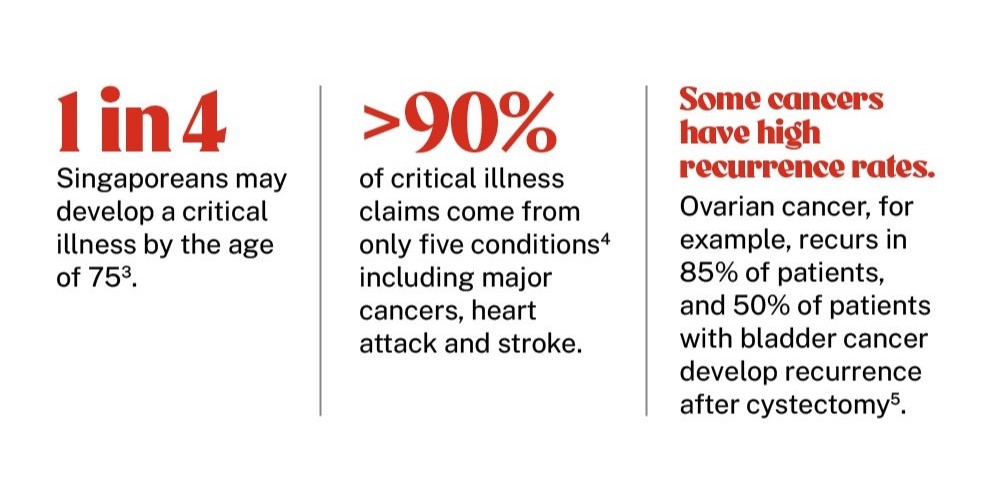

Why GREAT Critical Cover Series?

-

100% payout for every critical illness claim

Receive 100% lump sum payout1 upon diagnosis of 53 critical illnesses at early, intermediate or critical stage.

-

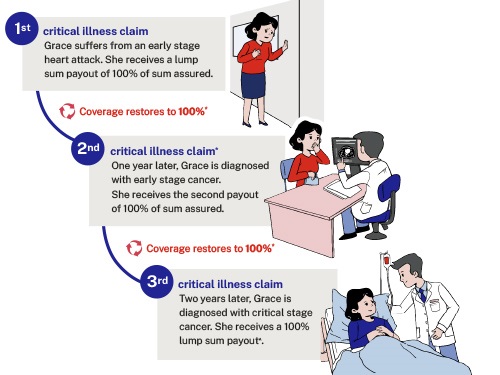

Coverage continues over and over again, even after the first critical illness claim

Boost your coverage with the Protect Me Again rider. Enjoy financial certainty against a new or recurring critical illness diagnosis with a 100% payout for another two more critical illness episodes2, up to a total of three critical illness claims.

-

Flexibility in choice of coverage

Choice to be protected against 53 critical illnesses or just the top 3 critical illness conditions - cancer, heart attack or stroke.

Your questions answered

After a claim is paid out, the plan will terminate if Protect Me Again: Complete/Top 3 CI Rider is not attached.

Yes, there is a $25,000 lump sum payout upon which the plan will terminate.

GREAT Critical Cover: Top 3 CIs - Premiums will gradually increase with age till the policy term expires

GREAT Critical Cover: Complete - Premiums will not increase with age. Premiums are level at the entry age.

12 months waiting period will apply for a different or new critical illness

Example: 1st claim: Undergoing Brain Aneurysm Surgery & 2nd claim: Early Breast Cancer must occur 12 months later.

24 months waiting period will apply for a subsequent recurring critical illness

Example: 1st claim: Undergoing Brain Aneurysm Surgery & 2nd claim: Carotid Artery Surgery must occur 24 months later.

No, the Protect Me Again: Complete/Top 3 CIs Rider can only be added to GREAT Critical Cover: Complete or GREAT Critical Cover: Top 3 CIs Base plan.

No. The sum assured of the Rider will follow the Base plan.

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

1 Please refer to the Product Summary for more details on the benefit terms and conditions.

2 Coverage restores to 100% after 12 months from the date of diagnosis for the most recently diagnosed critical illness, for a subsequent claim of a different critical illness. Coverage restores to 100% after 24 months from the date of diagnosis of the immediately preceding applicable critical illness for recurrent critical illness.

Please refer to the Product Summary for more details on the benefit terms and conditions.

3, 4 https://smartwealth.sg/critical illness statistics singapore/

5 https://www.cancertherapyadvisor.com/home/tools/fact-sheets/cancer-recurrence-statistics/

* Coverage restores to 100% after 12 months from the date of diagnosis for the most recently diagnosed critical illness, for a subsequent claim of a different critical illness. Coverage restores to 100% after 24 months from the date of diagnosis of the immediately preceding applicable critical illness for recurrent critical illness. Please refer to the Product Summary for more details on the benefit term and conditions.

^ We will pay the higher of 100% Basic Sum Assured or the Total Premium Paid less all prior CI claims paid.

All ages specified refer to age next birthday.

All figures used are for illustrative purposes only and are subject to rounding.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

As this product has no savings or investment feature, there is no cash value if the policy ends or is terminated prematurely.

You may wish to seek advice from a financial adviser before making a commitment to purchase this product. If you choose not to seek advice from a financial adviser, you should consider whether this product is suitable for you.

In case of discrepancy between the English and Chinese versions, the English version shall prevail.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Information correct as at 28 March 2023.