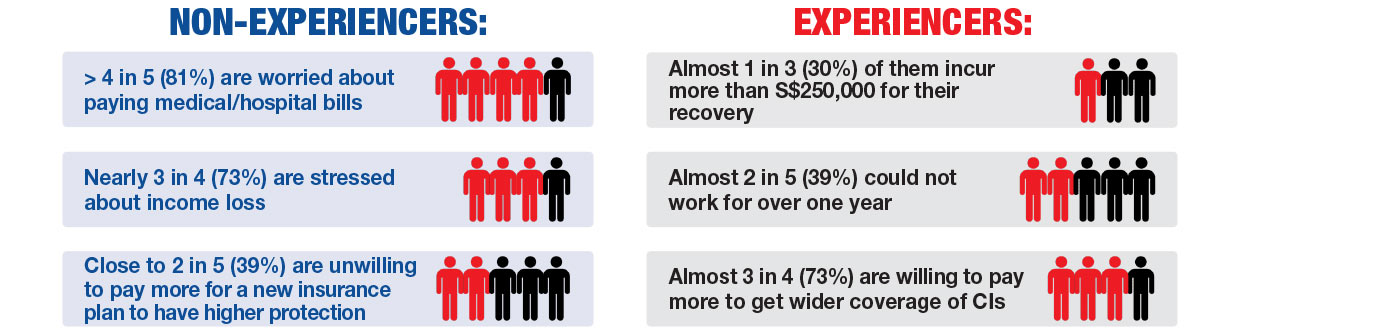

- Over 50% of Critical Illness (CI) patients and their caregivers (People who have experienced CIs or “Experiencers”) depend on insurance payouts to manage their financial expenses. Almost 1 in 3 (30%) of them incur more than S$250,000 in medical and hospitalisation bills for their entire recovery duration with nearly 2 in 5 (40%) with no income for at least 12 months

- Almost 3 in 4 (73%) of the Experiencers are willing to pay higher premiums for more protection against various CIs or relapses in the future, and over 80% regretted not getting more coverage

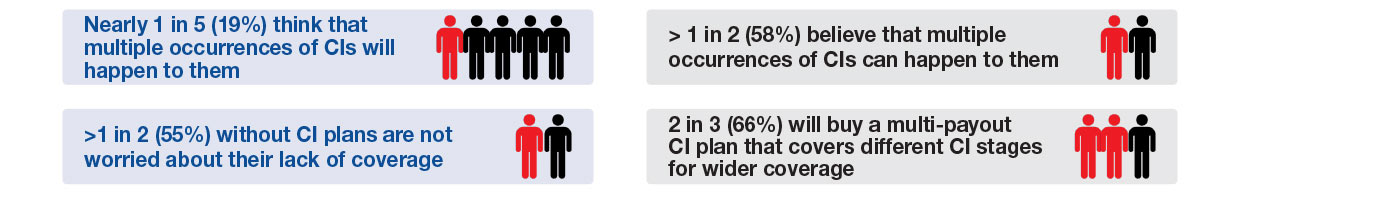

- Over 50% of the Experiencers believe that they will have multiple occurrences of CIs

- Almost 40% of the surveyed non-CI patients and those who have not cared for a CI patient before (People who have not experienced CIs or “Non-Experiencers”) are unwilling to pay more for a new insurance plan to get higher protection

SINGAPORE, 8 March 2021 – Great Eastern’s “The Impact of Critical Illness in Singapore” survey conducted in December 2020 with over 500 Singaporeans, revealed that Singaporeans are worried about incurring long-term medical expenses and income loss.

This survey covered two groups with an even mix of :

- CI patients and their caregivers (People who have experienced CIs or “Experiencers”) in the past three years, and

- those who were not CI patients nor cared for a CI patient before (People who have not experienced CIs or “Non-Experiencers”) in the past three years.

Protection Gap Exists

Singaporeans are mostly worried about hefty medical bills and loss of income as recovery can take several years. Almost half of the Experiencers cited medical costs for prolonged treatments. More than 4 in 5 (81%) of the Non-Experiencers are worried about paying their medical bills, and nearly three-quarters of them are concerned about losing their income while being caregivers for parents or relatives who were ill.

According to LIA’s 2018 Protection Gap Study, an average Singaporean working adult has critical illness cover of just S$60,000, way below LIA’s recommendation of about S$316,000 or almost 4 times the average annual pay of S$81,663.

Great Eastern’s survey highlighted the perception differences of the Non-Experiencers. Almost 40% of them are unwilling to pay more for a new insurance plan that gives higher protection. Not being aware of the benefits of a CI plan is also a key barrier to them getting one.

For the non-Experiencers who own CI plans, nearly half of them think they have sufficient coverage. Close to half (45%) who have no CI plans are not worried about their lack of coverage as they assume that their existing medical plans (MediSave/MediShield/Integrated Shield plans) are sufficient.

Importance of Getting Insured against CIs Early

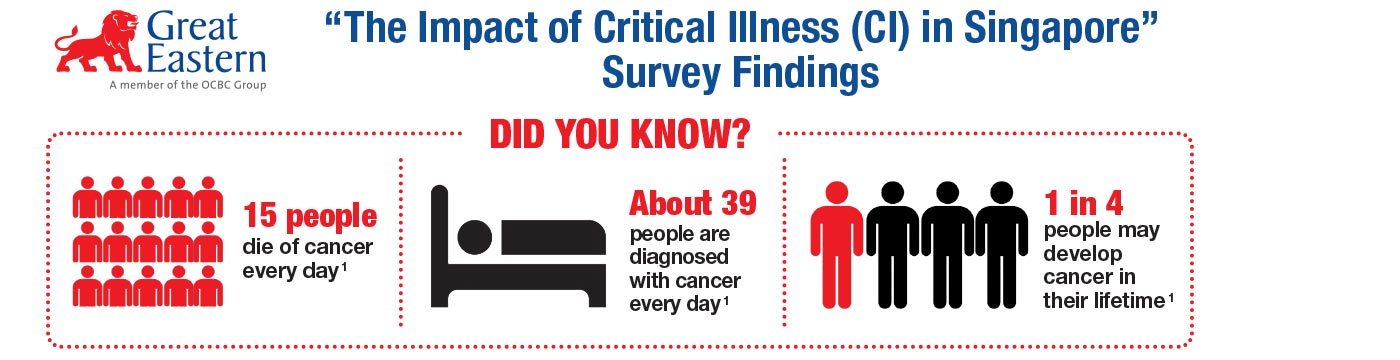

According to the Singapore Cancer Society, about 39 people in Singapore are diagnosed with cancer every day, while 15 people die of cancer every day, and 1 in 4 people may develop cancer in their lifetime1.

Patrick Kok, Managing Director, Group Operations, said : “Being inflicted with CIs such as cancer can be very challenging and financially straining for the patient and his family. Preventive measures such as regular health screenings and having early intervention are important. We also need enough protection to be financially prepared against CIs so that we can focus on recovery and have the peace of mind if CIs strike.”

An average Singaporean born in 2017 is expected to live for 84.8 years, including 10.6 years in poor health2 and is only covered for around 20 per cent of the expenses needed to tide over a CI event3. Assuming the recovery period for a CI3 patient is five years, he still needs to provide for his daily needs during this recuperation period or until the insured person can resume work or adjust his lifestyle needs.

CIs can happen multiple times, according to a 4-time Cancer Survivor

Zoe Yap, a CI survivor who has since become a Great Eastern financial representative herself, said: “When I was diagnosed with cancer, I never thought it would happen to me. In the last six years, I have fought through four incidences of cancer and am still battling against cancer today. Early insurance planning before my first diagnosis helped my family manage my medical and hospitalisation bills. This has actually inspired me to become a financial representative during the time I was recuperating. I realised that it was important to share the message on early insurance planning especially for critical illnesses. Now, as a financial representative, I am a living example to my clients as I have seen for myself the importance and benefits.”

Forward Planning against CIs works hand in hand with other health insurance

More people are getting diagnosed with CIs as according to the National Registry of Diseases Office, there is an overall increase in the number of teenagers and young adults (age 15 to 34) diagnosed with cancer4. With increasing life expectancy, it is important to start planning early for sufficient protection throughout all stages of CIs.

Colin Chan, Managing Director, Group Marketing, Great Eastern said : “Not all CI patients have continued protection after their first diagnosis, as it depends on the type of insurance plan they own. Multiple incidences of critical illnesses can happen. Our survey showed that 80% of those who experienced CIs are actually willing to pay more for additional insurance (hospitalisation or CI). Almost all who tried to buy more insurance plans later encountered difficulties, and regretted not having provisioned for the additional coverage upfront. We hope to address this with a solution that offers continued coverage after a diagnosis of CI with multiple payouts. As an insurer, we want to help Singaporeans to have all-rounded protection and continued coverage for life.”

To further build awareness among Singaporeans, Great Eastern launched its “I Don’t Want to Miss a Thing” campaign to communicate that we can enjoy life and not miss out on its important milestones if multiple occurrences of CIs strike unexpectedly. The campaign will be shared on various media, including free-to-air television and digital platforms.

Great Eastern’s GREAT Life Advantage with its Complete MultiPay CI Plus Advantage Rider provides multiple CI coverage for life and restores the sum assured after each claim5. It gives up to 3 times coverage against all stages of CI (early, intermediate and critical6.

Customers can find out more about the GREAT Life Advantage and its Complete MultiPay CI Plus Advantage Rider that provides coverage against 120 critical illness conditions across different stages through Great Eastern’s financial representatives.

Great Eastern also offers other insurance solutions such as hospitalisation, disability insurance and CI plans for forward planning and to enable customers to receive financial support against hospitalisation and medical costs.

Footnotes:

1. Source: Singapore Cancer Society - https://www.singaporecancersociety.org.sg/learn-about-cancer/cancer-basics/common-types-of-cancer-in-singapore.html

2. Source: Ministry of Health Singapore and University of Washington - The Burden of Disease in Singapore, 1990 to 2017

3. Source: Life Insurance Association Singapore 2017 Protection Gap Study - https://www.lia.org.sg/media/1332/protection-gap-study-report-2017.pdf

4. Source: Singapore Cancer Registry 50th Anniversary Monograph (1968 – 2017)

5. Coverage restores to 100% after 12 months from the date of diagnosis for critical illness (excluding subsequent cancer, subsequent heart attack or subsequent stroke) and after 24 months from the date of diagnosis of the immediately preceding cancer, immediately preceding heart attack or immediately preceding stroke for subsequent cancer, subsequent heart attack or subsequent stroke respectively.

6. The Complete Multipay CI Plus Advantage Rider allows claims for up to 3 times on the same CI condition - cancer, heart attack and stroke, and regardless of the CI stage (Early, Intermediate or Critical), subject to terms and conditions.

*Note to editors: The online survey was conducted between December 2020 and January 2021. The 507 respondents are between the ages of 18 – 64, of which 250 respondents are CI patients and their caregivers (People who have experienced CI or “Experiencers”) and the remaining 257 are non-CI patients and those who have not cared for a CI patient before (People who have not experienced CIs or “Non-Experiencers). All the respondents are Singaporeans or Permanent Residents based in Singapore. Critical illness refers to any 1 of the 37 conditions of the Life Insurance Association Critical Illness Framework, including major cancer, heart attack of specified severity, and stroke with permanent neurological deficit. View the full industry list here. Great Eastern covers over 53 CIs in our health insurance plans.

Appendix: Infographics – “The Impact of Critical Illness in Singapore” Survey Findings

About Great Eastern

Founded in 1908, Great Eastern is a well-established market leader and trusted brand in Singapore and Malaysia. With over S$90 billion in assets and more than 10 million policyholders, including 6 million from government schemes, it provides insurance solutions to customers through three successful distribution channels – a tied agency force, bancassurance, and financial advisory firm Great Eastern Financial Advisers. The Group also operates in Indonesia and Brunei and has a presence in China as well as a representative office in Myanmar.

The Great Eastern Life Assurance Company Limited and Great Eastern General Insurance Limited have been assigned the financial strength and counterparty credit ratings of "AA-" by Standard and Poor's since 2010, one of the highest among Asian life insurance companies. Great Eastern's asset management subsidiary, Lion Global Investors Limited, is one of the largest private sector asset management companies in Southeast Asia.

Great Eastern is a subsidiary of OCBC Bank, the longest established Singapore bank, formed in 1932. It is now the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with an Aa1 rating from Moody’s. Recognised for its financial strength and stability, OCBC Bank is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

#GreatEasternSG #TheLifeCompany #Lifeproof

For more information, please contact:

Annette Pau

Head, Group Corporate Communications

Email: Corpcomms-sg@greateasternlife.com

Abigail Han

AVP, Group Corporate Communications

Email: Corpcomms-sg@greateasternlife.com