Key benefits

-

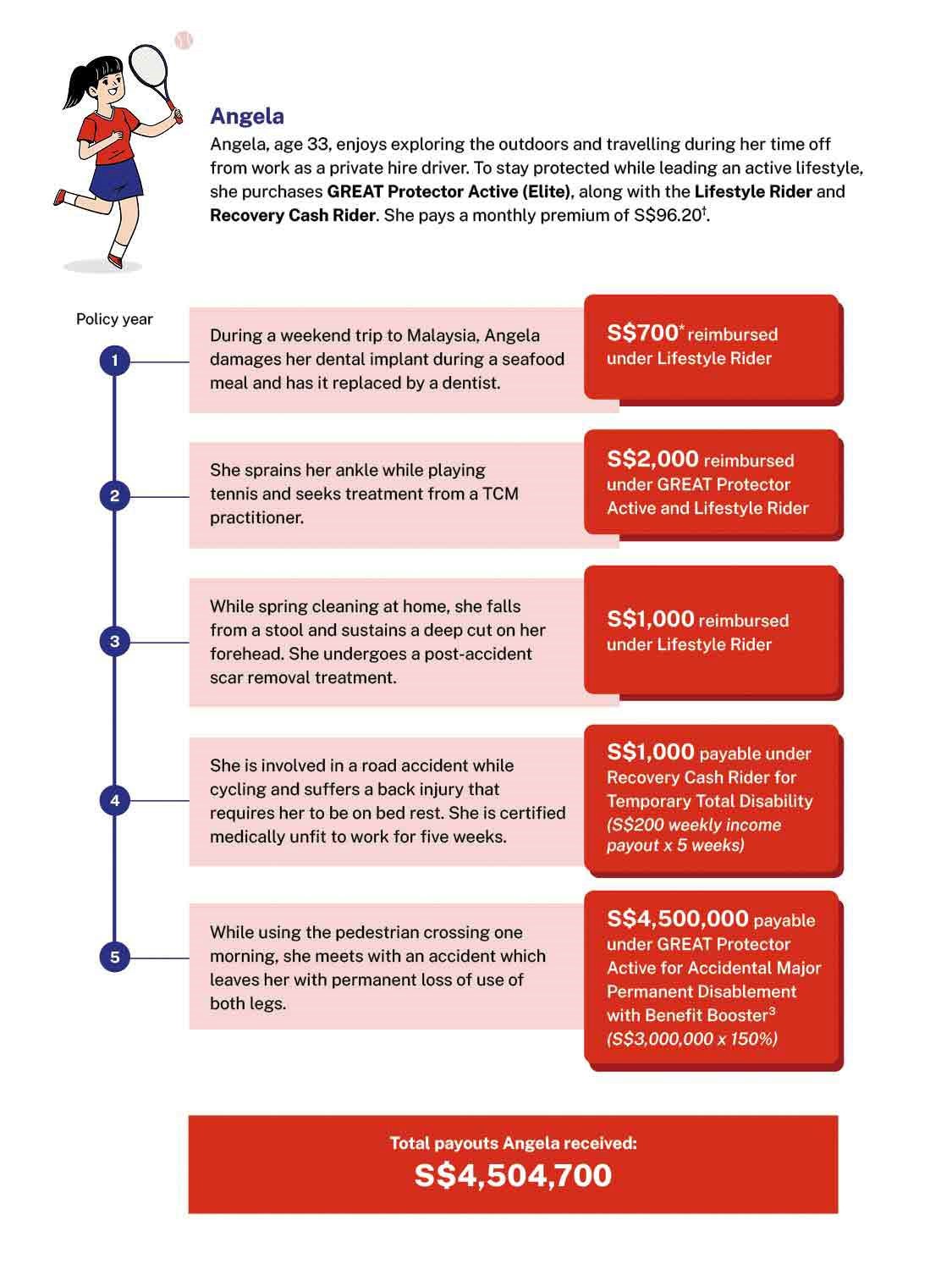

High accident coverage of up to S$4.5 million3

Enjoy one of the highest personal accident coverages of up to S$4.5 million3 in the event of total and permanent disability, or loss of use of limbs or sight due to an accident. This lump-sum payout can help cover medical and caregiving expenses as you adjust to lifestyle changes.

-

Income payout of up to S$20,800 to support your recovery

Receive up to S$200 in weekly income payouts for up to 104 weeks per accident with the optional Recovery Cash Rider if you are medically certified as being temporarily unable to work, perform domestic duties or attend school4.

-

TCM, aesthetics and dental treatments to restore confidence

Add the optional Lifestyle Rider to claim reimbursement for expenses on eligible post-accident recovery treatments, including:

• Up to S$1,000 per accident for TCM treatments

• Up to S$1,000 per accident for scar removal aesthetic treatments

• Up to S$700 per lifetime* for dental treatments2 to replace artificial tooth (e.g. dental crown, implant) damaged in an accident

Your questions answered

GREAT Protector Active is a yearly renewable personal accident plan which is specially designed to pay benefits in the event of an accident which results in Accidental Death, Accidental Major Permanent Disablement or Accidental Other Permanent Disablement. This plan also provides coverage for Accidental Medical Expenses Reimbursement and Benefit Booster in specified situations.

This policy is not a MediSave-approved policy and you may not use MediSave to pay the premiums for this policy.

Please refer to the Table of benefits as shown in the brochure for the summary of benefits payable under GREAT Protector Active.

We will reduce all benefits payable under this policy by 50% if the Life Assured suffers a claim event while engaging in the following Increased-Risk Activities:

(a) Sports coaching;

(b) Motor cycling; or

(c) Military or police service of a peace-time nature, namely normal training, rangework and military exercises including National Service under Section 10 of the Enlistment Act 1970 of the Republic of Singapore (“Enlistment Act”) (other than peace-time reservist duty under Section 14 of the Enlistment Act whereby full benefits shall be payable).

Furthermore, if it is proven that the Life Assured suffered the claim event while engaging in any of these activities and in so doing, broke or disregarded the usual precautions and safety guidelines accepted for that activity, we may adjust any benefits otherwise payable under this policy or reject the claim for such benefit.

Premium rates for GREAT Protector Active are not guaranteed. These rates may be adjusted based on future experience. We may at our sole discretion change the premium rates by giving at least 30 days’ notice to the policyholder before the renewal date at which these amended rates apply.

There will be no protection under this policy if you surrender your policy early. As the policy has no cash value, you will also lose the premiums that you have paid.

This policy is renewable yearly up to the renewal date before the Life Assured turns age 76 next birthday. All endorsements on and variations in this policy which have been authorised by us and any premium loading imposed will also apply to the insurance granted upon renewal unless otherwise agreed in writing by us.

We reserve the right to amend the terms and conditions of this policy provided that (a) the amendment(s) take effect on the renewal date; (b) the amendment(s) apply to all policies of this class of insurance; and (c) we have informed the policyholder of the amendment (s) at least 30 days before the renewal date.

This is a short-term accident and health policy and we are not required to renew this policy. Renewability is not guaranteed and we reserve the right not to renew this policy by giving you 30 days’ written notice.

What are the optional riders I can add to the plan?

Lifestyle Rider

What does the Traditional Chinese Medicine (TCM) Expense Reimbursement benefit cover?

This benefit reimburses you for the expenses incurred for TCM treatment for accidental injuries, up to S$1,000 per accident. This is an additional TCM reimbursement coverage on top of GREAT Protector Active’s Accidental Medical Expenses Reimbursement benefit.

What does the Post-Accident Scar Removal Aesthetic Expense Reimbursement benefit cover?

This benefit reimburses you for the expenses incurred for aesthetic treatment for scar removal or scar reduction as a result of an accidental injury, up to S$1,000 per accident.

What does Accidental Dental Expense Reimbursement benefit cover?

This benefit reimburses you for the expenses incurred for dental treatment for the repair or replacement of a damaged artificial tooth as a result of an accident, for up to S$700 for one (1) accident claim per lifetime. We will only reimburse for a maximum of one claim event per lifetime under this benefit, upon which this benefit will be terminated regardless of whether the maximum limit insured has been paid out.

Artificial tooth refers to a prosthetic replacement for a natural tooth whether partially or fully to replace the form and function of a natural tooth. Artificial tooth is but not limited to dental crown(s), dental implant(s), denture(s), dental bridge(s).

Recovery Cash Rider

What is Temporary Total Disability?

The life assured being totally and continuously disabled on a temporary basis due to an accident and is unable to perform all duties of their occupation, domestic duties or attend school as the case may be.

What is Temporary Partial Disability?

The life assured being partially and continuously disabled on a temporary basis due to an accident and is unable to perform minimally one duty of their occupation, domestic duties or attend school as the case may be.

Must you be hospitalised to qualify for a claim under the Lifestyle Rider or the Recovery Cash Rider?

No, you do not need to be hospitalised to qualify for a claim. We will assess your claim based on the attending doctor’s memo or statement and medical certificate. The attending doctor must be licensed and practising in Singapore.

Must I be employed to be covered under the Recovery Cash Rider?

No, eligibility is based on age and citizenship eligibility. Singaporeans citizens, Singaporean Permanent Residents and Foreigners with selected valid pass holders with validity period of at least 6 months excluding work permit and long term visit pass holders, between the ages of 17 and 65 next birthday and residing in Singapore at the point of application can be covered under this rider.

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

1 Such activities are covered only when undertaken on a leisure basis with or under the management of a licensed organisation or establishment, and only if every safety precaution has been followed by the life assured. The company has the absolute discretion to determine if an increased-risk activity is eligible for claim. Please refer to the policy contract for full details.

2 Refers to dental treatment by a Medical Practitioner to replace or repair artificial tooth that was damaged from or due to an accident. An artificial tooth refers to a prosthetic replacement for a natural tooth, whether partially or fully, to replace the form and function of a natural tooth. Please refer to the policy contract for full details.

3 Benefit Booster of up to 150% of payout is applied on Accidental Major Permanent Disablement benefit when the Life Assured suffers injuries from (i) accident while on public conveyance as a passenger (ii) being involved in a road accident as a pedestrian, cyclist or passenger or (iii) accidents while outside of Singapore. Accidents involving Personal Mobility Devices (“PMDs”) do not qualify for the Benefit Booster.

4 The optional Recovery Cash Rider covers a Life Assured from 17 Age Next Birthday regardless of the employment status and occupation class.

* We will only reimburse for a maximum of one claim event per lifetime under this benefit, upon which this benefit will be terminated regardless of whether the maximum limit insured has been paid out.

† Premium rates include the prevailing rate of GST. The prevailing rate of GST is subject to change. The premium rates for this policy are not guaranteed and may be adjusted based on future experience.

‡ Please refer to the Tables of Disability Payout in Sections B, and C, respectively, of the policy contract.

§ Refers to Food Poisoning, HFMD (Hand foot, mouth disease) or injury and/or specific condition directly caused by a bite, sting, attack or such similar incident but excluding any complications and infections.

ǁ If the life assured resides outside of Singapore for more than 183 days, he/ she is entitled to the overseas Benefit Booster only if the Accident occurs outside of his/ her residing country and issuing country i.e. Singapore.

¶ The Limit Insured will be increased by 150%, but not the Sub-limits.

^ Payable every 7 days of relevant disability, and pro-rated if relevant disability lasts for fewer than 7 days.

# From date of accident.

All ages specified refer to age next birthday.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Singapore Citizens, Permanent Residents (PRs) and holders of Employment Pass who are aged between 17 and 65, may purchase any plan (Basic, Classic, Elite) under this policy. Juveniles (aged between 1 and 16) and holders of S Pass, Dependant’s Pass or Student’s Pass may purchase only the Basic Plan under this policy.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

It is usually detrimental to replace an existing accident and health plan with a new one. A penalty may be imposed for early plan termination and the new plan may cost more, or have less benefit at the same cost.

You may wish to seek advice from a qualified adviser before buying the product. If you choose not to seek advice from a qualified adviser, you should consider whether the product is suitable for you. If you decide that the policy is not suitable after purchasing the policy, you may terminate the policy in accordance with the free-look provision, if any, and the insurer may recover from you any expense incurred by the insurer in underwriting the policy.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

In case of discrepancy between the English and Chinese versions, the English version shall prevail.

Information correct as at 26 August 2025.