Climate Action

Great Eastern believes in sustainable development and we are committed to achieving Net Zero by 2050. Our plan for contributing to the global environmental conversation focuses on making responsible investments, safeguarding our investments and policy holders from the impact of climate volatility and contributing to the transition to a low-carbon economy.

Our Management Approach

Climate change is one of the most complex and pressing issues of our time. In the years to come, the global economy will face enormous challenges as a result of climate change and the global transition towards a low-carbon economy.

We believe that the current global focus on sustainability is timely and will lead to actions that have material regulatory, economic, political and social impact.

At Great Eastern, we are committed to enabling the net zero transition through innovative insurance solutions, the stewardship of capital and minimising the direct environmental impact of our operations.

The transition risks arising from various factors, such as changes in asset values, regulatory changes and market disruptions, are expected to remain significant in the near term. As countries and industries worldwide continue to transition towards low-carbon economies, there will be notable shifts in policies, regulations, technologies and market dynamics. These changes can create both opportunities and challenges for businesses and financial institutions.

Extreme weather patterns are already happening and the global temperature is expected to increase. Record-breaking heat waves on land and in the ocean, drenching rains, severe droughts, extreme wildfires and widespread flooding are becoming more frequent and intense. This will impact on the Group’s investment portfolio and insurance business.

Climate or weather can be a risk multiplier or a contributing factor to ill health or death. We believe that these effects will become more relevant in the years to come as global temperatures continue to increase. Our approach will evolve with our understanding of climate-related risks and opportunities. The inter-relationships and full impact on the planet, economy and people are emerging and not fully understood.

As part of our commitment to support the transition to net zero and climate resilience, we will continually review and update our approach in line with our business strategy. We will also review our risk management approach to meet the challenges and uncertainties posed by climate change. Climate-related metrics and targets, both near-term and longer-term, will be regularly reviewed and disclosed to account for evolving science-based targets and regulatory expectations.

As a baseline, we have started tracking the carbon footprint of our operations, investment and underwriting portfolios using the Global GHG Protocol and relevant industry standards.

The carbon footprint dashboard is reported regularly at the SC and RMC meetings. Our tracking will be refined alongside evolving industry developments.

Internally, we have stepped up our focus to build climate knowledge and competency in key job functions such as underwriting, actuarial, investment and risk management.

To date, the Group has assessed the physical and transition risks of its investment portfolio as part of the 2022 IWST Climate Stress Test exercise1. The three climate-related risk scenarios covered in this exercise, which is based on the Network for Greening the Financial System (NGFS) simulation were also applied across Great Eastern’s underwriting and investment portfolios to better understand possible physical and transition risks.

Committing to a Net Zero Future in our Investment Portfolios

We are committed to aligning our investment portfolios towards a Net Zero by 2050 pathway through a two-prong approach: (i) To reduce the carbon footprint of our investment portfolio and (ii) Focus on supporting companies in transition and active stewardship.

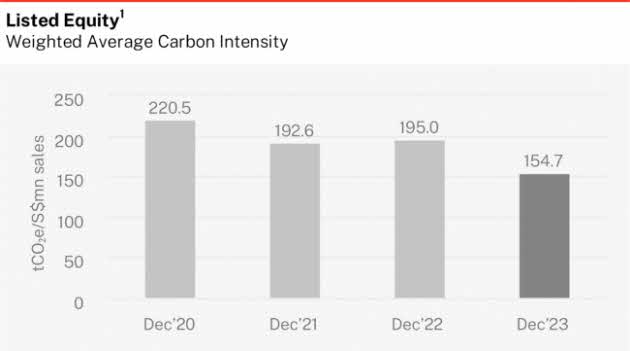

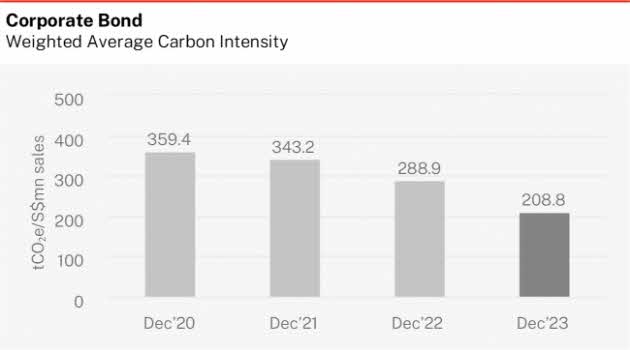

Building on our interim 2025 targets, we are pleased to announce our 2030 target to reduce the carbon footprint of our listed equity asset class by 40% and corporate bond asset class by 45% (baseline year: 2020). This considers our decarbonisation progress achieved to date and the need to support transition financing within Asia. Contributing towards transition financing may cause our carbon footprint to increase materially over the short and medium term as this involves making investments into issuers or projects in higher-emitting industries to enable them to transit towards more sustainable pathways.

Notwithstanding this, we are committed to achieving portfolio decarbonisation in line with our longer-term targets. We will also collaboratively engage through the Asia Investor Group for Climate Change (AIGCC) to drive constructive conversation with investee companies.

Successfully achieving Net Zero by 2050 requires the collective achievement of net zero decarbonisation outcomes by underlying investee companies and global governments. Moreover, the decarbonisation trajectory is not expected to be linear, given the need to balance provision of transition financing for companies with credible transition plans and the need to ensure alignment with other investment objectives like return, yield and duration. Our approach to decarbonisation will be calibrated as we monitor the pace of actual self-decarbonisation at investee companies and across broader economies versus plans and forecasts. Our targets will also be regularly reviewed as regional and global decarbonisation pathways evolve.

Proactive Engagement and Environmental Stewardship

On the Stewardship and Engagement front, our investment affiliate Lion Global Investors (LGI) and our regional in-house investment teams have continued to actively engage top emitters and those which perform poorly on ESG-related metrics, to improve their net-zero emission ambitions and environmental risk disclosures. As of December 2023, in total, 242 engagements on ESG were conducted with various corporates, covering issues such as growing their awareness of regular ESG reporting and incorporating climate considerations in their financing decisions. This is testament to our commitment to support corporates in their transition and to steer ESG laggards to improve their net zero ambitions.

Under the AIGCC and at various climate-related industry roundtables, we have also advanced the discussion on key environmental issues in a number of different ways. This includes participating in quarterly meetings of the Paris-Aligned Investment working group, Engagement and Policy working group and the China working group under AIGCC to enhance information sharing and identify common interests with our peers for collaborative engagement. In particular, LGI has also engaged an Asian electric utility focus company under the Asian Utilities Engagement Program (AUEP)*, to influence behavioural change. The objective is to drive diversification and transformation among such carbon-intensive players to encourage reduced carbon emissions aligned with the Paris Agreement and to provide enhanced climate-related disclosure.

Refining Carbon Emissions Reporting

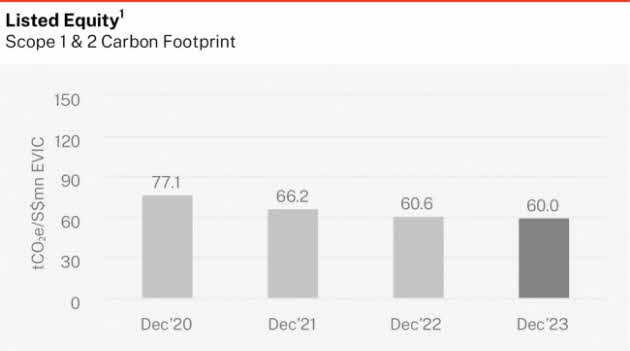

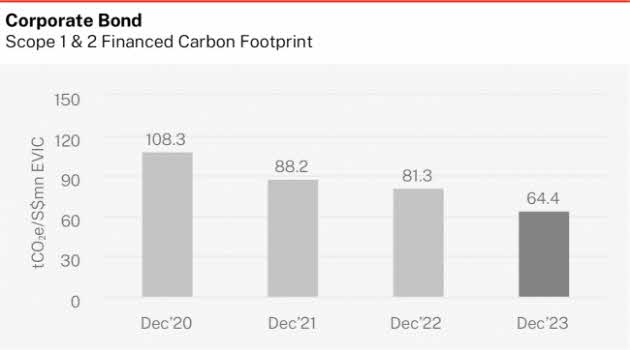

From 2023 onwards, in line with industry best practice, we will be reporting our Listed Equity carbon footprint on an ‘Enterprise Value including Cash’ (EVIC) basis, instead of market capitalisation. This allows better recognition of investee carbon emissions borne by both equity and bondholders. This change will also align our carbon footprint reporting approach across Listed Equity and Corporate Bond portfolios. The EVIC-based carbon emission figures are stated in the following paragraph.

As of December 2023, our listed equity portfolio’s carbon footprint was 60.0 tCO2e per million SGD EVIC, which is 22.2% lower (baseline year: 2020). Our corporate bond portfolio’s carbon footprint was 64.4 tCO2e per million SGD EVIC, which is 40.5% lower (baseline year: 2020). Given the significant market volatility in 2023, we have also observed variability in our emission numbers arising from mark-to-market for our investments and currency fluctuations, e.g. MYR/SGD from our regional subsidiaries. Nonetheless, our significant decarbonisation progress keeps us on track to achieve our interim 2025 and 2030 targets.

Beyond climate action, on the social front, our investment affiliate LGI has also signed the investor statement on the World Health Organisation Framework Convention on Tobacco Control (WHO FCTC) to encourage the move towards a future free from tobacco, in recognition of the negative effects of tobacco on public health and economic costs from the loss of human capital.

Integrating ESG Risk in our Insurance Portfolio

Great Eastern is guided by the framework and methodology provided by the UNEP FI Principles for Sustainable Insurance (PSI), Partnership for Carbon Accounting Financials (PCAF) and the Net Zero Insurance Alliance (NZIA).

The UNEP FI PSI offers a framework that helps us address ESG risks and opportunities within our underwriting portfolio. We are incorporating PCAF’s comprehensive carbon accounting techniques and NZIA’s strategic insights to meet our net zero ambition. The PCAF methodology helps us calculate the insurance associated emissions (IAE) which is a key step to establishing a credible baseline for our net zero ambition. These established frameworks provide a consistent basis for insurers to participate actively in the global climate effort.

Two dedicated specialists have joined Great Eastern in 2023 to expedite the process of carbon footprinting our General Insurance portfolio and operationalising ESG insights into underwriting strategy and policies.We have set interim decarbonisation targets of a 30% reduction in carbon emissions for Retail Motor on an emissions per GWP basis by 2030 (baseline year: 2023).

Our approach to driving decarbonisation is in developing our existing product lines, such that we have enhanced our product coverage to include solar panel replacement costs, offering sustainable claims options that produce lower or zero emissions and promote energy efficiency.

For personal motor lines, to address our transition targets, we have launched our new EV product to encourage low/zero-emission forms of transportation.

Progressing Towards our 2025 Goal for Operational Net Zero

Great Eastern set a goal in 2021 to achieve Operational Net Zero by 2025. When we compare our operational emissions to last year’s benchmarks, we consider various factors such as improvements in energy efficiency, shifts to renewable energy sources and changes in our operational activities.

Our operational emissions intensity has reduced by 2% from 3.09 in 2022 to 3.03 in 2023 (tCO2e/full time employees). We remain on track to meet our reduction targets through our planned infrastructure improvement works.

Managing Resource Consumption

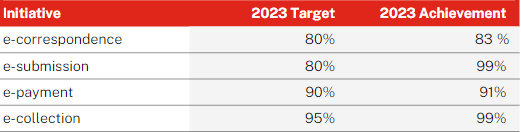

Great Eastern's investments in digitalisation and operational infrastructure enhancement have yielded meaningful results for our operational net zero ambition. Through consistent efforts and active stakeholder engagement, we have seen a substantial reduction in paper consumption in our operations.

In 2023, Great Eastern’s digitisation efforts resulted in a 19% year-on-year reduction in paper usage. This achievement is possible due to key reductions in our offices in Singapore and Malaysia:

Investment in Operational Infrastructure Enhancement

We are committed to meeting our Operational Net Zero target and have identified innovative energy-efficient solutions for our buildings to be progressively implemented over the next two years. These solutions will strengthen our contribution to the Singapore Green Plan 2030 and help us achieve Green Mark certification for our properties in Singapore.

As we near the end of our Singapore office transformation project, we are pleased to announce the installation of various energy-efficient and water-saving devices such as energy-efficient VRV air-conditioning, LED lighting, motion sensors and timers and sensor-controlled water taps. We avoided wastage by recycling old furniture, which will be reassembled or reused. Scrap metals were also collected and sold to recycling vendors from old workspaces. Proceeds were donated to Community Chest, a charitable organisation supported by Great Eastern.