This e-publication is for internal sharing only and is not to be distributed outside of the company.

October 2021

Click below to read more.

Hear from Our Leaders

» Message from Patrick Peck

Highlights of the Quarter

» To finish the year STRONG

» Live #Lifeproof with Early Retirement Planning

» Glenn Yong's Secrets to a Long and Successful Career

» Robo Advisors or the Human Touch?

» Holistic Health Insurance Planning with Financial Services Director, Catherine Chee

» Raising Awareness for Protection against Breast Cancer

» Going the Distance for a Good Cause

Must-Knows

» GREAT CareShield – Pays Out Earlier and Pays More

» #Lifeproof your Income for Life with Prestige Life Rewards 5 (SGD) series

» New Funds for Sustainable Investing and Wealth Growth

» Greater Protection for Professionals and would-be Travellers

» A New Mobile Studio for your Digital Needs

» 4th Quarter 2021 Market Outlook – A Summary from Agency Propositions and Portfolio Management

» Calendar of Events

From Good to Great

» Reach for the Sky!

People

» Serving with a Purpose

Click here for past TGC issues.

Message from Patrick Peck

Message from Patrick Peck

Dear Leaders and Financial Representatives,

As we collectively sprint into the final quarter of 2021, I am confident that all of you are staying focused to achieve your year-end goals and to FINISH STRONG.

In Prime Minister Lee Hsien Loong’s recent address, he shared that we would embark towards a new normal, and that even as we live amid the COVID-19 endemic, we must not live in fear.

His message stirred me to think about the continual need for us to work and engage with our clients and prospects in this new normal. This means ramping up our efforts to enhance our digital infrastructure to further boost the three key pillars of our business – Sales, Manpower and Customer Experience. As we set our sights to be the Undisputed #1 Agency and Financial Advisory in Singapore for 2021, we need to differentiate ourselves from our competitors.

After attending our virtual Final Sprint earlier this month, I hope that your engines are revved up by all the exciting initiatives launched. There are boundless opportunities waiting to be uncovered. As the Number 1 in Singapore in the first half of 2021, we need to have the hunger to constantly outdo and outperform ourselves. Let’s set higher ambitions for ourselves and together, finish the year strong and proud!

To finish the year STRONG

As we approach the final lap, we want retain our no.1 Agency/Financial Advisory in Singapore for 2021 again. And the signs are looking good as we made a final rallying call to REV UP our sales force at the Final Sprint event, held on 5 October, to a “virtual audience” of our 5,000-strong agency network. The theme was aptly of motorsports, where every second counts and racers must stay focused right till the end as they head towards the finish line.

Here are some key highlights!

Group CEO, Mr Khor Hock Seng, fired the first salvo, by emphasising that we are the undisputed no.1 Agency/Financial Advisory in Singapore for 2021. He shared the good news that Great Eastern is in a leading position, ahead of the pack in terms of Total Weighted New Sales (TWNS) and Manpower, heading into the fourth quarter of 2021. To finish the year strong, Mr Khor reminded us about reaching our Big Hairy Audacious Goals, to stay focused on what we want to achieve and to take action NOW!

To be the undisputed no. 1, Mr Patrick Peck, Managing Director of Regional Agency/FA and Bancassurance, challenged the team to outdo last year’s performance to achieve higher sales targets. He urged everyone to do their best as exciting initiatives and digital tools will support our financial representatives to up their performance, with the enhanced Financial Storyboard and a new ConnectNow platform to be launched in later this year.

Of course, you need products to drive sales. Managing Director of Group Marketing Colin Chan and Bernard Tan, Vice President, Personal Lines, Great Eastern General Insurance, shared the line-up of new products in Q4 that you can share with your customers. These include:

- GREAT CareShield

- Retirement products

- ESG-linked ILPs for the Prestige Portfolio

- TravelSmart Premier

As we know, no session is ever complete without some words of inspiration and motivation. Senior Financial Consultant Clarence Tay shared his secrets to success, having achieved MDRT within four months of joining Great Eastern in March 2021! Speaker, trainer and author Maxine Teo taught us how to speed profile and get people to say ‘yes’. Mr Glenn Yong, Head, Agency Business Development, wrapped up the session with a reminder to look after our own portfolios even as we plan for others, and issued a challenge for all to GO FOR GOLD.

Live #Lifeproof with Early Retirement Planning

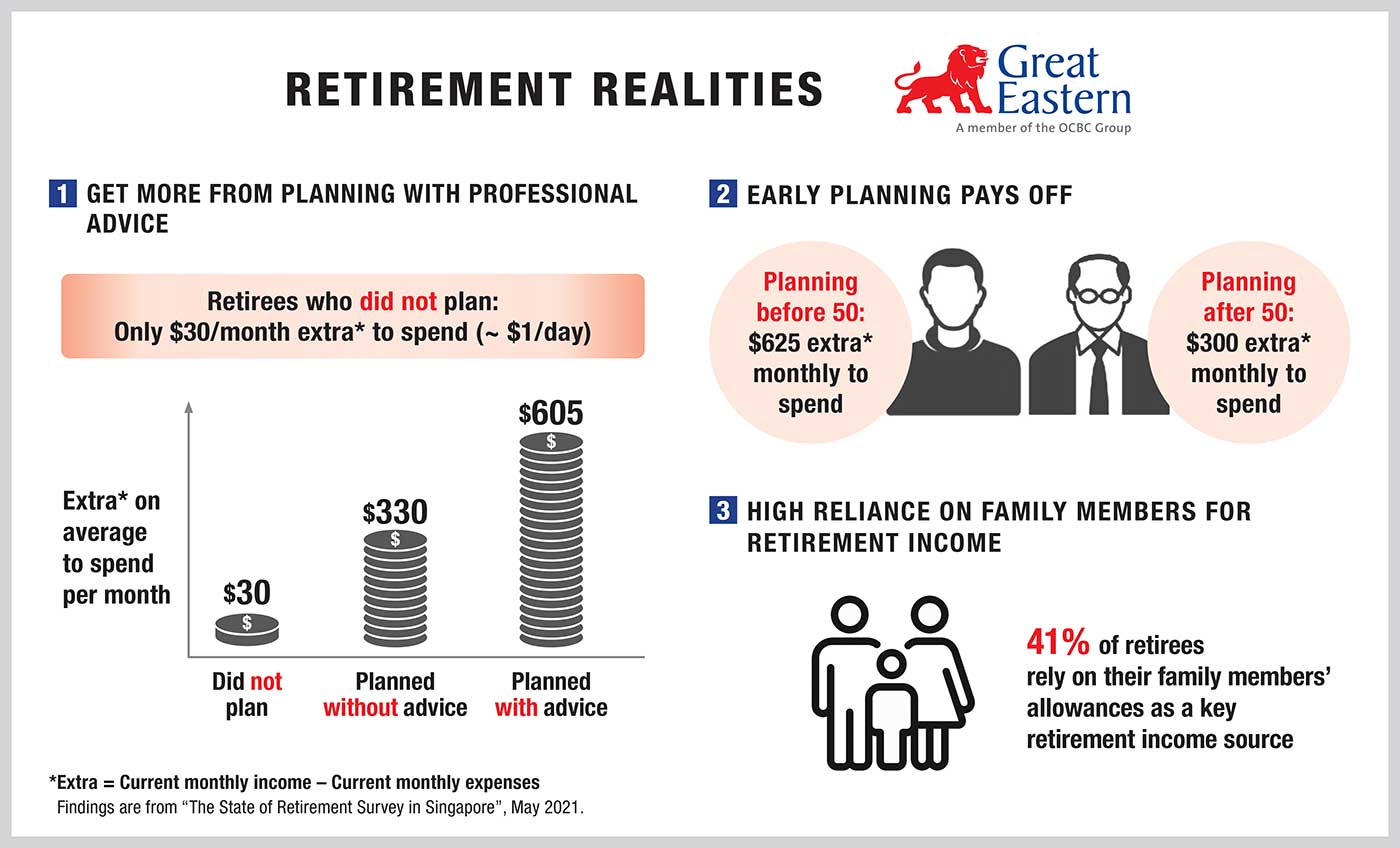

Did you know that 85% of retirees who planned with professional advice are happier with their retirement outcomes based our recent “The State of Retirement in Singapore” survey where we interviewed 304 respondents above age 63?

Here’s a snapshot of the key survey findings:

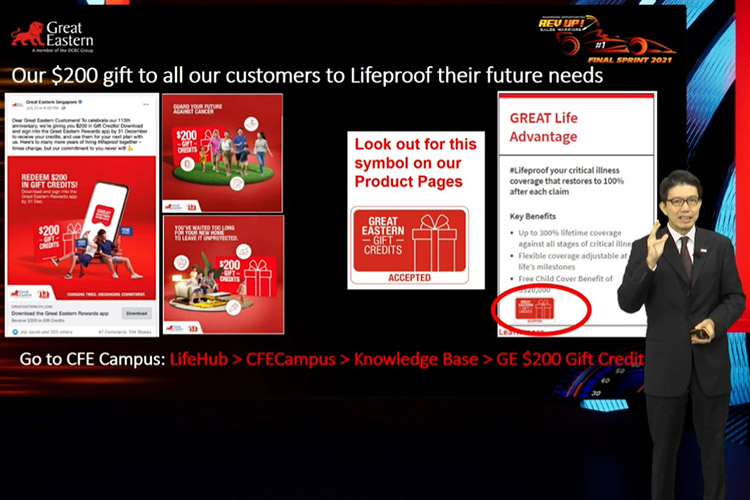

To encourage people to become financially independent and be empowered to make their financial decisions even after retirement, we launched “Don’t Lose the Freedom to Make Your Own Choices” campaign. This was supported by the launch of two new products – GREAT Retire Income and GREAT Lifetime Payout – to help your customers plan for their retirement early.

Encourage your customers to do their financial planning with you using the Financial Storyboard tool and they will get $20 worth of GREAT dollars!

We had massive press coverage, and many of the pieces featuring our reps. Check out articles in the press for your use. Share them with your teams and in turn, with your customers. Here is where you can find them all, including The Straits Times and Money Smart, as well as The Business Times Money Hacks podcast interview with our very own Mr Jay Phua, Financial Services Director on retirement planning.

Glenn Yong's Secrets to a Long and Successful Career

Ever wondered how you can enjoy a successful and long-lasting career in insurance? You can by catching Glenn’s interview with Asia Advisers Network to get his take and nuggets on this.

Glenn shared what goes into the making of a great financial representative and why it is important to move with the times, and to embrace change to overcome challenges.

Loving your work is possible, according to Glenn: “Every day I tell myself that I’m able to touch more than 5,000 lives, including about 800 sales leaders here in Great Eastern, and that’s why I love my job,” he said.

Be inspired! Know that you can enjoy success and love what you do as a financial representative today!

Robo Advisors or the Human Touch?

Will face-to-face financial advisory still remain relevant with the emergence of Robo Advisors? Head of Centre For Excellence, Zubaidah Osman certainly thinks so.

Speaking on the panel at the Fireside Chat “Robo Advisors and You” organised by the Financial Planning Association of Singapore at the 5th Annual World Financial Planning Day on 6 October, Zubaidah shared why marrying the best of robotics and human touch can better serve our customers.

She shared that while a robo-driven digital platform can manage the middle and back office matters to provide convenience and ease of service to customers, financial planning is still primarily a human interaction business. That is the X factor of having a person (financial representative) to deliver the human touch, connect and empathise with customers, and draw a deeper understanding of their needs, priorities and aspirations, in dialogue and discussion, while helping them with a holistic and more in-depth financial planning session.

While robo advisors may be preferred by some, and costs are transparent to end-users, and financial representatives receive commissions for their services, Zuby shared that the industry has been and will always be driven by humans for humans.

She emphasised the often forgotten key role that reps play, especially in after sales services. Financial representatives are always on hand to help their customers make claims and they are usually one of the top five persons that customers will contact almost immediately when unexpected events happen. This is unlike robo advisors where financial planning is very much a transaction-based experience, and everything is self-service. In the world of investments and insurance, it is always important as customers may not be so savvy as to manage everything themselves and more often than not, need a human person to verify things with, and guide them along their journey.

However, at the same time, in this digital age, it is important that financial representatives engage customers in the online space. Great Eastern was one of the first insurers in Singapore to introduce a fully remote advisory and sales process at the start of the COVID-19 pandemic last year, said Zuby. In the coming year, our financial representatives will also have their own digital channel where they can share products with their customers via personalised online links, for them to make purchases seamlessly, thus enabling greater interaction in the digital space.

To reiterate the importance of financial planning, the ‘human’ advisor and how Great Eastern sees its purpose and mission in helping customers meet their life goals and live #Lifeproof for their future, she shared a quote by the late Minister Mentor Lee Kuan Yew, ‘This is not a game of cards. It’s your life and mine’.

Holistic Health Insurance Planning with Financial Services Director, Catherine Chee

Do you find it hard to explain to customers the differences between the Central Provident Fund Board (CPF) MediShield Life and Integrated Shield plans?

Catherine Chee, Financial Services Director, drilled down on the differences and emphasised the importance to have all-round health insurance plan in her recent Facebook “Live” interview with Singapore Press Holdings HAO FM Chinese radio station on 4 October.

Catherine shared on what the CPF MediShield Life scheme covers and its benefits, and why some customers add Integrated Shield plans to their health insurance portfolio to enjoy a wider range of benefits such as the choice to be treated/warded in private and restructured hospitals, and the option to add riders to cover the deductibles and co-insurance payments. This is especially important as we will receive higher claim payouts from Integrated Shield plans which will enable us to focus on our recovery with peace of mind.

However, Catherine also reminded that we need to look at what we are comfortable to pay as premiums will increase for Integrated Shield plans as we grow older.

She added: “Nobody plans to fail but many fail to plan”, and ensure we are well-covered against death, critical illnesses, personal accident and disability. She also reminded the listeners to seek professional advice to do holistic planning according to our protection needs, gaps and budget.

Raising Awareness for Protection against Breast Cancer

Nor Azila Kasmani (right) at the Berita Harian Fireside Chat with host Shahida (left) and breast cancer survivor Aisha Jiffry.

October is Breast Cancer Awareness Month. In partnership with the Breast Cancer Foundation (BCF), Berita Harian organised a Fireside Chat on its Facebook page on 20 October and invited our Financial Representative Nor Azila Kasmani to inform the public on the importance of financial planning in the event of a critical illness like breast cancer.

“I shared how critical it is to have a hospital plan coupled with a CI coverage, as both plans have their own objectives. I am happy to use this platform to raise awareness of the importance of having sound financial/insurance planning for greater protection, and to encourage the public to get insurance coverage while still healthy.

“BCF shared a statistic with me that 1 in 13 women will suffer from breast cancer. That was a reality check. This month is Breast Cancer Month, so please use this opportunity to advise your customers to be protected and plan for uncertainties in life,” said Azila.

You can catch the Fireside Chat here.

Going the Distance for a Good Cause

The Great Eastern Women’s Run (GEWR) is back! And our reps are lacing up their running shoes to stay healthy and support a good cause. This year’s GEWR is going to be a virtual race and includes a fundraising element – the Great Eastern Cares Fundraising Challenge – to raise funds in support of two Women-related charities – Breast Cancer Foundation and Daughters of Tomorrow.

The Challenge was fully subscribed, with 53 teams of four members going the distance for a good cause. So far, we have raised more than $50,000, as at 19 October. Even if you are not running, you can still do your part and support our ladies in the community. Scan the QR code below or click on the simplygiving.com button to donate!

So come on and do your bit before 7 November!

Hear from some of the top fundraising teams and learn how they walk the talk.

(Photos were taken before COVID-19)

Team Whirlwind

Members: Lydia Lee Mei Yoke, Marie Mak Li Choo, Mary Tan Lay Muay and Christine Cheah Pek Ching

Team: We are members of the same Christian Fellowship Group and call ourselves Whirlwind to inspire us, and all other runners, to sprint fast. We set a very ambitious target to raise $11,300, to commemorate our company’s 113th anniversary this year. As at mid-October, we have managed to raise more than $8,000 through distance-based funds raised and donations.

Since the Challenge started in September, we have clocked over 1,000 km in runs and walks. What motivates us to go the distance, besides the health benefits of exercising, is the passion to support a good cause, especially those of breast cancer patients. We also hope to volunteer with Daughters of Tomorrow to impart financial literacy when it is possible.

For us, every drop of perspiration towards this cause is definitely worth the effort.

(Photos were taken before COVID-19)

Team Roar

Members: Sherri Tan Xue Qi, Pauline Ng Mui Leng, Becky Foo Peck Kee and Celine Tan Bee Yoke

Sherri: The four of us love to exercise and we do regular walks and jogs on our own. Because of the Safe Management Measures, we have not been able to exercise together as a team but collectively, we have clocked about 200 km since September. We do hope that we can go for one long walk together as Team Roar when it’s deemed safe to do so.

I walk or jog between 5 and 10 km at least twice a week, and the four of us regularly update our exercise mileage every week. To be honest, we did not set a target amount to reach; it’s more for our health benefits and more importantly, to raise awareness for a good cause in support of women. In fact, many of those who contributed to our fundraising were women too. Our agency was very supportive of our efforts. Our director and colleagues also donated once they heard that we were involved in this Challenge during the Final Sprint.

GREAT CareShield – Pays Out Earlier and Pays More

Think you’re young and invincible? Think again. Accidents are one of the top 5 causes of disability for adults aged 35 years and under1. And 1 in 10 stroke patients are under 502. Add to these statistics is the fact that long-term care3, which is typically required in the event of disability, is often costly. Even with the national disability schemes like ElderShield 300, ElderShield 400 and MOH CareShield Life, there is still a significant gap that consumers have to pay for these long-term care.

Here’s where our GREAT CareShield (GCS) comes in to bridge that gap to offer greater protection against disability. And if your customers act fast and sign up early with this plan, they pay less for their premium, and get paid early and get paid more!

GCS is the first and only CareShield Life supplementary plan in the market that provides lifetime payouts as long as your customer is unable to perform at least one Activity of Daily Living (ADL). What’s more, your customer will receive additional monthly payouts if he or she is unable to perform at least two ADLs with our latest Dependent Benefit and Caregiver Benefit with this NEW plan. GCS was launched on 5 October and replaced both the GREAT CareShield Enhanced & Advantage plans, which were taken off the shelf on 4 October.

To help you encourage your customers to get this first-in-market plan, they will enjoy a lifetime 20 per cent discount off their premiums upon purchasing GCS from now till 31 December 2021. To make it even sweeter, our reps will also enjoy cash incentives for every two cases of GCS sold*.

So share the GCS plan with all your prospective customers now!

*Terms and conditions apply.

1 Source: Oct - Dec 2014. A/Prof Goh Lee Gan. The Singapore Family Physician Vol 40 No. 4. “Health Conditions that Result in Disability in Adults”.

2 Source: 22 Nov 2016. Linette Lai. The Straits Times. “1 in 10 stroke patients here aged under 50”.

3 23 Jul 2019. MoneySmart. “Nursing Homes in Singapore – How Much Does It Cost?”. Accessed from https://blog.moneysmart.sg/family/nursing-homes-singapore

#Lifeproof your Income for Life with Prestige Life Rewards 5 (SGD) series

We have rolled out the latest Prestige Life Rewards 5 (SGD) series that will guarantee your customers a lifetime of income by just making a one-time premium payment!

What your customers will enjoy:

- Coverage against death or terminal illnesses

- High payout from as early as the 2nd policy anniversary via Prestige Life Rewards 5 (SGD)

- High policy value over time but start receiving lifetime monthly payouts later from the 4th policy anniversary onwards via Prestige Life Rewards 5A (SGD)

If your customers are seeking lifetime payouts that they can use for their lifestyle needs or use this plan as their gift to their loved ones upon demise, share the Prestige Life Rewards 5 (SGD) series with them today!

New Funds for Sustainable Investing and Wealth Growth

We are excited to share new Prestige Portfolio funds for your customers to have the opportunity to participate in sustainable investing and grow their wealth at the same time!

AB Global Sustainable Thematic (SGD)

ESG (environmental, social and governance) Fund

- Forward-looking sustainable investment themes, such as Climate and Health

- Invests in stocks with growth potential, such as MCSI Inc and Apollo Hospitals

- Aligns with Sustainable Development Goal (SDGs), which include “Good Wealth and Well-Being” and “Affordable and Clean Energy”

Allianz Income and Growth (SGD-Hedged)

Monthly dividend payout

- Provides monthly payouts derived from underlying assets (US equities, high yield and convertible bonds)

- Participates in the upside potential at a relatively lower volatility as this is a mixed asset find (includes equities and bonds) compared to a pure equity fund

- Managed by an investment team with extensive industry experience1

BGF Sustainable Energy (SGD-Hedged)

ESG (environmental, social and governance) fund

1st Insurer to launch this fund

- Invests in stocks that are focused to achieve a lower-carbon world

- Exposure to 30-50 companies with long-term growth potential

- Proven track record with a team managing new energy mandates since 20001

1 Past performance of the fund managers may not be indicative of their future performance.

Here is an overview of each of the fund’s track performance record:

Name |

YTD |

1-month |

3-month |

1-year |

3-year* |

5-year* |

10-year* |

Since launch* |

|---|---|---|---|---|---|---|---|---|

AB Sustainable Global Thematic Fund A SGD |

15.52 |

-4.01 |

3.55 |

23.39 |

21.04 |

17.64 |

13.54 |

6.35 |

Allianz Income and Growth AM (H2-SGD) |

7.87 |

-1.63 |

1.03 |

17.37 |

11.7 |

10.6 |

N.A. |

8.72 |

BlackRock GF Sustainable Energy Fund A2 SGD-H |

6.58 |

-7.64 |

-0.49 |

24.86 |

N.A. |

N.A. |

N.A. |

28.39 |

Source: Great Eastern website; © FE fundinfo 2021. Performance figures are calculated on a bid-bid basis, with all dividends and distributions reinvested, taking into account all charges which would have been payable upon such reinvestment. Information is correct as at 7 Oct 2021.

* Performance figures longer than 1 year are annualised.

Disclaimer: The information presented is for informational use only. Investment in this fund involves a high degree of risk and is only appropriate for a person able and willing to take such a risk. A product summary in relation to the Prestige Portfolio may be obtained through Great Eastern or its financial representatives. Potential investors should read the product summary before deciding whether to invest in the Prestige Portfolio. Returns on the units of the Fund are not guaranteed. The value of the units in the Prestige Portfolio funds and the income accruing to the units, if any, may fall or rise. The fees and charges payable through deduction of premium or cancellation of units are excluded in the calculation of fund returns. Past returns, and any other economic or market predictions, projections or forecasts targeted by the fund are not necessarily indicative of future or likely performance of the fund. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Greater Protection for Professionals and would-be Travellers

General Insurance has rolled out new plans for your customers who are professionals and the eager travellers. Here’s what you need to know about these plans.

Professional Indemnity Insurance for Sports Coaches, Wellness and Allied Health Professionals

Who can apply?

- Individuals providing Sports Coaching services

(such as Bowling, Chess, Fitness Trainers, Football, Swimming, Yoga etc.) - Individuals providing Wellness and Allied Health services

(such as Hair & Scalp treatment, Meditation, Physiotherapy Massage, Traditional Chinese Medicine etc.)

Why do professionals need Professional Indemnity Insurance?

This is to protect a professional who may face claims from their clients for financial loss due to mistakes, or allegations of professional negligence or misconduct.

Our Professional Indemnity Insurance provides valuable protection for your customers’ assets as well as professional reputation.

What is covered?

This policy covers your customer’s legal defence costs and expenses, as well as any civil liability (including claimant’s costs) arising from any claim first made against your customer notified during the Period of Insurance, and which arises out of the conduct of the Professional Services provided by your customer.

How to apply?

Submit your customer’s Proposal Form with his resume and professional certificates(s).

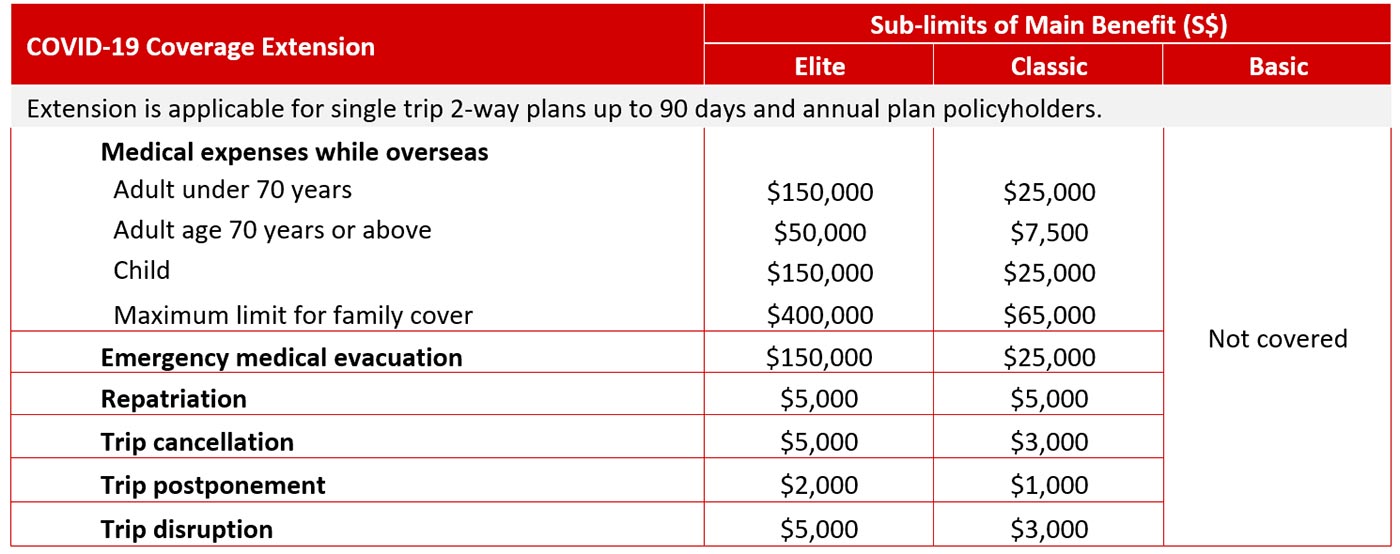

TravelSmart Premier with COVID-19 Coverage

Great news! We have enhanced our travel insurance plan with extended COVID-19 coverage at no additional premium. Your customers can also get up to S$150,000 COVID-19-related coverage for medical expenses while overseas.

Who can apply?

Those travelling overseas under Singapore’s permitted travel arrangements including Vaccinated Travel Lane (VTL).

What is covered?

If your customers are eager to make use of the VTLs to travel this year end, remember to share our latest travel insurance plan that will give them GREATER peace of mind!

A New Mobile Studio for your Digital Needs

To help you better connect with your customers in the digital era, the Centre For Excellence (CFE) is rolling out a Mobile Studio infrastructure in Q4 2021, which will be supported by a suite of media production services.

Here’s what you can expect at our industry-first Mobile Studio, housed within our state-of-the-art training facility:

- Basic Photography and Videography services to design your social media posts

- Basic Graphic Design software

- Booking for hybrid training/events with live-stream for up to 500 participants virtually, with the option for some physical attendees, depending on room capacity

Can’t wait to start on your own direct digital marketing efforts to reach out to more customers and prospects? Simply book these services via the existing CFE booking email, and specify the services you require. Availability is on a first-come-first-serve basis.

*Note: You can still continue with normal room booking for agency meetings and training sessions.

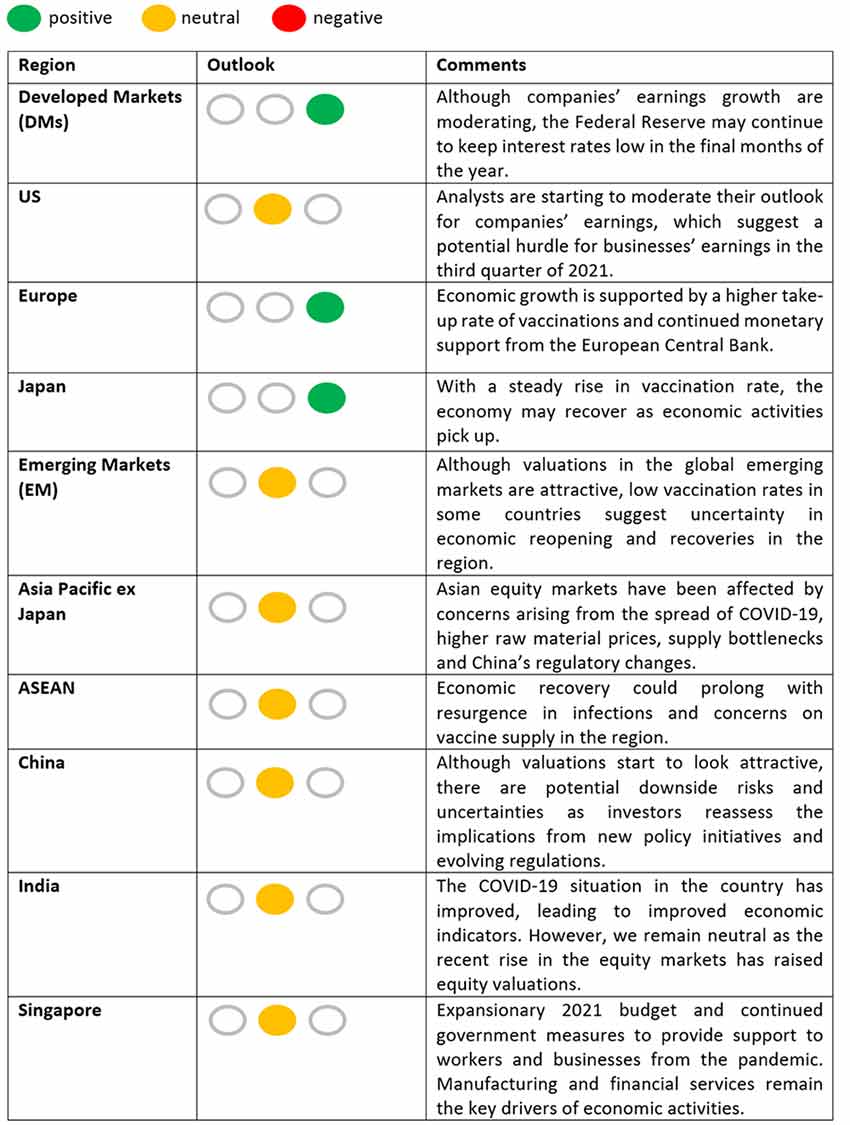

4th Quarter 2021 Market Outlook – A Summary from Agency Propositions and Portfolio Management

We remain our view to hold a positive outlook on equities and are neutral towards bond funds.

Economic growth in most regions may continue to be supported by countries’ fiscal and monetary policies. While inflation due to supply chain bottlenecks and rising energy prices worries investors, interest rates are likely to stay low which will favour equities.

Calendar of Events

Stay up-to-date on Great Eastern’s upcoming activities and events for its financial reps. You can login to Lifehub to view the calendar.

Reach for the Sky!

How is it possible that an accountant-turned-financial representative could achieve the Million Dollar Round Table (MDRT) within four months? Catch the secrets to Clarence Tay’s success and be inspired!

1. Do you have a mantra/quote you live by to start your work day to motivate yourself? If yes, please share.

I ascribe to a quote by an entrepreneur, Gary Vaynerchuk who said :“It’s not about how much you sleep. It’s what you do while you’re awake.”

While sleep is important to me (I love to sleep!), it is more about how I spend my waking hours to maximise my time to make my day count.

2. Having made a career switch to become a financial representative, were there major adjustments that you had to get used to?

Having come from a corporate role with a fixed and stable income, I had to adjust my mindset to accept that I am no longer protected by a ‘safety blanket’, and my monthly pay is now wholly dependent on my efforts put in to serve my clients as a financial representative. This was a terrifying thought initially, but it motivated me to work very hard in my current role.

3. What is your secret to achieve MDRT?

It’s all about analysing your clients’ needs, being genuine and passionate about your strategies, and having an inquisitive mindset.

For me, I will always find out what my clients’ needs and gaps are, and to develop tailored proposals that serve their best interests.

I remind myself that I am not “selling” insurance, but rather, I aim to instil that trust and credibility as a professional who is committed to lifeproof my clients at all life stages.

Finally, I would always reflect on any learning points after each conversation with prospects and clients to constantly improve myself for the next opportunity that comes, and to strive as an effective and successful financial representative.

4. What would you tell new joiners who would be inspired to achieve MDRT as well?

Remind yourself the reason why you are here; and never lose your roots on the journey towards meeting your goals.

MDRT is just another milestone and is not an end-all. Most importantly, integrity must follow every action.

Serving with a Purpose

Doing community work does not only require your time, it also requires a heart to help those who are in need. Lydia Lee, one of our financial representatives, shares her volunteering experiences.

1. How long have you been doing community work and what led you to be involved?

I have been doing community work for over 30 years as I believe in serving the needs of the community and the less fortunate.

2. What made you continue to be involved in your community work? Please share a bit more on what you do.

I am a volunteer befriender at St Luke’s Community Hospital and St Luke’s ElderCare Service. As a befriender, I chat and engage in simple activities with them to provide them companionship (pre-COVID-19 period). However, due to the COVID-19 restrictions, I am not able to visit them at the moment but will certainly do so once the restrictions are lifted.

I also joined various mission trips organised by my church to help the less fortunate in Myanmar, Vietnam, Cambodia and the Philippines, such as providing food and teaching them conversational English. I also do online Zoom sessions teaching English to those whom I met in Vietnam as they are keen to learn English and our Singapore culture as well.

My motto in life is to be a blessing to others. It is emotionally rewarding for me whenever I know that I have made a difference to someone’s life. This is what keeps me going in my community work. Through this, I have learnt to be a better listener and not see my own problems as BIG problems because there are others who may need more help.

3. Do you see your work or role as a financial rep tied to your passion or heart for the people?

I see my role as an extension to help others not only with their financial planning, but also a window of opportunity to touch their lives by making a difference.