Key Benefits

-

High lifetime protection of up to 20 times2

Invest with a single premium of your choice1 and enjoy the assurance that your family's well-being is taken care of with a lasting legacy.

-

Flexibility to enjoy potential returns of your investment

Enjoy the freedom to withdraw 5% of your policy value every year3, from the 11th policy year, without impacting on your protection.

-

Luxury of customisable solution

Choose from a selection of three expertly curated GreatLink Dynamic Portfolios, and more than 30 GreatLink Funds to build an investment portfolio that best suits your risk appetite and financial objectives.

With GreatLink Dynamic Portfolios, let the fund experts at J.P. Morgan Asset Management navigate investment uncertainties with their asset allocation strategy, adapting to changing market conditions, while you focus on what truly matters.

-

Non-lapse privilege4

With the non-lapse privilege4, you are assured that your high protection is continued for the first 15 policy years, regardless of the performance of the investment of your policy. This gives your investment portfolio the time to achieve its potential returns.

Your questions answered

1. What is Prestige Legacy Advantage?

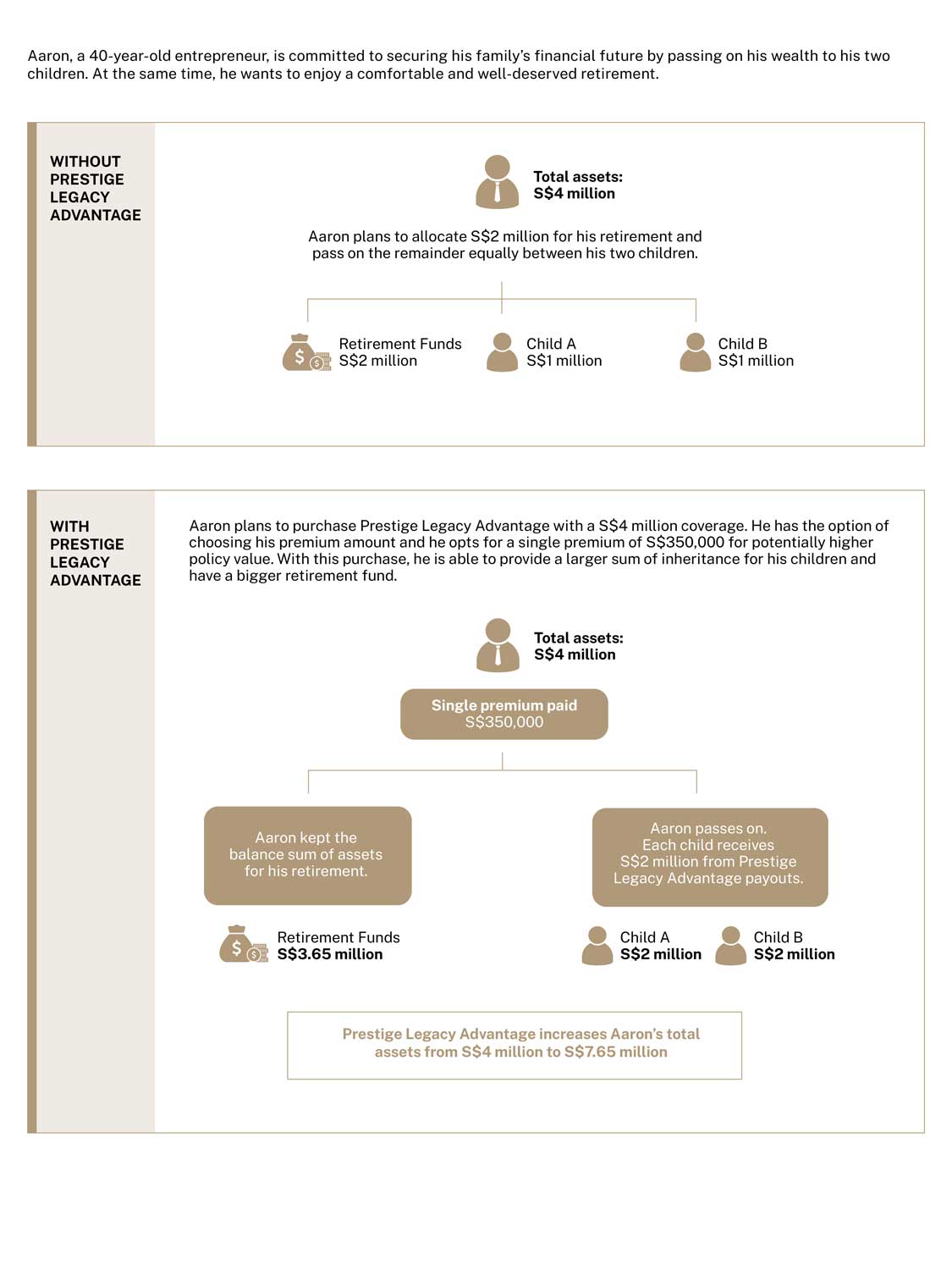

Prestige Legacy Advantage is a single premium whole of life investment-linked plan (ILP) designed to meet your investment and protection needs. This plan allows you to choose your preferred single premium amount from a premium range. It is a Singapore-dollar denominated (SGD) plan.

This plan also gives you access to professionally managed ILP sub-funds (“funds”). The premiums you pay will be used to create units in the funds and the value of the policy will vary directly with the performance of the funds.

2. What is the coverage under Prestige Legacy Advantage?

Prestige Legacy Advantage provides financial protection against death and terminal illness.

3. What is ‘Free Partial Withdrawal Facility’?

You may choose to withdraw up to 5% of the policy value as at the start of each particular policy year from the 11th policy year onwards without reducing the protection coverage and if there has been no partial withdrawal of the policy value during the first 10 policy years, the Non-Lapse Privilege (as explained below) will continue to be in effect until its expiry under the policy.

If the total amount of the partial withdrawal(s) in a policy year exceeds the Free Partial Withdrawal Annual Limit (as explained below) for that policy year:

(a) the protection coverage will be reduced by the amount that the total amount of partial withdrawal(s) exceeds the Free Partial Withdrawal Annual Limit for that policy year; and

(b) the Non-Lapse Privilege will cease,

from the date of the partial withdrawal that exceeded the Free Partial Withdrawal Annual Limit for that policy year.

The ‘Free Partial Withdrawal Annual Limit’ is 5% of the policy value as at the start of each policy year from the 11th policy year onwards.

Any unutilised amount of the Free Partial Withdrawal Annual Limit in a given policy year will not be carried forward to the next policy year.

4. What is ‘Non-Lapse Privilege’?

During the first 15 policy years, the policy will not lapse even if the policy value falls to zero or below, provided that:

(a) for the first 10 policy years, there is no partial withdrawal of the policy value.

(b) from the 11th to the 15th policy year, the total amount of partial withdrawal(s) of the policy value during each policy year does not exceed the Free Partial Withdrawal Annual Limit for that policy year.

If the condition in (a) or (b) above is not satisfied during the respective applicable period as specified, the non-lapse privilege will automatically cease upon the relevant partial withdrawal being made.

5. What are the funds available under Prestige Legacy Advantage?

You can choose to invest in one or more of the GreatLink funds. For the full list of funds available for your policy, you can refer to our website. Details of each fund can be found in their respective fund documents, which will explain the risk that is specific to each fund.

The following documents are also made available for you to better understand each fund:

- Prospectus/Fund Details/Fund Summary (where applicable);

- Product Highlights Sheet (PHS);

- Provider’s Factsheet;

- Semi-annual and Annual Reports; and

- Performance charts

Please note that every fund or combination of funds has its own investment objectives, horizon, liquidity, and level of risk. You are advised to select fund(s) that match your risk profile, needs and preferences.

All funds are audited by PricewaterhouseCoopers certified public accountants.

5. Can I switch my funds?

Yes, you may request to switch all or any of the units of one fund to another fund offered under the policy, subject to such minimum amounts as we may stipulate from time to time.

6. What happens if I surrender my policy early?

If you surrender your policy after the 14-day free-look period, you may lose part or all of the premiums paid. This is because the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

Buying a new policy may mean we need to reassess the life assured’s health and circumstances and may result in higher premiums and/or benefit exclusions due to the age and health status.

For more details on Prestige Legacy Advantage, please refer to the product summary of the plan. Alternatively, you may also speak to your financial representative or call us at 1800 248 2888 (9am to 5.30pm, Mon-Fri).

Let our Financial

Representative serve you

We are happy to help you.

Understand the details before buying

1 The life assured's age at entry, gender, smoker status, country of residency at inception and underwriting risk class would all be taken into consideration to determine the range of premium payable based on the chosen sum assured.

2 Based on a 30-year old male, non-smoker, standard risk class.

3 Any free partial withdrawal annual limit that is unutilised in a given year will not be carried forward to the next policy year.

4 Subject to no partial withdrawals of the policy value during the first 10 policy years, and the total amount of partial withdrawals from the policy value each year during the 11th to the 15th policy years not exceeding the free partial withdrawal annual limit for each of the 11th to 15th policy years. After the expiry of the non-lapse privilege, the policy will lapse when the policy value is insufficient to pay off any debts owed to the Company.

All ages specified refer to age next birthday.

All figures used are for illustrative purposes only and are subject to rounding.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The above is for general information only. It is not a contract of insurance. The precise terms and conditions of this insurance plan are specified in the policy contract.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. Please refer to Fund Details and Product Highlights Sheet for the specific risks of the fund(s). Past performance is not necessarily indicative of future performance.

A Product Summary and a Product Highlights Sheet in relation to the fund(s) may be obtained through The Great Eastern Life Assurance Company Limited or its financial representatives. Potential investors should read the Product Summary and the Product Highlights Sheet before deciding whether to invest in the fund(s). Returns on the units of the fund(s) are not guaranteed. The value of the units in the fund(s) and the income accruing to the units, if any, may fall or rise.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

In case of discrepancy between the English and the Chinese versions, the English version shall prevail.

Information correct as at 17 October 2025.