Claims-Adjusted Pricing feature on GREAT TotalCare P Signature Plan

What is Claims-Adjusted Pricing

Claims-Adjusted Pricing (CAP) framework is an equitable and sustainable framework that allows you to decide on your preferred treatment option based on your circumstances.

It is applicable to policyholders with GREAT TotalCare P Signature supplementary plan. The yearly renewal premium for your supplementary plan will be determined by your personal claims experience and prudent use of healthcare services during the Assessment Period1.

Learn more about CAP and how it benefits you

With CAP, your Premium Level at each policy renewal may increase or decrease depending on the source of claim and the total amount of claim paid under your GREAT SupremeHealth P Plus and GREAT TotalCare P Signature during the Assessment Period1.

| Source of Claim | Total Amount of Claim(s) Paid by the Company during the Assessment Period | Premium Level (at Renewal date) |

| Private Hospital / Private Community Hospital / Private medical clinic that is not a Panel Provider | S$1,000 and below | Up 1 level |

| Above S$1,000 | Up 2 levels | |

| Private Hospital / Private Community Hospital / Private medical clinic that is a Panel Provider | S$1,000 and below | Remain on same level |

| Above S$1,000 | Up 1 level | |

| Restructured Hospital / Government-funded Community Hospital / Inpatient Palliative Care Institution | Any amount | Remain on same level |

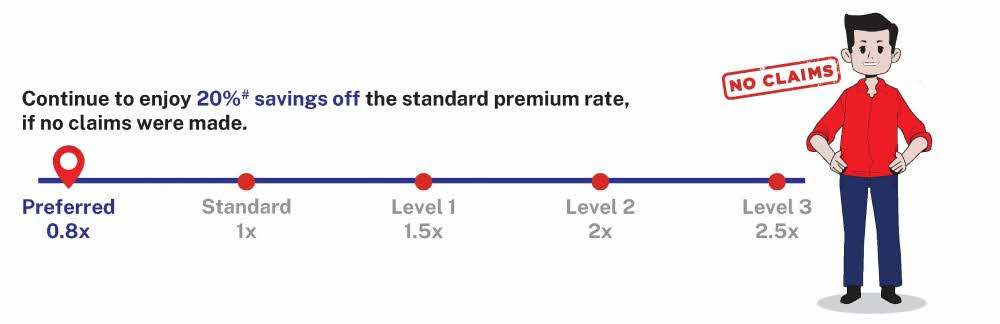

| No Claim | Nil | Down 1 level |

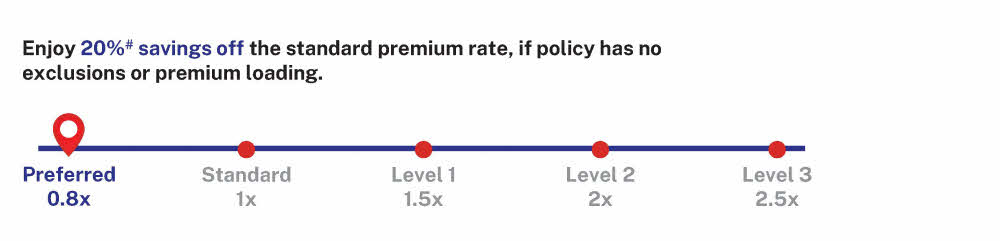

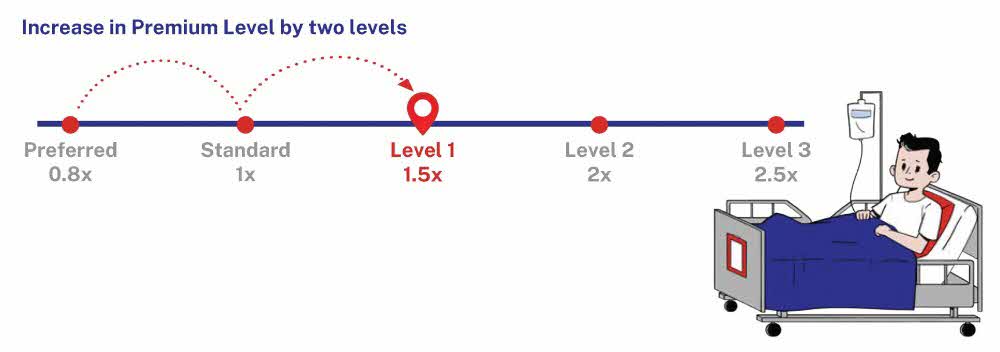

Depending on your age, there are 5 premium levels as shown below in ascending order from left to right. Your premiums are determined by multiplying the Multiplier Factor corresponding to the applicable Premium Level at policy renewal.

| Premium levels for Life Assured whose age is below 65 Age Next Birthday at renewal | |||||

| Premium Level | Preferred | Standard | Level 1 | Level 2 | Level 3 |

| Multiplier Factor | 0.8 | 1.0 | 1.5 | 2.0 | 2.5 |

How does it work?

With CAP, you will start at the Preferred Premium Level which gives you 20%# off the standard premium rate when you are healthy. At each policy renewal, your Premium Level will be determined by any previous claims2 you have made during the Assessment Period1.

Staying at the Preferred Premium Level

If you stayed healthy and did not make any claim during the Assessment Period1, you will remain at the Preferred Premium Level and continue with 20%# savings off your renewal premium.

How does CAP change upon a hospitalisation claim?

The scenarios below show how CAP changes for a Life Assured whose age is below 65* at renewal.

Claim Made Under Specialists or Medical Practitioners in Restructured Hospital

- If you were on the Preferred Premium Level and made a claim for treatment in a Restructured Hospital, (including Government-funded Community Hospital and Inpatient Palliative Care Institution), you will remain at the Preferred Premium Level and continue to enjoy the same 20%# discount off your next policy renewal.

When will your Premium Level change upon the next policy renewal?

Should you prefer your medical care and support to be provided by a Private Hospital and/or private medical specialists, here’s what you need to know to make an informed decision on your choice of healthcare.

Claim Made Under Private Panel Specialists

We collaborate with over 800 specialists across all specialisations and provide 24/7 dedicated support through our in-house concierge service - Great Medical Care Concierge. Reach out to our Great Medical Care Concierge team when you require medical support via email (medicalcareconcierge-sg@greateasternlife.com) or Whatsapp (65) 6278 2929.

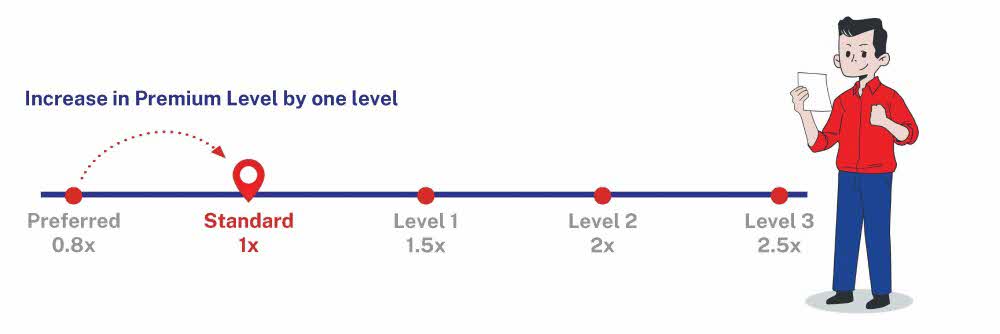

If you were on the Preferred Premium Level and made a claim for treatment with a private panel specialist in a private hospital, here’s how your Premium Level will change:

- For a claim amount S$1,000 and below - you will remain at current Premium Level and continue to enjoy the same 20%# discount off your next policy renewal.

- For a claim amount of above S$1,000, you will lose the 20%# preferred discount and your premium level will increase by 1 Premium Level on your next policy renewal.

Claim Made Under Private Non-Panel of Specialists

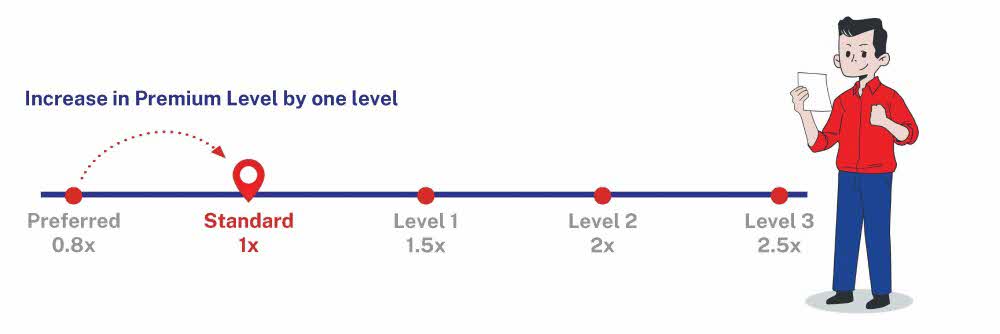

If you were on the Preferred Premium Level and made a claim for treatment with a private non-panel specialist in a private hospital, here’s how your Premium Level will change:

- For a claim amount S$1,000 and below - you will not enjoy the 20%# preferred discount and you will be at the Standard Premium Level on your next policy renewal.

- For a claim amount above S$1,000 – you will lose the 20%# preferred discount and your premium level will increase to Premium Level 1 on your next policy renewal.

How can I maintain affordable premiums in the long run?

We understand that you may require hospitalisation and/or medical treatments and may be concerned on the possibility of increased premium in the following year. Here are some options which can help you decide better:

- Consider if there is a need for in-hospitalisation stay for minor medical attention.

- Consider having your medical treatment supported through Singapore's restructured hospitals or our Panel Specialists.

- Consider if your employer has additional health coverage that enables claims or reimbursement from your company’s group insurance employee benefits plan so you can make your claim under that coverage instead.

How to maximise benefits from your other insurance plans?

By reducing the claim amount made under your Integrated Shield policy and supplementary plan, you can better manage future premium increments. One way to do this is to recover the cost of your medical claims from other insurance plans that you are insured under, such as your company’s group insurance employee benefits plan. By doing so, you can reduce the claim amount made under your Integrated Shield policy and help us keep your premiums more affordable in the long term.

You may reach out to your Financial Representative or reach out to our Customer Service team at greateasternlife.com > Contact Us for assistance.

Enjoy 24/7 dedicated support through our in-house concierge service

Through Great Medical Care Concierge, you will enjoy access to one of the largest private specialist panel in Singapore and have the assurance of what is covered before your treatment.

Our dedicated team serves as a trusted link between you, your insurer, and the healthcare provider ensuring a seamless and reassuring experience.