How to supplement your disability coverage

Rising medical costs and care needs may mean you need additional support with GREAT CareShield.

As Singaporeans live longer, the risk of disability rises along with the need for long-term care services. According to a study by National Council of Social Service, about one in 30 Singaporeans aged 18 to 49 has some form of disability.

These concerns are addressed by CareShield Life, a compulsory national long-term care insurance scheme for all Singapore residents born in 1980 or later, that began on Oct 1 last year*, which provides basic financial support for those who become severely disabled.

It is a fallacy to think that young people are immune to the risks of disability. “It is possible for young people to suffer from mild and moderate disability. This is especially so if they suffer upper limbs disability due to accident, trauma or stroke which can result in an inability to dress themselves”, says Dr Raymond Ong, medical director at Doctor Anywhere.

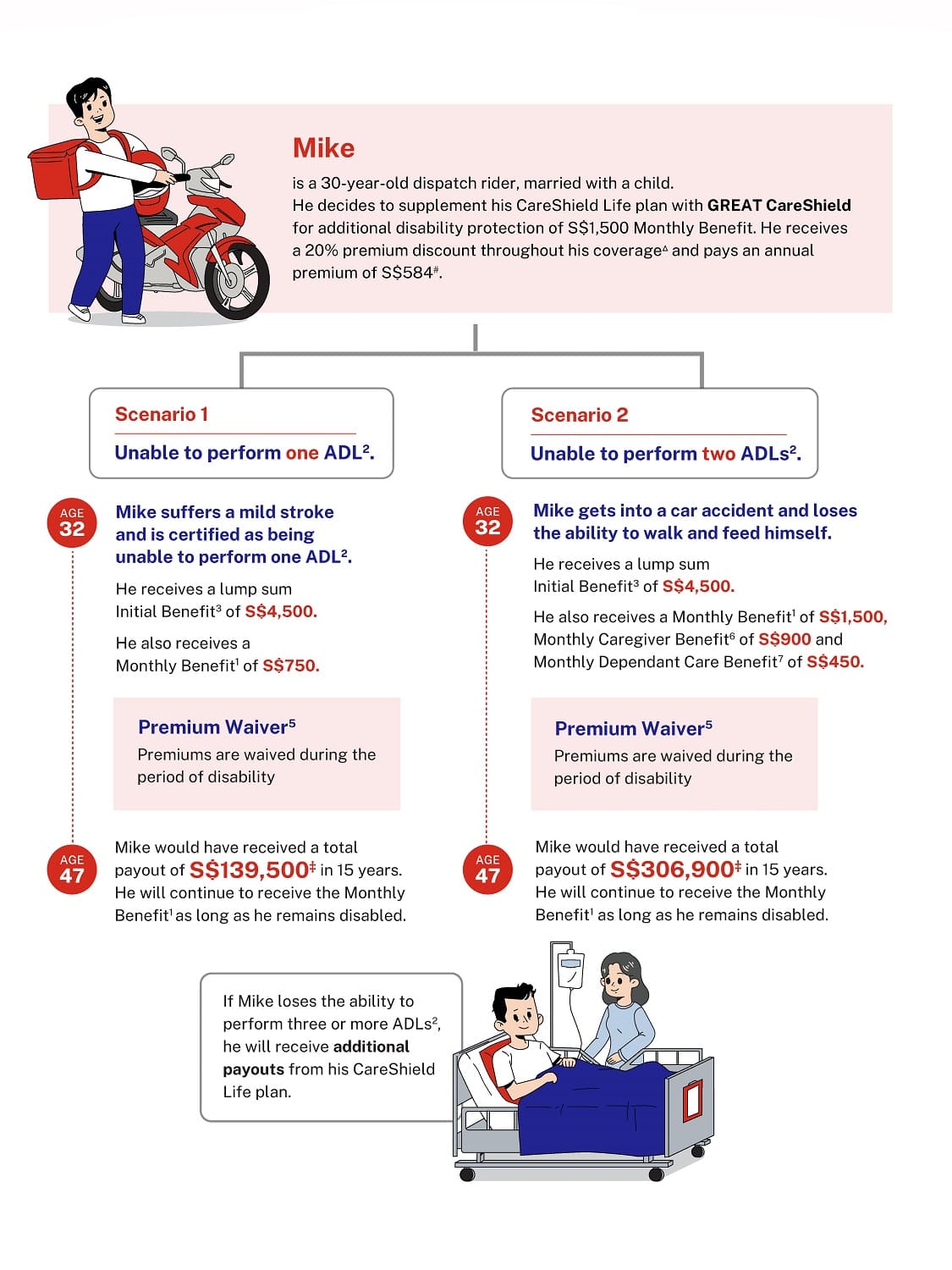

Rising medical costs, inflation and long-term care costs further increase the need for coverage beyond what is provided by CareShield Life. This need can be met with resources such as Great Eastern's GREAT CareShield disability insurance plan.

The basics of CareShield Life and potential long-term care costs

CareShield Life caters for severe long-term disability. It pays out a fixed monthly amount starting from $600 in 2020 for the duration of the disability, even if it is for the rest of the person's life*.

A person who cannot perform three of the six activities of daily living (ADLs) without assistance qualifies for the payout. The six activities are*:

PHOTO: GREAT EASTERN

These ADLs highlight several potential long-term care services that a person may need. Some estimated costs include:

● Domestic helper: $1,000 per month1

● Rehabilitation: $425 per session2

● Daycare centre: $20 per hour3

● Nursing home: $2,300 per month4

Nursing homes are the most expensive component of long-term care†, according to a Straits Times report in 2017.

Great Eastern’s GREAT CareShield supplements CareShield Life by providing monthly payouts5 and a lump sum called the Initial Benefit6 for the inability to perform just one ADL.

Monthly payouts start once there is an inability to perform one ADL

The Initial Benefit6 may be payable again for disabilities due to different causes in the future.

This plan has a lifetime policy term, and premiums are waived9 for as long as a person is unable to perform at least one ADL.

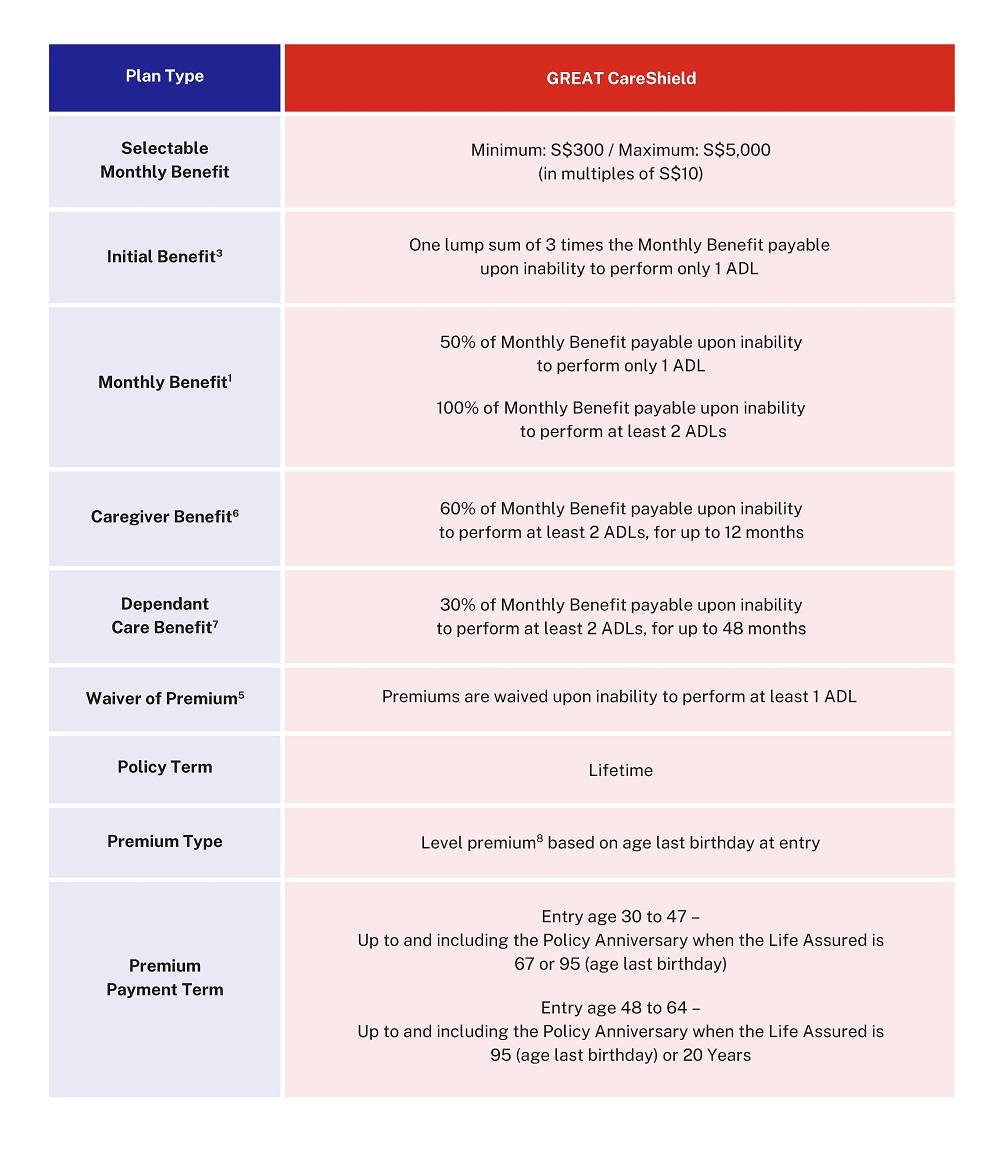

Get a head start with GREAT CareShield

GREAT CareShield provides monthly payouts at 50% of your Monthly Benefit and a lump sum Initial Benefit upon the inability to perform just one ADL. Upon the inability to perform 2 or more ADLs, the plan will provide monthly payouts of 100% of your Monthly Benefit and additional payouts from the Caregiver Benefit and Dependant Care Benefit (if applicable). PHOTO: GREAT EASTERN

The main benefits of GREAT CareShield are:

● Monthly payouts5 and a lump sum Initial Benefit6 of up to S$15,000 upon the inability to perform one ADL

● The Initial Benefit payout may be payable again upon full recovery and for disabilities that occur due to different causes in the future6

● Additional monthly payouts from the Caregiver Benefit7 and Dependent Care Benefit8 for those with two or more ADLs

● Premiums payable in part or full by MediSave13

GREAT CareShield kicks in earlier than CareShield Life because it makes monthly payouts5 when there is an inability to perform two of the six ADLs, as opposed to the national CareShield Life scheme, which makes payouts when a person is unable to perform three or more ADLs.

Premiums do not increase with age10 as the premium is fixed at the age that the customer buys the policy. So, buying the plan earlier means premiums will be lower.

GREAT CareShield premiums can be paid using your own or a family member’s MediSave funds — such as those of a spouse, parent, child, sibling or grandchild — up to a limit of S$600 per calendar year for each insured person. The remaining amount will be payable in cash.

Customers can buy the GREAT CareShield plan through Great Eastern’s online platform and its financial representatives and enjoy 20 per cent off premiums throughout their coverage. For example, if your annual premium payable is S$750, you save S$150 (20 per cent of the original amount), bring your annual premium to S$600, which can be fully paid for via your MediSave account.

Get a quote today!

This article is an updated version of the original story which was published in The Straits Times.

Sources:

* The Straits Times, How new insurance scheme CareShield Life affects you, October 1, 2020, https://www.straitstimes.com/singapore/how-new-insurance-scheme-careshield-life-affects-you

† The Straits Times, Long-term care: If this is so important, why aren't we putting our money where our mouth is?, October 7, 2017, https://www.straitstimes.com/opinion/new-ways-to-fund-better-long-term-care

Footnotes:

1 Dollars and Sense, [2020 Edition] How Much Does It Cost To Hire A Maid In Singapore?, March 20, 2020, https://dollarsandsense.sg/2019-edition-much-cost-hire-maid-singapore/

2 Singapore General Hospital, Rehabilitation Centre, https://www.sgh.com.sg/patient-care/specialties-services/Rehabilitation-Centre

3 Homage, https://www.homage.sg

4 MoneySmart, Nursing Homes in Singapore – How Much Does It Cost?, July 23, 2019, https://blog.moneysmart.sg/family/nursing-homes-singapore/

5 Subject to Deferment Period. Payouts of Monthly Benefit are payable for as long as the Life Assured suffers from the applicable number of disabilities, up to a lifetime.

6 The Initial Benefit is a lump sum payment equivalent to 3 times of the Monthly Benefit. In the event the Life Assured fully recovers from the disability, the Initial Benefit may be paid again for subsequent episodes of inability to perform at least one ADL. However, it is not payable if such subsequent disabilities arise from or are related to the cause of disability(ies) for which there was a previous claim for Initial Benefit.

7 Subject to Deferment Period and payable for up to a maximum of 12 months (whether consecutive or not) per Policy Term.

8 Applicable if the Life Assured has a Child who is below 22 years old (age last birthday) as at the Claim Date; subject to Deferment Period and payable for up to a maximum of 48 months (whether consecutive or not) per Policy Term.

9 Subject to Deferment Period, and for as long as he continues to suffer from the disability.

10 Premium rates are not guaranteed and they may be adjusted from time to time based on future experience.

11 Activities of Daily Living (ADLs) are: washing, toileting, dressing, feeding, walking or moving around and transferring.

12 Total Benefits refer to benefits payable after Deferment Period and are calculated based on Monthly Benefit of S$750 for 12 months and a one-time Initial Benefit of S$4,500.

13 Subject to cap of S$600 per calendar year per insured person.

Disclaimers:

All ages specified refer to age last birthday. Figures illustrated are rounded down to the nearest dollar. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Terms and Conditions apply. Protected up to specified limits by SDIC.

This is only product information provided by us. You may wish to seek advice from a qualified adviser before buying the product. If you choose not to seek advice from a qualified adviser, you should consider whether the product is suitable for you. Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs. If you decide that the policy is not suitable after purchasing the policy, you may terminate the policy in accordance with the free-look provision, if any, and the insurer may recover from you any expense incurred by the insurer in underwriting the policy.

Information correct as at 1 January 2024.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.