This e-publication is for internal sharing only and is not to be distributed outside of the company.

December 2021

Click below to read more.

Featured Story

» The Business of Sustainability

People

» Real Talk with Jimmy Tong, Managing Director, General and Group Insurance

» In Conversation with Leaders – You, Me & Culture

» Finishing the Year Strong – Updates from GELS HOD Town Hall

» #FutureReady Virtual Learning Carnival 2021

» Celebrating 113 years with Great Eastern Gift Credits

» Get GREAT CareShield TODAY for greater protection against disability

» In Conversation with Leaders Session 2 – Tackling Accountability and Exploring Possibilities

» Stepping up to the challenge!

» Going BIG To Do MORE

» MikroSayang offers basic protection for underserved and unserved segments in Malaysia

» GELI 25th Anniversary Celebration Campaign

» Financial Literacy Class: Build Your Sustainable Eco-Friendly Business

» Insurance Services in the New Normal Era

» GEGI Turns 27

» GEGI Supports Financial Inclusion Month

» GEGI handovers renovated sports field to orphanage in Semarang

» Driving Financial Literacy Awareness Among Students

Business & Customers

» Doing Our Bit to Help Families with Special Needs Children

» Great Eastern Women’s Run launches first hybrid edition in its 15th year running

» New Features for Great Eastern (Indonesia) Corporate App

» Awards from Around the Region

Read & Win

» Read & Win: September Issue Quiz Winners & New Quiz

Click here for past TGT issues.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

As the Life company, Great Eastern is in the business of ensuring the sustainability of our customers, our people and our communities. For 113 years, we have anticipated and evaluated risks so that we can offer customers protection in areas where they need them most.

Our sustainability strategy is anchored upon our three core pillars of Environment (Low Carbon Economy), Social (Improving People’s Life) and Governance (Responsible Business Practice). These pillars form the guiding principles behind our initiatives to contribute towards a sustainable future for all.

We have set out a decarbonisation plan for our operations to achieve Net Zero. We will also use the influence of our investment and underwriting to support the Paris Agreement and facilitate the transition to a low carbon economy.

“The business of insurance has always linked profitable growth with sustainability – the nature of our business requires us to understand complex risks and to operate with a long-term mindset,” said Winnie Tan, SVP, Sustainability.

“Health, food security, unemployment and forced migration are just some of the many ways climate change can affect our communities,” said Winnie. “This is why our efforts to address this issue is not just about the environment. It is about helping our customers and communities build resilience through good risk identification, planning and protection.”

That sounds exactly like the business that Great Eastern has always been in the last 113 years.

It all starts with us

As a company, we should increasingly be conscious about what we can do – not just as an insurer and investor, but also as a member of our community. We are taking active steps to manage our carbon footprint, and finding ways to improve people’s lives and make waves where we can to support our community by bringing to life our sustainability pillars.

To close 2021, we held a tree planting event to celebrate our 113th anniversary in Singapore and the 10th anniversary of our Financial Advisory arm – Great Eastern Financial Advisers (GEFA) to support Sustainability for Life through Green Citizenry. Ms Sim Ann, Senior Minister of State for Ministry of National Development, and Ministry of Foreign Affairs, was the guest of honour for this event.

Through generous contributions from our employees and financial representatives, we raised a total of $328,744 for Garden City Fund1 to plant 1,429 trees around Singapore, including 30 trees at Great Eastern Centre.

At the same time, we also believe in starting the conversation on environment and sustainability early. Hence, our donation of $120,000 – from the proceeds of GREAT Green SP, Singapore’s first green life insurance product, to Zero Waste SG to drive its Sustainable Schools Programme in 2022, a holistic initiative aimed at building advocacy and environmental awareness among secondary school students.

By partnering with the Special Needs Trust Company (SNTC), we are also helping underprivileged families with special needs children to future-proof their long-term financial needs through the Great Eastern Cares Term Plan. This plan makes affordable insurance coverage accessible to parents of SNTC beneficiaries so they can provide better for the cost of long-term care for their special needs children in future. In addition, our employees and financial representatives are raising funds for SNTC’s Gift Of A Lifetime (GOAL) Sponsorship Scheme, which supports eligible families with the initial deposit to set up an SNTC trust and co-pay the premium of a term plan on the parent’s life.

Look out for more news on exciting initiatives coming up in 2022, including the resumption of our inaugural sustainability challenge for employees, and a tree planting session for employees and financial representatives scheduled for Q1.

1Garden City Fund is a registered charity established by NParks, the statutory board under the Ministry of National Development

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

1. Tell us more about General and Group Insurance business, and plans ahead.

General Insurance is part of overall financial planning which involves the protection of one’s assets. Many people view financial planning as taking care of their life insurance needs only, but it’s really more than that. It includes protecting you and your loved ones from unforeseen events and covers your major assets like your home and motor vehicles.

We want to create more awareness amongst our intermediary partners and customers about the importance of general insurance, which together with life insurance, helps to complete the entire financial planning cycle such that one’s life, lifestyle and assets are protected, and to reach out to the wider market through partnerships with companies that have a large affinity base.

Group Insurance business is mainly in two areas, namely – 1) coverage of employees’ hospitalisation, medical and life needs through their company; and 2) coverage of one’s hospitalisation, medical and life needs on a portfolio basis.

Our ambition is to cement our position as a leader in Group Insurance through the improvement of our product suite and service level.

2. How has COVID-19 impacted the General and Group Insurance business landscape and what is the team doing to overcome these challenges to serve customers better?

COVID-19 has demonstrated the importance of augmenting our digital services to give customers choices and for us to better reach out to them. Fortunately, General and Group Insurance have embarked on digitising our products and processes prior to the onset of COVID-19.

General Insurance launched its new point of sale system in July which allows intermediary partners and customers to digitally purchase General Insurance products in a more convenient and seamless manner, while Group Insurance continues to grow after a difficult year in 2020, as many companies grapple with COVID-19 challenges.

3. We are rolling out Corporate Insurance plans on mental wellbeing. What is your take on employee mental wellbeing and why is it important for corporates to provide such support for employees?

Work pace is getting faster and COVID-19 has disrupted our daily lives greatly. This has given rise to more stress. Hence, besides looking after your physical wellbeing, mental wellness is equally important to ensure the overall wellbeing of employees. Good physical and mental health make for a healthy and motivated employee, which will also benefit the employer. It is timely and appropriate that we are rolling out Corporate Insurance plans on mental wellbeing and are seeing greater interest from corporates to include insurance coverage for mental wellbeing as part of their employee benefits plans.

4. Sustainability is a big topic these days. What are some plans in the pipeline for General and Corporate Insurance customers who are environmentally/climate conscious?

Everyone has a role to play to ensure a cleaner environment and a better future for the next generation. We are doing our part and coming out with sustainability-linked products in the future. At the same time, we do not insure businesses that are not environmentally-friendly, and those with negative social impact.

5. A favourite mantra of yours is – “…..”

“It will pass”. We live in a fast-paced and stressful world, and many times we feel overwhelmed by family, people or work problems. If we brood over these, we will find our mood and morale affected and go on a downward spiral. So, it is important to remember that all these problems don’t last forever. It will pass and life will go on. Hence, one of my favourite mantra is “It will pass”, to remind myself each time that I am affected by a problem, it will too pass in time.

6. What is your favourite book and why?

“How to stop worrying and start living” by Dale Carnegie is one of my favourite books. The real stories of people overcoming their worries and start living again have always inspired and motivated me to take life’s problems in my stride and believe that things can only get better. I’ve read this book countless times and I recommend it to friends and colleagues facing stress and anxiety.

7. A good leader is… One who believes that people are here to do their best each day.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

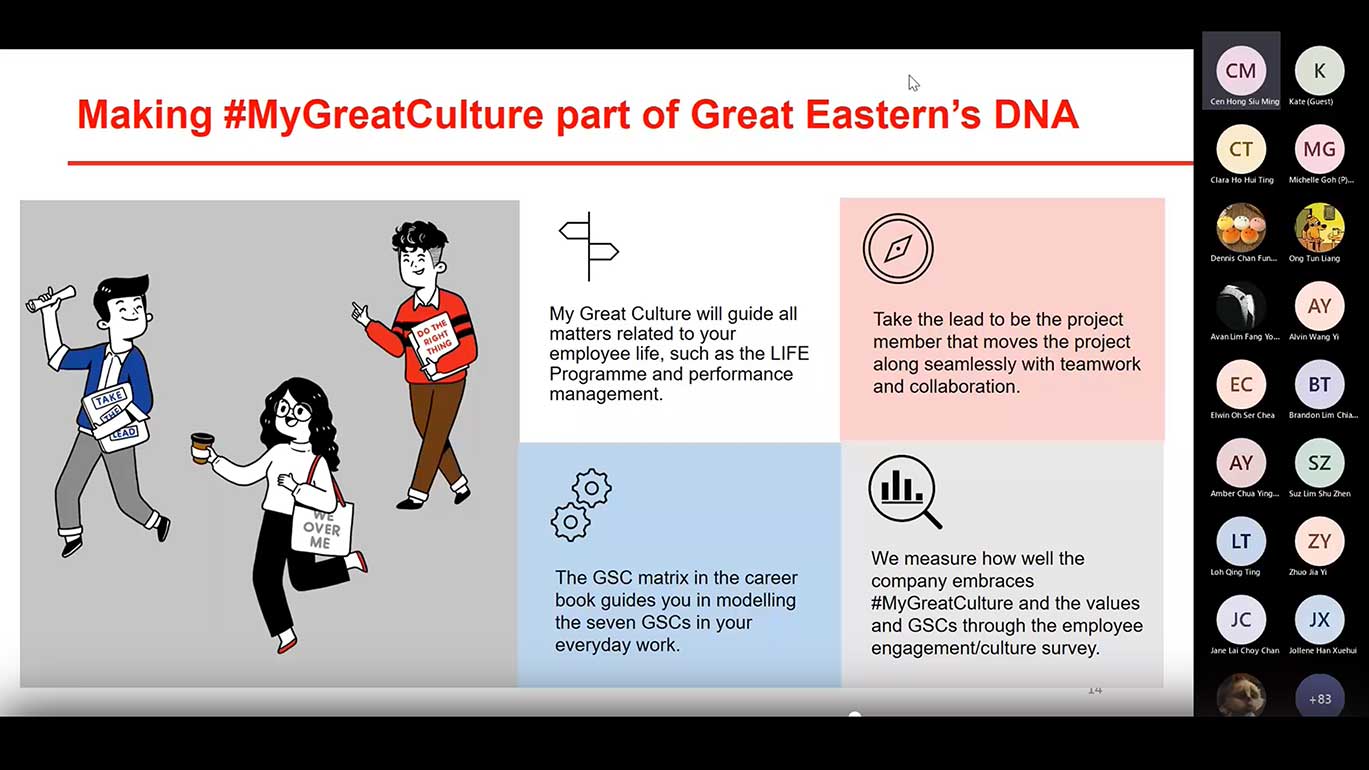

As a Life Company, we put our customers at the heart of everything we do. Our legacy extends beyond our products and services to our culture, which is defined by our core values and how we work.

To build up a strong and aligned customer-centric culture, an interactive session entitled “In Conversation with Leaders – You, Me & Culture (ICWL)” was developed to help employees visualise how practising the core values and generic skills and competencies (GSCs) can help them find greater meaning and purpose in their career with Great Eastern. This will kick-start further conversations on how everyone can contribute to a more conducive and effective working environment, for themselves, their teams and their colleagues.

ICWL was rolled out to all divisions in Singapore from August to October 2021, connecting with more than 1,300 employees. We received positive feedback, with the majority appreciating the importance of the GSCs and how it builds Great Eastern’s culture, and being inspired to learn more, to apply it to their ways of working.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

The HOD Town Hall was held virtually on 8 November 2021.

Highlights from the three main speakers include:

Group CEO Khor Hock Seng, who kicked off the proceedings with a recap of the Q3-2021 financial results, followed by his rallying call on all leaders to do their part to finish the year strong. To achieve this, he reiterated the urgency to “Make every day count, instead of counting the days”, for the organisation to be agile and flexible to the changing environment, while keeping focus on the business goals.

Patrick Peck, MD, Regional Agency/FA and Bancassurance, shared updates from the Agency and initiatives to finish the year strong. He emphasised the importance of having the right belief to guide the way we think and act, to achieve the impossible.

Winnie Tan, our newly-appointed SVP of Sustainability, shared about her vision of our sustainability direction, what we have done in this area and how we can do more, such as contributing to a low-carbon economy. She also shared that the organisation is working to achieve Net-Zero carbon emissions in all our operations by 2026.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

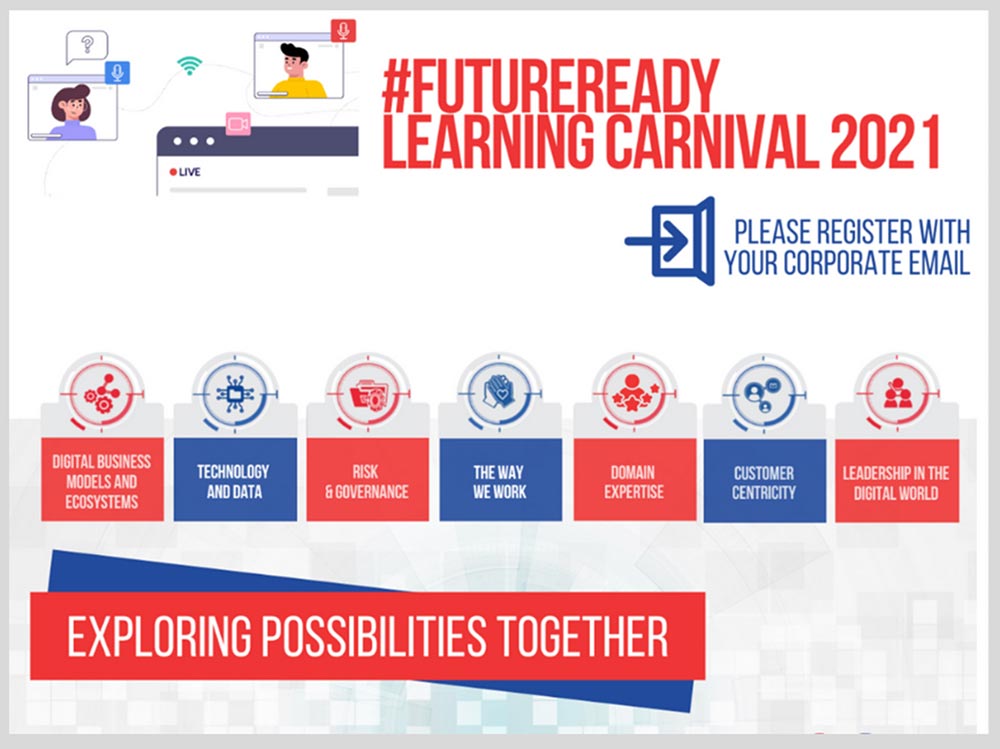

As an organisation seeking to bring greater value to our customers and create a more sustainable business, we have been investing in new technology and infrastructure to enable us to embrace new opportunities in the future.

However, building a digital mindset and having the right skill sets among our people is also crucial for our digital transformation journey. With this in mind, the #FutureReady Framework was developed to build a skilled and adaptable workforce that is always ready to take on future challenges.

This year, the #FutureReady Virtual Learning Carnival was held from 20 September to 29 October 2021, with a total of 16 sessions on topics revolving around the seven #FutureReady pillars, allowing employees from all offices to broaden their knowledge, acquire new skills, sharpen existing ones, and be more effective and productive in their work and life.

Thank you for your participation! Check out the recordings here if you missed the earlier sessions!

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

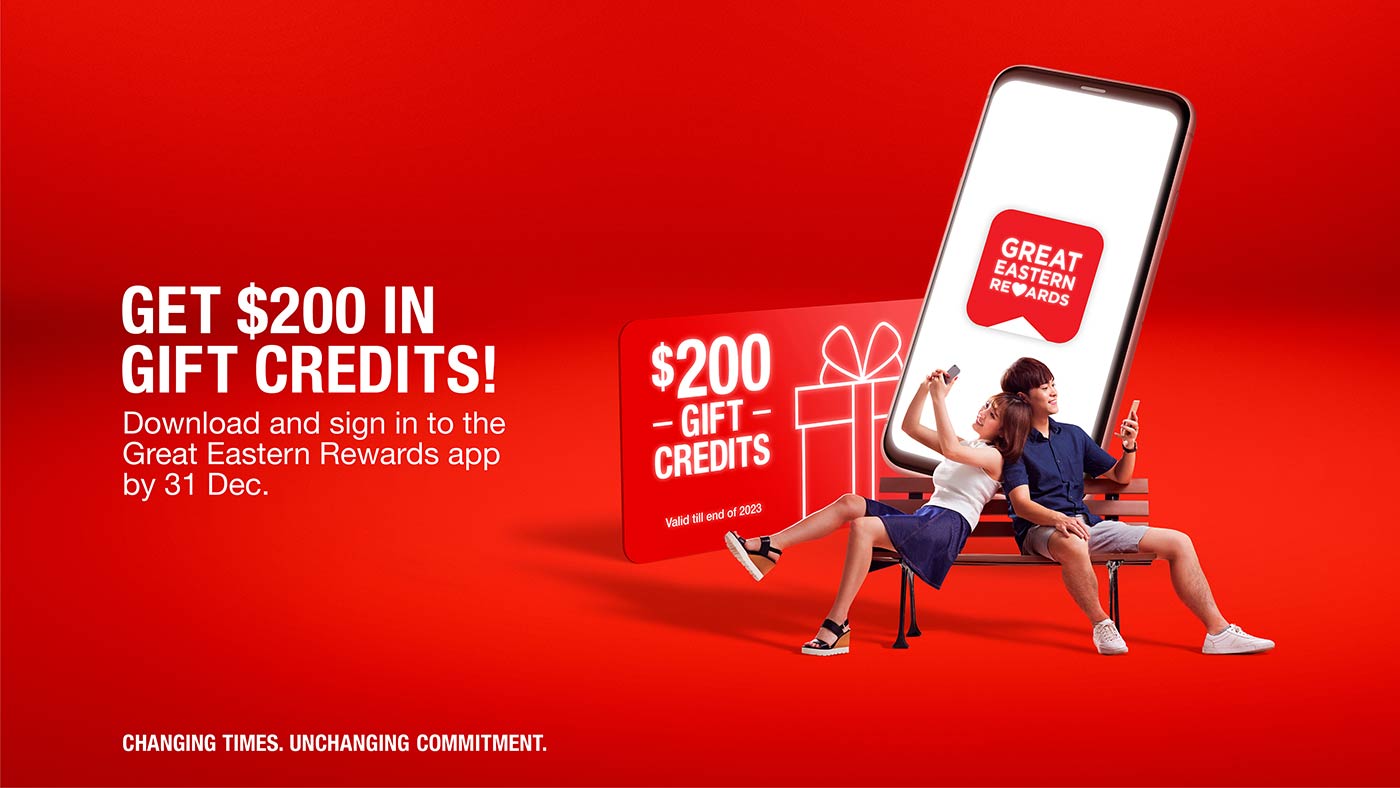

As part of our 113th anniversary celebrations this year, we launched Great Eastern Gift Credits in Singapore, the latest of many initiatives to support our customers and help them protect themselves and their loved ones against life’s uncertainties.

All Great Eastern Life policyholders* will receive S$200 worth of gift credits once they sign in to the Great Eastern Rewards App by 31 December 2021. They can then use the gift credits to offset up to 10 per cent of the premiums for multiple purchases, from a range of over 30 life and general insurance products.

The gift credits are valid till 31 Dec 2023 and can be used for purchases made through our financial representatives, website or at our Customer Service Centres. They can also be used along with other customer promotions and discounts.

Sign in to Great Eastern Rewards App today for your gift credits (if you are our customer) and remind your family and friends to do so too!

*Great Eastern Gift Credits is available to all Great Eastern customers with in-force Life policies on and before 31 December 2021, including government scheme customers.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

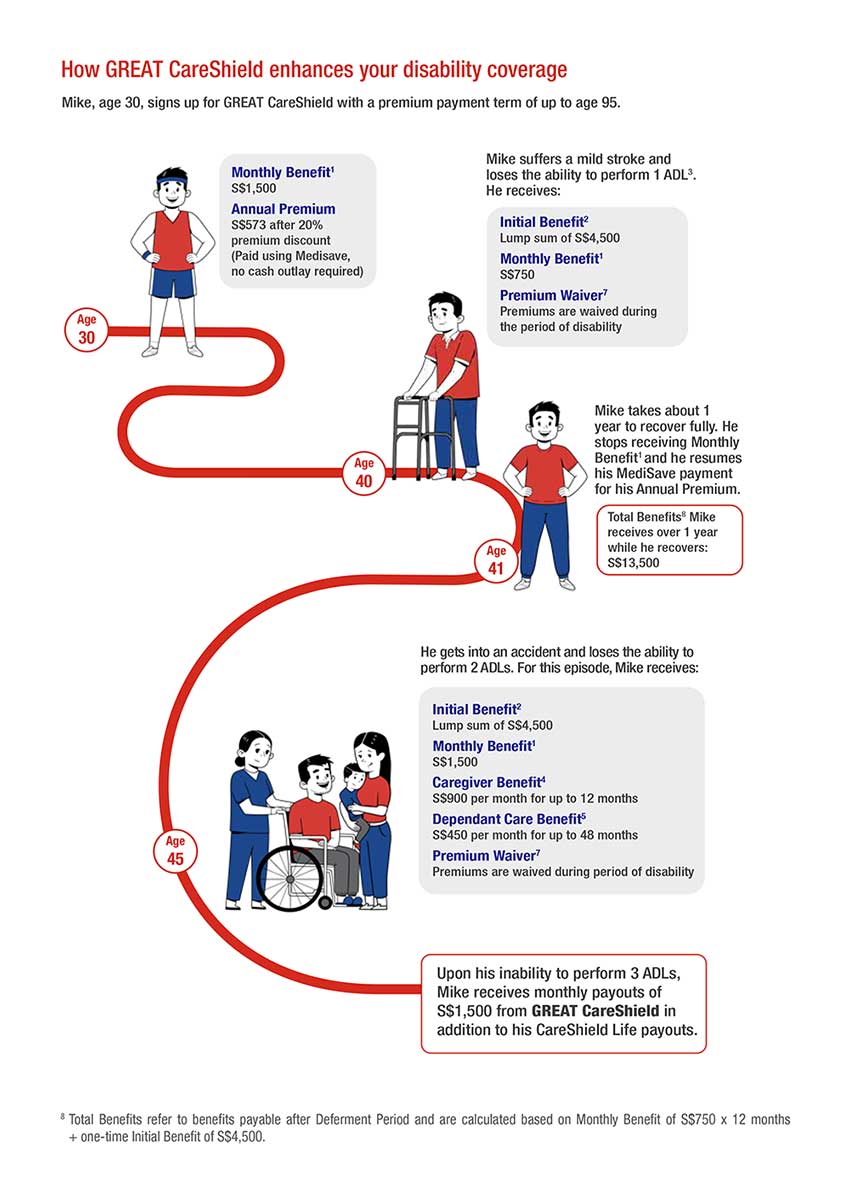

You may be aware of national schemes like ElderShield and CareShield Life that protects you in the event of disability. But do you know that even with these plans, there may still be a significant gap that consumers have to pay for in the event they require long-term care?

This is where supplementary plans like our GREAT CareShield (GCS) come in to bridge that gap to offer greater protection against disability.

The GREAT CareShield plan, launched in early October this year, replaces our earlier supplementary offerings – GREAT CareShield Advantage and GREAT CareShield Enhanced1 – and has been enhanced to offer greater protection for policyholders against disability, with earlier payouts.

This market-first plan is the only MediSave-approved supplementary plan in the market currently that provides policyholders payouts upon the inability to perform 1 of 6 Activities of Daily Living2.

Benefits include:

- Greater protection coverage when they start at a younger age (higher monthly benefits within the S$600 MediSave funds withdrawal limit per person per calendar year)

- Pays early upon the inability to perform 1 out of 6 ADLs

> Lump sum payment of 300% of Monthly Benefit3

> 50% Monthly Benefit4 as long as the life assured is unable to perform 1 ADL - Dependent and Caregiver Support (upon the inability to perform at least 2 ADLs)

> Dependent Care Benefit5 – 30% of Monthly Benefit for up to 48 months (or 4 years) per policy lifetime (for policyholders with children below 22 years)

> Caregiver Benefit6 – 60% of Monthly Benefit for up to 12 months per policy lifetime

Sign up before 31 Dec 2021 and get 20 per cent off premiums throughout your coverage on top of your Staff discount! So what are you waiting for? Find out more here.

1There is no change to the terms and coverage for existing GREAT CareShield Advantage and GREAT CareShield Enhanced policyholders.

2Activities of Daily Living (ADLs) are: washing, toileting, dressing, feeding, walking or moving around and transferring.

3In the event the Life Assured fully recovers from the disability, the Initial Benefit may be paid again for subsequent episodes of inability to perform at least 1 ADL. However, it is not payable if such subsequent disabilities arise from or are related to the cause of disability(ies) for which there was a previous claim for Initial Benefit.

4Subject to Deferment period. Payouts of Monthly Benefit are payable for as long as the Life Assured suffers from the applicable number of disabilities, up to a lifetime.

5Applicable if the Life Assured has a Child who is below 22 years old (age last birthday) as at the Claim Date; subject to Deferment Period and payable for up to a maximum of 48 months (whether consecutive or not) per Policy Term.

6Subject to Deferment Period and payable for up to a maximum of 12 months (whether consecutive or not) per Policy Term.

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

The “In Conversation with Leaders” series is back for a second instalment, and our colleagues were excited!

The second session of this forum was held on 23 September 2021, featuring both GELM and GEGM leaders – Vincent Chin, GELM Head of Information Technology; Yvonne Gan, GELM Head of Healthcare Services and Operations Planning; and Chong Wan Leng, GEGM Appointed Actuary.

Tackling the values of “Accountability” and “Exploring Possibilities”, our leaders shared how they practiced these values in both their work and daily lives, highlighting real-life examples that were both inspiring and relatable. Moderated by Mallory Loone, Co-Founder of WorkInspires, the “In Conversation with Leaders” series aims to inspire employees to practice accountability and exploring different possibilities while bridging the communication gap between leaders and employees.

Watch the video snippet here and find out how our leaders practice accountability in their day-to-day!

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Stepping up to the challenge!

Our GELM, GEGM and GETB employees stepped up their game with the LIFE programme and participated in a series of step challenge activities to stay active and healthy.

In September 2021, GELM organised a one-week Steps Challenge hosted via the GETGREAT Malaysia app. 50 teams of two participated in the Challenge and clocked in over six million steps during the challenge period, with members of the top team walking away with 100 LIFE Points each.

As the Activ@Work Challenge by PERKESO, a 3-months steps challenge, wrapped up by end-September 2021, we are proud to announce that four of our employees were among the Top 10 “Most Active Employees” under the Sapphire category, for private sector organisations with at least 50 participants or more. Ms Ooi Chiew Ean from GELM Branch Operations-Taiping and Ms Chan Qing Yi from GEGM Branch Distribution-Kuala Lumpur came in 1st and 2nd respectively in the category.

We are extremely proud of them for putting in consistent effort throughout the steps challenge. Let’s congratulate the winners for their well-deserved achievement!

Activ@Work Challenge 2021 Award Ceremony

Activ@Work Challenge 2021 winner – Ms Ooi Chiew Ean (1st place)

Activ@Work Challenge 2021 – Ms Chan Qing Yi (2nd place)

Since the middle of this year, GETB received several requests from Non-Governmental Organisations (NGO) for funds to support the basic needs of families who had lost their jobs and income due to COVID-19. This was cause for concern, as breadwinners were unable to even provide food for their families.

GETB had in mind to channel our entire CSR budget for this year to help these communities, but felt we needed to do more. That was how we came up with our GET BIG initiative. Our management decided to conduct a donation drive among staff and agents from August to October 2021, and pledged to match dollar-for-dollar the amount raised from this initiative.

Through staff and agency contributions and corporate matching, we were able to grow our CSR fund to almost RM190,000, and this was distributed to more than 20 beneficiaries, most of which were helping families impacted by COVID-19.

We also supported organisations like Befrienders KL, a helpline who had reported increased number of calls from people who were struggling to deal with the negative impact of the pandemic.

“The pandemic and numerous lockdowns have been challenging for many. As a non-profit organisation, we were impacted as well because donations were greatly reduced. Thanks to this amazing GET BIG initiative by Great Eastern, we are now able to carry out more awareness programmes on mental health and suicide prevention, and also to reach out to more people who are in distress,” said Mr Kenny Lim, Executive Director, Befrienders KL.

Despite the challenges, we are always grateful for the blessings we receive, and with that in mind, we want to help those in need during such difficult times and live up to our Takaful purpose.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------

Great News! GETB has soft-launched a mikrotakaful distribution channel known as MikroSayang to cater to the basic protection needs of the underserved and unserved segments in Malaysia, especially the B40 and lower M40 and aged 18-55 years old.

MikroSayang is the first product launched under the Perlindungan Tenang, an initiative under Bank Negara to ensure the availability of simple and affordable protection for all. It offers three benefits – hospitalisation, critical illness and death due to Personal Accident.

There are currently three plans* available:

- Plan A: Hospitalisation benefit at only at RM50 per year or RM4.20 monthly;

- Plan B: Critical Illness coverage at only at RM50 per year or RM4.20 monthly;

- Plan C: Hospitalisation benefit and Critical Illness coverage at RM90 per year or RM7.50 monthly

*Note: all three plans comes standard with Accidental Death Benefit (ADB) of RM5,000

MikroSayang is fully distributed digitally through its own portal at www.mikrosayang.com, where customers will experience intuitive and simplified on-boarding process with an end-to-end process taking less than 3 minutes. Interested customers can register online and be protected almost instantly. They will subsequently be granted access to an online dashboard/portal where they can manage their account, submit their claims, check the benefits available to them and refer other customers.

The product ideation and design stems from the experience gained by the team from managing mySalam, the free takaful scheme by the government to about 7 million eligible members.

For Bantuan Prihatin Rakyat (BPR) recipients aged 18-55 and are eligible for the Perlindungan Tenang Voucher (PTV), they can redeem their RM50 voucher and get protected with MikroSayang for free for one year.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

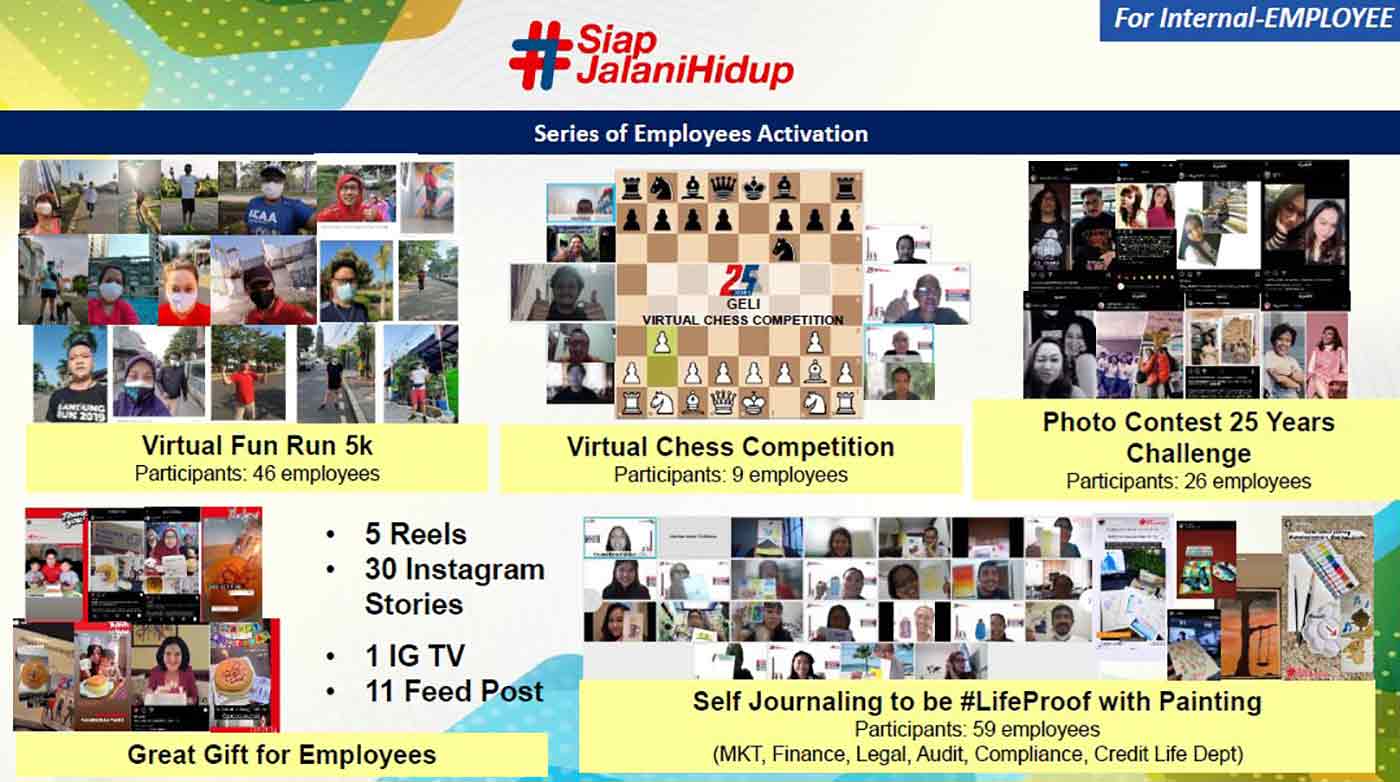

To celebrate our 25th Anniversary this year, Great Eastern Life Indonesia (GELI) organised a series of activities for our employees and customers.

Our Human Capital team organised events for employees such as the Virtual Fun Run 5km and a Virtual Chess Competition. There was also a photo contest on Instagram, where we challenged our employees to “show” how much they have changed, by posting a photo of them where they were 25 years old and their current photo.

On our birthday on 16 August, we sent a birthday cake and greeting card to the homes of all our employees, numbering more than 200, as a token of gratitude for their hard work. This is a practice that we have been doing for the last three years.

Because of COVID-19, our employees have been working from home for almost a year and a half. Our Human Capital team collaborated with Bartega Studio to conduct a self-journaling by painting session as part of our mental wellness programme, to help our employees live #Lifeproof, and this saw participation from 59 employees from six departments

For our customers, we launched “The Great 25” campaign from August to September 2021 in collaboration with various partners, with the aim of promoting our sales website GoGreat. Customers that buy our products from GoGreat website will get additional benefits such as:

- 25% Cashback on Great Cancer Protection (GCP) or Great Heart Attack Protection (GHAP)

- 2.5% Cashback on Great Pro Assurance (GPA) or Great Saver Assurance (GSA).

- XtraGreat Package: 10 Free Teleconsultation sessions from YesDok for up to five persons (1 customer + 4 family members)

- Rp 750.000 Discount voucher from Mayapada Hospital for medical check-up

- 20% Discount Voucher from ZALORA.

“The Great 25” campaign aims to help customers live #LifeProof or #SiapJalaniHidup. The GPA, GCP and GHAP products were the top three bestselling products during the campaign.

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Commemorating Financial Inclusion in October, Great Eastern Life Indonesia (GELI) partnered Dream Diadona, the largest digital media community for moslem women in Indonesia, to conduct a virtual financial literacy class, “Build Your Sustainable Eco-Friendly Business”, on 25 October 2021.

Besides increasing financial literacy, we also raised issues on sustainability since it is very important to have a business that is profitable but also does good for the environment. In her opening speech at this event, Ibu Nina Ong shared that this activity is aligned to our mission to make life great by providing financial security and also in line with our campaign #SiapJalaniHidup.

Tifani & Ratri, co-founders of Vert.erre, an eco-friendly business, spoke about how to start a sustainable business that is environmentally-friendly. Agustina Fitria (CFP, QWP, AEPP, CSA), a Certified Financial Planner from OneShildt, shared her knowledge on financial literacy, including how to start a financially healthy business, managing finances for business, business financial checks and introduction to various kinds of financial products.

The virtual event, which lasted almost two hours, was attended by more than 120 enthusiastic participants who posted numerous questions to the speakers. Post-event surveys indicated a 21 per cent increase in financial literacy knowledge, a positive sign and encouragement to organise similar events in the future.

This activity supports the Indonesian Government’s initiative to achieve the target of financial inclusion to 90 per cent by 2024. The third National Financial Literacy and Inclusion Survey (SNLIK) conducted by OJK in 2019 showed the financial literacy index at 38.03 per cent and the financial inclusion index at 76.19 per cent.

Catch the highlights of the event at https://www.youtube.com/watch?v=3hS2elhswXo&t=1051s

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

COVID-19 has impacted all aspects of life. Companies have to become more efficient and adapt digital technology to transform the way they work. GELI conducted a HR Gathering webinar, “Insurance Services New Normal Era” on 19 October 2021, in collaboration with Good Doctor and Workfit, to shared how insurance can help HR practitioners in this new normal by providing digital services that can increase employee satisfaction.

Danu Wicaksono, Managing Director of Good Doctor Technology Indonesia, a digital healthcare provider with a focus on telemedicine, introduced integrated digital outpatient benefits for GELI customers and how his digital services can complement existing outpatient benefits for corporate clients in their group policies.

Nico Huitink, Founder of Workfit, shared the advantages of his company’s app, which makes it easy for employees to access and arrange hospital visits, dental checkups, eye checkups, and wellness programmes in an automated, affordable and easy to access manner, through its wide network of healthcare providers.

GELI speakers at the webinar included Daniel Herjun Putranto, GELI Head of Broker & Affinity Division; Alfi Yani, GELI Head of CX & Digital Services; and R. Wiena Cahyaningsih, GELI Head of Broker & Affinity Sales. They shared about the new Great Eastern Corporate App and how it will help benefit HR practitioners.

The two-hour virtual event was attended by 100 participants who were HR practitioners and brokers. Participants were given a voucher worth Rp 900.000 from Good Doctor to purchase health products at GoodMall and a free COVID-19 test from Workfit.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Great Eastern General Insurance Indonesia (GEGI) celebrated the company's 27th anniversary on 22 September 2021. As a lead up to the celebrations, GEGI conducted a series of activities for staff to participate, including inter-department photo and video contests with the theme on anniversary wishes to the company. Staff response was enthusiastic, with many uploading fun photos and videos on Instagram and tagging GEGI at its official IG handle @greatasterngeneral.id.

The public was also invited to join in the anniversary celebrations via social media, to convey their hopes and wishes to GEGI on its 27th anniversary. We also had a quiz for our followers that helped GEGI gain new following and drive engagement.

On 22 September, GEGI organised a virtual anniversary townhall for all staff. Directors shared department updates and strategic directions for the company, before announcing the winners of the staff photo and video contests, and ended with a birthday celebration with cake cutting and lunch.

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

October is Financial Inclusion Month in Indonesia and the theme for 2021 is Financial Inclusion for All, Revive the Nation's Economy. Initiated by OJK, the Financial Services Authority, various companies in the financial industry including GEGI organised activities to increase public financial literacy and inclusion.

GEGI held a webinar on “Understanding insurance products that support millennial lifestyle” which was attended by 100 participants from different backgrounds, including working adults and students. GEGI also actively promoted insurance literacy through a series of content that introduced the types and benefits of insurance on its social media channels in October.

In addition, GEGI participated in a Virtual Expo organised by OJK from 18 October to 2 November 2021, which was supported by 300 companies in the fields of Banking/Finance, Insurance, Fintech and e-Commerce. GEGI had a virtual booth that showcased its products to the Virtual Expo’s visitors.

As part of GEGI’s campaign during the 2021 Financial Inclusion Programme, it offered 25 per cent discount on purchase for Personal Accident (PA) plans in the month of October to increase public awareness and access to PA insurance.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

GEGI held several CSR activities in 2021 to support the company's social mission to help empower the community to be more independent. One such activity was the renovation of the sports field at the Tanah Putih Orphanage, Semarang, which GEGI sponsored, and was completed in July 2021. However, due to COVID-19, we were only able to organise the official handover ceremony on 17 September 2021.

GEGI helped to renovate this sports field to enable the 26 children living at the orphanage to enjoy a healthy lifestyle with their outdoor activities. In addition, GEGI representatives gave washing machines, dispensers and computers to aid their learning.

The Tanah Putih Orphanage was founded in 1930 and is a social foundation for neglected children from broken families, left alone, rejected by their families and live in poverty.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

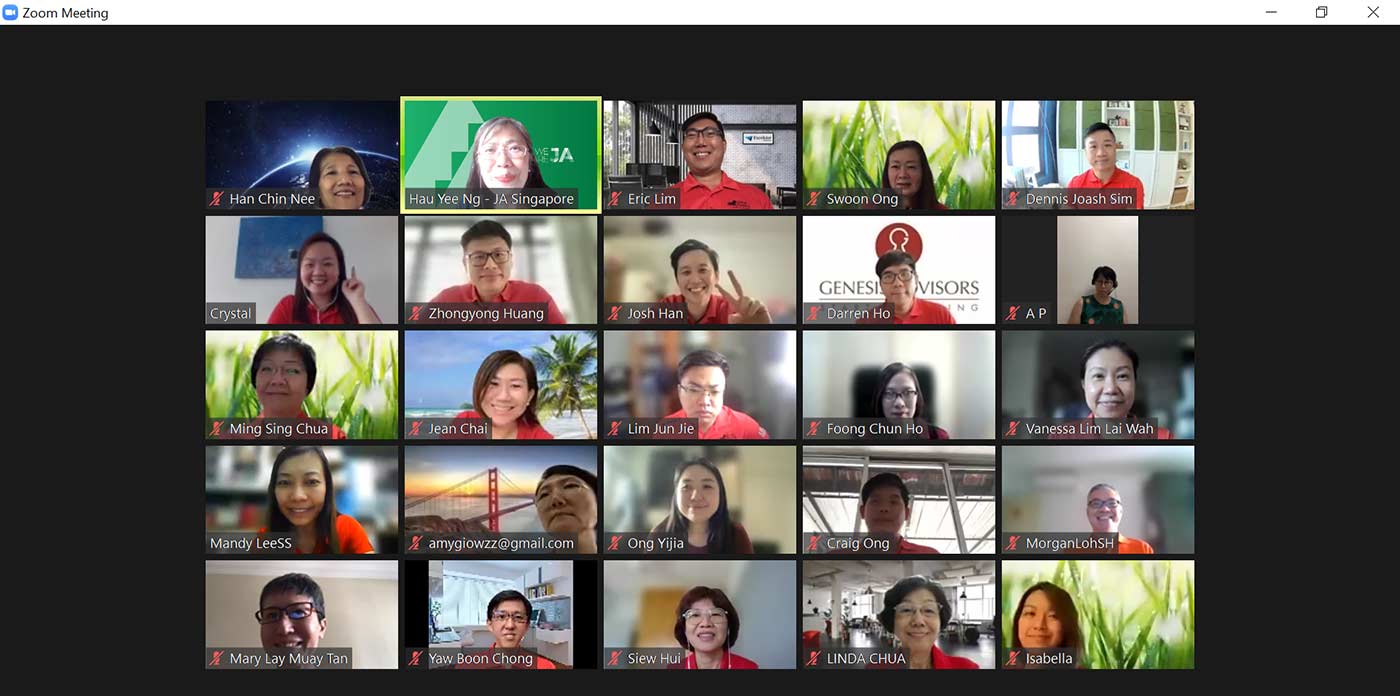

As part of our CSR focus to increase financial awareness among the young, we partnered Junior Achievement Singapore to run a series of financial education workshops for secondary school students. Over three sessions in October 2021, more than 30 staff and financial representatives went back to school to share basic career and financial tips with over 500 students from Evergreen and Kranji Secondary Schools.

The workshops were carried out via Zoom and despite the lack of physical interaction, our volunteers were able to engage with the students through a series of interactive activities that got them thinking about possible career choices, how to set goals for themselves, making choices according to their available budgets and how to be a savvy shopper.

Here’s what some of our volunteers have to share about their experience.

“It was an engaging and fun experience. I felt that whatever little time and effort we spent during this workshop may go a long way for some of these students, in terms of understanding career choices and managing their finances. In addition, I even shared about my experience as a student at their age, and how important it is to keep moving forward despite numerous setbacks and failures.”

Michael Wong, General Insurance

“We had to actually study the materials and rehearse our presentation so that we were prepared to ‘play teacher’ for a day. It was enjoyable to interact with these students and go through basic financial education with them. I wish I had such ‘lessons’ back when I was in school!”

Samantha Halim, Group Investment Management

“I hope the students learnt something useful after our session and that we have made a difference in how they view their career goals and on financial planning. It was also an eye opener for me, learning about how this generation of youths view their career ambitions and paths.”

Mel Teh, Financial Representative

----------------------------------------------------------------------------------------------------------------------------------------------------------------------

Mr Khor Hock Seng signing the MOU with SNTC Chairman Moses Lee (left).

This year, the Propositions and Portfolio Management team, the “architects” behind the design of products for customers, has been firmly focused on adding a Sustainability element into our product offerings. It started with GREAT Green SP in July, a short-term endowment policy that invests its portfolio assets to achieve significant positive environmental impact. It was also the first green life insurance product in Singapore.

In recent months, the team had been busy drawing up a plan to support the needs of an underserved segment of the community – families with special needs children – in line with our Sustainability pillar of Improving People’s Lives through financial inclusion.

The result was Great Eastern Cares Term Plan, in partnership with the Special Needs Trust Company (SNTC) to help parents ensure the long-term financial security of their special needs children for the future.

Those who open a trust account with SNTC for their child can purchase the Great Eastern Cares Term Plan, which provides affordable insurance coverage for parents of SNTC beneficiaries. The plan, nominated to the child’s trust account with SNTC, will help fund any expenses later on as needed when the parents are no longer around to take care of their child.

To support low-income families who may not have the resources to set up a trust or save for their children, SNTC has also launched its Gift Of A Lifetime (GOAL) Sponsorship Scheme to support eligible means-tested families by helping them put a plan in place to provide for their special needs children.

From now until Friday, 31 December 2021, we will be raising funds to support SNTC’s GOAL campaign. Great Eastern will match donations dollar-for-dollar up to S$50,000, so do donate generously at http://sg.gelife.co/makeadifference and help spread the word to your family, friends, partners and vendors. Every dollar helps. Together, let’s make a difference in the lives of these families!

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

We kicked off our first-ever virtual Great Eastern Women’s Run (GEWR) on 14 November 2021. The 15th edition of GEWR also welcomed the return of the competitive half-marathon race that same day, with 15 invited local elite runners competing ‘live’ in the first all-women physical race in Singapore in two years since the onset of COVID-19.

Continuing as a socially responsible corporate citizen, this year’s GEWR also raised funds for women’s charitable causes – Breast Cancer Foundation (BCF) and Daughters Of Tomorrow (DOT) – to the tune of S$101,038. Over two months in September and October, Great Eastern staff and financial representatives activated their networks to raise funds for the two charities. They also ran and walked to clock long distances as part of the Great Eastern Cares Fundraising Challenge, where the company pledged to donate S$1 for every 1 km clocked, up to $20,000.

Guest-of-Honour, Ms Low Yen Ling, Minister of State for the Ministry of Culture, Community and Youth, and Ministry of Trade & Industry, and our GCEO, Mr Khor Hock Seng, presented the trophies and cash prizes to the top three elite runners. Ms Low and Mr Khor also recognised the efforts of the top three fundraising teams from both corporate and agency with a fun photo session.

Mr Colin Chan, Managing Director of Group Marketing, said: “Supporting causes for women has always been close to the hearts of the GEWR community. We hope to help advance the work of our two beneficiaries by activating the community’s networks to help enable and empower women and families in need to achieve financial independence.”

Close to 4,500 participants signed up for the virtual race. They ran across a total of five different race categories, with a special 113km category to commemorate Great Eastern’s 113th anniversary this year, and clocked in their distances via a mobile app.

Top Staff and Financial Representatives Fundraising Teams

TEAM COURS (Staff - 1st place)

TEAM FTW (Staff - 2nd place)

TEAM Fabulous 4 (Staff - 3rd place)

TEAM Whirlwind (Financial Representatives - 1st place)

TEAM Mickey Miles (Financial Representatives - 2nd place)

TEAM Tired Toes (Financial Representatives - 3rd place)

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

As part of our digital roadmap, Great Eastern Life Indonesia (GELI) updated its Great Eastern Corporate application, launched in Q2 2021, with new features from October 2021 for customers and a new portal for HR and Broker partners.

For customers, new features on the Great Eastern Corporate App include:

1. Register family members in the app for them to check on benefits available

2. Submit and view the guarantee letter (for hospitalisation)

3. View and pay excess claims

4. Make appointments with a doctor

We also launched a HR/Broker portal with the following features:

View employee personal information, insurance benefits, claim utilisation and all insurance-related on a real-time basis (instead of calling their insurance agents)

Efficient and seamless self-service process, such as adding new employee, removing those who resigned, update insurance plan etc.

Monitor claim utilisation, premium billing and excess claim billing in real-time (within one business day)

Self-service report generation when required

This platform is proof of how GELI understands and addresses customers’ needs, and will be a strong competitive factor in our goal to be a leading financial service provider in Asia, recognised for our excellence.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Great Eastern Life Indonesia (GELI) was presented the Indonesia Best Corporate Sustainability Initiatives Award 2021 in the Pandemic Initiatives category, organised by MIX Marcomm on 10 December 2021. This Award has been held since 2016 and is presented to companies for their social and environmental initiatives in supporting the achievement of the Sustainability Development Goals (SDG).

GELI won the Award for its #SiapJalaniHidup campaign that started in 2020 and continued through 2021, with a series of activities to help Indonesians live #lifeproof especially during these difficult times amidst the COVID-19 pandemic. This is the first time GELI has won in the Corporate Sustainability category.

Awards List – Q4 2021

Singapore

- Most Transparent Company (Runner Up) in the Financials Category – SIAS Investors’ Choice Awards 2021

- Excellence in Sponsorship Activation (Bronze) – Marketing Excellence Awards 2021

Indonesia

- Top Insurance Employers Award 2021 – Insurance Business Asia Magazine

- The Most Committed GRC Leader (Clement Lien Cheong Kiat) & Top Governance, Risk and Compliance Awards 2021 #Star 4 – Top Business Magazine

- Best Insurance 2021 with Outstanding Financial Performance & Business Segmentation Development (Category – Life Insurance Total Asset Rp 5-Rp 10T), Indonesia Best Insurance Awards 2021 – Warta Ekonomi

- Best Life Insurance 2021 (Category – Equity Rp 500 bio-Rp 1.25T), Insurance Award 2021 – Media Asuransi

- Marketing Award 2021, (Category – The Best Marketing Campaign) – Marketing Magazine

- Best Customer Service Reputation (Category – Life Insurance > Rp 10T), Indonesia Best Financial Brands Award (Millennials’ Choice) 2021 – The Iconomics

- Excellent Predicate, (Category – Private, Life Insurance with Asset Rp1T - Rp5T), Indonesia Finance Award IV 2021 – Economic Review

- Best Data Governance 2021, Best Customer Data Safety & Privacy Protection, Data GovAI Award 2021 – ABDI & Komite.ID portal

- Top 20 Financial Institutions 2021 (Category – Life Insurance with Total Gross Premium Rp 1T-Rp 5T), Top 20 Financial Institutions Award 2021 – The Finance Magazine

- Indonesia Corporate Sustainability Initiatives 2021 (Category – Pandemic Initiatives), Indonesia Best Corporate Sustainability Initiatives 2021 – MIX MarComm Magazine

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Read & Win: September Issue Quiz Winners & New Quiz

A big “Thank You” to all readers who took part in the last issue’s quiz.

Congratulations to the following winners with the correct answers! You have won 2,000 GREAT Dollars (worth S$20)!

- Koh Jing Hiang

- Joeline Ang

- Swapnil Chandra

- Rebecca Joo

- Amaraneni Shashank

- Deepa

- Susan Chan

- Evon Lee

- Linda Chew

- Chai Yu Zhen

The points will be credited into your Great Eastern Rewards account in January 2022. Keep a lookout for them!

And now for the next quiz. Answer all the three questions below correctly and stand to win 2,000 GREAT Dollars (worth S$20)! Five lucky winners with the correct answers will be picked.

1. How many trees did we plant at Great Eastern Centre as part of the celebration for our 113th anniversary in Singapore and GEFA’s 10th anniversary?

2. What is Jimmy’s favourite mantra?

3. What is the final amount that the Great Eastern Women’s Run raised this year?

Send your entries to tgt-sg@greateasternlife.com by 31 January 2022. Open to GELS staff only. Winners will be announced in the next TGT issue in March.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Read & Win: September Issue Quiz Winners & New Quiz

A big “Thank You” to all readers who took part in the last issue’s quiz.

Congratulations to the following winners with the correct answers! You have won 2,000 GREAT Dollars (worth S$20)!

- Koh Jing Hiang

- Joeline Ang

- Swapnil Chandra

- Rebecca Joo

- Amaraneni Shashank

- Deepa

- Susan Chan

- Evon Lee

- Linda Chew

- Chai Yu Zhen

The points will be credited into your Great Eastern Rewards account in January 2022. Keep a lookout for them!

And now for the next quiz. Answer all the three questions below correctly and stand to win 2,000 GREAT Dollars (worth S$20)! Five lucky winners with the correct answers will be picked.

1. How many trees did we plant at Great Eastern Centre as part of the celebration for our 113th anniversary in Singapore and GEFA’s 10th anniversary?

2. What is Jimmy’s favourite mantra?

3. What is the final amount that the Great Eastern Women’s Run raised this year?

Send your entries to tgt-sg@greateasternlife.com by 31 January 2022. Open to GELS staff only. Winners will be announced in the next TGT issue in March.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------